Five or six years ago, I wrote a post asking How much do you pay for your miles and points? In it, I made the argument that choosing rewards costs you the opportunity to have earned cash. It isn’t a “fun” take and it steals a bit of the Joy of Free, but as Bilt launched the ability to earn rewards through shopping portal Rakuten this week, it became clearer than ever just how much it costs to choose points. At the same time, the Rakuten partnership might create enough of a carrot for many more folks to consider chasing after Bilt elite status.

Bilt through Rakuten puts opportunity cost front-and-center

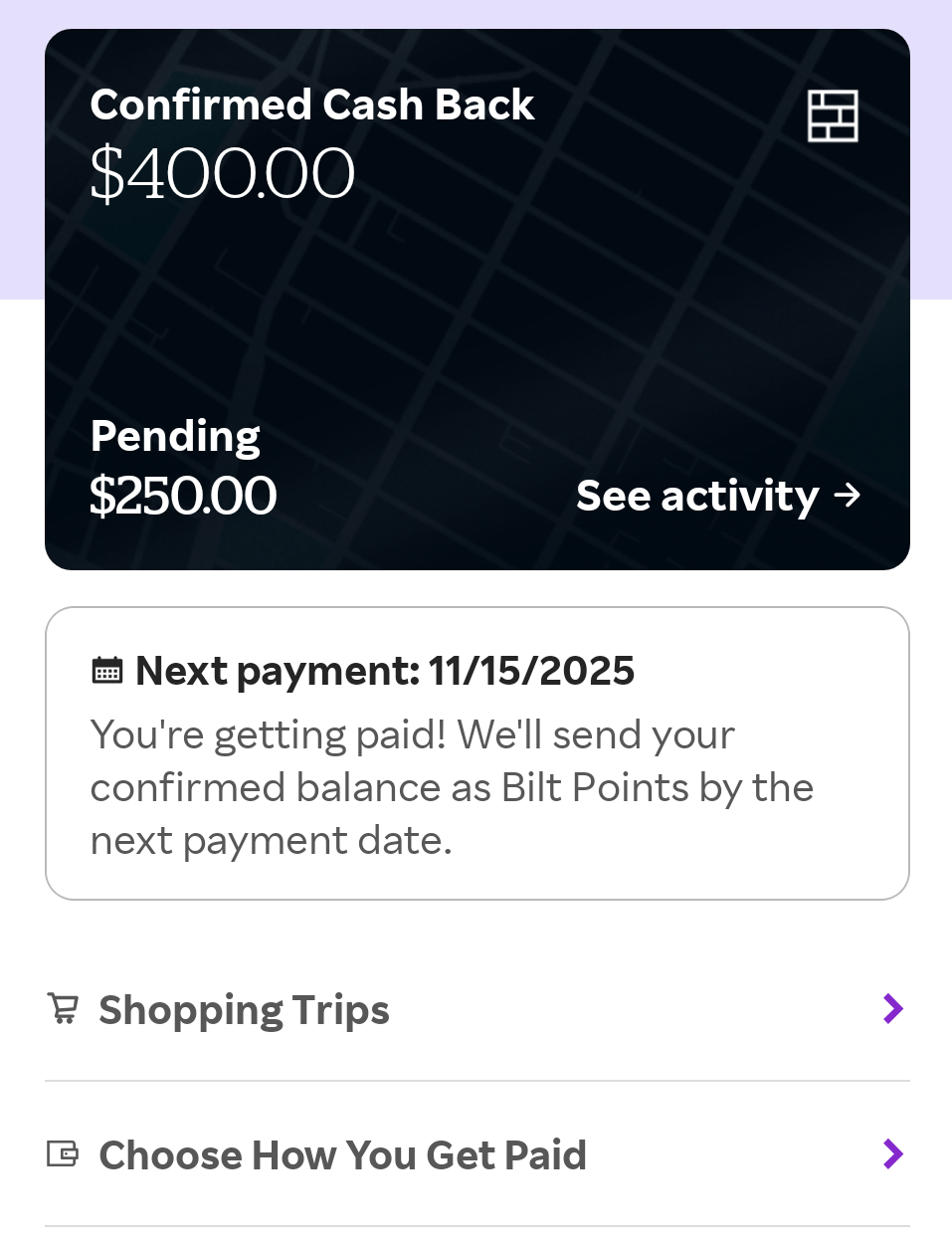

I was thrilled to change my Rakuten earning preference from Amex Membership Rewards to Bilt points yesterday. I have both confirmed and pending Rakuten rewards that should pay out next week, and I will be happy for them to become Bilt points that are transferable to programs like Hyatt and Alaska, where I don’t have as many points as I’d like.

