NOTICE: This post references card features that have changed, expired, or are not currently available

The biggest news of the week in the credit cards and loyalty space is undeniably the announcement of the future of the Marriott credit cards: and the news couldn’t possibly be much better for consumers. Of course, the news of new Marriott card opportunities might ring particularly musical to my ears since one of the Marriott cards in my household is currently frozen under Chase Financial Review. In other doom and gloom, the war on gaming appears to be taking no prisoners thus far. But on the bright side, we’ve got a nice save on the Google Express Amex offer and how to quickly rebuild your Membership Rewards. All that and more in today’s Frequent Miler week in review.

Recovering from my Google Express Fail

There’s a great Amex Offer out that gives $20 back on $50 or more at Google Express. Unfortunately, Google isn’t as good at math as you’d expect: they’ve mis-estimated order totals, leaving some orders short of the spend threshold. Find out how to make a save if Google’s poor estimation affected your order — and if you haven’t yet placed an order, it’s good to know what to expect so you can avoid falling short of the target.

How soon can you refer others for Chase cards?

I’ve long known that Amex referral links can be generated as soon as you can get into the online account, but after waiting years to get referral links on most of my Chase cards, I always assumed it must just take some time to build up history before you’re in the Chase referral system. Turns out I was wrong. If you’ve recently opened a Chase card, you might be surprised to know just how soon you can generate a referral link.

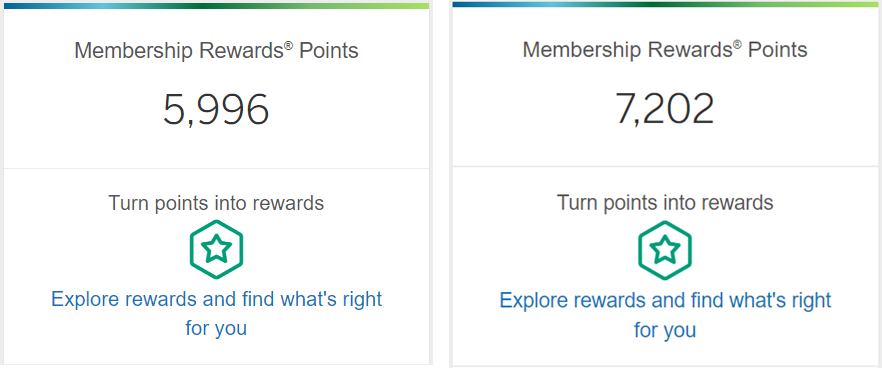

Rebuilding my Membership Rewards fortune

My name is Nick Reyes, and I am a pointaholic. I’ll admit to at least a slight anxiety when it comes to an anemic points balance. Part of that is definitely an acute FOMO (fear of mission out for the pre-millennials). But the truth is that points aren’t going to appreciate in value and there are always more to be made. Find out Greg’s plan for replenishing his recently-burned stash and share a laugh when you admit to yourself that you share in that fear of missing the next big thing.

Marriott announces new credit card lineup

In probably the most exciting news of the week, we found out that neither Chase nor Amex won the battle to be the exclusive issuer of the Marriott credit cards — they both won part of the portfolio. If there is one thing that’s really good for consumers, it’s competition. I’m really excited to see how this new portfolio of cards pans out. I imagine this is going to mean new signup bonuses — even for those of us with SPG cards — and this new premium card has me very intrigued. I’m definitely going to be holding onto SPG cards to see what happens there, but if the new ultra-premium card has benefits on par with the coming Hilton Aspire card, the hotel card space could get pretty interesting.

4% Off Your Next Meal (Sort Of)

In the first part of a series that I look forward to reading, JM Hoffman introduces a trip that I can’t wait to hear more about. I have the inside scoop in the sense that I know the where and when and what, but I haven’t heard a peep about how it went beyond this post. Come for the 4% savings and stay for the story — keep an eye out for more to come.

Amex fires another shot in their war on gaming

The credit card climate is constantly changing, and Amex has kept no secrets with regard to their distaste for certain types of spend. Sure, you’ll find stories running the gamut — from people who spend with the reckless abandon without a problem to those who spent a couple thousand at the grocery store and got shut down. What I know for sure is that spending on an Amex is kind of like going to a beach with no lifeguard: swim at your own risk.

Last minute Delta status grab

It’s the final countdown — 22 days to go in 2017 and you’re short X number of miles: what do you do? Look at a short case study and see what Greg recommends. Personally, I’m not a big believer in airline status as I feel like many of the benefits can be generated by flying premium cabins with miles and having credit cards with the right perks. That said, weekly business travelers would likely staunchly disagree with me. If you find yourself on the fence about whether to take that crazy double open jaw mileage run with twenty-seven stops in 48 hours, check out this post to find out if that really makes sense.

Shop until you’re dropped: Chase Financial Review freezes account

Many readers have probably heard of Amex Financial Review — it’s a topic that has been covered countless times and you’ll find numerous guides around the ‘net as to what causes it, what the process is like, and how to survive. On the other hand, Google “Chase Financial Review” and you’ll come up with decidedly less blog posts on the topic. Does that indicate that it is a less common occurrence? I’m not sure. Based on what I’ve read, it seems that many people may have gone through a Chase Financial Review without knowing it — if you don’t attempt to use your card during one (and therefore notice that the purchase gets declined), you may never know it even happened. Unfortunately, my wife is acutely aware that at least one of her accounts is currently under review. Find out what that means, what could have caused it, and what might happen next….and then stay tuned for the update when we know more.

Use your travel fee credits before its too late

If you have an Amex Platinum card, a Citi Prestige card, a Chase Sapphire Reserve card, or any other card with annual travel credits, time may be running out for using them up. Check out Greg’s tips for what qualifies to earn these credits, and some hints about how to shift spend from the future to now in order to earn that cash before it’s too late.

That’s it for this week at Frequent Miler. Check back soon for our week in review around the web and this week’s last chance deals.

![Mileage running 2026-style, playing the AA transition, a coming points conference and more [Week in Review] a group of toy airplanes on a game board](https://frequentmiler.com/wp-content/uploads/2022/01/American-Airlines-Game-218x150.png)