NOTICE: This post references card features that have changed, expired, or are not currently available

When I published “Navigating Marriott’s Byzantine Credit Card Rules,” a week ago, I had resigned myself to the fact that I wouldn’t be able to get the new SPG Luxury card and its expected 125K 100K welcome bonus because I already had the Ritz card. The new rules that begin on August 26th mean that I can’t qualify for the SPG Luxury Card bonus without getting rid of my Ritz card and then waiting 31 days before applying.

Then, surprisingly, we got word that the SPG Luxury Card would be available starting August 23rd. Apparently we will have a 3 day window to apply for the card in order to qualify for the welcome bonus even if we have the Ritz card and/or recently opened a Marriott Rewards card and/or received a Marriott Rewards card welcome bonus within the last 24 months. All of those things will disqualify us from the SPG Lux welcome bonus beginning August 26th.

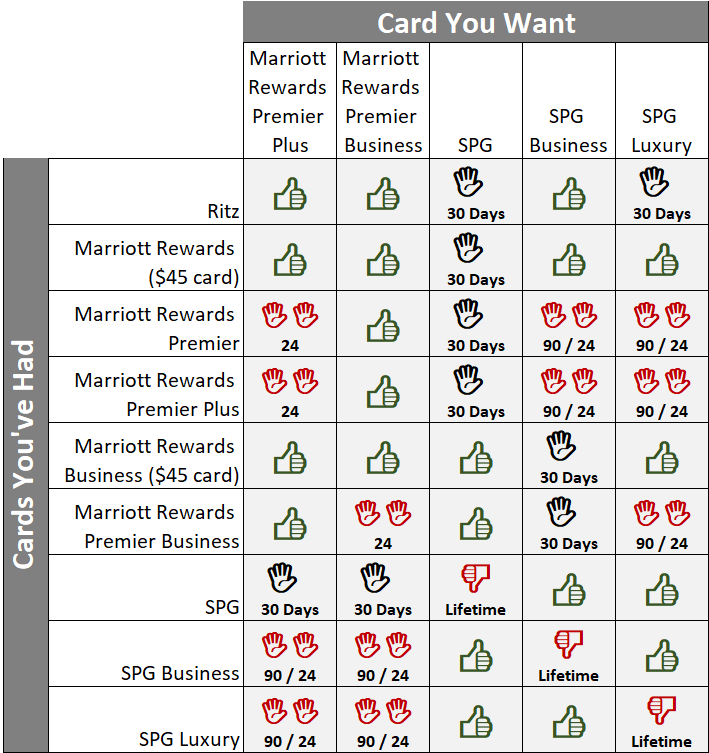

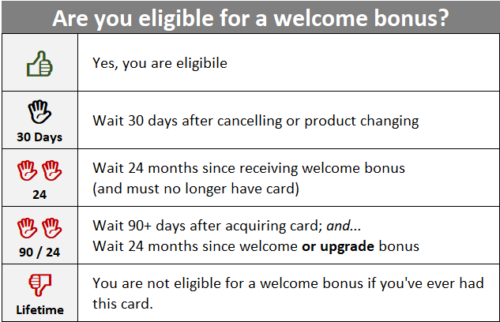

As a reminder, here are the new welcome bonus rules that take effect on August 26th:

Up to 450K on the table

Thanks to the Marriott and SPG loyalty program merger, both Marriott and SPG credit cards now earn the same types of rewards points (think of them all as Marriott rewards points). There are four different cards with signup bonuses available today, at a fifth one (the SPG Luxury Card) expected on August 23rd (click the links for more info about each card):

- SPG Luxury Card:

125K100K after $5K spend in 3 months (now available) - SPG Credit Card: 75K after $3K spend in 3 months

- SPG Business Credit Card:

100K after $5K spend in 3 months(offer has since expired) - Marriott Rewards Premier Plus: 75K after $3K spend in 3 months

- Marriott Rewards Premier Plus Business: 75K after $3K spend in 3 months

| Applying for Business Credit Cards Yes, you have a business: In order to sign up for a business credit card, you must have a business. That said, it's common for people to have businesses without realizing it. If you sell items at a yard sale, or on eBay, for example, then you have a business. Similar examples include: consulting, writing (e.g. blog authorship, planning your first novel, etc.), handyman services, owning rental property, renting on airbnb, driving for Uber or Lyft, etc. In any of these cases, your business is considered a Sole Proprietorship unless you form a corporation of some sort. When you apply for a business credit card as a sole proprietor, you can use your own name as your business name, use your own address and phone as the business' address and phone, and your social security number as the business' Tax ID / EIN. Alternatively, you can get a proper Tax ID / EIN from the IRS for free, in about a minute, through this website. Is it OK to use business cards for personal expenses? Anecdotally, almost everyone I know uses business cards for personal expenses. That said, the terms in most business card applications state that you should use the card only for business use. Also, some consumer credit card protections do not apply to business cards. My advice: don't use the card for personal expenses if you're not comfortable doing so. |

