Update 10/30/25: Capital One reached out to Doctor of Credit to clarify the new 48-month policy on the Venture cards. Effectively, it’s adopted the same sorts of “family rules” that Amex uses, which allows you to apply for more expensive cards than you’ve had previously and still get the welcome offer, but not vice-versa.

- You’re not eligible for a welcome bonus on a new Venture X card if you’ve already received one for the Venture X within the last 48 months. Earning a welcome offer for a Venture Rewards or VentureOne card does NOT affect your eligibility for the welcome bonus on a new Venture X.

- You’re not eligible for a welcome bonus on a new Venture Rewards card if you’ve already received one for either the Venture X or Venture Rewards within the last 48 months. Earning a welcome offer for a VentureOne card does NOT affect your eligibility for the welcome bonus on the regular Venture Rewards card.

- You’re not eligible for a welcome bonus on a new VentureOne card if you’ve already received one for the Venture X, Venture Rewards, or VentureOne within the last 48 months.

~~~

Doctor of Credit reported yesterday that Capital One has added new terms regarding the welcome bonuses on the Capital One Venture Rewards Credit Card and Capital One Venture X Rewards Card as follows:

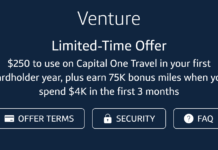

How does my spend bonus work?You will earn 75,000 bonus miles if you spend at least $4,000 within 3 months of your rewards membership enrollment date. Once you qualify for this bonus, we will apply it to your rewards balance within two billing cycles. You are not eligible for this product if you have received a new cardmember bonus for the Capital One Venture card or the Capital One Venture X card in the past 48 months.

As you can see above, the new language notes that you are not eligible for the welcome bonus if you have received a new cardmember bonus on either the Venture or Venture X card in the past 48 months.

Previously, this language existed separately for each version of the card. That is to say that you would need to wait 48 months before being eligible to earn a new cardmember bonus on the same product, but it was possible to separately open both the Venture and Venture X cards within a shorter timeframe. Unfortunately, it seems like that is no longer possible.

All that said, Capital One is notoriously difficult/unpredictable for those who have opened many credit cards, so it wasn’t necessarily easy/popular to get both cards anyway. Furthermore, I haven’t seen any data points as to whether or not this new language is being enforced. Still, it is worth being aware that it exists.

I got the venture X 2 years ego can I still get the capital venture one bonus

Many of us stand no chance with C1 approvals… we’d have to scale back to basically 0/24 to get them to say ‘yes’… and, besides that, the hard-pull for all-three credit bureaus is hella lame of them.

Ja, skat. Vat hom !!

It’s much more random than that. I am always far over 5/24, am not a high earner or big spender, and yet have never gotten a C1 rejection. They don’t use a formula like the one you think, but they do seem to keep a blacklist.

do you apply for cards that you’re pre-approved for only or what’s your thought process behind C1 applications?

I’ve been approved for the Venture X and recently applied for the Venture. I had to wait a full year with no personal card apps before I was approved. On both occations I applied through the pre-approved Venture application on their site.

P2 had to do the same strategy as well. However, his application was via my referral link for the Venture X. I believe another referral is off the cards as they notate that only new C1 memebrs qualify for the bonus.

My plan was for him to then get the Venture, but I am still working on the SUB. I don’t know if this means I will have to pivot my card application strategy.

nope. Just applied for Venture X and got it. 4 yrs ago. After that I got a spark business. Also easy. They just seem to dislike certain people. If you’re frustrated and unable to figure it out, talk to Greg who has been befuddled by their dislike of him.

I’ve had both the Venture and Venture X in the past and still have one of those cards downgraded to a VentureOne. The pre-approval page doesn’t really seem to pre-approve me for any cards with a bonus so I’m guessing I would be an automatic rejection right now but I’ll keep my eye on it.

I have said many times before that the pre-approval tool is completely unreliable. My wife was only pre-approved for *secured* cards (the kind where you need to deposit money with the bank and that’s your credit limit), not pre-approved for any of their credit cards, but yet she was instantly approved for the Venture X minutes later with a $20K credit line. Similarly, some people show a pre-approved offer and get declined. Capital One is very unpredictable. I consider the pre-approval tool for entertainment value only.

Since they collapsed the signup bonuses restrictions together this way, does this mean that I can get a referral bonus if I have the Venture X and refer someone to the Venture? It would only be fair if they made this change too. But I bet they didn’t. Also, another reason signing up for multiple Venture cards would be less likely is because they do hard pulls on all 3 credit reporting agencies. I believe they also report business credit to the personal accounts. So they are just generally ornery.

Awe bummer. I got the VX back in 2023 and the Venture in 2024. Looks like I’ll be waiting until 2028…