NOTICE: This post references card features that have changed, expired, or are not currently available

Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email.

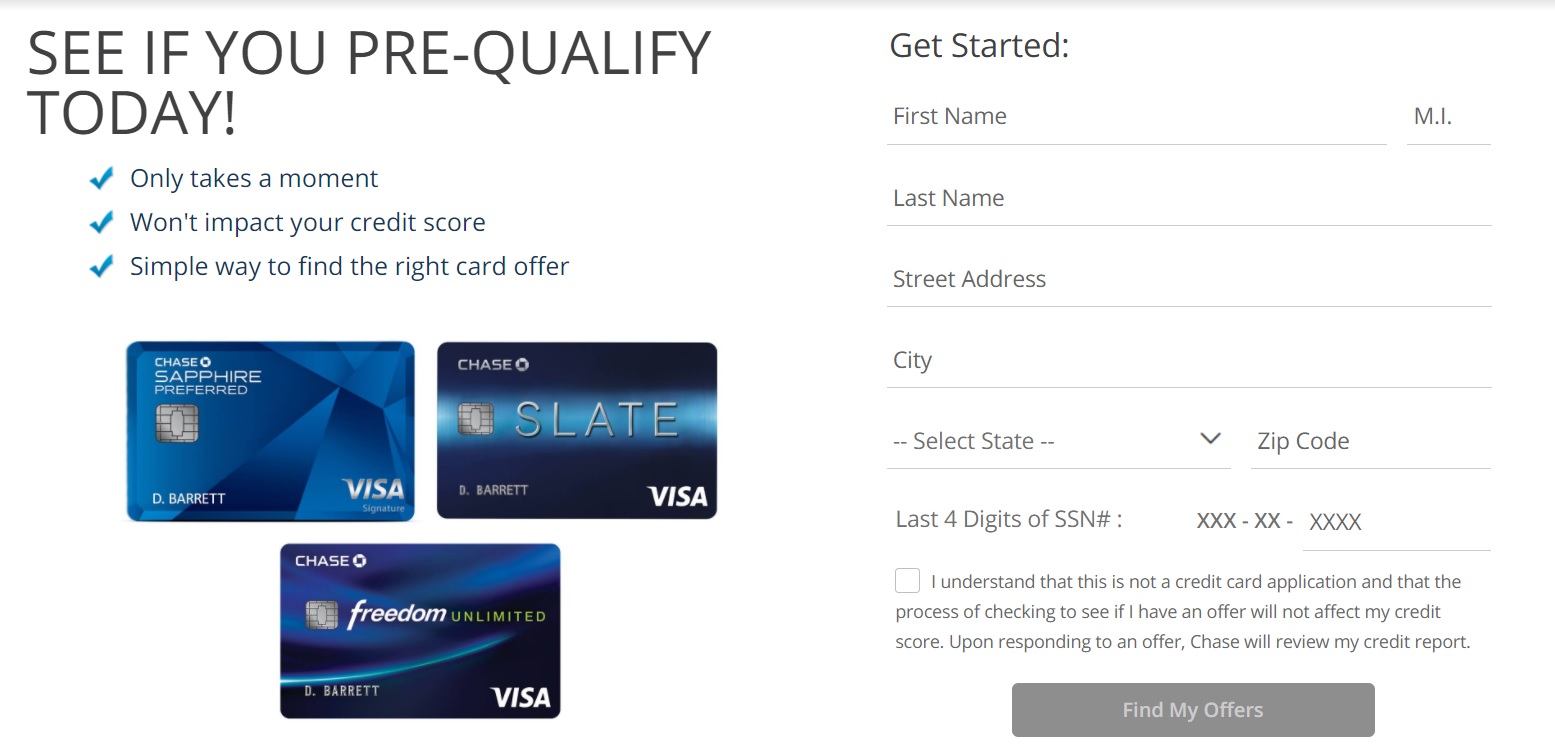

In this morning’s post (See: Over 600,000 points and well under 5/24), Greg mentioned that Ben received a targeted mailer for a 60K signup bonus on the Chase Sapphire Preferred that included a waived annual fee the first year. Both that offer and an offer for a 30K signup bonus on the Chase Freedom may be available online. Chase is showing increased pre-qualified offers for some people through their pre-qualification tool. Note that these offers do not bypass 5/24.

The Offers

- Chase is offering increased signup bonuses to some via its website pre-qualification tool including:

- Chase Sapphire Preferred: 60,000 points after $4K spend in 3 months; annual fee waived the first year

- Chase Freedom: $300 cash back (30K) after $500 spend in 3 months

- Click here to check for pre-qualified Chase offers

Key Terms

- Be aware of the Chase 5/24 rule as these offers do not bypass 5/24 (unlike pre-approved offers you may get in-branch)

| Chase's 5/24 Rule: With most Chase credit cards, Chase will not approve your application if you have opened 5 or more cards with any bank in the past 24 months. To determine your 5/24 status, see: 3 Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely. |

Quick Thoughts

Similar pre-approved offers are sometimes available in-branch, but it’s nice to have these offers online as not everyone lives near a branch or has the time to stop in and check for offers in person. The $300/30K offer on the Chase Freedom is the best I can recall and the 60K on the Chase Sapphire Preferred is notable since the annual fee is waived the first year. The best public offer on the CSP, which as always is included on our Best Offers page, offers the same number of points, but the annual fee is not waived the first year. If you’re under 5/24, both of these offers are excellent.

H/T: Doctor of Credit

How do you make yourself eligible for branch offers? Do you signup by email or make an appointment with a branch manager?

If I opted out of Chase offers in the past is there a way to opt back in? I’ve never been able to figure out how to do it.

can a person with ITIN only apply for chase card?

my credit score is 732…….would i likely be approved or declined for the csp card? with no late payments, a utilization of 11% and available credit of $25,000

It’s always hard to say for someone else, but that sounds like you’d be good to go. Creditboards has a database where you can see what other people have reported in terms of their scores and approvals or declinations. Type “Sapphire Preferred” into the search box (you don’t have to pick a state or bureau — just Sapphire Preferred is enough to give you general info):

https://creditboards.com/forums/index.php?app=creditpulls

I just applied CSP yesterday and got approved. Would they match it to this no annual fee offer?

Can you get approved for this Freedom and bonus if you already have a Freedom from 3 years ago?

Yes as long the bonus was received more than 24 months ago.

Ethan is half correct. You can get approved for the bonus if you haven’t received a signup bonus on the same card within the past 24 months — but Chase won’t approve you for a card that you currently have. If you still have that Freedom, you’ll have to product change or cancel it before applying anew. Conventional wisdom says to wait a week or two between changing/product changing and applying again. Some people have been able to re-apply the same day, but others haven’t. I’d give it at least a week.

Thank you for your insight, Nick!