NOTICE: This post references card features that have changed, expired, or are not currently available

The new US Bank Altitude Reserve Card has the distinction of being the first card ever to offer a standard category bonus for mobile wallet payments. Specifically, the card offers 3 points per dollar for mobile wallet payments (Apple Pay, Android Pay, Samsung Pay, and Microsoft Wallet) and travel purchases. Many readers undoubtedly wonder if they can use mobile wallet payments to buy and liquidate gift cards as a way of earning points cheaply. I’ve previously warned people away from this because I believed that US Bank would be watching for that behavior and shutting down accounts when they see it.

I recently attended a US Bank promotional event for US Bank’s new Altitude Reserve card, and I had the chance to talk extensively with John Steward, president of Retail Payment Solutions. During our conversation he proactively brought up the gift card topic. He said that they were ready to handle situations where people abuse the mobile wallet perk by buying lots of gift cards. I asked whether they planned to warn people first, or immediately shut down accounts, or…? He declined to elaborate.

I then asked if it was OK to buy gift cards in the course of regular shopping. I gave the example of someone doing their regular grocery shopping and throwing in a gift card with the purchase. He made it very clear a purchase like that would be fine. I pushed a bit and asked “what about $500 gift cards?” And his answer was along the lines of “yes, that’s fine. No one’s going to get in trouble for doing that.” He followed up with (I’m again paraphrasing here): “Now, if someone goes from one store to the next buying gift cards on the same day, we’re not going to allow that.”

I tried pushing a bit more to learn the boundaries of what’s OK and what isn’t, but he politely refused to go into more detail. He explained that if they gave out too much information about what they’re looking for, then people can use that info to work around the limits. I can’t argue with that. That’s true.

My experience buying gift cards with mobile wallet and the Altitude Reserve

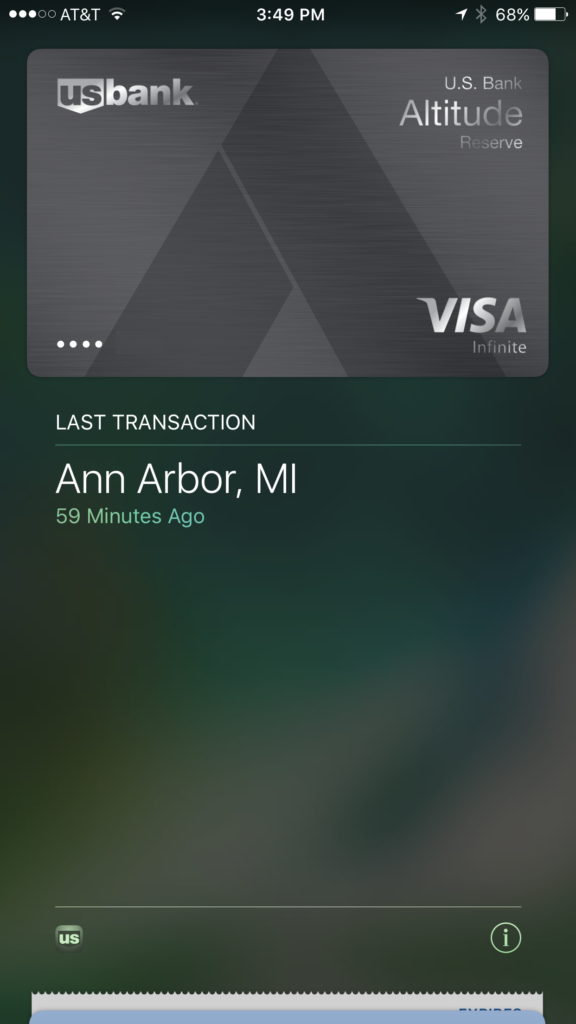

I applied for the Altitude Reserve last Tuesday but the decision was pending. On Friday, the card appeared at my door. That was quick! After activating the card, I added it to my phone’s Apple Pay Wallet, and then I made it my default card within Apple Pay (instructions for doing so can be found here). On Saturday I successfully used Apple Pay at a pay-at-the-register restaurant, but two local clothing stores I visited were not able to accept mobile payments.

Then, yesterday I visited Toys R Us. Based on John Steward’s comments, I think I can get away with buying a $500 Gift of College gift card every now and then. I hope so, because I did. When I entered the store, I first checked a register to verify that Apple Pay was accepted. Yep, the Apple Pay symbol was clearly (or, rather, blurrily) there:

I didn’t see an Android Pay symbol, but the Android Pay website lists Toys R Us as a supported merchant, so that should work too.

Checking out with my Gift of College gift card was a breeze. I double-clicked my phone’s home button to bring up Wallet (that’s the name of the Apple Pay app) and it told me to hold the phone near the swipe terminal. A second or two later I heard a friendly chime, and the phone vibrated to indicate that the payment was successful. I signed the swipe terminal screen and that was it. I walked out with an activated Gift of College gift card and, presumably, 1,518 Altitude Reserve points ($505.95 x 3 points/$) worth $22.77 towards travel.