Window of Opportunity

On August 26th, due to the new welcome bonus rules, it will suddenly become very difficult to qualify for bonuses for many of these cards. Until then, it is theoretically possible to qualify for the welcome bonuses for up to four of these cards. It would be very difficult to qualify for all 5 before August 26th because Amex has an unwritten rule in which they don’t allow more than 2 credit card signups in 90 days.

It is theoretically possible to get all 5 bonuses, though. A person with good credit and a side-business, who has not signed up for any of these cards before, should be able to qualify for the SPG Luxury Card, SPG Business Card, and both Marriott cards before August 26th. Then, sometime later, they could cancel both Marriott cards, wait 31 days, and sign up for the SPG consumer card if it is still available (we don’t know if the SPG consumer card will be available to new applicants long term).

Most readers, I suspect, cannot qualify for so many cards. Here’s a guide to help you figure out what you can qualify for…

Which Chase cards are you eligible for?

Chase enforces several rules which may make you ineligible for the Marriott Rewards Premier Plus or the Marriott Rewards Premier Business Plus:

24 Month Rule: In general, you cannot get a welcome bonus for same Chase card again until you’ve closed the old card and 24 months have passed since you last received a welcome bonus. The rule is implemented slightly differently between the consumer and business card, though:

- Premier Plus: “The product is not available to either: (1) current cardmembers of the Marriott Rewards® Premier or Marriott Rewards® Premier Plus credit card, or (2) previous cardmembers of the Marriott Rewards Premier or Marriott Rewards Premier Plus credit card who received a new cardmember bonus within the last 24 months.

- Premier Business Plus: “The bonus is not available to you if you: (1) are a current cardmember of this business credit card; (2) were a previous cardmember of this business credit card who received a new cardmember bonus for this business credit card within the last 24 months.”

It’s interesting that the current rules for the Premier Plus ban you from getting the card at all if you’ve received the bonus in the past 24 months, whereas the business card rules let you get the card, but not the bonus. In the new rules that take effect August 26th, both cards will be obtainable, you just won’t get the welcome bonus if you don’t meet the new rules.

5/24 Rule: If you’ve opened 5 or more cards, with any bank, in the past 24 months you’re probably not going to get approved for the Premier Plus. Fortunately, Chase has not been enforcing the 5/24 rule with the Premier Business Plus.

| Chase's 5/24 Rule: With most Chase credit cards, Chase will not approve your application if you have opened 5 or more cards with any bank in the past 24 months. To determine your 5/24 status, see: 3 Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely. |

Eligibility Summary by Card:

- Premier Plus: You’re eligible if you meet all of the following criteria:

- You don’t currently have this card; and

- You don’t currently have the Marriott Rewards Premier card; and

- If you ever received a bonus for this card or the Marriott Rewards Premier card, it has been more than 24 months ago; and

- You are under 5/24

- Premier Business Plus: You’re eligible if you meet all of the following criteria:

- You don’t currently have this card; and

- If you ever received a bonus for this card or the Marriott Rewards Premier card, it has been more than 24 months ago; and

- You have a business

Which Amex cards are you eligible for?

Amex enforces several rules which may make you ineligible for the SPG, SPG Business, or SPG Luxury Card:

Lifetime Welcome Bonus Rule: Most Amex welcome offers state that you are eligible for the bonus only if you’ve never had the same card before. Fortunately, some have reported that Amex seems to “forget” that you’ve had a card before if it has been many years since you closed the account (~7 years is a good guess).

Max 5 Amex Credit Cards: When applying for a new card, you won’t be approved if you currently have 5 or more Amex credit cards. Amex charge cards are not part of this count. Consumer and business credit cards are added together for this purpose. SPG cards are all credit cards. To determine whether your Amex cards are credit cards or charge cards, find each card on our Best Offers page and look for “Card Type: Amex Credit Card” or “Card Type: Amex Charge Card”.

5 / 90 Rule: Usually Amex enforces a limit of 1 credit card approval per 5 days and 2 in 90 days. There is no known limit for charge cards. Despite the 5 day part of the rule, it is possible to get 2 credit cards in 1 day when both are instantly approved.

Recommended Strategy

- Review the above rules to figure out which cards you may be eligible for.

