NOTICE: This post references card features that have changed, expired, or are not currently available

Our Manufactured Spending Complete Guide lists many ways to increase your credit card spend with the intent of getting most of it back, and the inherent risk varies from one method to the next. One popular method of manufactured spending is gift card reselling, whereby you purchase merchant gift cards (at a discount or with a strong enough category bonus) and sell them for a break-even amount or even a small profit, thereby earning what feels like “free” rewards. If I can offer one tip with regard to all methods of MS, it would be this: Always be cautious how much you choose to float — whether reselling gift cards, merchandise, or buying Visa and Mastercard gift cards. There have been reports of some people having problems with checks from gift card resale site The Plastic Merchant in recent days. While Mike Dean, the owner of The Plastic Merchant, tells us that these problems were temporary and have been resolved, we have received some conflicting reports about exactly what happened. I’ve personally sold gift cards to The Plastic Merchant without issue and have been in contact with a number of members who have recently sold gift cards and received payment as expected. But I’ve also been in touch with a reader whose check bounced and some people who have heard very similar stories in their extended networks. It’s a good reminder to spread your risk, be cautious, and go slowly if you are dipping your toes into Manufactured Spending.

Gift Card Resale: Public vs Private Marketplaces

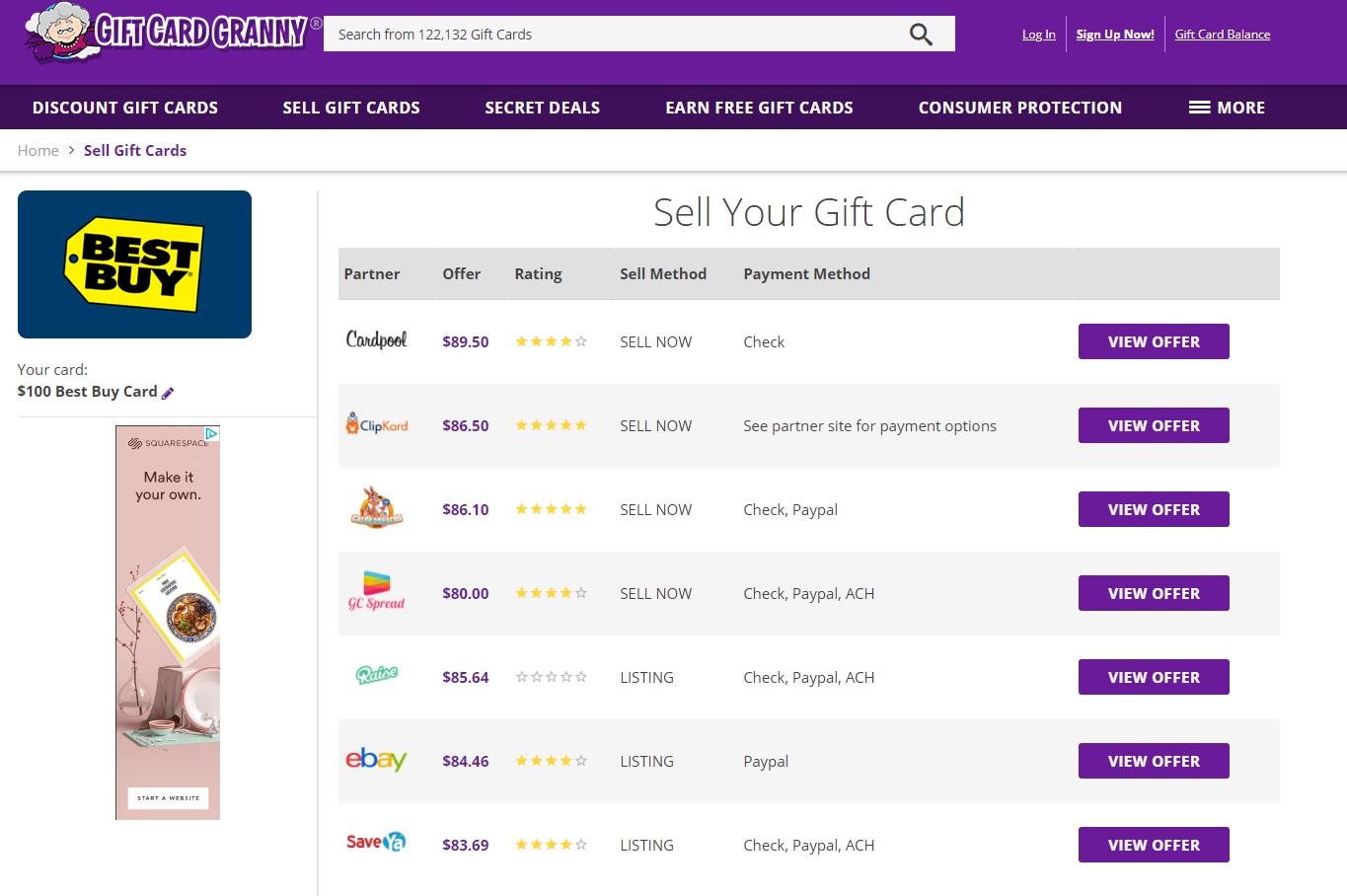

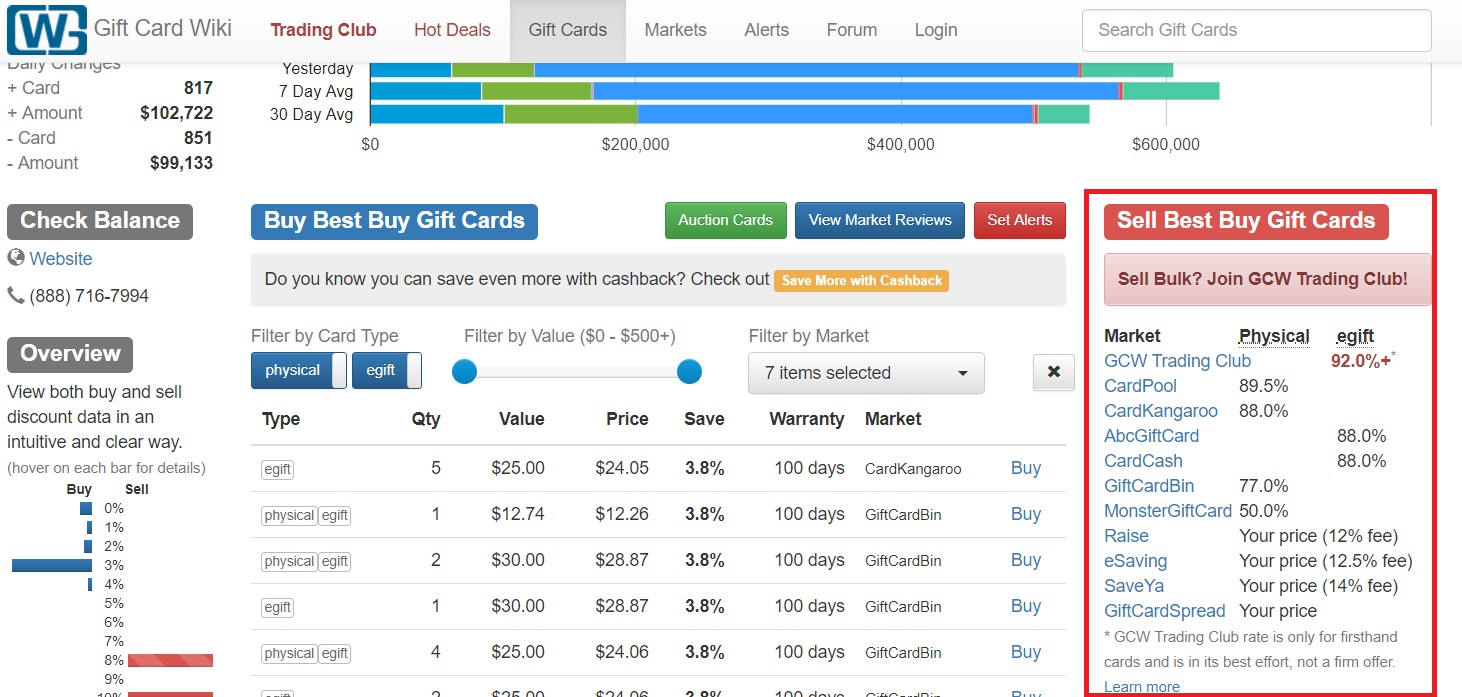

There are many avenues by which to resell gift cards — Sites like GiftCardGranny.com and GiftCardWiki.com list the rates at which you can sell your gift cards on a number of different marketplaces:

