NOTICE: This post references card features that have changed, expired, or are not currently available

Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email.

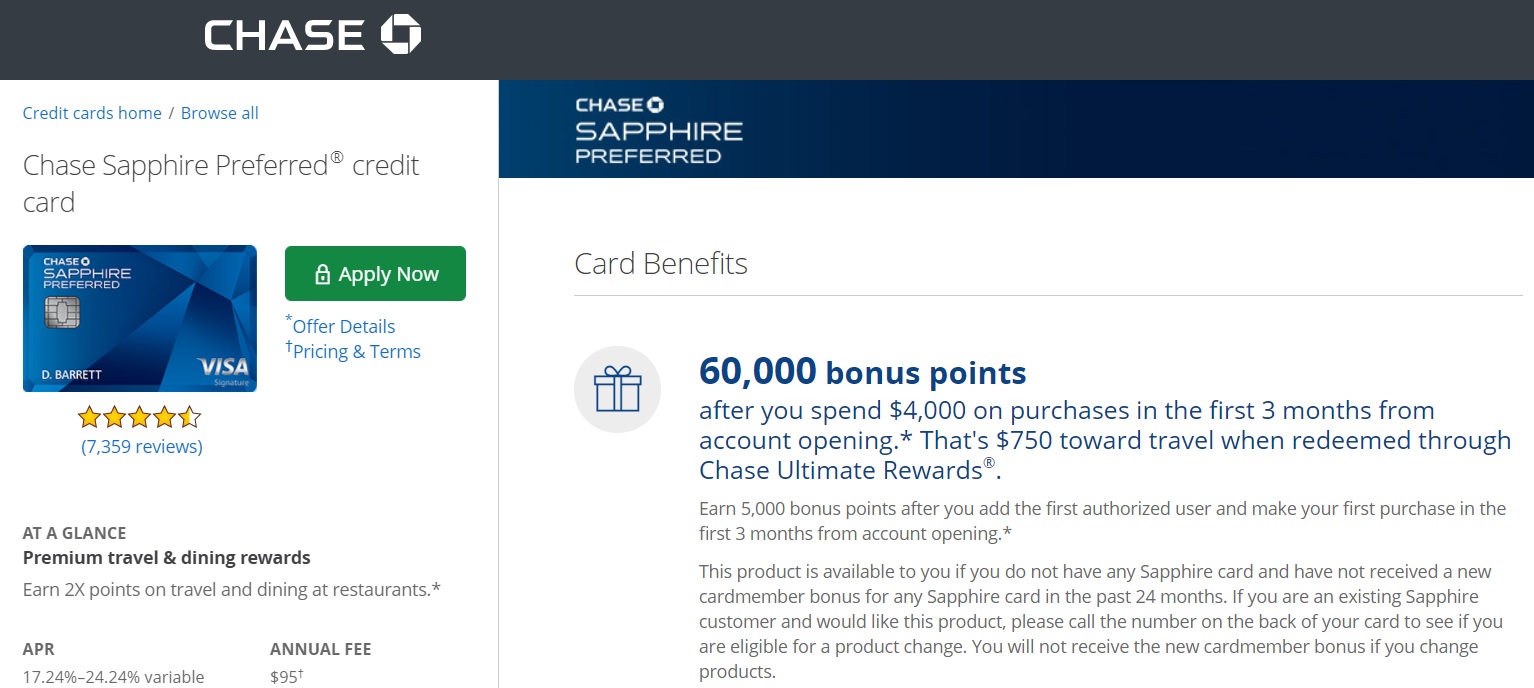

There is a newly increased signup bonus on the Chase Sapphire Preferred: 60,000 Ultimate Rewards points after $4,000 spend in the first three months. You can get another 5,000 bonus points for adding an authorized user and making a purchase in the first three months. Note that the annual fee is not waived the first year with this offer as it has been on the 50K offer. Still, the additional 10,000 Ultimate Rewards points are worth more than the $95 fee even if only used for a statement credit as 1 cent each.

The Offer

- Get 60,000 Ultimate Rewards points after you spend $4,000 on purchases in the first 3 months with the Chase Sapphire Preferred.

- Get an additional 5,000 points after you add the first authorized user and make a purchase in the first 3 months

- See our Best Offers page or our Chase Sapphire Preferred card page for more information and a link to this offer

Key Card Details

- $95 annual fee is not waived the first year

- Earn 2x on travel and dining purchases

- Earn 1x everywhere else

- Get Primary CDW on rental cars when the entire cost of the rental is paid on your Chase Sapphire Reserve

Quick Thoughts

Keep in mind that Chase will now only allow you to have one Sapphire product at a time (See: Chase ends ability to double up Sapphire Reserve and Sapphire Preferred bonuses). Additionally, you are not eligible for the signup bonus if you have received a signup bonus on any Sapphire-branded card within the past 24 months.

