NOTICE: This post references card features that have changed, expired, or are not currently available

Earlier this week we reported that Southwest had changed the value of their points when redeemed for flights. They slightly reduced the value of points applied to Wanna Getaway Fares, but greatly increased the value of points applied to Anytime and Business Select fares as follows:

- Wanna Getaway Fares increased from 70 points per dollar to 78 points per dollar

- Anytime Fares dropped from 100 points per dollar to 78 points per dollar

- Business Select Fares dropped from 120 points per dollar to 78 points per dollar

It never made sense to me before that points were worth less for more expensive fares. If they are going to tie point values to flight prices, they might as well do so consistently across the board. And so they have.

Our own Stephen Pepper, took this new 78 points per dollar price and asserted that points are now worth 1.28 cents per point (100 cents / 78 points = 1.28). Sorry Stephen, but that’s not right. Points are worth more than 1.28 cents each. The actual point value depends on the flight price and the route. Let me explain…

Calculating the value of Southwest points is not as straightforward as it seems. With each fare, there are taxes and fees that are not part of Southwest’s award calculation. In other words, the points required for an award flight are less than you would expect based on the overall fare. The result is that the value you get from Southwest points is higher than the value that can be calculated directly from the known 78 points per dollar.

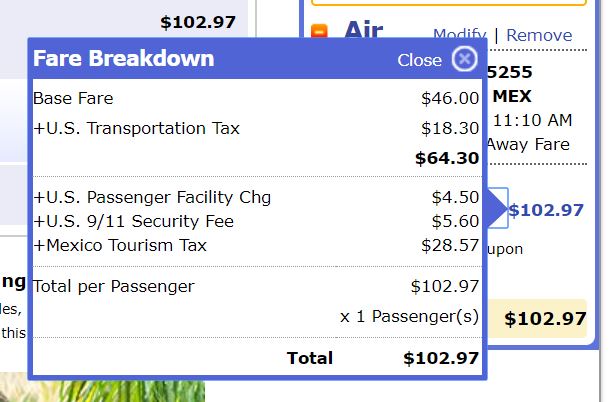

Let’s look at an example. I found a Southwest flight from Houston to Mexico city with a Wanna Get Away cash price of $102.97 and a point price of 3,588 points plus $34.17 in fees. This means that those 3,588 points are worth $102.97 – $34.17 = $68.60. And that gives us a per point value of $68.60 / 3,588 = 1.91 cents per point!

How is this possible? Let’s look at the fare breakdown. As you can see below, the base fare is only $46. 3,588 points divided by $46 gives us the magical 78 points per dollar. When paying with points, Southwest charges cash for the U.S. 9/11 Security Fee ($5.60) and the Mexico Tourism Tax ($28.57), but does not charge the US Transportation Tax or the US Passenger Facility Charge. These are thrown in free when you pay with points. And this is why points are worth more than they seem.

The best point value is found on flights with low fares and high taxes

Even though Southwest now charges a fixed 78 points per dollar on base fares, the per point value you can get from awards is smaller with higher fares. This is because the taxes that are thrown in for free are a smaller percentage of these higher fares.

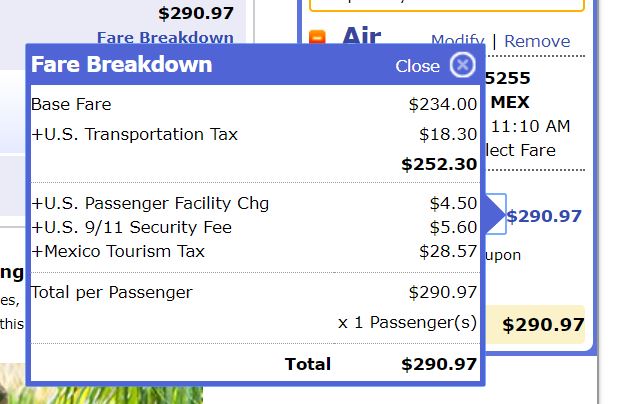

Here’s an example of the same flight as above, but with the much higher Business Select Fare of $290.97. As you can see in the Fare Breakdown, the taxes and fees are exactly the same as with the much cheaper Wanna Getaway fare shown above. As a result, I calculate the per point value of this $290.97 fare at 1.41. That’s still better than Stephen’s 1.28, but obviously not nearly as good as the 1.91 cents per point shown above.

When flying to/from different countries, different taxes apply. The higher the taxes (the ones not charged on award tickets), the more value you’ll get from points.

