NOTICE: This post references card features that have changed, expired, or are not currently available

Update: Chase has changed the annual free night benefit, sending out a letter indicating that annual free night certificates issued after 5/1/18 will be capped at properties costing up to 40K per night. See this post for more details.

Over the weekend, Chase links to the IHG credit card went down. If you browse to an old Chase link, you’ll get this:

Doctor of Credit reports on rumors published by AskSebby that suggest that Chase may be replacing the current IHG card with two new cards, neither of which will have an annual free night. That seems unlikely to me, but I do think it is certain that any new cards will be less of an amazing deal than the current IHG card.

Update: Details about a new IHG card have leaked out. As I expected, the higher-end card ($89) will offer an annual free night. Still, personally I’d prefer the $49 card. See: New IHG card will carry free night, but higher fee.

Fortunately, there are still some working links to the IHG card, but these may disappear any moment. We will do our best to keep up-to-date working links on our dedicated IHG credit card page.

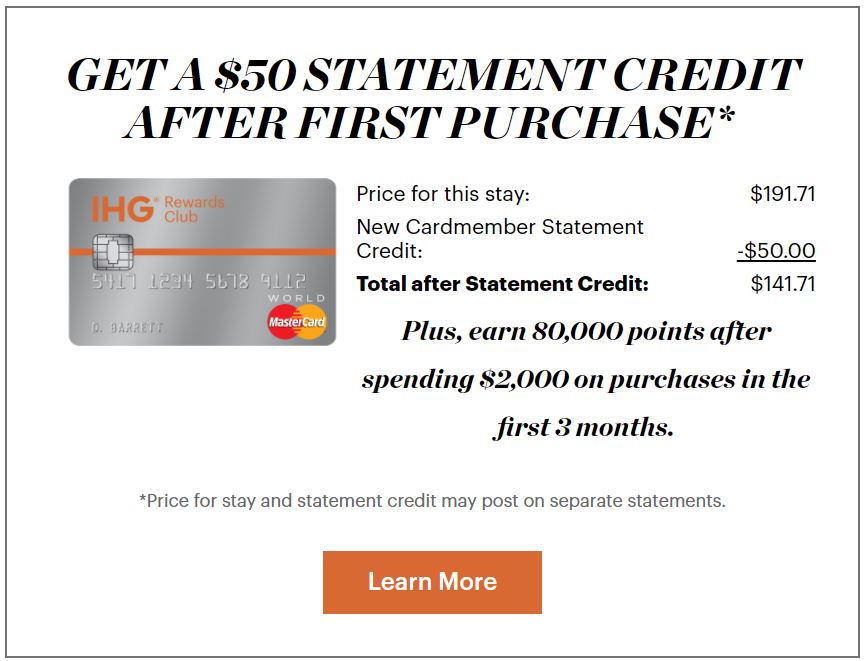

As I write this, the best working offer is for 60,000 points after $1K spend, plus a $50 statement credit after first purchase. If you have IHG elite status, you may be able to find an even better offer by going through the steps of booking a paid night on IHG.com. On the last screen before confirming the booking, scroll down to the bottom to look for an 80K offer (I can’t promise it will be there, but it might).

I’ve always thought of the $49 Chase IHG card as the single best card to have and to hold. It offers fantastic value for it’s annual fee, but it’s not particularly rewarding to use for spend. Here’s why I love the IHG card in its current form:

- It’s cheap: $49 annual fee

- Annual free night e-certificate good at ANY IHG property

- Automatic 10% point rebate on awards

- Automatic Platinum elite status

The annual free night certificate will first appear at the end of your first year of card membership and then each year after that. The amazing thing about this free night certificate is that it is good at any IHG property worldwide, including Intercontinental Hotels that may otherwise cost upwards of $1,000 per night. But, even if you use the certificate to cover a hotel that would have cost $200 per night, you’ll come out way ahead. And now that the free night certificates can be used at Kimpton hotels, I like them even more! See: Kimpton IHG Platinum experience redeeming free nights at the Kimpton Muse.

What about 5/24?

The IHG card is not subject to 5/24. That means that even if you’ve signed up for 5 or more cards in the past 24 months, it is still possible to get approved for this card. On the other hand, as is true with all personal cards, this card does add to your 5/24 count once approved.

| Chase's 5/24 Rule: With most Chase credit cards, Chase will not approve your application if you have opened 5 or more cards with any bank in the past 24 months. To determine your 5/24 status, see: 3 Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely. |

Who should apply?

Anyone who doesn’t already have the IHG card should consider picking one up today. Our hope is that Chase will grandfather in everyone who gets the card now so that we can keep the current card pricing and benefits long term.

Question: I’m under 5/24. Is this card worth pushing me closer to 5/24?

I think so, yes. Of course there are other Chase cards that may be even more worthy. If you have your eye on another card and you’re at 4/25, consider signing up for both on the same day. This way it’s possible to get approved for both even though you’ll end up at 6/24 afterwards.

Question: What if I’m way over 5/24?

Then definitely get the card. One more new account won’t hurt you.