Also note that with this new offer, the annual fee is not waived the first year (whereas it was on the 50K offer). Still, a trade of 10K Ultimate Rewards points for $95 is one I’d be happy to make as those points are worth at least $125 in travel through Chase Travel℠ (and potentially much more when transferring to partners).

That will exclude anyone who has gotten the Sapphire Reserve since that card is not yet 24 months old. However, if you have not opened a Sapphire card in the past 24 months and do not currently have one open, this increased offer certainly may be of interest. We recently compared the first year value of the Preferred vs the Reserve (See: Showdown: Sapphire Reserve vs Preferred First Year Value). For those who will not yet make use of the benefits to tip the balance in favor of the Reserve, this might be a good signup bonus to go after with an eye to potentially upgrade down the road.

H/T: Doctor of Credit

My Fairmont card was converted to Shapiro and cancelled in February. Will the fact that I was converted to the Sapphire (and got Fairmont bonus within 24 months eliminate me for a bonus?

My wife has one Chase slot open. She is down to 4/24. I would like to refer her for this 60000 Sapphire Preferred to also get 10000 referral points as I have had that card for 8+ years. When I go to my Chase Sapphire Preferred account and try to send her a referral it is a referral for the 50000 no fee 1st year offer. If I have to choose I’ll probably set for the 10000 referral bonus with 50000 & no first year fee offer.

But I’m hoping you know some way to get the referral bonus and the 60000 & pay $95 fee 1st year offer as well. Sounds like matching hasn’t worked.

My application was turned down, since I had another Sapphire account (Chase Sapphire). I have since downgraded the card to a Freedom Unlimited.

The reconsideration line wants me to drop in a new app, since they cannot reconsider, since the current app has the card still coded as Sapphire. What are my chances of being approved?

P.S Under 5/24 at this point.

Well I applied and was instantly approved for the CSP just a couple of days before this offer came out.

Sent a SM to Chase requesting to be upgraded to this offer and told them I would gladly pay the $95 AF to get the new offer of 65K UR points.

Didn’t take them very long to respond and tell me that “your account does not qualify for this offer”. No indication of which accounts would qualify.

Totally different response that what I got when requesting the 60K Chase SW RR Premier card upgrade to the 50K offer.

As others have noted in the comments, Chase hasn’t been matching this one because of the annual fee difference (waived vs not waived). With the Southwest match, there was no difference in annual fee. I’m not positive, but I assume they won’t charge you the annual fee and give you the points because there is likely something in the Card Act law prohibiting them from changing year 1 from no-fee to a fee. I could be wrong on that. It’s a bummer for sure!

[…] 65K Ultimate Rewards w/ new Sapphire Preferred signup bonus […]

[…] Chase Sapphire Preferred Bonus Increased to 60k […]

I just applied 5 days ago and was approved for the 50k offer. Sent Chase a secure message and told them I hadn’t even received my card yet and asked to be matched. They said no. When I asked why, this was their reply:

I am glad to review your inquiry regarding matching the sign up bonus offer.

Let me share, the 60,000 bonus offer is a targeted offer. Therefore, your account is not eligible for the new offer you requested. The original offer you applied for will remain on your account. You will receive 50,000 bonus points after you spend $4,000.00 on purchases in the first 3 months your account is open.

If you have received an invitation to apply for this offer please reply to this email with a copy of the offer

and we will be happy to assist you further.

Even though I’m 5/24 I’m still going to apply as one of the 5 cards is a store card..I mean what the heck all they can say is no…

Agree. What the heck! 🙂

I applied and got it!

Is this available via referral or targeted only?

If you go directly to the chase.com and then to their credit cards page, the Sapphire Preferred is still show the 50K bonus with $4K spend and $0 1st year fee.

It’s neither a referral nor targeted. On our Best Offers page, you can always tell which offers are referrals — see the Advertiser and Refer-a-Friend disclosure at the bottom of our Best Offers page.

You are correct that there are currently two offers available on this card. This offer comes with an additional 10K points. You could use 9,500 of those points to take a $95 statement credit for the annual fee and still have $5 worth of points leftover — making this offer at least 5 bucks better (and if you use the points well, much better).

Same! I literally just got my card in the mail today and started shifting monthly bills to begin the slog to the required spend. I just opened the account last week!

If I called them up, how likely would they be willing to give me the 60K in exchange for paying the fee and switching out of the old offer?

As noted above, they are infinitely more likely than if you don’t try. I don’t know whether or not they’ll match it for you, but they can’t if you don’t give them a chance. Chase is usually pretty good about matching. With the difference in annual fee, it’s hard to say. No harm in trying.

Chase replied – it’s a no go. Denied on the new offer. 🙁

first lady I talked she told me that in order to get that 10K extra I need to pay annual fee, and I hung up to think. now on the phone with supervisor and other lady, said no………..NO no Nono annoying.

Damn, I just got one, and my bonus is pending! Maybe they will match the offer via SM? I’m willing to pay $95 for additional 10k.

It’s worth sending a SM to ask. If you don’t ask, you definitely won’t get a match — if you ask, you at least give yourself a chance to get a match.