NOTICE: This post references card features that have changed, expired, or are not currently available

I’m calling it: The US Bank Altitude card is Dead On Arrival.

This morning, Greg wrote about US Bank’s Sapphire Reserve Killer. Long story short: US Bank is making a foray into the premium card market. This card would presumably do what the Citi Prestige and the American Express Personal and Business Platinum cards haven’t done: kill the buzz on the Chase Sapphire Reserve. Unfortunately, I think the only thing the US Bank Altitude Reserve is going to kill is itself. Dead on arrival — my opinion is that this card will be hobbled straight out of the gate.

3X Mobile Payments would be crazy, right?

OK, so DOA might be a bold statement and it is a bit disingenuous. I don’t think the card is going to be a flop altogether — on the contrary, I think it’s going to be so huge with a small subset of big spenders as to self-destruct very quickly. If the rumors are correct and this card offers 3X on mobile payments (via Android Pay and Apple Pay), its death certificate will be signed from day 1. Don’t get me wrong — I’d love a card that paid 3X on mobile payments. But so would you. And my friends. And your friends. And your coworkers. And their friends. And their friend’s neighbor’s sister’s hairdresser’s cousins. Everyone would love it. It’s a category bonus that will just get too much love to be sustainable if the card were to be popular enough to be a Sapphire Reserve killer.

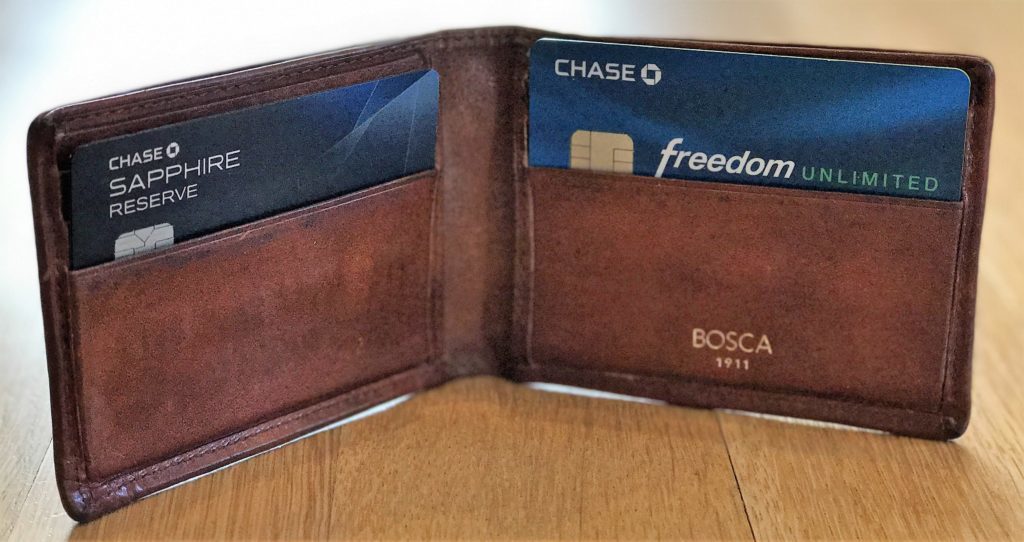

What does your wallet look like?

I admire US Bank’s attempt here. For years, the focus for card issuers has been how to become the top-of-wallet card that you pull out for everyday purchases. For the classic Chase Freedom card, the gimmick was rotating categories — if the categories are constantly changing, maybe you’ll just use the card all the time since you can’t remember which one is bonused this quarter. For Amex cards, the sell has been Amex Offers — there might be an offer for this store, right? For Discover, the game has been double rewards for the first year — if they can take a year to condition you to keep the card on the top of your wallet….well, you know old habits are hard to break. US Bank deserves credit for recognizing that the new frontier is not the top of your wallet but rather being saved on your smartphone. I give them points for creativity. And I can do that — give them points — because my points aren’t worth 1.5 cents each towards travel. I don’t see US Bank being able to keep up that earning structure. And US Bank isn’t exactly new to offering a benefit that turns out to be too generous to sustain (I’m looking at you, Club Carlson Visa).

