The Platinum Card from American Express for Schwab has a unique super power that’s often mentioned in passing by the FM Team: it makes it possible to convert your Membership Rewards points to cash at a rate of 1.1 cents per point. Even if your Membership Rewards points were earned from other Amex cards, simply having the Schwab Platinum card unlocks this capability. The name for this feature is “Invest with Rewards.”

Starting October 1st, the ability to cash out points a 1.1 cents each will be limited to 1,000,000 points per calendar year. The value of any points moved to Schwab after that limit is reached will be 0.8 cents each, making it a much less attractive option.

How to Use Amex/Schwab Invest with Rewards

Using the Invest with Rewards feature is simple: Log into your Amex account, click “invest with rewards”, then follow the prompts. In the end, the cash will be deposited into your Schwab brokerage account where you can invest or withdraw it.

1) Log into Amex and click “Invest with Rewards”

Log into your Amex account and select your Schwab card. On the right, you should see a box showing your Membership Rewards points total. Beneath that total, you should see a link labeled “Invest with Rewards”. Click it.

2) Enter you Schwab Platinum card info

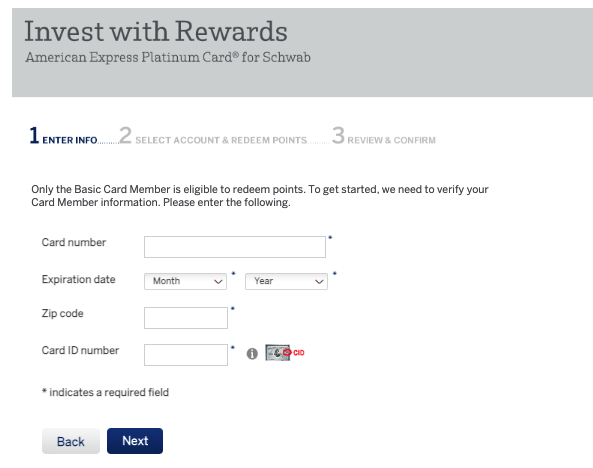

The next screen will invite you to get started. The screen after that will ask for your Schwab credit card info:

After entering that info, click “Next.”

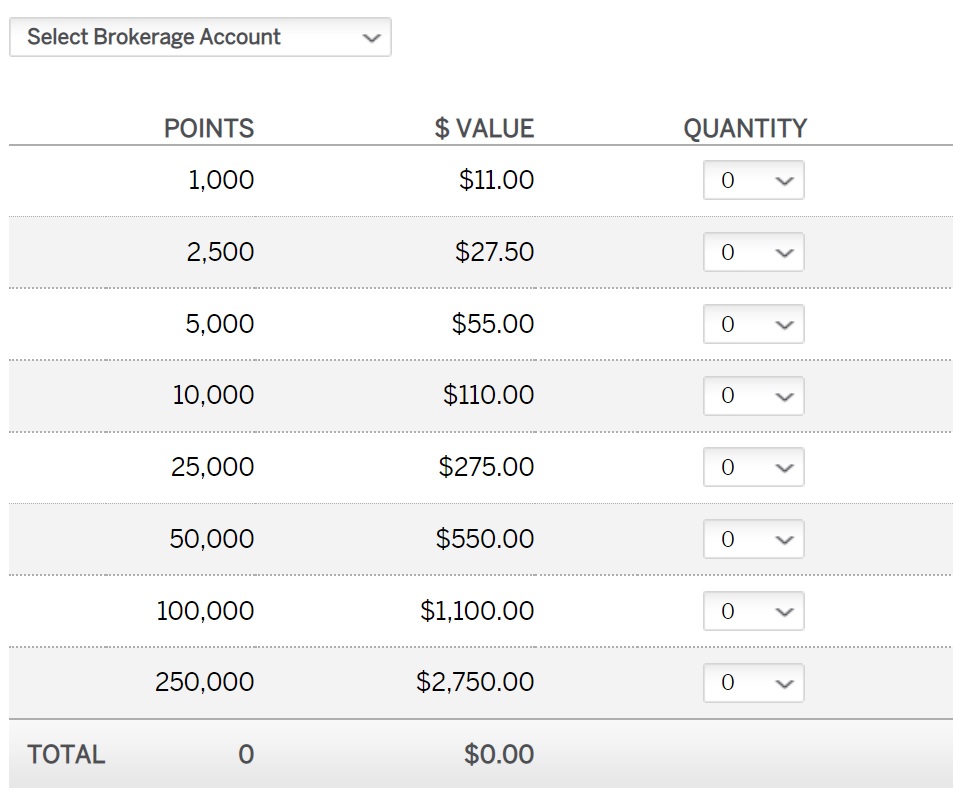

3) Pick your brokerage account and the number of points you want to convert

The “Select Brokerage Account” drop down should auto populate with any valid Schwab brokerage accounts you have. You will then be able to review all of your choices on the final page. If everything is correct, click “Redeem Now.” Afterwards, you’ll see something like this:

Your redemption has been received and is being processed. Thank you for redeeming your Membership Rewards® points through Invest with Rewards. You should expect to see a deposit from Schwab in your brokerage account in approximately 4-6 business days. If you do not receive your deposit within that time frame, please contact Charles Schwab at 1-866-385-1227.You will receive an email confirmation of your redemption request. In the meantime, please print this page for your records.