Further advantage to Wanna Get Away point awards…

Due to the factors shown above, Wanna Get Away fares lead to better point values because the base fares are much lower. There is another side to the story, though. On paid tickets, you earn points. And Business Select and Anytime fares earn more points than Wanna Get Away fares do:

- Wanna Get Away: Earn 6 points per dollar on paid fares

- Anytime: Earn 10 points per dollar on paid fares

- Business Select: Earn 12 points per dollar on paid fares

Points are arguably worth a bit less on Anytime and Business Select fares because you give up more point earnings by booking an award. An argument could be made that one should include the loss of earned points when calculating point values. Let’s look at the two fares above, for example.

If we paid $102.97 for the Wanna Get Away fare to Mexico, we would earn 6 points per dollar on the base $46 fare. In other words, if we book this with points, we give up earning 46 x 6 = 276 points. If we paid $290.97 for the Business Select fare, we would earn 12 points per dollar on the base $234 fare. If we book this with points, we give up 234 x 12 = 2,808 points. An argument could be made that the real award prices for the Wanna Get Away and Business Select fares are 276 and 2,808 points more than shown since you’d be giving up these earned points.

With the above in mind, we can re-calculate the points per dollar as follows:

Adjusted Wanna Get Away Point Value (Mexico City example)

- Price: $102.97

- Base Price: $46

- Points “lost” by booking award instead of paid fare: 46 x 6 = 276

- Point Price: 3,588 points plus $34.17 in fees

- Adjusted Point Price: 3,588 + 276 = 3,864 points + $34.17

- Adjusted point value = ($102.97 – $34.17) / 3,864 = 1.78 cents per point (vs un-adjusted 1.91)

Adjusted Business Select Point Value (Mexico City example)

- Price: $290.97

- Base Price: $234

- Points “lost” by booking award instead of paid fare: 234 x 12 = 2,808

- Point Price: 18,252 points plus $34.17 in fees

- Adjusted Point Price: 18,252 + 2,808 = 21,060 points + $34.17

- Adjusted point value = ($290.97 – $34.17) / 21,060 = 1.22 cents per point (vs un-adjusted 1.41)

Reasonable Redemption Values

For the purpose of estimating signup bonuses, we maintain a page of Reasonable Redemption Values (RRVs) for points and miles. These are meant to be the values at which it is reasonable to expect to get that much value or better per point. We do not include lost point earnings in any of these calculations due to the complexity. In many cases, point earnings are based on a traveler’s elite status, current promotions, etc. So, for Southwest Reasonable Redemption Values we do not use the adjusted point values described above.

Most airline RRVs were last calculated based on statistics showing that average airfares in the US were $361 roundtrip (you can read about the methodology here). So, I found a round-trip Southwest flight that cost nearly the same ($366) and calculated the cost per point: 1.51. Rounding down slightly, we get to a new Southwest RRV of 1.5 (previously 1.6 prior to the devaluation in Wanna Get Away awards)

Summary

Even though the value of Southwest points for Wanna Get Away fares has gone down, the actual per point value is better than it seems. On average, you can expect an un-adjusted value of about 1.5 cents per point. Keep in mind, though, that points are worth more when applied to very cheap fares (where taxes make up a significant portion of the fare), and less for very expensive fares.

[…] couple of years ago, Greg wrote a post called The new true value of Southwest points. How to get up to 1.9 cents per point in value. I was re-examining that post in preparation for what I planned to be an entirely different post […]

[…] the cost of a flight, but certain taxes aren’t charged on award tickets which can make for a redemption value as high as 1.9 cents per point to some Latin American […]

[…] the cost of a flight, but certain taxes aren’t charged on award tickets which can make for a redemption value as high as 1.9 cents per point to some Latin American […]

[…] the cost of a flight, but certain taxes aren’t charged on award tickets which can make for a redemption value as high as 1.9 cents per point to some Latin American […]

[…] $900 in Wanna Get Away fares (or perhaps as much as $1,140 worth of airfare since you can get up to 1.9c per point in some instances). While other airline cards offer the opportunity to get outsized value with international premium […]

[…] the sign up bonus. I honestly have no idea what the value is, so I’ll go with the experts. Frequent Miler says the reasonable redemption value is about 1.5 cents per point, so let’s go with […]

[…] complicated because of taxes and fees. (Frequent Miler has a good article explaining the details here.) Because of this methodology, Southwest’s redemption rates are reliable. You’ll […]

So now SWA is having a 40% bonus promotion on purchasing points. Is this a good deal? Thank you.