Signup Bonus Weak Compared to Fee

The second reason I’m calling this card “DOA” is because I don’t think it’s going to appeal to average consumers. The average consumer wants to know how much the signup bonus is worth in dollars-and-cents. Show me the money! The major factor that blew up the Sapphire Reserve in popular culture was that the signup bonus was worth an impressive amount: $1500 when used towards travel. That number was psychologically significant enough to wash away the $450 annual fee for most people. It was an easy sell.

US Bank, on the other hand, is rumored to be offering a $750 bonus (50k points x 1.5 cents) on a card with a $400 annual fee. I don’t think that’s going to excite average consumers (who may never have considered a card with a $400+ annual fee) in the same way that the Sapphire Reserve’s signup bonus did.

Unfamiliar Entity

Let’s face it: everyone has heard of Chase; many fewer consumers know US Bank. While a major player in the midwest, US Bank isn’t nearly as well known nationwide. Name recognition is important in selling premium products. I think fewer average consumers will get excited about a premium card from a bank they’ve only seen on the stadium of the Minnesota Twins. No disrespect to the Twins.

Wait a second……….the Twins play at Target Field. It’s the Vikings who play in US Bank stadium. Who woulda known? I’ll tell you who shoulda known: A Detroit Lions fan. Like me. :-). Much love to the Twin cities and apologies for mixing up your teams!

But I do like it

All that said, I don’t dislike the card as rumored. I think it will be very interesting. Unfortunately for US Bank, I don’t think the equivalent of 4.5% back almost everywhere is sustainable. I see a redemption structure that is less generous or more difficult to use than Chase Travel℠, whether that happens at launch or is a change that comes in the not-so-distant future. My guess is that we’ll see a more FlexPerks-like redemption structure — where a set number of points gets you “up to” a certain value. For example, 20,000 points gets you any ticket “up to $350” — whereby you theoretically can get 1.5 cents per point in value, but you have to find just the right flight. I’d love to be wrong. In fact, I’d love to see US Bank compete with a premium card that really shakes up the market — and they have the opportunity to do that here I think.

What could make the US Bank Altitude card a stone-cold assassin

In addition to keeping 3X mobile payments, which would definitely make them a must-use card on a daily basis, I can think of one thing: Transfer partners. Some unique transfer partners could be the benefit that would make the earning structure sustainable. Airline miles are a less costly benefit for the bank, yet can still yield psychologically-significant value to consumers. Am I the only person who finds it ironic that a bank with a name as patriotic as US Bank issues 0 cards that are co-branded with US-based airlines? Having a US-based airline partner would be big. How soon will Richard Branson be starting Virgin America 2.0, anyway?

The bank already has a hotel partner in Club Carlson. US Bank also has a few airline co-brands with Korean Air, LATAM, and Aeromexico. At the very least, that gives them Skyteam and Oneworld presence. Adding a European partner in the Star Alliance that isn’t already a partner elsewhere — maybe SAS — could spice things up a bit and get people transferring points to miles instead of redeeming for expensive airline tickets. OK, maybe SAS is wishful thinking — I was just hoping to have a backup for topping up miles earned from the Hertz promotion. Transfer partners could make the 3X mobile payment bonus more sustainable and excite at least a slightly wider swath of consumers. I’m still not sure that Aeromexico, LATAM, and Korean Air partnerships appeal to a wide enough range of consumers to kill the Sapphire Reserve, but it would be a start.

But maybe that’s all wrong — that’s all just my opinion of a rumor. What’s yours? Let’s dream: What would make the US Bank Altitude a true player in the premium card market?

