NOTICE: This post references card features that have changed, expired, or are not currently available

Bank of America has just launched a new premium rewards credit card creatively named “Premium Rewards”. While this card won’t be for everyone, those who have $100K+ on deposit with Bank of America / Merrill Lynch can get best-in-class earnings on everyday spend with a 75% bonus bringing the return up to 2.625% back on everyday spend. Since those earnings can be deposited in your eligible Bank of America / Merrill Lynch account, that’s like 2.625% cash back on everyday spend, which is excellent.

Bank of America Premium Rewards Card

Offer Details

- Earn 50,000 points after $3,000 spend within 90 days of account opening. 50,000 points are worth $500 cash back.

Card Details

- Annual Fee: $95, not waived first year

- No foreign transaction fees

- Earns 2X on travel and dining; 1.5X everywhere else

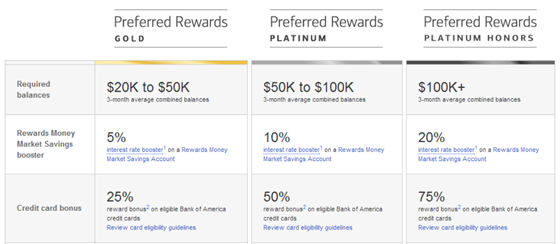

- Earn more points with Bank of America’s Preferred Rewards program:

- Gold ($20K on deposit): 25% bonus = 2.5X travel & dining; 1.875X everywhere else

- Platinum ($50K on deposit): 50% bonus = 3X travel & dining; 2.25X everywhere else

- Platinum Honors ($100K on deposit): 75% bonus = 3.5X travel & dining; 2.625X everywhere else

- Issued as Visa Signature

- Key benefits:

- $100 annual reimbursement for airline incidentals

- Incidentals include purchases on flights originating in the US and certain US carriers and include seating upgrades, ticket change/cancellation fees, checked bag fees, in-flight entertainment fees, in-flight food & beverages, and lounge access. Ticket purchases, mileage purchases, gift cards, duty free, and award ticket fees with alliance partners don’t qualify. Incidental fees must be separate from airfare in order to qualify.

- $100 Global Entry/TSA PreCheck reimbursement every 4 years

- $100 annual reimbursement for airline incidentals

Additional Details and a signup link can be found here: Bank of America Premium Rewards Card

Also see our Bank of America Premium Rewards Credit Card Complete Guide for more details on this card and its benefits.

Quick analysis

This offer looks great. Five hundred bucks back on $3,000 spend is a nice, simple signup bonus that doesn’t require finding the perfect redemption or award availability. That’s just $500 in the bank, and that’s a bonus worth spending for.

Long term, this card isn’t very compelling in that it essentially earns 2% back on travel and 1.5% back on everything else. You could easily open a no-fee 2% cash back card (or the 2.5% back Alliant Cashback card).

However, with Preferred Rewards, particularly the Platinum Honors tier, this card becomes a terrific alternative for everyday cash back. Unlike the Bank of America Travel Rewards, the points earned from this Premium Rewards card do not have to be redeemed for travel and can instead be redeemed as straight cash in your eligible bank account. That adds a great deal of flexibility to your rewards and makes this card.

While the annual fee is not waived in the first year, the $100 airline incidentals reimbursement will probably offset the fee for many travelers. The travel insurance does not look particularly interesting, though note that this card does include medical evacuation coverage — a benefit that is normally reserved for more expensive premium cards. We do not yet know the details and limitations of this benefit.

Again, for more detail and analysis, see our Complete Guide linked above.

[…] 50K offer now live: BOA Premium Rewards Credit Card: This is a great new offer that boils down to $500 back on $3K spend. […]

[…] 50K offer now live: BOA Premium Rewards Credit Card: This is a great new offer that boils down to $500 back on $3K spend. […]

are these the same type points that can be pooled with the ones earned from the Meryl Lynch card? Sorry, never used the BOA rewards before, but have the 50k bonus ones from the ML card. Thank you.

If you have a platinum honors status and qualify for the 75% boost to redeeming your cash rewards, is that $500 sign up bonus worth $875?

This card earns the 75% boost on purchases, not redemptions. The Cash Rewards card earns the bonus on redemptions.

The answer to your question is “probably not”. But I did write a post on how it might not be impossible if you have both cards and Platinum Honors status — though we won’t know for a while yet:

https://frequentmiler.com/2017/09/18/can-earn-4-59-back-everyday-spend-new-boa-premium-rewards-card/

So if I have a Chase Sapphire account but also house more than $100K at Merrill, the bonus on this new card is higher than Chase card. Therefore I do not need to use Chase for dining and travel anymore and can stick with this new BoA card for all. Then all the points accumulated would work just like current BoA Travel card… Correct?

I will probably keep the Sapphire card as I need to for the miles that are in the account (or transfer to airline/hotel partner). Also you can get a lot more bang for the points if you find a transfer to a flight that you are looking for correctly (Wife and I are planning a trip to Fiji and Australia and are looking to put Chase points to work for first class/business class tickets).