NOTICE: This post references card features that have changed, expired, or are not currently available

Many credit cards offer free stuff for signing up. That’s not what this post is about. And, many cards offer great rewards for spend. This post isn’t about that either.

This post is about those rare no-fee cards that give you free stuff just for being card member.

$25 or $30 every 3 months (free Netflix, Hulu, etc.)

What card: BankAmericard Better Balance Rewards

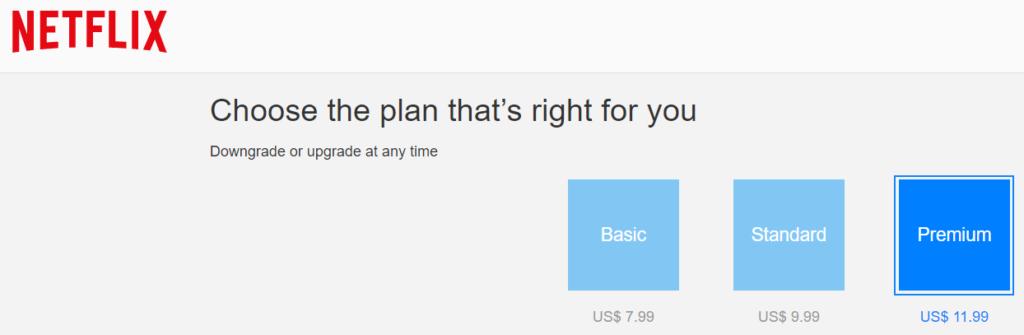

What you get: $25 or $30 every 3 months. I think of it as free Netflix.

The BankAmericard Better Balance Rewards card offers $25 every quarter in which you pay more than the monthly minimum on time all 3 months of the quarter. Plus, if you have a BOA checking or savings account, you’ll get an additional $5 per quarter when you choose to have the rewards deposited to your BOA account. You need to have a charge appear on your credit card every month for this benefit to kick in. I simply auto charge my Netflix subscription and I get all of the money back!

$30 in airline related stuff each year (free in-flight wi-fi, snacks, airline fees)

What card: Discover It Miles

What you get: $30 in airline related stuff each year (in-flight wi-fi, on board snacks and drinks, checked bag fees, etc.)

Discover advertises that the card includes a $30 in-flight WI-FI credit each cardmember year. Simply use your Discover It Miles card to pay for in-flight wi-fi and it will be automatically reimbursed (up to the $30 per membership year limit). In practice, Discover reimburses any airline charges: on-board snacks and drinks, checked bags, award booking fees, etc.

Free Museums

What card: Any Bank of America or Merrill Lynch credit or debit card.

What you get: Free Entrance to Museums and Cultural Institutions on the first full weekend of every month.

On the first full weekend of every month, you can present your Bank of America or Merrill Lynch credit or debit card along with a photo ID in order to get free admission to more than 150 museums and cultural institutions in the United States. More info can be found here.

Miscellaneous free stuff

What card: Any American Express credit or charge card; or an Amex Serve or Bluebird prepaid card

What you get: Varies

Amex Offers are a fantastic way to save money at many different merchants. Usually offers equate to a 20% rebate, at most. For example, you may get an offer to Spend $100+ and Get $20 Back at a particular merchant. If you then spend exactly $100, you save a total of 20%. In rare cases, though, Amex offers stuff for free. In July, for example, Amex gave away free Sam’s Club memberships to those who were targeted with this offer.

Thx just got approved -will use for Hulu

I wasn’t aware that the Discover Miles benefit would work on any airline fees. Goot to know!

Does BOA issue 1099s for the value of the rewards?

I’d expect so (I don’t remember whether or not I got one last year)

I’ve never gotten one from my BoA BBR cards nor my BoA Rewards cards. I believe if the total amount paid out is $600.00 or more than you will get a 1099.

Here is recent news article on the subject;

http://money.usnews.com/money/blogs/my-money/articles/2016-03-21/credit-card-rewards-arent-taxable-if-you-earn-them

subscribe

cool post bro

For the BBR, do you need to allow the statement to cut with the charge on it, or do you just need to make the charge and can also pay it off (for statement balance of 0)?

You have to let a statement balance report each month or you wont qualify for that month. Just pay it off the day after your statement cuts.

I have 2 of these cards and like Greg I have a reoccuring charge each month and pay it off. For me its my $9 MyPrivacyMatters monthly payment. It allows my finance and I to pull all 3 of our reports every day. OCD I guess. I have a $20 MyFICO subscription that I need to cancel since I get all my scores from different cards at different times of the month now anyway.

On my other one I took a direct deposit (2%-3% fee then 0% for 18 months I think) for $2000. I have just been paying $100-$120 per month on that until its paid off and then Ill either another BT/DD if needed or put a monthly charge on that one.

So you get the extra $5 per quarter / $20 per year, if needed I can send you a referral to open a free account and we both get a bonus. Forgot the amount off hand.

Yes, that’s an important point. You need to have a charge show on your statement for every month of the quarter in order to get anything for that quarter. So make sure not to pay it off in advance.