Late last year, I stopped using my Bilt credit card. On October 1, 2024, Bilt began limiting its Rent Day double-points promotion to a meager 1,000 bonus points per month. Before that, when the limit was 10,000 bonus points, I made sure to spend enough on the first of each month with my Bilt card to earn top-tier Platinum status by the end of the year. This way, I earned at least 2x on all of my Bilt card spend, and I qualified for the best Bilt transfer bonuses (which they often limited to top-tier elites) — sometimes as high as 150%. It was a great deal while it lasted, but the new 1K limit meant that I could no longer earn top-tier status while also earning at least 2x on all purchases. So, I put away my card and was relieved that I no longer had to worry about making at least five purchases per month to earn rewards (a weird requirement of the Bilt card).

Recent developments have prompted me to reconsider my 2026 Bilt-card plans…

Bilt background

Bilt is a rewards program initially designed for renters, but it has since expanded to be relevant for all US residents. Bilt offers rewards for paying rent (and soon, mortgage too), as well as for spending with any linked credit card at participating merchants of Bilt’s Neighborhood Rewards program (this includes Walgreens, many restaurants, fitness studios, and parking lots, among others). You do not need a Bilt credit card to earn Bilt points, but it’s the only way to earn Bilt points without a fee when paying rent or (soon) mortgage.

Bilt points can be used for 1.25 cents per point towards travel booked through Bilt, or you can do even better by transferring to an airline or hotel partner to book valuable awards. Bilt has an impressive array of transfer partners, including Hyatt, Alaska, Japan Airlines, United, and many more.

Additionally, Bilt offers “Rent Day” promotions on the first of every month. Rent Day promotions often include transfer bonuses to a particular airline or hotel partner. Sometimes the size of the transfer bonus depends on the member’s elite status. It’s common to see transfer bonuses as high as 100% for top-tier Platinum elite members.

Bilt’s elite status is earned within a calendar year based upon either the number of points you’ve earned or the amount you’ve spent through Bilt:

- Silver: 50,000 Bilt Points earned or $10,000 spent

- Gold: 125,000 Bilt Points earned or $25,000 spent

- Platinum: 200,000 Bilt Points earned or $50,000 spent

Rakuten & Bilt

For some time now, the Rakuten shopping portal has offered the option to earn American Express Membership Rewards points instead of cash back. What’s new is the option to earn Bilt points instead. That’s exciting! It’s easy to earn huge numbers of Amex points through credit card welcome and referral bonuses. With Bilt, though, the opportunities for big points windfalls center around paying a lot in rent, buying a new home, or (soon) paying a lot for your mortgage. None of those apply to me. However, I do earn a significant amount of rewards from Rakuten, both through shopping and by referring others. I’m thrilled with the opportunity to earn Bilt points that way! Specifically, I’m interested in taking advantage of some of the great deals that Nick uncovered with Japan Airlines (JAL) miles. Only Bilt offers 1 to 1 transfers to JAL.

A new purpose for Bilt elite status

For the next six months, everyone who chooses to earn Bilt points from Rakuten will earn a point for every portal penny earned. That’s the same as when you choose to earn Amex points. After six months, only those with elite status will continue to earn at that 1 to 1 ratio. That makes Bilt elite status essential if I want to continue earning Bilt points from Rakuten. Additionally, if I’m earning lots of Bilt points, I’ll want access to the bigger transfer bonuses that elite status often unlocks.

Sadly, points earned from Rakuten do not count towards Bilt elite status.

A new life for my Bilt card

To keep my Rakuten to Bilt ratio at 1-to-1 beyond the next six months, I’ll need at least Bilt Silver status. Silver status requires either 50,000 Bilt Points earned (excluding Rakuten-earned points) or $10,000 spent. If nothing changes about that next year, then my go-forward plan is to spend $1,000 every Rent Day (probably on Kiva loans). Since Bilt doubles card earnings on Rent Day (up to 1,000 bonus points), I’ll earn 2x on all that spend, and I’ll earn Silver status by month 10.

Actually, since the Rakuten to Bilt ratio will drop next May for non-elite members, I’ll have to accelerate those plans. If I spend $2,000 each month, January to early May, I’ll have Silver status in time for the mid-May payout from Rakuten (Rakuten pays out once every three months). That plan reduces my point earnings to 1.5x in 2026, but once I earn Silver status in 2026, it will remain in effect until the end of 2027. Starting in January 2027, I could switch to my $ 1,000 per month plan without worrying about dropping to a lower transfer ratio from Rakuten.