As you can see, the “buy” prices vary by face value of the card, physical vs eGift, and also based on the market where you sell. While you’ll see familiar names on the list — like Raise, CardCash, and CardPool, you’ll also note that the market with the highest payout on Best Buy gift cards, at “92%+” of the face value, is something called “GCW Trading Club”. While I’ve never sold with GCW Trading Club, I understand it to be a private club. Presumably, clubs like this operate by buying large amounts of firsthand cards (i.e. cards you purchased directly from a merchant or from something like PayPal Digital Gifts on eBay). By keeping membership private and only buying firsthand gift cards, they can ensure that their cards are “clean” (not stolen or purchased with stolen credit cards) — and therefore theoretically the private club can resell the gift cards for a higher rate to their customers (who in turn can trust to receive clean cards). That’s the gist of it, anyway. For a miles & points aficionado, it enables one to sometimes buy a gift card and resell it at a break-even point (thereby earning “free” rewards) or sometimes even a small profit + rewards. The private gift card resale club makes money, the club’s customers receive legitimate/unused gift cards, and the miles & points enthusiast gets rewards. It’s a win-win-win. So much so that it kind of makes you wonder why you didn’t think of that, right?

Potential Pitfalls

While this may sound like roses and sunshine and blue skies all day long, there are some potential problems. For example, if you buy physical gift cards, you may have to send them through the mail to your chosen marketplace. I’ve done this with ABCGiftCards and CardKangaroo a number of times (last year’s epic Sam’s Club Amex Offer left me with a lot of gift cards). But what if your envelope gets lost in the mail? What if the person opening it has butterfingers and misplaces one of your cards….or sticky fingers and misplaces it in their pocket. It can be scary if you’re sending gift cards through the mail since they spend like cash. It’s risky.

And so eGift cards have a nice appeal. If you’re selling eGift cards, there is nothing physical to ship through the mail — just upload the card information and get paid. Some exchanges pay via PayPal, others use ACH transfers, and some send a check. All of those methods sound equal…at least, until you get to the bank with a larger-than-normal check with a name like “SaveYa” printed on it and get mistrustful glares from a cashier who I like to call, “The Skeptic” (Note: I’ve never sold to Save Ya. I have sold to others; I can’t imagine The Skeptic would be more impressed if the company name were Save Ya.)

Some recent negative reports are a reminder to proceed with caution

A couple of days ago, a Frequent Miler reader brought to our attention a post at PointChaser.com about a private gift card exchange called The Plastic Merchant. If you attended the Chicago Seminars or FTU Chicago, you may have met Mike Dean, the owner of The Plastic Merchant, and/or some members of his team. The Plastic Merchant has been around for just over two years and is a popular private resale site in the miles & points community — though membership requires application and not all new member applications are accepted. I personally sold a decent quantity of gift cards to The Plastic Merchant in late 2017, though I haven’t sold enough to receive a check yet in 2018. My experiences with The Plastic Merchant have been very positive; I’ve sold large quantities of gift cards at one time (certainly much less than some of the biggest manufactured spenders, but more at one time than a casual seller). I’ve been paid on time by check and received several checks for thousands of dollars without issue.

However, the PointChaser post in question (See: The Plastic Merchant Tutorial: How to Sell Gift Cards) was met with a markedly negative response in the comments, with a number of commenters indicating that some members had received checks from The Plastic Merchant that bounced during the past couple of weeks. PointChaser received enough blowback from readers as to post a follow-up later that day (which included an update with a response from Mike Dean of The Plastic Merchant — see: The Plastic Merchant’s Payment Issues (UPDATE: Response from TPM Included)). To paraphrase, Mike explained that The Plastic Merchant experienced a temporary cashflow issue that lasted a few days and only affected about 20 checks out of 450 sent to sellers. He went on to explain that in all cases, new payments were expedited and insufficient funds fees incurred by sellers would be refunded.