- If you plan to sign up for both Chase and Amex cards, go for the Chase cards first since Chase can be tougher on approvals than Amex

- If you plan to sign up for any Amex cards, count how many Amex credit cards you currently have (don’t count authorized user cards). If you have more than 4, then cancel one or more cards so that the new cards that you intend to get won’t take you over 5.

- If you plan to sign up for the SPG Luxury Card, set a calendar reminder for August 23rd or 24th to do so.

- If you plan to sign up for the SPG Luxury Card and another SPG card, consider signing up for the other one by August 17th. Amex sometimes will only approve 1 credit card per 5 days, so this will give you some buffer before applying for the Luxury Card. Note however that we do not know what the welcome bonus rules will be for the Luxury card. While it’s not likely, it’s possible that signing up for the SPG consumer card before signing up for the Luxury card would make you ineligible for the Luxury card bonus. If the SPG Luxury card bonus is especially important to you, then wait to sign up for the regular SPG card until after you sign up and are approved for the Luxury card. If you are auto-approved for both, then you’ll bypass the 1 card per 5 day limit. If not, you’ll have only given up the SPG consumer bonus (75K) not the SPG Luxury bonus (expected

125K100K).

My Plan

I currently have open both the Marriott Rewards Premier and Marriott Rewards Premier Business cards. Since it has been over 24 months since I received welcome bonuses on these cards, I could theoretically cancel both and wait about a week before applying again. The consumer card, though, is subject to Chase 5/24 rules and I’m way over 5/24. The business card is not currently subject to 5/24 rules, but honestly I have no interest in gambling with Chase over a 75K Marriott Rewards welcome bonus (see: Why Chase shutdowns have increased and how to avoid them). No, I won’t =bother with either of the Chase cards.

On the SPG side, I don’t currently have either card, but I’ve had both the consumer and business SPG cards within the past few years. As a result, I don’t expect to qualify for the welcome bonus for either one (due to Amex’s standard rule: you can’t get the welcome bonus if you’ve ever had the card before). On the other hand, now that the Amex application process checks your eligibility for the bonus, there’s little risk in my trying. But I won’t even consider trying one of these until after going for the Lux card…

The SPG Luxury card is the only card of the bunch that I can likely qualify for. To get it, though, I’ll need to cancel an Amex credit card first. I currently have 5 Amex credit cards: Delta consumer, Delta business, Blue Business Plus, Amex Everday, and an old Blue Cash card. I won’t cancel either Delta card since I use those to manufacture top tier status. And I certainly won’t close the Blue Business Plus card because it is awesome. I rarely use the Amex Everyday card or the old Blue Cash card, so I’ll close one of those, probably the latter.

After cutting down to four Amex credit cards, I’ll apply for the SPG Luxury card once it becomes available on August 23rd. Most likely, I’ll meet minimum spend either by paying estimated Federal Taxes (due by September 17th) or via Kiva Loans. My wife and I stay at Marriott properties pretty often so I’m sure we won’t have any trouble earning the card’s $300 in rebates.

If I had fewer Amex credit cards, I would try applying for the SPG personal or business cards after getting approved for the Luxury card. Even though I’m not technically qualified for either welcome bonus, I’d be curious to see if Amex’s computers are aware of this. But, I don’t think this is likely enough to work to be worth cancelling another credit card in advance.

My wife is in a similar situation to me. She has both Chase Marriott cards and so is not currently eligible for either. She has both the SPG consumer and SPG business card currently open. She also has three other Amex credit cards open (Delta consumer, Delta business, and Blue Business Plus).

Unlike me, she does not have the Ritz card, so she is eligible for the SPG Luxury card even after August 26th. Even though she has the Chase Marriott cards, it has been more than 24 months since she received the welcome bonus on either one, so those cards won’t disqualify her under the new rules. So, with her account, we have plenty of time. Most likely we’ll cancel her consumer SPG card before applying for the SPG Luxury card, but when?

The annual fee for my wife’s SPG cards should appear on her next statement which will be cut about two weeks from now. Then, she should get her annual free night certificate (up to 35K) within the next 8 weeks. It appears to be timed such that it will be past the window of opportunity to cancel the card to get back the annual fee. That’s OK. I’m sure that we can get more than $95 worth of value from the 35K free night certificate. So, our plan is as follows: we’ll wait until the certificate appears, then cancel her SPG card, and then apply for the Luxury card.

What will you do? Comment below.

Originally applied on 8/23 to beat the clock (held Marriott biz last year), but was approved on 8/29 on the same application only after closing another Amex credit card. Should I still expect to get the bonus though it was approved after the 3-day window?

Your applicate date should be what matters. I expect you’d get the bonus.

