NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

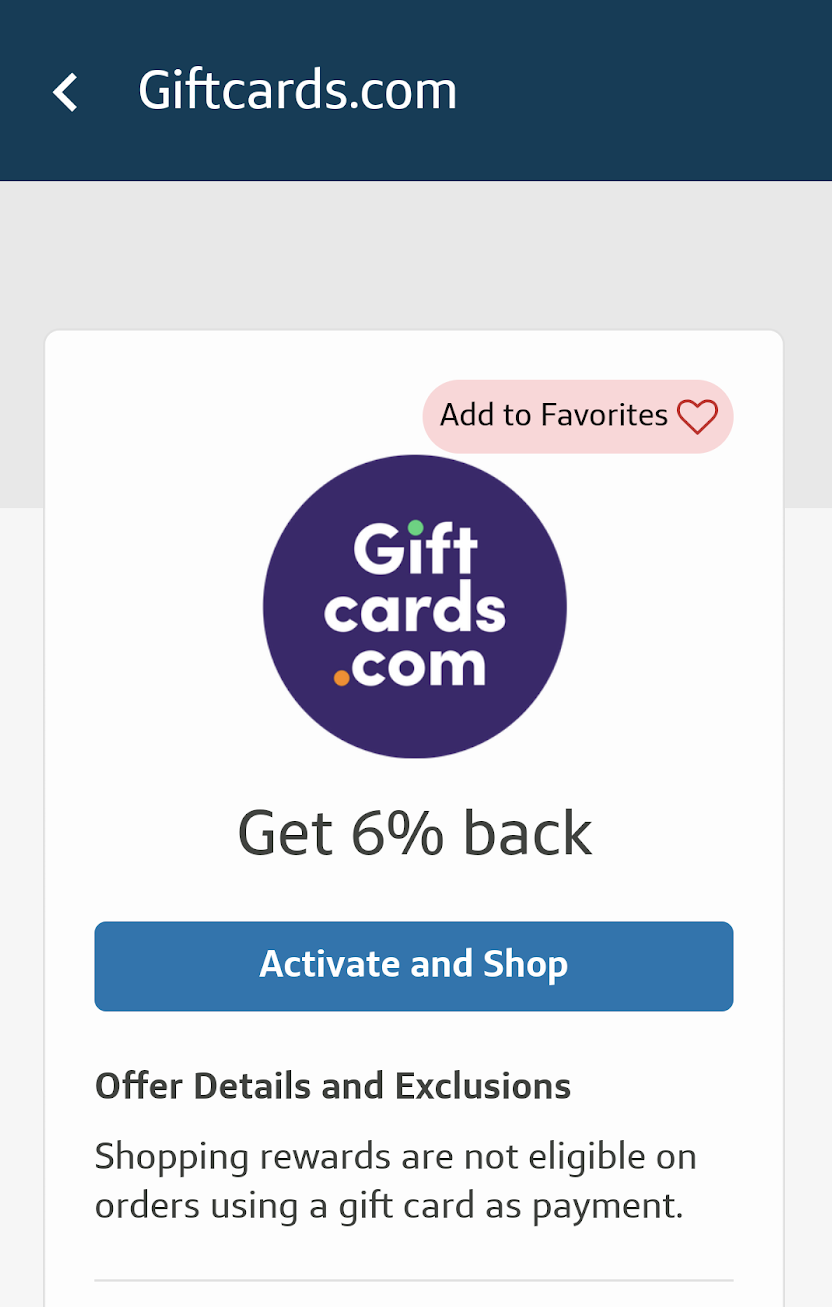

Update 8/1/22: This deal is now available as a Capital One Offer to Capital One cardholders without having to go through the Capital One Shopping app. In order to find the offer, log-in to your account, go to “Capital One Offers” in the bottom-right corner and click-through to the display of all of the offers. Type “giftcards.com” in the search bar and the offer should come up.

The Capital One Shopping app, which is open to anyone (regardless of whether or not you have a Capital One account), is offering 6% cash back at GiftCards.com. It is possible that this deal is targeted or that you must sign in to the app to activate it. Either way, this can be a solid deal if it tracks properly.

The Deal

- The Capital One Shopping app for Android and Apple is offering 6% back at GiftCards.com. This promotion may be targeted.

- Link to Android app

- Link to Apple app

Quick Thoughts

Six percent back on some brands could be a good deal on its own, though I imagine that most interest will be in Visa or Mastercard gift cards. Whether or not this tracks as expected is anybody’s guess. Some comments at Doctor of Credit indicate difficult with tracking. Most of my own purchases (not for gift cards) through the Capital One Shopping portal have tracked without issue. Keep in mind though that cash back earned via Capital One shopping can only be redeemed in the form of 3rd party gift cards, not actual cash back.

