NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

United is offering a 5-10% bonus when you add funds to your United Travel Bank (the bonus amount depends on how much you add in one shot). While the bonus cash is only valid for 4 months, the money you actually add to your Travel Bank is valid for five years. I wouldn’t ordinarily be in a hurry to lock up cash in airline credits, but the fact that these are valid for so long means that it could be a terrific use of airline fee credits.

The Deal

- United is offering a 5-10% bonus when you add funds to your United Travel Bank in the following denominations:

- Load $50, get $2.50 bonus cash

- Load $100, get $5 bonus cash

- Load $250, get $25 bonus cash

- Load $500, get $50 bonus cash

- Load $750, get $75 bonus cash

- Load $1,000, get $100 bonus cash

- Direct link to this promotion

Key Terms

- Members can choose from six purchase amount options and, once purchased, the value remains valid for five years from the date it is deposited in your TravelBank account.

- Purchases made between December 3, 2020, at 12:01 a.m. CT and December 9, 2020, at 11:59:59 p.m. CT, are eligible for a bonus deposit equal to 5% of the purchase value for purchases of $50 and $100, and 10% for purchases of $250, $500, $750 and $1,000.

- The bonus value expires 120 days from the bonus deposit date.

- Purchases of TravelBank cash are not refundable and are limited to $1,000 per promotion per MileagePlus account.

- See promo page for full terms

Quick Thoughts

As noted at the top, the amount of “bonus cash” you get depends on how much you load. These bonuses are on the amount added in one purchase — the bonuses are not cumulative to my knowledge.

Note that you can earn bonus cash on a maximum of $1,000 loaded to your United Travel Bank account and the promotion is set to end on 12/9/20.

There are a few reasons why this promotion is more appealing than it seems on the surface. If you know that you’ll book United travel in the next few months, this can obviously be a rare opportunity to save money on those trips. However, even if you’re not sure that you’ll travel before the bonus cash would be set to expire, you should be able to book a ticket with those funds now and then later cancel for a credit that is valid for a couple of years.

But more importantly, United Travel Bank purchases have been working lately to trigger Amex airline incidental credits. YMMV as this is not one of the “official” uses of those credits, but it has been known to work this year. It may also work with airline credits on cards from other issuers (like the Bank of America Premium Rewards card, etc). The nice thing here is that the funds you add to your travel bank remain valid for five years. That’s about as good as it gets if you’re looking to turn your incidental credits into funds that are usable well into the future.

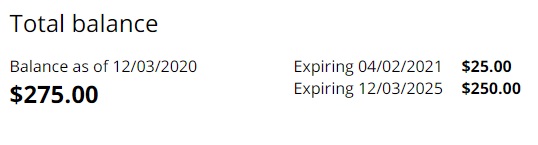

I had a Hilton Aspire card with a full $250 in fee credits to use, so I just now added $250 to my United Travel Bank via the link above. While the purchase terms indicated that the bonus cash would be added within 7 days, I immediately saw it in my United account. Note that while the $275 initially showed an expiration of 4/3/21, an information bubble explained that my funds had different expiration dates. Clicking through for full details indicated that the $25 in bonus cash will expire on 4/3/21, but the $250 that I added are valid through 12/3/25.

I have long been using Southwest for Amex airline fee credits since award fees have long triggered the credits, but I may load up on United cash here in order to have funds available farther into the future since I will very likely find a good use within the next five years (I currently have enough Southwest points and gift cards to last me for the next couple of years).

Keep in mind that if you haven’t yet used any of your airline credit for the year, Amex will usually allow you to change it via the chat function on the website (and sometimes they have let me change it even after using some). It’s always worth asking if this appeals to you.

H/T: Dan’s Deals

[…] last year, many of us loaded funds to the United Travel Bank as a way of banking airline credit since Travel Bank credits are valid for 5 years. However, The […]

[…] Hat tip to FM […]

[…] Bank of America Premium Rewards incidental credit works like Amex and Chase above in that the credit runs from January 1st to December 31st. Be sure to place qualifying charges by December 31st. As a data point, United Travel Bank recently worked for me just as it has for many Amex cardholders. […]

Great comments here -thanks for that. Question – with the $200 Amex credit – is it best to do 2 – $100 United purchases, or 1 – $250? Im worried that the $250 is too high to get reimbursed. Would love to have a comment of similar data point – with the Amex Plat – not the Hilton Amex. Thanks much!

I had the same concern. I put it through as $100, $100, and $50 for my Aspire and got reimbursed 3 days later.

Hoping my mistake didn’t cost me. Does anyone know if you select the airline after the charge hit but before it posted if it will still trigger the credit? I had no airline selected, I purchased Travel Bank funds, then about 30 seconds after realized I didn’t select an airline went and selected United. Any DP of it still working out since it has not cleared (still in pending)?

Yes, Nick, you were absolutely right. I would like to confirm that my United Travel Bank purchase triggered Amex airline incidental credit. Kudos to you for the timely advice!

I can understand some being frustrated you all “promoting” this, but honestly I applaud you. I use this site for exactly this type of information. I could subscribe to this site, thepointsguy.com, Dan’s Deals and doctorofcredit.com to make sure I see everything, but I only have so much time in the day. I find frequentmiler to be fair in their editing/promoting which I know is a fine line. That is why I stick with your site and don’t change to one of the others. Keep doing what you are doing! Just enough/not too much/make people dig into the comments a bit. Thanks!

This. I don’t have time to wade through the “deals” that require me to buy beans at the grocery store and convert them to batteries at an office supply store so that 6-8 weeks from now I’ll get $10 in Kohl’s cash.

I had literally resigned myself to losing the $200 in Amex Travel Credit this year until I saw this post.

A charge of $100 that appeared on my Amex Gols as United Electronic Ticketing does not seem to be to promising to be reimbursed…

Cheap tickets on other airlines (which have long triggered the credits) don’t code as baggage fees. I wouldn’t be too concerned yet.

I know this promo will be finished, but I hope this method still works in early January when credits reset and I can change my airline, but I’m guessing by then it will be dead.

Thanks for the tip Nick! Does this work the same way with Delta or jetBlue? I still have the perky $100 from the Gold that I cant seem to use anywhere else

See the guide I linked to for what works for JetBlue and Delta: https://frequentmiler.com/amex-airline-fee-reimbursements-still-works/

I just brought the credit last night. Few hours before he promotion kicked in. Anyway for me to get this credit by contacting United or am I out of luck?

Y

Can this blog post please disappear?

It’s already out there at Dan’s Deals. It would be a disservice to our readers who don’t also read other blogs not to report something that’s already out there and well established. The fact that Travel Bank purchases work has been in our guide to what works for months.

Burying it in a guide to what works is different than a headline announcing “great use of airline credits”.

See Dan’s headline.

Also I just got a Platinum card and was reading several FlyerTalk threads before deciding which airline to designate for December. I had found out about the TravelBank idea already, then read this article to clinch my decision. I think if you start hiding good ideas that work, you lose your viability as the go to place for honest information.

RIP

Is there any way left to effectively turn the Amex incidental credits into value that doesn’t have an expiration date and without flying? It seems airline gift cards and buy/cancel flights for a refund no longer work. All I’ve found so far are Southwest low fares/award fees buy and cancel for voucher and United Travel Bank, both of which result in travel funds rather than cash. Agree that without fairly definite plans to fly Southwest within the next year, United’s 5 year expiration beats Southwest’s 1 year.