Thanks Nick! Yesterday I chatted with a rep Amex.com who confirmed the spend requirement and the bonus, so it would indeed seem I’m eligible even though the application was approved after 8/26. Will confirm once bonus posts…

[…] of Credit, the SPG Luxury Card is now available for applications. The good news is that the 3 day window of opportunity that I’ve mentioned previously is working. The bad news is that Amex is offering only a […]

Any thoughts? Just tried to apply for Luxe for my husband and was denied. He got his first plain SPG Amex about 2 weeks ago, I thought this wouldn’t preclude him. He was approved for SPG Business and pending on Chase Marriott. He’s not in the points game but I’m starting to collect so we can pool together.

It looks like he might have been caught by the Amex rule allowing no more than 2 new credit cards in 90 days. If he got both the consumer and business SPG card recently, then it makes sense that he’d be denied for the Lux

[…] Unfortunately for me, I depleted most of my points by buying travel packages so I can’t take advantage of this unless/until I have success signing up for the new SPG Luxury card expected to debut 8/23 (tomorrow). And, due to new rules coming out on 8/26, I’ll have to sign up between 8/23 and 8/25 (see: Up to 450K on the table and a short window of opportunity with Marriott & SPG). […]

One thing I’m unclear about – when filling out an application for a business card recently, it asked for my income from the business, now this is minimal while my salary would more than meet any requirements. What does one fill out in that situation? Regular cards seem to just ask for income from all sources. Thanks

Just be honest. If you expect the business to earn $1K this year, say that. I believe the app will also ask for total income. You don’t need big business income to get approved.

Hi Greg …Any help appreciated…

We have an SPG Amex (purple, consumer card). Just applied for and received the Chase Marriott Premier Plus card b/c they offered a 100k bonus.

I’m guessing the “3-day window” is 8/23-26? And if so, does it seem likely that upgrading to the Lux Amex will get us the bonus points?

It’s all in my wife’s name/account number. She’s the biz traveler in the family.

THX

Yes the 3 day window is 8/23-26.

Upgrading will not get you the 125K bonus, but you might get a targeted upgrade offer for maybe 50K points.

Hi Greg, I’m 4/24

CSR 9/16

Hyatt 10/16

CSP (now Freedom) 2/17

United 6/17

Chase BIP 3/17

Chase Cash Ink 5/18

Should I apply for both Marriott cards before the 23rd then apply for SPG lux on the 23rd?

Personally I’d go for the Ink Business Unlimited before going for the personal Marriott card. Other than that, yes that makes sense.

So I just picked up the Chase MRPP at the end of June when they were still offering 100k points. I haven’t met the spending requirement to earn the points, do you think I could get the new Amex luxury card, spend the remaining amount needed for my chase bonus, and still be eligible for the new card bonus if the points haven’t hit my account yet from my Chase MRPP?

Your best bet is to apply for the Luxury card Aug 23,24, or 25th. Otherwise you have to wait 90 days from when you acquired the Marriott card

[…] all the Marriott and SPG cards out there now all earning…Marriott Rewards points, get it? Up to 450K on the table and a short window of opportunity with Marriott & SPG. All small bloggers hope they get the SPG Luxury cards affiliate links working on August 23rd. We […]

What would you recommend for someone who’s actually never had any of the SPG and/or Marriott cards? (Experienced in points & miles, under 5/24, can do business cards, can free up enough Amex slots, solid relationship w/Amex & Chase, easily able to do all minimum spends, etc. Basically, a perfect storm for maximum applications.)

I’m thinking of having my wife apply for the SPG Luxury. In the past she could easily transfer her points to me fee free. Will she be able to do that in 2-3 months from now after she earns the bonus?

There has been so many changes in the last few days that it has my head spinning. I cannot decide which card strategy would be the best. Currently have CFC & CSP but I am way beyond 5/24. I was planning on the Ritz Carlton Infinite Visa for the end of July for the conversion bonus. Alas that appears to be a completely dead option. The restrictions on SPG and Marriott cards make it a very tangled web. I was not planning on hitting the personal cards again for a while to allow myself to drop down under 5/24. I was concentrating on business cards, but with the Amex business card affecting a Chase and vice versa it seems convoluted to say the least. There is also a few options left in the world that may be vanishing in the near future that are not 5/24 dependent that might be worth considering such as the BA, Hyatt, IHG, IB, or IE cards.

I do not have any Marriott, SPG, or Ritz Carlton cards personal or business. With the 26th date drawing near, could I get the Marriott business and the SPG business before the deadline and get both bonuses? Not sure how that date matters right now. It seems if you apply now and you cannot get the bonus before that date, they wouldn’t give the bonus on both. That is why I am so confused. I need a strategy to get the most out of the Marriott program with the situation as it is now.

