NOTICE: This post references card features that have changed, expired, or are not currently available

Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email.

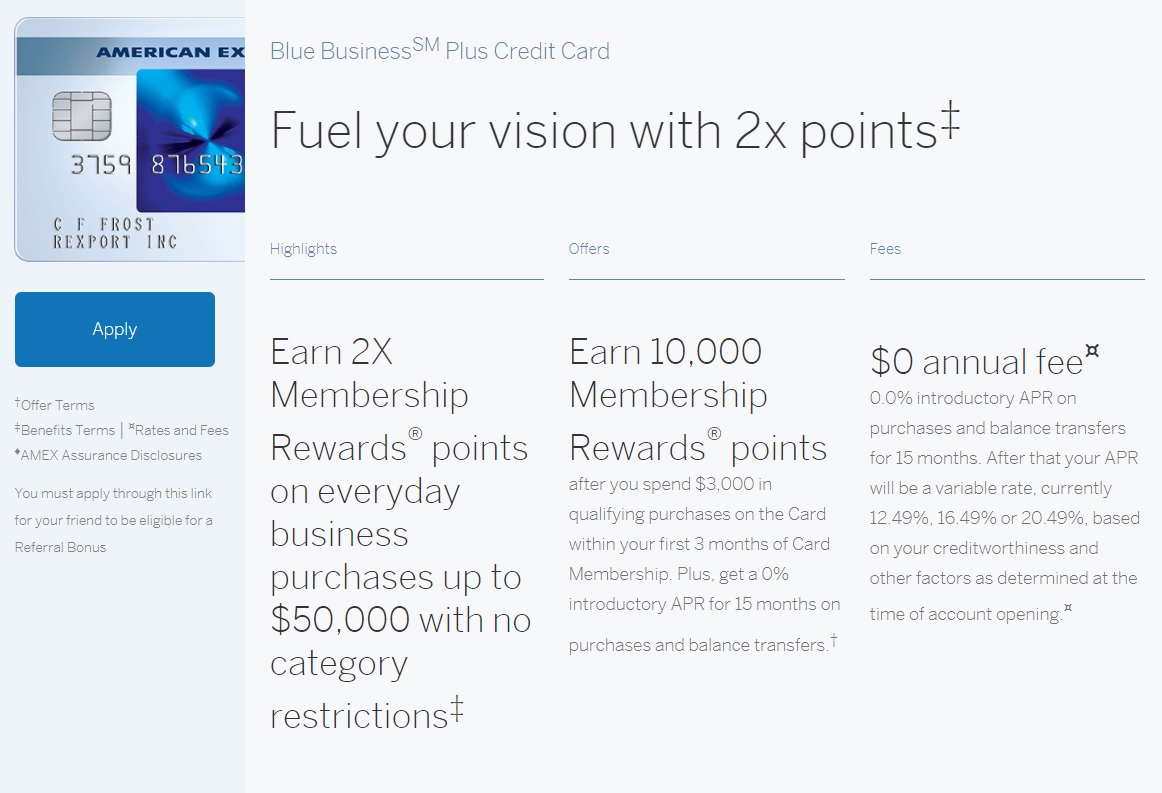

Current cardholders of the Blue Business Plus Credit Card from American Express can now refer friends — and the referral offer comes with a welcome offer of 10,000 Membership Rewards points after $3,000 in purchases in the first 3 months for your friend (and if you have the card and refer friends, you can earn 10K per friend who is approved up to 55K points per year).

The Offer

- Earn 10,000 Membership Rewards points after spending $3,000 on qualifying purchases within the first 3 months

- Find a link to this offer on our Best Offers page or see our Blue Business Plus Credit Card page for more card info and a link.

Key Card Details

- Earn 2x everywhere on the first $50,000 in purchases each year (then 1x)

- No annual fee

Quick Thoughts

This card debuted with a welcome offer of 20,000 points last summer, but that offer expired and there has not been a publicly available bonus on the card since last June (though some people have received targeted offers). This new offer is available to anyone via referral link from an existing cardholder.

The Blue Business Plus is the most compelling card in the Membership Rewards lineup in terms of rewards for everyday spend. At 2x everywhere on the first $50K in purchases each calendar year, it’s hard to beat this card’s return on unbonused spend. Furthermore, the Blue Business Plus carries no annual fee. One drawback is that Amex Offers have been light on this card. That said, I’ve received a few good offers (including a recent offer in my account for an additional 1x at Dell).

While the size of the offer is meager compared to other cards, the everyday earning structure and lack of an annual fee make it worth a look.

Where to share your link

If you currently have this card and have a referral link to share, head over to our Frequent Miler Insiders Facebook Group and find the appropriate thread (be sure to read the directions in the first post of that thread to make sure your link isn’t deleted). Replies to this post with links will get caught in our spam filter and will not post, so please head over to Facebook if you have a link to share.

H/T: US Credit Card Guide

[…] New 10K Signup Bonus on 2X Everywhere Card – The Frequent Miler […]

[…] New 10K Signup Bonus on 2X Everywhere Card – The Frequent Miler […]

How strict are they that the spending must be for a business instead of stuff that would obviously be personal?

Just so I’m clear— the one referring doesn’t get anything, correct?

Incorrect. Both people get 10K. I didn’t include that in the post, but I’ll update it to make it clear. Amex allows you to earn up to 55K per year from referrals on this card.

Currently have the old Blue for Business that I want to switch to this and am maxed out on Amex slots. Should I cancel Blue for Business and then apply for Plus? Or should I apply for Plus, get denied, and then cancel original Blue during reconsideration call?

Are you sure you’re maxed out? I ask because I’ve seen a couple of reports recently of people getting a 6th card….and I’m not sure how the Citi conversions are impacting the landscape.

That sounds like I’m saying to apply and then call recon if you need to….but on the other hand, if you want to be sure you get the bonus on this and you have no use for the Blue for Business anyway, go ahead and close that one and then apply for the Blue Business Plus. I don’t really think there’s a wrong answer here for you.

I got denied for the targeted Amex Delta Gold bonus at the end of last year for having too many cards. I’ll probably try the close and re-apply route. Is there a recommended amount of time to wait after closing an Amex before applying for a new one?

I waited 5 minutes.

I got turned down for the Blue Business Plus originally back in Dec and was told I had the max credit cards (5). When I read the D of C post, I called, got the 20k offer, cancled one card, got approved.

I had 5 credit cards and 3 charge cards (Plat & 2 Gold). Had a Hilton card Idid not wanty. Was advised by Amex to cancel that card to open a credit card slot, first, then apply. D of C had a post a few days ago to call in and you might get offer not publicly available. Worked for me. Got 20k offer, applied after canceling Hilton card, got approved for this card. See this D of C post.

https://www.doctorofcredit.com/see-american-express-business-bonus-like-call/

Also a cheap way to park your points while you are in-between more premium cards from AMEX.

Great point!