Obviously, that’s a huge issue for those affected. Some people reported checks worth north of $10,000 that had bounced and some claimed to have had their bank account shut down as a result. That sounded absolutely horrible. At the same time, with many Internet comments being anonymous and membership at TPM being private, it’s hard to gauge the veracity of some of the claims. There was a claim of someone receiving back-to-back bounced checks and another of someone receiving a $60K check that bounced. Are those claims totally true? Are they exaggerated? Are they made up by Internet trolls? Did someone else see the win-win-win nature of the business and want to put TPM out of business by making up outlandish claims? I certainly didn’t know — and to a large extent I still don’t know all of the details.

However, I reached out looking for more information. I wrote to people I know who have done business with TPM. I put a post in Frequent Miler Insiders asking for data points (I asked for anyone who has sold gift cards to TPM within the past 3 weeks whether or not they had any problem with payment and I told people that they could PM or email me if they didn’t feel comfortable sharing publicly). I found one acquaintance whom I’ve met in person who reported to have received a bounced check. That individual received a replacement check, though it took a couple of days and didn’t happen as smoothly/quickly as one might hope when one’s account suddenly dips into the red a few grand (truth be told, I’m not sure there is a “fast enough” method to rectify that). This person reported having experienced some other problems with TPM over time and being pretty unsatisfied with the experience.

All of the other people who responded to me via Facebook and private channels about their recent experience with TPM told me that they had recently received payments that had cleared without issue, but that they had heard stories within their own extended networks of failed payments (bounced checks). Some reports conflicted with Mike’s account of what happened and how.

I reached out to Mike directly. I’ve met him at conferences and listened to his podcast interview with the Saverocity Observation deck (found here) from around the time of the Chicago Seminars. Mike has seemed like a nice guy to me in person — nice enough for me to entrust large amounts of gift cards for a couple of weeks at a time pending payment — though I don’t know him personally aside from those couple of meetings. I had hoped to get a slightly more detailed explanation from his end — either about what happened or how it would be prevented in the future — and I included a number of questions in my email. The response I received was the same comment, word-for-word, given to PointChaser. As these comments have already been published publicly, I’ll copy the text here again in its entirety:

Nick,

We experienced a cashflow issue lasting roughly 3 days about two weeks ago where ~20 checks (out of ~450 that successfully cleared our account during that same time without issue) were returned for insufficient funds. As soon as I was able to reconcile it, I made sure we fixed everything on our end and began reaching out to those affected to make things right. In every case, we offered to either send an expedited check or wire transfer if necessary. I also explained to each person that I would be reimbursing any and all fees incurred on their end due to the issue. None of the replacement payments or future payments sent out to sellers since have been returned, and this will not be an issue moving forward.

Mike

On the one hand, I would expect most companies making a public statement about a mishap to put out one statement and keep it consistent across different channels. After all, if you give different stories or more or less detail to one outlet or another, you run the risk of angering those who perceive to have received less info. On the other hand, as Mike says himself in the podcast linked above, gift card reselling is a business based inherently in trust, and so I think some sellers have had that trust tested — those who received bounced checks may have had that trust broken and understandably so.

In actuality, the reports I received didn’t differ substantially from what Mike is saying — the majority of those who reached out to me reported having received checks with no problem; the one user who received a bounced check reported receiving a replacement. Many people reported that NSF fees from the bounced checks haven’t been refunded, though these reports are secondhand and it is at least plausible that the first step was reissuing payments due with a second step to refund fees forthcoming. Of course, I don’t know any of that for sure — and had I received a bad check, I’m not sure I’d feel satisfied even after receiving a replacement. I can imagine the pit in my stomach if I were sitting on a large bounced check awaiting repayment and email communication. It wouldn’t feel good. Furthermore, some people tell me that this isn’t the first time there has been such an issue.

Is it safe to sell to XYZ?