[…] card is brand new, but I think that the writing may be on the wall already (see Nick’s post: I’m calling it: US Bank Altitude will be DOA). As more and more vendors accept mobile payments, it will become easier and easier to get 3X […]

[…] and benefits — as well as a Complete Guide to the US Bank Altitude Reserve. A week ago, I called this card DOA. I’m still not sure whether this card has what it takes to step into the ring with the […]

I should say the details are out, the card will be out in May.

Now that the card is out we find it’s calendar year, which was a downer for some looking to the travel credit as a way to offset and make some gain. The fee is a bit too steep for such a low initial bonus. I look at cashback, not just travel value. I have enough points to travel so I look at cash value when looking at new cards that come out. I even have an established business relationship with US Bank and I think I might pass. I have plenty of 5% cashback opportunities that 3% isn’t as appealing as it used to be. If I can find the time to spend beyond what I can already do with my families 5% cards, then maybe this is interesting. If only the fee was smaller or the bonus was bigger. It’s also harder to utilize their travel credit, from what I’ve gathered compared to other cards (although they’ve been getting harder to ‘cash out’ too in regards to travel credits).

I’ve noticed on reddit there seems to be a lot of positive chatter about this new card, but they sound like they’re from their advertising team, or just lots of newbs who don’t know of all the 5% methods.

“I have plenty of 5% cashback opportunities that 3% isn’t as appealing as it used to be”

The appeal for me is the 3% opportunity for all of the venues that don’t have a 5x opportunity. This will add up quickly.

It’ll be interesting to see how the 1.5 cents towards travel works in practice. I know they’re saying it will not be FlexPerks. If you can really get 1.5% towards travel, the plethora of 3X options should make this interesting as you’re earning 4.5% towards travel at a really wide range of places (and growing). I additionally like that, while I *can* buy gift cards at Staples/OM/OD for many places at 5X, I’m then stuck with A) a leftover GC balance and B) no CC protection for those purchases. I’d give up half a percent for the convenience of mobile payment and not being stuck with the GCs in some situations. We’ll see!

But I maintain that I can’t see this lasting long — but I’m happy that it’s sounding like it may happen as advertised.

This card would be worth getting, but I doubt that it’ll be worth keeping.

Every US Bank card that I’ve gotten was good the first year or so, and then ended up on the sock drawer. I have three dead cards with them now.

I’m MSP based and already a long term U.S. Bank customer. Only way I’d go for this card is if they’d sign on Delta as a transfer partner. I use by Starwood Amex now to earn Sky Miles (via SPG transfer) but would love a Visa/Mastercard option to do the same thing.

This card is like buying a Ferrari kit car. On the surface it looks amazing but when you get in, it’s just plain vanilla looking product nothing like you had first imagined.

A pig with lipstick is still a pig.

After being a Flexperks cardholder for several years I have no desire for another US Bank card. I acquired a lot of Flexperks points through “supermarket” spend but they are so hard to redeem. I can find a flight on Google flights for $395 which should be a 20,000 point redemption, but somehow they cannot find these flights and it will price at 50 or even 60,000 points, especially if looking for flights not originating in the US.. I regularly fly to Sao Paulo GRU and there website doesn’t even recognise this city/airport. I call about it and they say maybe it is blacklisted because it is too dangerous!!

US Bank until recently issued the Avianca card. Maybe that could be their *A partner.

I think you will find the Avianca card is issued by Banco Popular not US Bank.

Is mobile payments that big of a category? The only place I go regularly that even has that is Peet’s, and I don’t spend nearly enough on cappuccinos to move the needle. Why should I care about a few hundred extra points per year?

I’m willing to bet that there are more places that take it than you think.

https://www.android.com/pay/where-to-use/

Best Buy, Macy’s, Bloomingdale’s, gas stations, grocery stores, pharmacies, Newegg, B&H Photo, Etsy – just to name a handful. And that’s just on the Android side. And the list isn’t exhaustive. For example, I live in an area with Rite Aid pharmacies and they take Android Pay (didn’t see them on the list). A growing number of square-based merchants do.