I am looking for a strategy to maximize my bonus and not get a shut down. I opened my CSP in Dec 2017, an Amex Plat and Delta Gold in May and was declined for being over 5/24 by chase in May for the CB Ink card. Of course it is strange that I was good in December when I was at 8/24 then, but they approved it anyway and stuck to the 5/24 when I was really 10/24. I still am 10/24 and will drop under 5/24 in Nov 2019. 😀 So there is my predicament. Your wisdom and recommendation would be appreciated.

Most of these are questions many of us are pondering.

The rules that go into effect on August 26th will only apply to applications from that day forward. If you apply before August 26th, it is OK to meet min spend afterwards.

One option for you is to apply now for the SPG biz and Marriott biz cards. Then decide if it is worth getting the Lux card between on the 23rd or 24th, keeping in mind that it may delay you dropping below 5/24 again.

Another option is to apply only for the SPG Biz card now. It won’t hurt your 5/24 status, nor will it prevent you from getting the Lux or SPG personal card in the future, whenever you’re ready for it. It will make it harder to get Chase Marriott cards in the future but honestly Chase has more valuable cards to pick from.

I think I’d recommend the second option: SPG Biz only.

Am I wrong in thinking that the Marriott business card will be dumped soon? Considering that I will not be below 5/24 until Nov 2019 at which time I will be 3/24 if I make no more applications. Then January 1st 2020 I will drop to 2/24.

For the Luxury card, i’m a little unclear on how the Ritz Card effects eligibility. I’ve had the Ritz since Nov 2017. On the graphic, what does the 30 wait imply?

You’d have to close the Ritz card, then wait 30 days, then apply for SPG lux. However, many are speculating that current Ritz card holders will have this three day window to pick up SPG lux without any restrictions.

My understanding, as I have the Ritz Carter’s well, is that if I wanted the SPG luxury card, other than those three special days described in this article, I would have to cancel The Ritz Carlton wait 30 days before I could apply for the SPG luxury card. And you’re not guaranteed to get it. So you could end up with neither. So I plan to apply for the SPG luxury car doing that 72 hour window when you can still have the Ritz and apply for the SPG.

Alex and Patricik Oh! are right.

Just wanted to bounce this off you. My 5 AMEX spot are filled (Everyday, Ascend-from surpass, Aspire-just got 1 month ago, SPG personal, SPG biz). In order for me to get the Aspire I had to cancel the 2nd Ascend (from Hilton Reserve transition). I also have the old Ritz and old Marriott so I’m not even going to waste my time with the new cards cuz I’m way over 5/24. If I would have only known to apply for the CSP before started on this journey. In order for me to apply for the SPG Lux I am thinking of getting rid of the Ascend since there is no annual award night unless you spend 15K. I want to make sure I do it prior to the new launch so my app doesn’t go pending as the Aspire did. Does this sound OK to you?

Side note: I’ve had the SPG personal for 20 years so really don’t want to cancel my longest card.

So I currently have the Ritz (bonus earned 20 months ago), SPG Personal (bonus earned 6 months ago), and SPG Business. (bonus earned 3 months ago) I could theoretically sign up for the Marriott Business and SPG Luxury on the 23rd (or whenever the Lux card launches) and be approved while keep all 5 as long as I do so during that 3 day window, right? I’m over 5/24 and only have 3 Amex cards.

Seems like you could to me. But are you willing to risk Chase shutdown on Marriott Business for 75k with the annual fee? Chase just recently was offering the same bonus with annual fee waived. Pretty much in the same situation as you, however, I just got approved for the Ritz card.

I don’t think the risk would be so big considering I have a real business I could apply with and I have been CPC with them for awhile. They also have my business checking. Too bad that no af offer isn’t around since I would only have the 3 day window to get both cards.

Yes. Actually, you could apply for the Marriott Business card right now and then apply for the Lux card on the 23rd or 24th.

Greg why do you use CNB card for grocery purchase and not the AMEX BBP card? 3c vs 2×1.7 c.

Great question. I have sometimes been able to eek out 1.25 cents value towards airfare with CNB points, but still I’d prefer Amex points. It’s probably because I made the decision to use the CNB that way quite a while ago and I haven’t reassessed.

how long do the airline miles from a travel package take to post? i bought one 7/29 and still no alaska miles…

The answer is different for different airline programs. I don’t know how long Alaska miles take to post. I’d guess a couple of weeks. Does anyone have recent experience that can say?

Alaska takes about a week so yours should show up soon.