However… All of this is dependent upon Bilt’s credit card working the same way next year. But maybe it won’t…

New Bilt credit cards

Last week, Bilt announced that its lineup of three new credit cards issued by Cardless will be launched on February 7, 2026. The annual fees will be $0, $95, and $495. Beyond that, we know very little. We expect to learn more in January.

Current cardholders (like me) will have the opportunity to transition to a Cardless Bilt card without incurring a hard credit inquiry. Additionally, our current Bilt cards issued by Wells Fargo will be converted to the Wells Fargo Autograph card. The latter is a decent card that earns transferable points. I’m happy about that part of the transition because it will give me an easy way to dip my toes into the Wells Fargo rewards ecosystem. Regarding the transition to a new Cardless card, the card will likely appear on my credit report as a new account (rather than being backdated to when I opened my current Bilt card). If so, that will add to my 5/24 count. Boo.

I’m looking forward to learning about the new cards. If any of them offer an accelerated path to elite status or better than 1x base earnings, I could easily imagine that I’d set my sights on higher than Silver elite status. I’d be happy to return to earning Platinum Elite status if it’s not too expensive to do so. If nothing else, I’d love to do a free Blade helicopter ride each year. Hopefully, that Platinum perk will stick around.

A second look at the Rakuten card

When the Rakuten American Express card debuted, I was underwhelmed. Its primary selling feature is that it earns 4x points on all Rakuten purchases above the amount offered by the Rakuten portal itself. So, if you see a Rakuten portal offer for 8x at Macys.com, click through, and pay with the Rakuten American Express card, you’ll earn a total of 12x. That’s pretty good, but there’s an annual cap. The 4X bonus is limited to a total of $7,000 in annual purchases. That cap means you can earn a maximum of $280/28,000 points per year. If you consider that you would have earned half that with a 2x everywhere card, then you see that the maximum upside is small: 14,000 points per year.

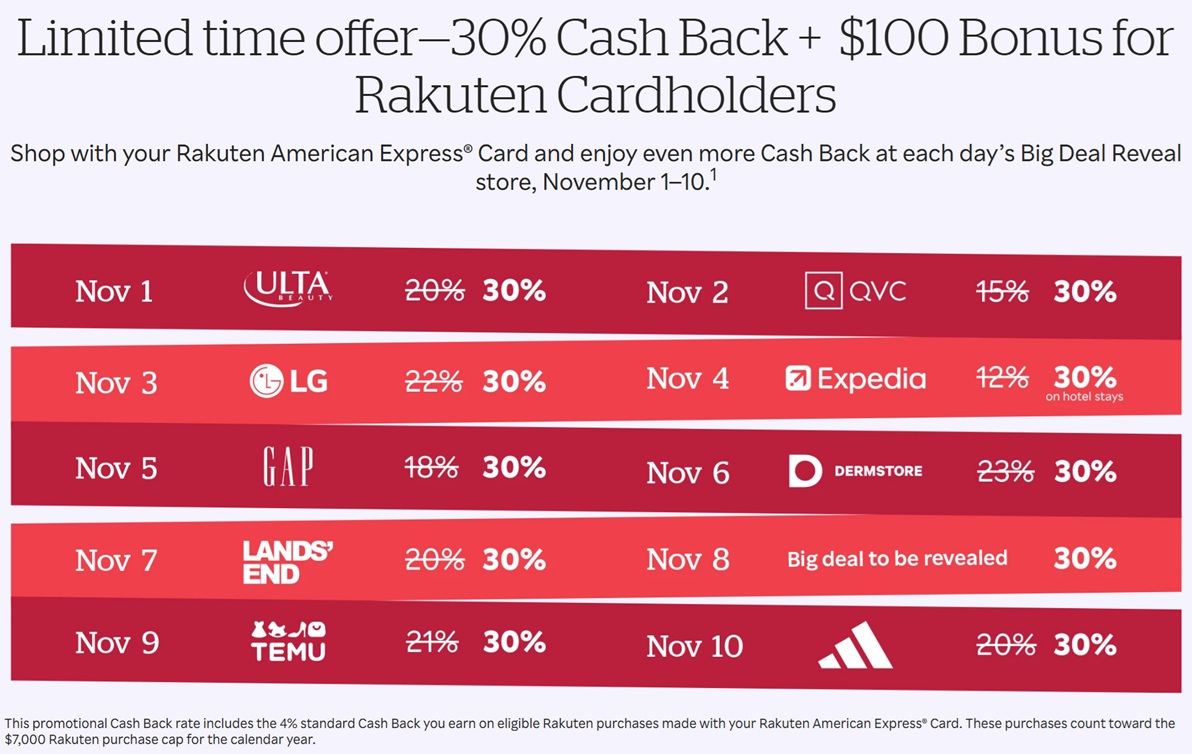

With the newfound ability to earn Bilt points through Rakuten, I took a fresh look at this card. By doing so, I found that cardholders had access to a special promotion that had just ended, where they offered 30% back with a specific merchant on each of the first 10 days of November. Wow! Those rates are inclusive of the card’s 4% back, but they’re still awesome. Consider, in particular, that they offered 30% back for Expedia hotel stays on November 4th. That would be exciting on its own, but with the ability to turn that into 30x Bilt points… wow!