H/T: GC Galore

Can someone confirm whether one must use Capital one to pay and also the cashback can only be redeemed for GCs on their portal?

My Capital One offer shows below (via PC website):

To earn credit, click the button above and complete your purchase using your Capital One credit card in the browser that opens. Purchases made through a merchant’s app will not qualify for the rebate.

Cash back seems to be in form of statement credit.

Thanks! I ended up using Rakuten to take advantage of 3x cashback.

@Jay, you’re confusing two different things I think.

Capital One Shopping is a shopping portal that is available for anyone. They have both a website and an app. You don’t need a Capital One card to sign up for Capital One Shopping. “Cash back” earned through Capital One shopping accumulates in your Capital One Shopping account (just like most shopping portals), but it can only be redeemed for gift cards. You can choose merchants like Amazon and Walmart, so I find it to be almost the same as cash, but not quite.

If you are a Capital One cardholder, there is a separate shopping portal-like experience within your Capital One login (I think they title it “Capital One Offers”). It works like a shopping portal, but you do indeed get the cash back as a statement credit. In that case, the terms indicate that you need to click through and use your Capital One card to make the purchase and this is a rare instance where I think that’s true because I think it needs to show up on your statement in order to trigger the statement credit.

Anyway, I’ve seen GiftCards.com at 6% in both the Capital One Shopping app (open to anyone, no Capital One card required) and in Capital One Offers (requires a Capital One login).

Nick, thank you for your clarification.

I was not aware of the Shopping app open to public. I will check out.

6% in app, 3% online for me

[…] Update 8/1/22: Deal is now available on desktop as well. Hat tip to FM […]

please put warning that many transactions do not track. i learnt the hard way and bought more then i should have assuming will get cashback.

When did you make your purchase? It looks like we previously posted this on July 16th. That wouldn’t be long enough for the transaction to show up yet. In my experience, these Capital One offers take a month or two to show up.

i’ve been using their shopping portal for cashback on & off over past year and most transactions do not track.

It’s definitely targeted.

this is killing me… I just place a (barely under) $2000 order YESTERDAY with them so that I could get my (almost) 6000 AA Loyalty Points.

6% back would have been nice.

Is this stackable with the AA shopping portal? I thought you have to go through the Capital One portal.

No. Zebraitis is lamenting the fact that they bought through the AA portal at 3x AA miles the day before we posted this (and I think would have rather ordered at 6% back). GiftCards.com generally only allows for awards on up to $2,000 in purchases per month (a limit that is clearly stated on most portals, though I don’t see that in the terms with Capital One).

Yes, exactly.

BTW… a tip:

Doing this monthly is working out well, and I’ve already made AA EP status for FY2023 using this and some other purchases that are multiplied (and a few flights too).

BUT… when purchasing at giftcards.com, make sure that you ONLY purchase $1925.00 in cards.

WHY: They charge fees and shipping… and those bring you up to $1980.35

So, you qualify, and you get your 5915 Loyalty points on the 3x bonus, and then an additional 1980 Loyaty points if purchased on an AA affiliated CC, for a total of 7895 loyalty points. Per month.

Doing this monthly means 94740 Loyalty Points per year.

Nice!

HOWEVER… if you DO buy $2000, AND they charge fees and shipping THEN you are over $2000… and you get NOTHING.

So, as always, read the fine print.

Thank you for the warning about the $2000 limit… but

$664 (2.875%) in fees and nearly $24,000 in gift cards just for EP status? Can I ask which gift cards you buy? It would obviously need to be something you can immediately spend/redeem. Visa/MC generic cards?

Actually, that’s “… just towards EP status”. EP is 200K.

I have found two options that I use:

1) Virtual Visa card – Delivered by email immediately

2) Physical Visa CC – takes about a week.

The max per card (either virtual or physical) is $250.

You can carry the physical Visa card(s) and use it as you would at any place that takes Visa. I have done that in person (grocery stores, gas, etc), and gave the numbers over the phone (when getting an RV repaired), and I had no problems with it being accepted.

The virtual Visa is great for loading up my Amazon account. Since we have Prime, it’s easily used and that way everything I buy on Amazon gets me 4x.

You could use either to prepay any of your utilities or other regular monthly spending and ensure that you get AA LP’s.

Finally, if you use the physical card, you will rarely make exactly a $250 purchase. If you have $$ left on the card, you can first validate what you have left on giftcards.com, and then throw that small amount onto Amazon, or make your favorite tax deduction.

And no, I didn’t make EP on just that. I’ve taken a few flights as well… but using simplymiles and aadvantageeshopping. really helps. Especially if you use these cards to make the purchases that get you additional multipliers or really big rewards (example: AT&T fiber was cheap, got me 6500 LP’s and has no required contract / fulfilment)

Once you start this you think you won’t get 200K quickly, but it was surprising how fast it all added up.