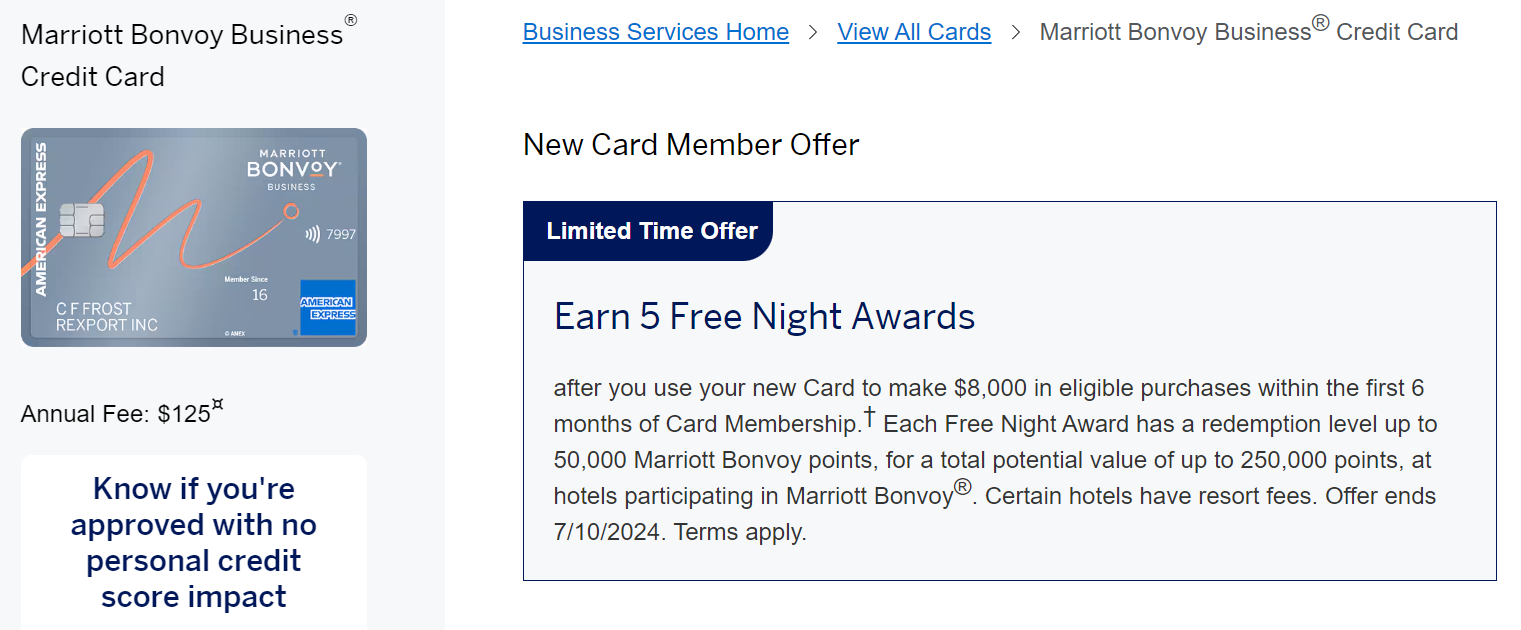

Amex has launched a terrific, limited-time welcome offer for the Bonvoy Business card that offers five Marriott 50K free night certificates after $8,000 in purchases within the first 6 months. In our most recent evaluation of Marriott points, we estimated that Marriott 50K free night certificates were worth around $300 each, making the total offer worth ~$1500.

Given that you can now top these certificates off with up to 15,000 additional points per night, this can be a great deal for anyone able to maximize the use of the certificates within the first year.

This 5x50K cert offer has come and gone several times on the personal Chase Marriott Boundless card, but this is only the second time we’ve had it on the Bonvoy Business, matching the best offer we’ve ever seen for that card. Go forth and conquer.