Moving forward, some will ask if it is safe to sell to TPM — the same as one would (and should) ask about selling with other marketplaces, public or private. The truth is that nobody knows for sure. In business, there is inherent risk. I’ve certainly participated in gift card reselling and I’ll probably continue to participate. In fact, before this story came to light, I uploaded some cards for sale to TPM earlier this week. The truth is that I have a significant quantity that I intended to sell to TPM this week before this news broke. I’ll personally take it slow moving forward to make sure the dust settles rather than diving in head first and I will look to spread my risk out with some other marketplaces. At this point, I’ll heed my own advice and be cautious about how much I choose to float with any one marketplace. I’ll probably continue to sell to TPM as long as my experiences remain positive, but I’ll avoid getting in over my head. I’ll stay in touch with others to monitor the pulse of the situation. To be clear, I’m not suggesting anyone follow my lead on that – there is certainly some cause for concern that I find as unsettling as others do. To each his own in determining an acceptable level of risk — but be aware that there is risk.

Bottom line

Again, it’s always prudent to be careful how much you float. As someone who was into merchandise reselling long before other avenues of manufactured spending, my advice to others is always to treat reselling anything like going to Las Vegas: don’t gamble with more than you can accept losing. Spread out your risk and keep an ear to the ground — both for opportunities to score big and pitfalls to avoid.

His checks have started bouncing again. Many people on GCW slack are reporting check bounce.

Uh oh.

I saw some reports last night and this morning, so I re-shared this post in the Frequent Miler Insiders group. Thanks for the comment.

Looks far, far worse this time….. (as in Fool me Thrice)

Surprised you did not do a “PSA” on this — as a headline warning to all your readers to NOT go forward with any more card submissions to TPM (I nearly did tonight, but got lucky and saw something via DDG and then Mark Osterman — kudos to them.)

Sadly anticipate the TPM “house of cards” is about to fold. (Achilles heel for TPM has long been its bizarre, delayed payment non-system…. and Mike’s ultra sensitivity to any reasoned questions about that, his constant changing the story as to why he was, or was not…. going to go to ACH….. (like RAISE)….. That TPM couldn’t get around to entering the 21st century on doing expeditious payments should have been a red flag to us all….. that this really was essentially a one man band….. If something went amiss with him…. or worse, no one apparently left able to keep the ship afloat. I’m done with TPM. (and this isn’t about being “patient” — that’s a load of hooey being floated about by those hoping that if we keep our money “in” — then they might get their’s out)

Only way TPM can survive is with a complete, total revamping of its payment system….. No more delays, no more obfuscations, half-truths, nasty non-communication with otherwise trustworthy folks who wanted to do good business with him. No more relying on puff pieces from AA.

Subscribing and DP. Just depositing a check for a little less than $500. No issues. Had a couple checks for around $3000, and never had an issue (been selling since about October or so?). Probably done $15k worth or so. Never had an issue.

Subscribing and a DP. I get a check almost every pay period from them, biggest in the low thousands but never had issue including the one I received last Thursday.

I’d love to hear what Meredith, Eric, and Molly have to say (the other three people involved in TPM) and, more importantly, if they are still an active part of the business.

Wow, I signed up with TPM awhile back and was accepted as a seller but never got around to doing any business with them. May have been a blessing.

Great article , a good public service announcement that easy MS has risks. I was not granted access to either of these groups use the other sites and I get AcH payments as indicated never an issue.

I lose some dollars which is sad but what a MS guy going to do but find a better deal to flip

I’ve been fortunate that all of my checks have cleared but I realize I’m a small fish compared to what people are claiming.

I’d love to have 60k in GC resale’s and don’t know how those folks do it – guess that’s only for the cool folks that don’t share that knowledge bc they don’t want it burned.

I will say, even for expenses, my job still mails reimbursement checks to us .. some of our expenses can be several hundred dollars a week yet our paychecks come ACH. So I really can’t blame Mike for this as, if it keeps costs low for him (like my employ), it may be inconvenient, but it also clearly states that’s what happens.

I’m glad we have avenues to liquidate to pursue our desires and I hope that TPM (and others) continue to operate and give us the ability to do the same.

I don’t have very MS friendly Walmart’s and the high cost of other sites rarely help me get break even.

If anyone cares to share their own tactic (I’d even pay a donation for access to some of these so-called private groups) to share strategies, I’m all ears.