In most cases: no. With the promo they cost 1.96 cents each. It would only be worthwhile if you could get that much value or more

[…] The new true value of Southwest points, 2018 edition. How to get up to 1.9 cents per point value. […]

This same logic applies to hotel points and taxes as well. Bloggers don’t ever mention the crazy hotel tax savings on point redemptions. In addition, you can get a ton of value from buying discounted points if you are short of the 4tg night, since the 5th night is free.

I think the main reason you don’t hear anyone talk about tax savings in valuing hotel points is because it is so incredibly variable that it is hard to build tax savings into a point valuation (and the effect of taxes on the value of the points will be proportional across different chains in the same municipality since to my knowledge none of the loyalty programs charge hotel tax on award nights — e.g. if taxes add 25%, your points become 25% more valuable in relation to their value against the room rate in whichever program you choose). You’re right that it’s certainly an important consideration, and I always take the total with taxes into account when determining whether or not to use points for hotels.

Along these lines, one of my biggest pet peeves is bloggers who push point + cash redemptions w/out taking into account taxes and/or resort/destination fee savings (if not charged).

MEX is an extreme example. I buy 6-9 WN tickets per year within the US with points. If I account for the fees that I don’t have to pay, I get a value of about 1.45c per point with the new system (after sampling some tickets I’d normally buy). It’s still higher than 1.28c but not the greatest.

Yes, I purposely picked an extreme example to prove a point. The 1.5 cent per point RRV is based on a domestic round-trip of $366 ($183 one-way). If your one-way flights are more than $183, then you’ll get less than 1.5, if they are less than $183, then you’ll get more than 1.5

Hey, I recently got the Delta Amex platinum and will have no problem meeting the bonus spend requirement. However the card offers an MQM waiver for dollars spent and in order to get status I will need to spend $25K By December 31st to reach this. I am wondering what my best option for approximately $5k worth of manufactured spending would be? Is it buying gift cards etc?

Figure out what u can spent in 3 months then pay ur Tax bill like 2% fee to hit min.

With Amex cards it’s a bit risky to do gift cards these days because you never know if they’ll really count. I’d go with credit card bill payments (via Plastiq, for example), tax payments, Kiva loans… See this page for details on each: https://frequentmiler.com/go/ms

Did Southwest specifically say that the earning rates for WGA/AT/BS are still going to be different? There was kind of a nice symmetry in the idea that earning and burning rates were both higher for the higher fares. I would have expected the earning rates to be equalized as well with the new burning rates, but maybe they want to still leave in a perk for those who spend cash on higher fares.

They still advertise the old earning rates on their site and it’s very easy to see that they still use those rates because when you go to book they tell you how many points you’ll earn.

I’m glad they made the price more consistent. Great explanation

Excellent article Greg. I’m continually amazed at how many bloggers don’t understand this.

I think you can make an argument that lost points earning should not be included in the RRV given that unlike credit card points, they remain with the particular airline, cannot be transferred, and depending on how frequently you fly with that particular airline, have a high likelihood of expiring unused.

But what about the credit card points (MR, UR) you sacrifice by not buying the ticket. Shouldn’t they be included in your calculation?

The way I justify it is to say that the RRV is an estimate of how much money you save at the time of purchase by using points instead of cash without considering rebates in any way. This applies to both awards and paid flights:

With awards, I don’t consider the Arrival Plus 5% rebate, nor do I consider rebates you get just by having a card (e.g. IHG 10% points rebate, AA 10% rebate, etc.)

With paid travel, I don’t consider rebates from credit card rewards, from hotel/airline programs, from portals.

Admittedly, I think it would be more accurate to include rebates but the complexity is overwhelming. Consider, for example, the Altitude Reserve. If you book an award through their travel portal, you don’t earn credit card rewards, but if you use their Real-Time Mobile Rewards, I think that you do. So I decided that it was better to develop ballpark RRV estimates than to get forever mired in this complexity.

You could also argue that the fact that point bookings are fully refundable makes the points a little more valuable. I know you can cancel a paid wanna-get-away fare and get a travel credit good for one year, but I prefer just getting a full refund rather than having to keep track of those travel credits and having to be sure to use them within one year. I love being able to just make a bunch of speculative bookings with points and cancel them anytime.

That is very true. I’ve made that same argument myself in the past.