But choosing to earn Bilt points through Rakuten, unlike choosing Amex points, does not show your rewards balance in the form of points, but rather in cash back.

That has an interesting psychological effect. Nothing has materially changed: I was already choosing Amex points over the opportunity to earn cash back. And truth be told, if I just kept taking Amex points and cashed out via the Platinum Card® for Schwab, I could have 10% more cash yet. But the psychological effect of Bilt earnings through Rakuten showing up in the form of cash back is that it feels a lot more like I’m buying Bilt points for $0.01 per point.

After all, my account now shows $400 in confirmed cash back and $250 more pending. It feels more like I’m paying $400 for 40,000 Bilt points with the mechanics of this switch. Again, that’s not a functional change but rather a psychological one based on the way the rewards are displayed.

Truth be told, I’m a buyer of Bilt points at that price (which is to say that if I had the opportunity to buy 40,000 Bilt points for $400, I would be happy to do so), so I don’t exactly feel badly about choosing Bilt for my Rakuten earnings. In reality, I should note that since I have the Schwab Platinum card, it is more like I gave up the opportunity for $440 in cash in order to receive 40,000 Bilt points, an “opportunity cost” of 1.1c per Bilt point. It is easy to imagine getting far more than 1.1c in value per Bilt point, but when I see the numbers in dollars-and-cents figures, it feels a lot more like a purchase than a tradeoff. I’m not really “buying” Bilt points, but it lays bare the trade I’m accepting by letting my Rakuten “cash” get converted to Bilt points at payout.

And it additionally makes clear the cost of the reduced conversion rate for non-elite members. After the first six months, it is expected that non-elite members will only receive 50 Bilt points per $1 of Rakuten cash back, so at this time next year, $400 in my Rakuten account may only turn into 20,000 Bilt points. If I don’t achieve Bilt status and I let rewards turn into Bilt points at the lower rate, I think I’ll certainly feel like it “cost” me $0.02 per Bilt point, and I feel less enthusiastic about that trade.

It is important to be reminded of this trade that we make every time we accept earning points instead of cash back (not just through Rakuten, but any time we choose to earn points instead of cash back). The point of my old post about how much it costs to earn points and miles was that we make this tradeoff all the time, even though we don’t always think about it. But this move to Rakuten “cash back” that gets converted to Bilt points makes that more obvious. That thought started to call into question other oortal earning decisions as well.

Bilt Rakuten vs other portals and Capital One Shopping

One of my big coming dilemmas is going to be where to draw the line between earning Bilt points from Rakuten vs earning Capital One Shopping rewards. This dilemma already existed when I was choosing between earning Amex Membership Rewards points via Rakuten or Capital One Shopping Rewards, but I had to revist that in the context of earning with Bilt.

Rakuten has long been incredibly popular for its reliable tracking and good customer service. Capital One Shopping sits in contrast: some people have great difficulty with orders tracking properly, and customer service experiences have been subpar for many folks.

However, my experiences with Capital One Shopping have largely been quite good. And the frequency of terrific targeted shopping offers has been incredible. Just last week, I made a $255 booking through Viator with 30% back from Capital One Shopping, only to get targeted with 70% back via TripAdvisor a few days later and rebook the same activity with $178.50 back. Rakuten was offering 10% back, which would mean $20 or 2,000 Bilt points. In that case, I didn’t need to think hard to realize that I would rather have the Capital One Shopping rewards.

But where do I draw the line? At what point would I pick Rakuten/Bilt?

Let us suppose that I had an offer to earn 10%/10x Rakuten/Bilt or 30% back via Capital One Shopping. In the interest of easy math, let’s imagine that I were going to spend $1,000. I could earn:

- $100 cash (if I took Rakuten rewards as cash)

- $110 via the Schwab Platinum card (by earning Amex points and then redeeming for a deposit to Schwab at 1.1c per point)

- 10,000 Bilt points

- $300 in Capital One Shopping rewards

If I valued the Capital One Shopping rewards at 50% of face value, that’s like a choice between $150 or 10,000 Bilt points. Am I a buyer at 1.5c per point? And do I really value the opportunity for a Marriott or Hotels.com gift card at only fifty percent of face value?