Best to all – and hopefully we can continue to do what we enjoy for many years to come. I get everything has its bumps in the road, and hopefully we’ll endure this one.

Stay positive folks, and help each other! After all, it is a community and there doesn’t appear to be a shortage of opportunities, just not maybe many published ones.

I, for one, appreciate the blogs and write ups on those I know about as I try to read up what I can, but it can truly be overwhelming. So, I thank you all for what you already have shared.

“my job still mails reimbursement checks to us .. some of our expenses can be several hundred dollars a week yet our paychecks come ACH. So I really can’t blame Mike for this as, if it keeps costs low for him (like my employ)”

OK, but that’s like comparing apples and bananas (not even oranges).

First, you don’t fear your company’s checks bouncing, or your company running a Ponzi scheme. Likewise you don’t have to worry whether or not your company is roping you into buying and selling things that might have legal implications, thus you don’t fear hearing from feds about your company-related expenses (I’d hope not, if so run).

Second, at most you’re waiting (you’re out) a few hundreds at a time and you will likely get those back even if your company goes belly up, whereas there’s zero guarantee with some guy operating resale private groups online.

Third, typically there’s regularity in receiving such payments from any half-decent company, whether you work 1099 or this is a W2 type of job and these are side expenses. You know checks typically come in after 2 or 3 or 4 weeks or whatever the case is, so there’s zero anxiety. And again you’re not floating thousands of dollars.

Fifth, whether your resale payouts with one guy/group are hundreds or thousands, these aren’t your side job expenses, it’s all of it, it’s all the money you’ve put into that venue at that time. So your job’s side expenses aren’t really comparable here.

Sixth, your company also sucks ass for mailing employees or regular /repeat contractors checks in 2018. They can still delay payments with ACH if they want and if that is part of the understanding or the contract.

Forth, there’s no forth in these type of comments lol

Lol, I hear what you’re saying and I agree. Just saying that there’s two schools of thought. But everything is YMMV.

And, yes, my company sucks for mailing reimbursements.

What are other options, then? Raise has high commissions yet others seem to be doing just fine w it.

I’ll let it go with the missing #4, you were on a rant. 😉

I really don’t like this article Nick.

I know you’re putting out an article about the dangers of GC reselling, but the personal biases in this article make it hard to read. The knocks on GCW seem like they’re written like someone who wasn’t let into the ‘private club’. (Never mind that anyone can apply publicly). Also, the defense of TPM is highly personal and his response is boilerplate (it’s verbatim the same response that’s on Pointchaser). You give him more than the benefit of the doubt and throw shade at those who’s data points don’t jive with his.

There are themes to the facts of the matter. There are some pretty alarming data points about the volume and frequency of bounced checks out there. There has been little to no communication from TPM about an alarming concern.

I think it’d be more constructive to point out the concerns about the risks of GC reselling and leave the judgments to the readers.

What a load of nonsense. Sure, talk about general risk. But if a SPECIFIC company is bouncing checks that is something that people should absolutely be alerted about because it means that the funds being generated by the sale of one gift card are being used to pay off someone else. At a BARE MINIMUM it is evidence of horrible management and it could well indicate that an actual Ponzi scheme is breaking down.

[…] don’t do gift card reselling. Just be careful out […]

There are channels in Pretend Spend, MTHGA, and other slacks dedicated to spreading misinformation, so this wouldn’t surprise me if this was a small issue that is being blown out of proportion.

Lol OK mike

Do you have any evidence of this?

Why do so many people have their heads in the sand about this? TPM is quoted on here and Point Chaser about bouncing checks!

Google Gift Card Rescue and maybe then you’ll understand why people are sounding the alarm.

Well creafted post Nick. You summarize most of the concerns well, including about the potential for competitors’ with incentives to pile on….. Yet even Mike has confirmed at least some of the serious problems now…. Simply replacing a delayed check and paying for any fees a bare minimum. (and doesn’t begin to cover damage to credit, as well as one’s own business reputation)

Supreme irony in the present situation…. On the one hand, TPM built itself on the concept of creating a platform where it would acquire gift cards with “bullet proof” validity (Mike’s key promotional phrase), where TPM buyers would pay more knowing that the quality & reliability of we sellers was top notch. Great concept.