There’s room for heavy spending is what I’m saying. The list has grown quite a bit…. And will probably continue to do so.

Am I the only one that things this is a card worth getting? If it has the Visa Infinite flight credit, that by itself makes the card worth its value, and doesn’t require applying at a Crystal Bank in person or having to do two flights to break even with either that or the Ritz-Carlton card. The Ritz-Carlton card also isn’t as good as the plain SPG card if you want to earn points for use at a Marriott or SPG property.

Getting at least 3% worth of value at grocery stores (and up to 4.5% with the right redemption) would be easy to do because the grocery stores nearby me all take NFC. NFC is also particularly nice when traveling abroad because that technology is very popular outside the US. US Bank does have a tendency to nerf their products after a while (the Cash+ comes to mind), but they tend to wait a few years before doing that.

While I do enjoy a good international redemption via a partner, cards like this tend to do better for domestic redemptions on any carrier. The bonus isn’t as nice, but they also don’t do the Chase 5/24 or once-in-a-lifetime thing.

Great points. If they do have the Visa Infinite Flights benefit, no question it would make sense to trade in my Ritz card for this. And I’d finally start using mobile payments

Bill, you are not alone. As a Minneapolis based long time usBank customer and a frequent churner of their cards, this has great appeal to me. One of the factors not clearly identified in the review is the fact that since the redemptions are semi-fixed values, one can redeem points at a very high redemption rate. For example, only 20K points are required for tickets valued up to $399. That’s nearly a 2x redemption value. The same ticket on Delta is usually priced at 36K points. When buying award airline tickets, I match prices between Delta, Chase, Flexperks and American. Flexperks often come out as being the better value. Of course, none really compare to Southwest, which is a Chase transfer partner, but that’s another subject. I subscribe to the diversification strategy for collecting points, and Flexperks have proven to be of great value on many flights and hotels.

Meh… The new “it” number is 100000. Anything less (50k?) won’t excite anyone. They should’ve made signup bonus nice and round 100K and that could be exciting enough. But USB is greedy with points. Their KoreanAir is usually 15K and I’m still waiting on my 40K/50K invitation. Aeromexico is 20K. LATAM is just slightly better but still ridiculous.

My opinion: no dice. USBank is too greedy to offer anything interesting now. Wait for the next financial crisis.

Totally agree — 100k + 3X mobile payments and this card might break the Internet. 50k….I don’t think it makes a huge splash. I’d still love to have it — but I think you’re right that it needs 100k to draw everyone in.

If it’s $750 plus 2x $325 for $450 it is starting to approach some real money. They probably won’t make the $325 on a calendar year basis but that would be big. Just like with CSR, you’re ahead of the game even before using the bonus points.

I don’t disagree with you — it’s a nice moneymaker in year 1 even if the $325 is a member-year benefit (as opposed to calendar-year like the CSR). If it is a calendar-year benefit, year 1 value would be excellent. We’ll see!

Wrong sport…. it’s MN Vikings that play in US Bank Stadium…

So it is! How does a Lions fan get that wrong? Thanks!

A fellow Lions fans? Nice!

No thanks…no time for US Bank…sorry. I don’t trust you US Bank. The only credit cards that my eyes are seeing right now inside my wallet are 1). AMEX Blue for Biz due to earning 2.3 pts. plus 10x (1st 6 months) on Restaurants, 2. Old Freedom for its rotating categories, 3). B of A Travel Rewards (for those instances where AMEX is not accepted) with 2x earning bcoz of my B of A status, 4). Chase Ink Plus for 5x categories, and 5). AMEX Plat Bus/Personal for the obvious reasons – Flights. I even forgot that I still have the Club Carlson card. For the Altitude and the new FNBO cards I say……….meh.

The Blue for Business was a terrific offer — especially when paired with the Business Platinum — no doubt. That’s definitely not a bad wallet.