Although the notice states that it will take 4-6 business days, normally it’s only a few minutes, even if you do the conversion outside of normal banking hours. Occasionally, there can be glitches that will stall the process or cause a delay, but that’s fairly rare.

The redeemed points will appear as cash in your brokerage account. Then, you can either invest the funds or transfer them to an external account.

If I open a new Schwab AMEX Platinum card, will it use my existing MR account? And then, could I transfer all my MR points into my Schwab brokerage account at 1.1c?

Talk to us about this card. Is it considered a separate product? Is the signup bonus decent?

[…] But, there’s a trick to maximizing your cash back. If you have the Amex Platinum by Schwab, you can technically cash out Amex points at 1.1 cents per point. See this article for more info. […]

I’m glad AMEX went this route on annual limits rather than devalue the cash out to 1 cpp like Morgan Stanley or even worse. That’s still $11K you can cash out annually at the better rate. The amount of people wanting to cash out more than that has to be incredibly small and a majority are going to be the big whale churners that AMEX is clearly targeting with the limit.

You mean like those who get bonuses on hundreds of employee cards using their own name and Social Security number for each employee card? You’d think Amex would have a process to spot this. A guy on Reddit said he clears $200k per year on Amex alone.

It’s all too often that a nice-to-have feature is shut down for everyone due to a small number of abusers. Imagine if they kept the 1.25 cpp cash out but on 500k points. For the average person, the 500k cap would have been fine.

Is there a limit to how many MR you can convert annually?

Under the old system, no. Under the new system, for practical purposes, one million Amex points per year. After one million, the cash-out rate works against you.

You can still cash out unlimited 1cpp with a business checking account.

Why bother? Can get 1 cpp by simply buying a ticket with points, canceling before 24 hours and getting quick statement credit for ticket at 1 cpp, Schwab seems like a lot of hassle for an extra .1 cpp or am I missing something?

I was wondering that too

Because you can put this into a Roth IRA and not have it count against the annual contribution limit or if are unable to contribute.

Wow, this is really interesting. No tax form?

Nope. As long as have Roth with Schwab, can transfer. According to Schwab it is a bonus and not a contribution.

I wonder if IRS might wonder how you have an extra 11k in the Roth however without any 1099?

are you sure this still works and with any airline likeunite or american? Becuase I thought they’d refund you back in Membership reward points and not cash like transaction unless someone here can confirm. I agree opening a new platinum card wit $700 fee just for the sake of converting points at 1.1 makes no sense.

Not sure. Not using that way anymore. Now have Amex Business Checking account which allows transfer of Amex point at 1 cent per point. Quick and easy online.

This conversion works with Platinum Business card, not sure about other Platinum cards

Is this the highest cash out option amongst the flexible currencies?

Yes it’s the highest sanctioned cash out option that I can think of. There are sometimes tricks that involved buying refundable travel that result in better cash-outs though

Thanks for the reply! In terms of refundable how would that work? Wouldn’t a refundable booked through CSR just be refunded in points?

Look to the Altitude Reserve.

Thanks I know about that but points are harder to come by. Looking for a better way to cash out UR/MR

Citi Rewards+ also allows cash out at 1.1% per point up to 100,000 points per year. Same rate but 1/10 the cap with no annual fee.

Is it possible to change a standard-issue Platinum card to a Schwab-branded card?

Answered my own question. From an AMEX page about Schwab cards:

“I already have an American Express Card. Can this Card be converted into The Schwab Investor Card® from American Express or American Express Platinum Card® for Schwab?

“No. You will need to apply and be approved for a new Schwab Investor Card® from American Express account or a new American Express Platinum Card® for Schwab account.”

Don’t forget to update it to 1.1c per point.

Thanks for the reminder. Updated.

I recently opened a Schwab Platinum card. When I get to step #2, after I enter my credit card details, I get an error stating that my information is incorrect and needs to be fixed. (It isn’t. Everything is entered accurately.)

I spent about an hour on the phone with an AmEx customer service agent, who ultimately concluded its a Schwab issue and directed me to contact them. I then spent about another hour on the phone with a Schwab agent who was equally flummoxed and insisted it must me an AmEx issue.

Has anyone else encountered this? Any idea on how to resolve?

This is a common problem with the Invest with Rewards option. I had the same problem back in 2019. Based on comments I’ve seen since then, it has never been fully resolved

I was in the same situation as you a few days ago. Did you get an instant number after approval? I used the expiration date from the instant number instead of the one on the physical card (I guess it takes them a while to update). The actual card number and CID should be the same though. Give that a try, it worked for me.

Had this issue early on as well. After calling in, we determined that the expiration on my card didn’t match what AMEX had in their system. Odd issue. Was easily resolved by requesting a new card (used that it was damaged – in order to get a new card number). As AMEX overnights Plat cards,it was working correctly in 24 hr turnaround.

Do you get 1099 if you convert MR to cash?

No