Question: I’m over 5/24, but will soon be under. What should I do?

That depends upon how many accounts will soon be past the 24 month threshold. If you’ll soon be well under 5/24, then that will still be true even if you sign up for this one card now. On the other hand, if you’re waiting for just one card to age off the 24 month limit, then signing up for this card will prolong your 5/24 count. In that case, the answer to whether you should go for this card depends upon what other Chase card you are anxious to get. Is it more valuable to get that other Chase card soon vs. giving up on the $49 IHG card forever? I can’t answer that for you.

Application Link

We will do our best to keep up-to-date working links on our dedicated IHG credit card page (click to view). At the present time, the best offer is not an affiliate link.

Bummed that I missed this….conflicted on whether to get one of these two or the Sapphire preferred maybe…I don’t travel much at all honestly but this is the kind of thing that one can make a mini holiday out of if nothing else.

Author: may I ask why you feel the $29 card is the sweet spot? What’s the main value you see in it?

I got denied. The rep on the reconsideration line said they won’t extend any more credit and new Chase policy does not allow moving existing credit to approve a new card.

Can I ask the details of your situation/credit score & report/cards & credit limits w/chase & your income level? Also do you frequently have relatively high utilization or low? New policy is a shame, when you say won’t allow moving existing credit do you mean part of your credit limit but keeping the other card open, or they won’t even allow you to close another card to in essence convert it to a new one? Thanks, appreciate your time and details, hopefully it will help me in my decision making as I expand my card holdings

[…] Last call for $49 IHG card. The single best rewards card to have and to hold […]

[…] card if you spend all of the nights at 5K point break hotels (make sure to check this card out before the $49 version disappears), the SPG card if you’re able to stretch out low category redemptions, or the Hyatt card […]

Can you apply for another IHG card if you have one already?

Approved for the 80k + $50 offer ($49 fees) with booking trick 🙂

Need to find a hotel in Rome anyway. the 80K + $50 offer showed up.

First time encountered a question after submit the stated income screen – whether I wanted to keep the existing amount (already a high number) or do I want to include other incomes – very strange. Opt for No. Still got an instant approval but with only 2K CL – the exact amount that I left on the X’ed card after transferred the bulk to Freedom. (Note to self – need to lower the CLs on the Inks)

May be it is due to late night (after 10pm), have not gotten a Chase Congrat email, the card also has not shown up online yet.

In any case have taken the screen shot of both the offer and the “You’re Approved”. So should be alright.

UPDATE

Just took a look Chase Online – new card shows up despite still no email. Still no email this morning the next day. Nonetheless I sent an SM to request expedition as we are leaving for a long trip next Wed. Hopefully they can do it. Else I would not see the card until Mid May…

2nd UPDATE

They are able to expedite the cards which would arrive in 1 to 2 business days.

Still no Congrat email from Chase.

So the only thing that I wasn’t clear on is do I get the free night when I sign up too? Or not until the end of the first year?

Got the card anyway seems like to good of a deal to pass up today.

You got it after 1 year as the card holder.

Thanks! Wishful thinking hoping for it on the front end, that literally would have been to good to be true.

Thanks to you and others (in particular, Doctor of Credit) for keeping an eye on this one and making sense of it. I think that this (current version) is one of those “you don’t know what you’ve got ’til it’s gone” things. I got the card a year ago and later plunked down the $200 for Ambassador status or what-have-you. Played right, you can live pretty high at ICs with comparatively low investment (buying points net less than half-a-penny-a-point). My free night literally just posted this week and I used it to cement a part of a European stay at an IC that would have cost >$500 for the night. Other side of the cement is 2-for-1 weekend booking with the Ambassador certificate. Anyhow, concatenation of events made me pull trigger for spouse, who is 1/24. Or was 1/24, since with instant approval she is now 2/24. Wasn’t in our plans, and with SPG Business and Aspire and … there is a lot of spend to keep an eye on… But, hey, aren’t these the kind of problems one wants to have?

Any chance they completely shut down this card when the new one comes out?

I think that’s very unlikely, but it is possible that they’ll eventually migrate cardholders to the expected new $89 card. I hope not!

In that case, might wait for the higher bonus

[…] seen multiple reports (rumors?) that the Chase IHG card is going away. I’ve seen reports from Frequent Miler, Miles to Memories and Ask […]

[…] might be your last chance to get the $49-annual-fee version of the Chase IHG card (see: Last call for $49 IHG card. The single best rewards card to have and to hold.). Spencer Howard at Straight to the Points now shares a screen shot of the new IHG Rewards Club […]

What’s the chances they approve an application from a back link?

I don’t know what you mean?

If they took the link off their website why would they approve an application from an old link?

Why not? I applied two hours ago, went pending. I called an hour ago and was approved after transferring credit.

Oh I see. IHG is still advertising the card. The link we use is direct from IHG as of this morning. But even if they were old links, they will honor the terms if they approve you

just got off the phone with chase rep…he claimed it’s just a technical issue and the page should be back on the chase website in a couple of hours….time will tell

crap did I just apply and lose out on 40k points??

I’m pretty sure that he was wrong