The Offer & Key Card Details

| Card Offer and Details |

|---|

Earn 3 Free Night Awards - Valued at up to 50K points each, up to 150K points total. ⓘ Affiliate Three 50k free night certificates after $6K spend in the first 6 months. Redemption level up to 50,000 Marriott Bonvoy(R) points for each bonus Free Night Award, at hotels participating in Marriott Bonvoy(R). Certain hotels have resort fees. Terms apply. (Rates & Fees)$125 Annual Fee Recent better offer: 5x50K free night certificates after $8K in spend (expired 3/20/24) Earning rate: 6x at Marriott Bonvoy properties ✦ 4x at restaurants worldwide, U.S. gas stations, wireless telephone services purchased from U.S. suppliers and on U.S. purchases for shipping ✦ 2x on all other eligible purchases. Terms Apply. (Rates & Fees) Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Earn an additional 35k free night certificate (can be topped-up with up to 15k additional points, subject to resort fees) after you spend $60K on purchases in a calendar year Noteworthy perks: Complimentary Marriott Gold elite status ✦ 15 Elite Night Credits each calendar year ✦ 35k Free Night Award every year after card renewal (subject to resort fees) ✦ Complimentary premium Internet access at Marriott properties ✦ Terms Apply (Rates & Fees) See also: Marriott Bonvoy Complete Guide |

Quick Thoughts

This new offer replaces one that gave 3 x 50K certs for $6K spend, obviously a significant improvement. In fact, it matches the best that we’ve ever seen for the Bonvoy Business.

We typically prefer points over free night certificates, as points are more flexible and don’t have to be used within a year. That said, there’s a lot of value to be had with these 50K certificates, especially when considering that they can be used at properties costing up to 65,000 points with Marriott’s top-up feature.

Last year, we redid the value of many hotel program’s free night certificates by taking the points value and multiplying it by a somewhat subjective “fudge factor,” that takes into account the inflexibility of the certificates and their one-year expiration dates. The Marriott 50K certs came out to just over $300, making the five certs “worth” ~$1500. In practice, it will probably be easy to get more value than that if you put even a bit of effort into trying to maximize the certs.

The business card is also appealing for many because it comes with 15 annual elite night credits that stack with the elite nights from having Marriott consumer cards. If you have at least one of each, you’ll begin the year with 30 elite night credits — just 20 nights short of Marriott Platinum status (otherwise known as “the ridiculously confusing free breakfast status“). The business card also doesn’t add to your 5/24 status.

This is probably the offer that will finally get me to pick up the Bonvoy Business card and I think that it’s worth a hard look for anyone who’s been considering it.

![Register to earn 10K bonus Marriott points after $7K spend [Targeted] a hotel entrance with a street and a building](https://frequentmiler.com/wp-content/uploads/2020/09/Marriott-Featured-Image-218x150.jpg)

I just applied for this card 2 weeks ago, spend a couple of hundred and now they say (via chat) that they will not match the new offer. I am annoyed enough to cancel the card (and P2’s). I will call directly now, but do you have any suggestions?

Don’t do it since it’ll put you in the bad books of Amex (i.e. if you close account before a year) and might impact your future approvals.

Good advice, but the days of 5 Business Platinum cards in 1 year are over, I fear.

Tim, I have had the Amex Marriott card and closed it within the last few months. Can I submit a application for a new Marriott business card with a different business with an EIN and be eligible for a SUB?

What is an elite night credit? What does it give me?

Elite nights toward Marriott yearly and lifetime status.

Applied using your affiliate link and was approved yesterday March 18th for the Bonvoy Business. Been a while since I used one of your links…or any affiliate link for that matter.

so i applied for this card and now it’s giving me only 3 free nights when i know i apply for the 5 free nights. What should i do ? I have contacted amex twice about this and as of today i only have the 3 nights…..wondering is someone else is dealing with this issue. thank you.

Did they fix it? Do you recall how quickly your free night certificates posted after meeting the minimum spend requirement?

Do the eligibility rules apply at the time of application or when the SUB is issued, or both ?

The former would mean that the bonus is guaranteed if I don’t get the pop-up during the application.

For example, could I sign up for the 5 night offer on this Amex Bonvoy business and for the Chase Bold (with no SUB) a few weeks later ? Or would this exclude me from the Amex SUB once I hit the minimum spending, let’s say in 4 months ?

Approved via 20k P2 referral w/o x10 dining. Interestingly, I was in pop-up jail for past year. Put a bunch of spend on my pers. Plat the past couple of weeks while on vacation & approved the day I got back. Immediately downgraded said plat to gold on the last day I was able to avoid the AF. Successful plat double dip & out of jail. Not bad.