Sadly, on the other hand, TPM’s payment system has been anything but “bullet-proof”….. As it stands, TPM apparently has only itself to blame for having a payout system badly riddled with holes and vulnerabilities.

1. Relying on mere first class USPS for delivery of any checks is, to be blunt, a really poor way to build confidence in sellers.

2. The ever longer selling periods, the repeated delays in getting out checks (and the lame, vague confusing email excuses we might get) —

those too, anything but confidence building.

3. The repeated broken promises about ach payments (which all the competition seems to have figured out for even the smallest of payments) raises all sorts of questions. Mike’s lame excuses (and curt, even nasty non responses when asked about this) …. again, reduce confidence.

4. Last (for now), offering ach payments only to sellers of more than 30k per pay period belies TPM’s promises to treat all their sellers equally. (and when Mike gets called on it, he gets extremely prickly — and yes, you feel the threat to lose access to the platform)

Therein, a final irony: I suspect the shoe’s on the other foot now. A lot more of us will be thinking twice before doing quite so much business with TPM — if any.

4-Feb was their most recent payout date; so we should be getting more DPs over the next few days on whether these checks are clearing or not.

My 2/4 check cleared, close to $10k, thank god. Keeping my foot off the gas pedal now as I research other outlets.

I was tempted but didn’t bother to apply with TPM or any other private gift card re-seller, especially after seeing the various negative comments about TPM on PointChaser the first time PC posted about it. Judging from the volume of negative comments it sounded like either there were a lot of fake negative comments from competition, or he makes sure to pay bloggers correctly (hence they don’t have personal negative experiences) and the rest are in a secondary category where their checks might be delayed as seen fit, or now even bounce?

Having to wait for paper checks and hoping they don’t bounce it’s a crazy premise in my opinion, especially when you’re talking about thousands of dollars; if it is profitable you will likely scale up to where your payouts get to thousands. For people who do this, at least make sure you deposit these checks on a checking account at a bank you can afford to be blacklisted, i.e. the ones you open and close for checking bonuses.

But even via ACH, the mere concept of having to trust some guy online with that much money is too risky for my taste; it’d be somewhat risky even if I new them personally, unless I can really trust them that much…think about how many people in your life can you blindly trust with thousands of dollars, blindly as in they can disappear from your life if they want and you’d never seem the again.

The same applies to the recent posts on MS forums about merchant re-sellers (you buy items online and ship them to some guy’s warehouse and he pays you back). It’d be a different story if we were talking about an actual long established company with assets and such. A guy online can just disappear at any moment and you’d likely have zero recourse. Having to risk up to a couple of hundred dollars at a time is one thing, but thousands it’s a different risk category altogether.

So if you do this, basically deduct from your profits not just the time you spend, but also the anxiety you experience until your checks/ACHs clear. And I hope TPM or others don’t think skeptics like me are trying to negatively affect their business; I have nothing against the premise of making money online in general or within a community of shared interests (several of us have at some point). I’m just saying why I wouldn’t risk it. I understand many others do and will continue to do so, just like with various MS, crypto nowadays, or other money-making venues.

“Having to wait for paper checks and hoping they don’t bounce it’s a crazy premise in my opinion,…”

In a nutshell, noon-rader, you nailed it.

Going forward, if TPM has any hope to restore its credibility, it has to do a major mia culpa….. bit the bullet, (puns intended) and create a reliable, quick, more frequent payment system.

If raise can do it, (and if TPM aspires to be a “better” platform, then time to get with it.

Alas, I suspect odds of Mike admitting a mistake and doing what seems obvious are roughly akin to the odds of the current POTUS ever admitting he did anything … amiss.

All of my checks from Mike have cleared. If people are blaming bank shutdowns on this, why did you use a personal bank account for business? No doubt Mike will make people whole.

“No doubt Mike will make people whole.”

Really? Have you been following along or was your head buried in the sand until today?

Following but I’m not being dramatic like everyone else.

I don’t consider it dramatic to be worried about bouncing a 5-figure check.

Sub