If I value those gift cards at 70% of face value, that’s $210 versus 10,000 Bilt points. At 2.1c per Bilt point, the price to buy Bilt points is a bit rich for my blood. And after the first six months, remember that without elite status, the Bilt option will only yield 5,000 points. At that point, the $300 in Capital One Shopping rewards begins to look far more attractive.

Of course, that’s just one example. In other cases, the difference will be far smaller. The question is: at what point am I happier to earn cash or a cash-ish gift card from Capital One Shopping?

I’m having some difficulty answering that definitively, but the Rakuten switch to display my rewards as cash makes me think about it more.

It isn’t cut and dry. Capital One Shopping gift card redemption options have ebbed and flowed over time. Sometimes, the options have downright sucked. For a while now though, they seem to have made a marked improvement. Sometimes, when the shopping portal features increased offers, we’ve seen similar offers from the Capital One credit card portal. There have been offers as high as 30 or 40 Capital One miles per dollar spent (or even more in some cases). Where is my X-factor that will determine whether I reach for Rakuten rewards or something else (particularly those Capital One miles)?

I think that our Reasonable Redemption Value is a good reference point here. Our Reasonable Redemption Value for Bilt points is 1.55c per point. It is certainly possible to get more value, but if I’m going to trade away the chance for cash in favor of Bilt points, those Bilt points would need to be costing me less than 1.55c each. Therefore, if I am comparing Rakuten to another shopping portal, I would choose Rakuten so long as the other portal isn’t beating the Rakuten rate of return by more than 55%. To put that in a concrete example, imagine:

- Rakuten is offering 10% back

- A competing portal is offering 12.5% back

- On a $1,000 purchase, the option is to earn $100 Rakuten cash / 10,000 Bilt points or earn $125 back. The opportunity cost to earn Bilt points is 1.25c per point. I’d probably rather earn Bilt points.

However, if the competing portal were offering 18%, the balance starts to tip:

- Rakuten is offering 10% back

- A competing portal is offering 18% back

- On a $1,000 purchase, the option is to earn $100 Rakuten cash / 10,000 Bilt points or earn $180 back. The opportunity cost to earn Bilt points is 1.8c per point. I’d probably rather earn cash than give up the chance to earn $180 in cash for the opportunity to earn 10,000 Bilt points.

And keep in mind that the math on that will change for non-elite members when the conversion rate from Rakuten to Bilt changes in 2026. At that point, I’d rather be earning cash back:

- Rakuten is offering 10% back

- A competing portal is offering 12.5% back

- On a $1,000 purchase, the option is to earn $100 Rakuten cash / 5,000 Bilt points or earn $125 back. The opportunity cost to earn Bilt points is 2.5c per point. I’d rather have the cash in that case.

All of that eliminates factors like the reliability of the other portal, the additional complication of multiple shopping portal accounts, etc. Still, once the Rakuten conversion rate drops for non-elite Bilt members, it would become hard for me to continue to consider taking Rakuten rewards as Bilt points. Will we see one of the new credit cards offer Bilt elite status, a reduced path to Bilt elite status, or some way to lock in the higher Rakuten redemption rate? That all might make a difference.

It does still leave me in a dilemma with Capital One Shopping. Given the restriction to only redeem Capital One Shopping rewards for gift cards, and the past variance in gift card redemption options, one can’t think of Capital One Shopping rewards as “cash”. At the same time, we have seen less variance over the past few weeks, and some of the currently available options (like Marriott, Hotels.com, Best Western, and Best Buy) feel closer to cash to me than what we were seeing.