Tim, my husband tried to apply for the business since he has the brilliant and is a great combo. However. he got the pop up jail sign saying he would not get the bonus if he continue with the application. We tried using my referral link, then incognito mode, still the pop up will show up.

We are trying to figure it why he is in pop up jail could be since he has been putting spend in all his amex: the blue cash every day, hilton business and the brilliant. He only has those 3 with Amex and the last 2 were opened on 1/23 and 6/23 respctively.. Could it be that he is not getting it because he got the brilliant bonus on 1/23 which is 13 months ago? any recommendations to try to get this sign up bonus or should we give up?

Hi Tim, I was hoping to get your insight on this! Please let me know your thoughts. Very much appreciated.

It can sometimes be tough to figure out why Amex does or doesn’t give someone the popup. I’ve had the popup disappear just by using a different link.

A couple questions: does P2 have any other Marriott cards or has he had any in the past?

Does he get the pop-up when applying for non-Marriott business or consumer cards?

My approval email seems to have a different card design than the website displays. Not that I generally care about card design, but thought that was interesting. Here’s a link to what my approval email shows:

http://www208.americanexpress.com/axp/cardart/bonvoy_business_amex_card.gif

same same

I was approved for the Boundless March 22, 2022 and pc to Ritz March 22, 2023, am eligible for the Amex Marriott Biz sub?

no

nope. there’s a 24 month clock or Marriott card eligibility any time you go from Chase to AmEx or vice versa.

Ohhh

I just canceled this same card two weeks ago after having it for a couple years

Am I out of luck for getting it again?

AmEx welcome offers are supposed to be once per lifetime. Never hurts to try, though.

I’m totally going to get the pop up, lol. I just closed like 3 platinum biz cards and a biz gold in the last 6 months. But you can’t get a hit if you don’t swing!

Crap, the matrix tells me I’m not eligible since I got the boundless in June 2022. Bummer!

If the baseball hits your bat without you taking a swing (e.g. you duck out of the way of a pitch but still are holding the bat above your head and the ball strikes it) and bounces into fair territory, it is a live ball. And so you can get a base hit without swinging if you make it to first base before being thrown out.

Does this mean you have to USE the FNCs within a year or merely book something within a year?

book and use within one of year of when they are awarded.

Dual Hyatt Globalist + Bonvoy Titanium here

As much as I hate Bonvoy, the certs I have found to be quite useful because they let you “top off” their value with additional points. Finding a property that is slightly above the value of the actual cert value are usually the better uses of the certificates.

However note this: Bonvoy’s stay 4 award nights get 1 night free for an award booking does not apply when using a cert. So in other words – these certs are to be used for a set of shorter stays, usually 1-2 nights. If you have trips where you are doing shorter stays, this works. Otherwise for a week in Cancun etc – would advise to do the 4+1.

Regardless will be hard to use during high season given lack of award chart anymore.

You are correct. 5th night free is for awards stays booked with all points only.

Would you mind posting the link to your brilliant (pun intended) marriott card conflict chart. I have the the amex biz (former SPG) fir a million years but have no other Marriott biz cards. Am I eligible? Thanks.

Yep…there’s a link in the post (“are you eligible for a Marriott card”) and I’ll put it again here.

Officially, that card falls into the “lifetime” 5-7 years restriction, but I’ve heard of folks getting approved for new one while holding the old one. I’d just give it a try and see if you get the pop-up. If you do, you can cancel the app. If not, you’re in.

Hey Tim! Have you heard of any DPs of people getting approved for new Marriott cards AND awarded the SUBs when they were technically ineligible? I got a Chase Boundless 5-night SUB within the past 2 years and I am wondering if there would be any risk in lobbing an application into Amex for this offer.

AMEX will tell you with a pop-up when you apply and are ineligible due to another Marriott SUB or card, and you can back out at that point. I picked up the Marriott Biz without a SUB for the elite nights and it told me I was ineligible during the application process – I was okay with that (have gotten good value from the breakfasts, Suite upgrades, and extra points earnings).

To be clear I was in the same situation after picking up the Boundless 5 FNC, you won’t be eligible. AMEX isn’t dumb. I wish Marriott didn’t have such a long waiting period between SUB eligibility on their cards.