This makes a world of difference

In my post “There is a reason to get and keep the Altitude Reserve card” I argued that heavy mobile wallet spenders who plan to use points toward travel should consider this card not just for the signup bonus, but to keep long term. I calculated how much one would have to spend on mobile wallet payments per week in order to do significantly better than with a 2%, 2.5%, or 3% cash back card, even when considering the Altitude’s annual fee. The results: you would have to spend $327, $409, or $545, respectively, on mobile wallet payments (or travel) to do significantly better than the aforementioned cash back cards. That’s a lot. However, if you can get away with throwing in a gift card now and then with your regular purchases, it suddenly seems doable.

Personally, I’ll see how it goes. If you’re a frequent traveler, then this $400 card is undoubtedly worth getting for its first year 50K signup bonus (worth $750 towards travel) and $325 in travel credits. Whether or not it’s worth keeping beyond the first year will depend upon how much you use it to earn 3X rewards.

Summary

It seems that it’s fine to buy gift cards now and then through mobile wallet with the Altitude Reserve card, but don’t plan to do it a lot. Unfortunately, I wasn’t able to get a definition of “a lot”. Instead, I got the impression that about $500 per week is fine. If I hear otherwise, I’ll let you know!

Is this the case with all off their cards or just the altitude?

Is it safe to get the SUB on a “business triple cash” with a few simon mall cards?

Greg, are there any recent update on this topic? I haven’t seen anything on this topic for a few years. I’d imagine VGCs are still a no-no and there never seemed to be a definitive answer on “store” cards…

That said, with the prevalence of slates like Fluz and Honey selling “store” gift cards, I’d be very interested know if anyone has had difficulties with these kids of purchases upsetting the apple cart.

Great point. No, I haven’t heard anything one way or another about this.

I buy Amazon gift cards at retail stores with my USB AR (via Mobile Wallet) somewhere around $100 at a time, 2-3 times per month, most months. That level has never been an issue, I’ve had the card 2 1/2 years.

Hi Greg, Could you still use the altitude card to buy Gift of College gift card ?

I wouldn’t risk it. Too many people have reported shut-downs since this was written

Fine?

I buy some airline GC and $500 VGC, the accounts was closed, the notice mail tell me, the Altitude can’t buy ANY kind of GC, $0 is maximum on Altitude Reserve.

Yikes. how much did you spend on airline gift cards?

~$1200, all of ticket is fly by myself

I am try to fill Small Claim Court form, I will report result in later.

[…] because I don’t want to get shutdown for simply spending too much. While Frequent Miler reports that U.S. Bank has said a small amount of gift cards are alright, I wouldn’t plan to generate […]

[…] few days ago, Frequentmiler chatted with one of the US Bank higher-ups and they indicated that there’s a team in place to make […]

i want mobile pay bonus to stick around as long as possible.

so i say more power to us bank enforcers.

shut em down!

Breaking news – credit card purchase of a VGC goes through. What a shocker.

No one was expecting them to watch transactions real time for MS.

Yet they are.

[…] Buying gift cards with the Altitude Reserve by Frequent Miler. Going to be an absolute shitstorm watching this play out I imagine. […]

DP: Applied 5/1. Got the pending language 7-10 days or whatever (expected a denial). Card showed up on 5/4 without any emails notifying me it was approved. Bought gcs. Shut down 5/5.

Shittiest bank ever.

troll?

Kinda funny though. Ms humor. A true ms’r would never buy gcs that quickly, but would season the card with regular spend.

Doctorofcredit has a new post about a few people having their Altitude cards cancelled after purchasing only three gift cards. He vouches for at least one of the people not being a troll. But if all it takes is three gift cards, I’d expect to have seen a few more reports on the forums of shutdowns by now. Perhaps the shutdown card holders were just unlucky.

Counting the days until this gets killed – gonna be a LOT of angry MSers out there who get bloodied here. Hope they all come looking for you.

Bloodied?? Loosing one card out of 10 that you MS in is a scrape. Risk is minimal. Take this to the max!! I don’t care if USBank kills me as a customer

But if they cancel your points, what is the point?

I don’t see a huge enthusiasm for this bonus, so the initial group that applies won’t cause the bank much problems anyhow.

shutdown reported on MS.

http://www.mitbbs.com/article_t/Money/32890051.html

All my US Bank credit cards got shut down yesterday, because I used my Altitude Reserve card to purchase visa gift card. I was clearly told so by their investigation department. I should have read more carefully about the warning…

yes, I also had IRS come over yesterday to confiscate all my property because I used my Altitude CC to buy a gift card. People don’t buy gift cards.

I just got castrated by USBANK security for using my Altitude Card to buy gift cards…………………top that!

They pulled my tongue from my mouth and stabbed it with a rusty screw driver.

So you bought a gift card to satisfy MSR? Do you hink it’s OK?

If you see John Steward again, tell him the Daily Show is not the same without him

no kidding, he quit at the wrong time. I stopped watching it, but that’s besides the point.