I think that if I can earn double the rate with Capital One Shopping that Rakuten is offering, I’ll probably stick with Capital One Shopping. In other words, if Rakuten is offering 10%, but I can get 20% or more from Capital One Shopping, I think I’ll probably stick with Capital One Shopping so long as gift card redemption options continue to stay strong. For me, some of this strongly hinges on Marriott. If my options are to rearn $100 in cash back from Rakuten, which will become 10,000 Bilt points (and then perhaps 10,000 Hyatt points by transferring) or $200 in Marriott Gift Cards (if that redemption option sticks), I think I’d take the Marriott gift card option since I could then re-stack the Marriott gift card (clicking through Capital One Shopping to make a reservation that I later pay at the hotel, earning Capital One Shopping cash back plus hotel points when I redeem the gift card). And I can use the gift card to cover not only the room rate, but also food/spa treatments/other room charges. But Hyatt points obviously can be even more valuable in the right situation. I think it’s probably a tough call for many people at the current Rakuten-to-Bilt conversion ratio.

But when that rate drops to 50 Bilt points per $1 in Rakuten cash and that comparison becomes 5,000 Bilt points or $200 in Marriott Gift Cards (assuming that Capital One Shopping redemption sticks around), I’d be far more inclined to go with Capital One Shopping.

Will this make the pursuit of Bilt status more exciting?

If I’m able to generate Bilt elite status and potentially move my Rakuten-earned rewards to a partner with a generous transfer bonus, the pendulum could swing heavily toward Rakuten/Bilt.

Having Bilt status is expected to be the key to maintaining a conversion of 100 Bilt points per $1 in Rakuten cash back (though this is subject to change). Bilt elite status is also a key to unlocking better Rent Day transfer bonuses. If you can both lock in the better Rakuten conversion rate and then move those points with a transfer bonus, the math could start to swing heavily toward Rakuten and Bilt.

As someone who earns quite a few points and miles each year, I could imagine waiting for Bilt transfer bonuses and juicing the return on my Rakuten rewards a bit further. That makes me more interested in Bilt status now than I was before.

Is that enough to make it worth spending on a Bilt card?

We’re going to have to wait and see what the Bilt Card 2.0 holds in store when it launches in February, but I could see Bilt elite status becoming even more relevant if the new cards offer accelerated paths toward elite status and that status both maintains a good conversion rate from Rakuten and access to transfer bonuses. In fact, while most of my portal shopping has shifted to Capital One Shopping over the past couple of years thanks to their crazy targeted rates, Bilt might just draw me back toward a stronger focus on Rakuten. But whether or not that happens likely hinges on how the new cards relate to earning elite status. With the right scenario, I could see Bilt status looking much more attractive for the possibilities with Rakuten in terms of both earning Bilt points and then leveraging transfer bonuses.

I find it very interesting that Bilt is both forcing me to think about the opportunity cost of my Bilt/Rakuten rewards while simultaneously making me consider the chase for elite status to maintain a good earn ratio through the chance to stack with transfer bonuses. That’s quite a series of carrots. If they make it a bit easier to chase those carrots with the Bilt Card 2.0 launch, I might have to bite.

I just booked a domestic business class ticket that “cost” me 15k Alaska Miles on AA metal. That same flight woulda cost me $600+ had I paid AA for it. ANY tools (now incl Rakuten) I have to rack up AS miles right now saves me a ton more in cash than the RRV of AS points..

> That same flight woulda cost me $600+ had I paid AA for it.

Would you have paid AA for it? Were you paying cash for domestic business class with any regularity before? It could be yes but that’s something you have to say.

I have been getting tremendous value out of 4.5k AA coach flights. Sometimes coach is sold out so I’ll get J for 9k, which is still over 2cpp even assuming I value the first class experience at $0!

Yea didn’t add up. Plus not all AA flights show on AS.

They definitely do not all show up but certainly with enough regularity I depleted 300k of AS miles this yr with fantastic value. For me, AS on AA really works well.

No they certainly don’t, but enough do where I have run thru 300k of AS miles this year (compared to only 100k of AA) for better deals on AA flights.

(esp now the partner fee is waived with use of the Summit)

I would’ve had to pay in this case because it was a couple’s trip & the others insisted on flying biz! Otherwise would’ve preferred 4.5k!

I was purchasing tickets for a couples’ trip. Everyone else in the group is insisting on business class so I was relieved with the AS offer. Otherwise, like you, I woulda been looking at coach! I always compare AS to AA to BA and select accordingly, but in the past year AS has been coming out on top far more cheaper than often for my travel.

Love this article Nick. I appreciate the deep analysis and am fascinated with how your mind works for these things.

This is probably a dumb question and I am too lazy to look it up, but with Rakuten is it possible to switch to Bilt (from AMEX MR) for the first six months and then switch back to AMEX MR?

