| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

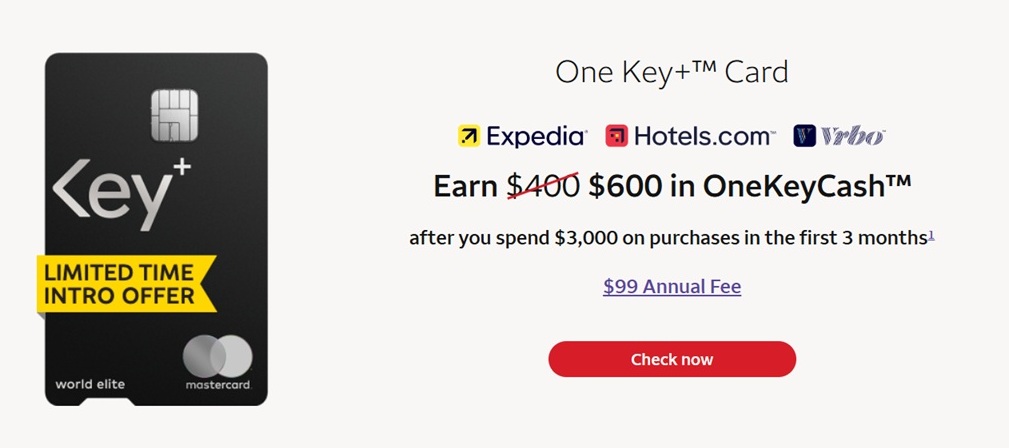

Wells Fargo has once again launched enhanced offers for their One Key and One Key+ cards. One Key is the loyalty program of the Expedia Group, which means rewards can be redeemed at Expedia, Hotels.com, and Vrbo. These enhanced offers end December 1, 2025.

The Offer & Key Card Details

| Card Offer and Details |

|---|

ⓘ $177 1st Yr Value EstimateClick to learn about first year value estimates $350 OneKeyCash Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler $350 OneKeyCash after $3K spend in first 3 months$99 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: $600 OneKeyCash after $3K spend in first 3 months (Expired 12/2/25) FM Mini Review: Good bonus categories, especially when combined with the 2x base earning. The anniversary bonus more or less offsets the annual fee and being able to combine primary car rental insurance with 7x earning at Expedia could be valuable for some. Earning rate: 3% at Expedia, Hotels.com, Vrbo and at gas stations, grocery stores, restaurants, food delivery ✦ 2X everywhere else Card Info: Mastercard World Elite issued by Wells. This card has no foreign currency conversion fees. Noteworthy perks: Automatic Gold status ✦ $100 OneKeyCash anniversary bonus ✦ $120 annual Global Entry/TSA Precheck credit ✦ Trip insurance ✦ Primary rental car insurance ✦ Cell phone Protection ($25 deductible, $1000 max per claim) |

| Card Offer and Details |

|---|

ⓘ $208 1st Yr Value EstimateClick to learn about first year value estimates $250 OneKeyCash Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler $300 OneKeyCash after $1K spend in first 3 monthsNo Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: $400 OneKeyCash after $1K spend in first 3 months (Expired 12/2/25) FM Mini Review: Good reward categories for a card with no annual fee. Could be a winner for folks who use Expedia, Hotels.com and/or vrbo frequently Earning rate: 3% at Expedia, Hotels.com, Vrbo and at gas stations, grocery stores, restaurants, food delivery ✦ 1.5X everywhere else Card Info: Mastercard World Elite issued by Wells. This card has no foreign currency conversion fees. Noteworthy perks: Automatic Silver status ✦ Cell phone Protection ($25 deductible, $1000 max per claim) ✦ Trip insurance ✦ Primary rental car insurance |

Quick Thoughts

Tim wrote helpful reviews of both of these cards:

As he noted in those reviews, the One Key+ card – i.e. the $99 annual fee card rather than the $0 annual fee card – makes the most sense for most people’s circumstances who’d plan on applying for one of these cards. Although it does have a yearly fee, the welcome offer is currently $200 higher than that of the no-annual-fee card. From the renewal each year, you receive $100 in OneKeyCash, which offsets the annual fee.

In addition to that, you earn 3% on purchases with Expedia, Hotels.com, and Vrbo, while also getting automatic Gold status, which earns you 4% on stays at VIP Access properties, which is an increase from the usual 2%, as well as larger discounts at more than 10,000 hotels worldwide. Another potentially interesting benefit is that you receive free One Key Price Drop Protection on select flights in the Expedia app. If the price drops, you’ll receive the difference in OneKeyCash. I’m not convinced that latter benefit is worth the potential hassle involved in the event of irregular operations versus booking direct with an airline, but if you book a lot of flights with Expedia anyway, it’s a useful and potentially valuable benefit to have.

The One Key program didn’t garner any plaudits when it slashed by 80% the value of earnings from stays booked with Hotels.com. It’s therefore not an attractive “loyalty” program from that perspective, but the welcome offers of $400 or $600 on the One Key and One Key+ cards are still decent values, seeing as OneKeyCash can be redeemed for stays, flights, and car rentals. If you like booking stays at boutique hotels that aren’t bookable with points, this is a good way to offset the cost.

Can you get both cards?

Does using the One Key Card keep points from expiring after eighteen months?

Can’t say One Key is a great program overall, but the $600 SUB is definitely worth it.

I have the no annual, does anyone have BOTH????

How to Decide Between the Two Cards

You can learn more about the two One Key credit cards on the Wells Fargo website

No but I wasn’t allowed to PC down to the no fee version.