I too switched my Rakuten account to Bilt points for the opportunity to xfer to Hyatt, Japan Airlines, and Alaska. However, at 2 cpp, I won’t continue to be a buyer, as that’s the minimum value I will redeem points at. If I can’t make a decent return on the spread, it’s not worth my time.

I’m hoping that one of the new Bilt cards will give silver status. If it’s only the premium card that does this, I’ll have to look at the overall return on investment of the annual fee + the value I’ll get from the Bilt points.

Note that I’ve also started paying my mortgage with my Atmos Summit card to buy Atmos points at 1 cpp, buy status, and earn the 100K companion cert, which overall decreases the value of Bilt points as a xfer to Atmos.

Hi, can you explain how you pay with Atmos card and buy points with it? Benefits for paying through Atmos card?

Here is something else to consider. If you have lots of spend to spread around, it could very well make sense to direct sufficient spend to bilt – even at only 1x. As a platinum member, you may feel it is safe to assume you will eventually find an exciting transfer bonus to a partner you want at 100% or more (it has worked out this way for me the past 3 years). This transfer gets you back to the same number of points as if you had gotten 2x in the first place. Anything above that is a bonus (blade, sometimes trf bonus more than 2x, etc) and they do seem to be committed to making it worthwhile to have and maintain platinum status.

Hey Nick,

Do the Tripadvisor/Viator bookings show up on Cap 1 Shopping as “ineligible” initially and then switch to pending once you complete the activity? I feel like you talked about this on a past podcast. I booked numerous activities for next summer with the 70% deal but all showed up “ineligible” today. Hoping this isn’t going to be a fight to get these credited.

I am having this problem too.

Yes, will change once activity completed. Source- Nick’s Complete Guide to Cap 1 Shopping.

If this is what’s “on Nick’s mind” how do you ever get any sleep?

Great analysis, Nick, BTW.

If only there was therapy (and possibly medication) for those of us who fool ourselves into thinking we are getting something for free, when indeed we’re paying just like everyone else.

Please keep the thought provoking articles coming…they’re worthwhile exercises in the finances and psychology underlying our participation in, and fascination with, playing the “points game”.

Also, if it hasn’t been done already, please correct the word “portal” in paragraph #8. (“That thought started to call into question other oortal earning decisions as well.”)

Thanks, Nick.

C1 shopping and C1 offers have largely overwhelmed Rakuten for me (the AA and B6 portals also get used, but less often). This Bilt news will probably change the calculus — I’ll use Rakuten more. I agree with you that the 1.5-2 cpp threshold is a fair one to make a decision. And I’m glad I naturally get Bilt Silver Status (from mostly restaurant spend). I am thinking harder about pushing the Gold threshold next year, but I’m not sure I could do it without significant opportunity cost.

Capital One Offers have really taken a bite out of using other shopping portals. The gift card redemption options have limited my interest in Capital One Shopping but their Offers for credit card holders usually work out to be the best return in points. I’ve pretty much stopped using the AA portal and Rakuten mainly gets used during 10X – 20X promos. During non promo periods C1 routinely comes out on top.

I’m having a few more tracking issues with C1 Shopping lately, which is pushing me to consider other options. Would agree that C1 offers is great, but I do find the offers more hit and miss. With Rakuten/Bilt, I might be pushed toward getting Bilt points if it is close. For example, I might prefer 3x Bilt points to 4x C1 miles on the same purchase. It is close, but I think some people are already making this choice with Amex (valuing 3x Bilt on dining over 4x MR).

Weirdly, Rove is also starting to show up as a viable option on occasion. I just think there are a lot of great options now for portal shopping compared to 2 years ago.

You might be the only person on earth who is satisfied with the capital one option. The tracking is bad, I’ve had GC issues with them, the GC offerings are inconsistent. Payouts are crazy slow on some of the recent deals.

Never had a problem with Rakuten. I think this BILT option is excellent.

Also, just from a content perspective…in my completely irrelevant opinion, you keep inching further and further away from your posts being comparable or relevant to the ‘average’ reader here. How many of the FM readers have generated well over $10,000 from the capital one shopping offers? (Similar to the posts about having 1,000s of dollars in premium cards, Greg apparently having over 6 figures in annual tax payments etc). It’s a natural tendency in the effort to dig deeper and go further to come up with new content. Maybe it’s just me that the posts have moved away from in terms of relevance, but I though I would share.

Regardless, I’ll keep reading 🙂

Were you in Caddy Shack?

Uh, I’m just gonna go find a cash machine

too much clutter in this post, just the fact please

Nicks mind is a busy place 🙂

some of us enjoy following the train of thought. the more info we have the more we can decide for ourselves what we should do.

Just like the display of your Rakuten payout in cash makes you think more about the cost of acquiring points, the Frequent Miler RRVs make me think more about the cost of spending them.

If I’m going to spend 100,000 points on something and I think about that as $1,500 (at a rate of 1.5 cents per point) it invariable causes me to think about “well, could I get the equivalent for $1,500 or close?” So, if I’m spending that on a business class fare, could I have gotten the equivalent travel service for $1,500, even if in another class of service? Or another carrier? For my own benefit hapiness-wise, it makes more sense to consider points that have already been earned to have a cash value of 0 cents per point.

This is excellent analysis and thinking. Thanks for discussing the quiet parts out loud. The only thing I would add is that a) for most people it’s not a choice in this economy – you take the cash and b) if you do have the luxury of the choice (as I suspect many readers of this site might), that means you likely have the ability to invest that cash instead of using it immediately. If one invested $1000 in the S&P 500 for the duration of 2024 they would have ~$1250 (minus whatever tax on the gain). Points, by contrast, stay in a “checking account” and generally do not earn “interest”. So unless one has a near term plan for points, there’s also the opportunity cost of not investing cash that should be considered in any analysis if the points are going to sit around for, say, 12 months or longer.

Ah, but this is actually my biggest argument towards points versus cash. I hoard cash already. Points allow me to use the accumulated points without guilt that I should be saving it instead. Points allow me to take guilt free vacations to places I would never spend cash on. Is this the optimal financial decision? No. Is this the optimal life decision? Definitely better than not traveling at all.

From a life perspective, if my options are invest every penny to grow a larger hoard of money or spend money/points to enjoy life and experience the world, for me (as a high earner who is already saving plenty), unquestionably spending the money on travel is the better life decision.

The crossover between hyper savers and the points or miles game is not small, and those hyperoptimizers sometimes benefit from something that allows them to go enjoy life without guilt.

The psychology of points is fascinating. Not saying I disagree with you at all! But unless you are never willing to pay cash for travel, I presume many of us are often comparing the cash purchase price to the points redemption prices, whether a) to evaluate whether or not we are getting a “good” redemption and/or b) to consider whether to pay cash versus points.

I do agree that Chase, for a moment there with its 1.5c CSR redemptions, took the “joy of the free” away if one otherwise had a ~1.5c minimum redemption value. I suppose that will only be a problem for some folks with some of their points through October 2027. Chase must have a psychologist consulting on this stuff.

I would really struggle to pay cash for luxury travel or for the volume of travel we current do. I would probably still travel, just less and in less style, without points and miles.

I do agree that we are all comparing to get “good” redemptions. If we aren’t doing that, we don’t end up on Frequent Miler.

Loving this thread. Cashing out points to book economy flights has been a good financial decision. Using that cash for our family to splurge on experiences at the destination ( and at home ) has worked out well as a life decision.

Getting Bilt status is important for this. I am not sure you can get Bilt status with tax spend but maybe you can?

James, It looks like tax payments are excluded. Also there is huge opportunity cost of paying taxes at 1x for status vs hitting a SUB.

Thank You

Yes that would not be good. I would have to pay the IRS fee and potentially lose a sub.

Are there subjective factors not discussed that ought to be considered?

Rakuten customer service is pathetic. They took away CVS in-store from me, and I’m fighting with them for more than a month without any success. And my Rakuten Amex card is mostly useless right now, since it’s tied to this account.

Nick, Great article! Initially I was really excited to switch to BILT rewards but as I have thought about it, I’m hesitant to pull the trigger because of the status requirement for the 1:1 transfer after six months. I can see for those who have it specific plans making the switch or you are sure you will hit the status requirements. For me I’m unlikely to hit the BILT status requirements as I don’t frequent any of the BILT restaurants. So unless I figure a way to consistently hit the status level I’m staying with AMEX.