There’s no guarantee that Rakuten will continue to offer cardholders special deals like the one shown above, but I’m willing to bet that they’ll run a promotion like that at least once a year, if not quarterly. I’m tempted to apply for this card just for the chance that the above deal wasn’t a one-off.

The waiting is the hardest part

The Rakuten/Bilt news has piqued my interest once again in pursuing Bilt Elite status, and it has even prompted me to consider applying for the Rakuten Amex card. But too much isn’t yet known…

- Will Bilt change the paths to elite status in 2026?

- What perks/benefits will the new Bilt cards offer, and will they make it easier or harder to chase Bilt elite status?

- Will Rakuten continue to offer incredible cardholder-exclusive promotions?

- Will other points & miles opportunities make chasing Bilt status irrelevant once again?

Will the rent/mortgage payments that you make your BILT card count towards earning status?

If so, that would make earning at least Silver status easier and thus worth keeping the BILT card in my opinion.

There are two ways to earn Bilt status: 1) through points earned; and 2) through the “fast-track” which is based on spend. Rent payments count towards the first option but not the second. See details here: https://support.biltrewards.com/hc/en-us/articles/5536520671117-How-do-you-earn-Bilt-Elite-Status

I just opened this Bilt card three months ago. Kind of irked I have to open a new account in order to get a new Bilt 2.0 card. Why can’t they just move the account. I’m sure I’m not the only one unhappy about this transition. Having to close the Wells Fargo account is probably gonna kill my credit along with opening up a new line in that short period. Wouldn’t be surprised if people slap Bilt with a class action lawsuit.

I heard the coffee break episode yesterday, but before you consider changing to be earning Bilt points, you should verify as the terms and conditions have always said if you exit the AmEx program with them you cannot go back to it. So in my opinion, not worth doing this just to get six months worth of Bilt points at 1:1 ratio

Something I’m confused about — I have a WF Bilt card currently. I just got a letter from Wells Fargo saying that the card would be converted to an Autograph in February. Are current Bilt card holders eligible for both the Autograph and the new Bilt card via a conversion process — or just one? I had assumed that we had to choose between WF Autograph and new Cardless Bilt, but Greg is using the word “additionally” in the blog post, which makes me wonder if we might end up with two cards (unless we proactively close one).

You’ll have the option of both (subject to Cardless approval for Bilt)

Cardless isn’t buying the backbook from Wells Fargo. So, it’s going to be a soft pull for the cardless version. Not sure if you have other recent cards if that’s a deal breaker or not but I’d assume so.

If you do nothing, you’ll have a WF Autograph with the same opening date and card limit and no Bilt card.

My understanding is that if you choose to have a new Bilt card through Cardless, then you can either have your Wells Fargo account closed or have it turned into an Autograph card.

From the Bilt announcement page:

Would it make any sense to get one of the Autograph cards before the transition takes place, get the sign on bonus, and hope they are directly transferable to Bilt?

Why would they be transferrable to Bilt?

No, I don’t think there’s any scenario in which Wells Fargo Autograph points will convert to Bilt points

Only makes sense if you wanted the 0% apr and/or ~$200 SUB from the autograph.

Greg:

Query – If I switch my credit card from Bilt neighborhood dining to Rakuten 5% cash back, would I potentially be earning more Bilt points for such dines for the next 6 months or so?

Should we do this?

Many thanks!

Yes. The thing to do is to check which program has the restaurants that you frequent. If both programs do, then switching to Rakuten is a good idea.

Sorry but 80%+ of that merchant list is overpriced junk. So unless you’re a really big Gap spender or whatever, I think the initial reaction of the Rakuten Amex remains correct, namely that the $7k annual spend cap for 4x earnings excessively limits the value proposition of this card. Even doubling the cap to $14k (so being able to earn 56k points) really wouldn’t cut it imo. There’s no chance that such a low cap would justify a 5/24 spot for the marginal benefits above and beyond what, e.g. a Citi Doublecash card offers.

When we learn more about the new Bilt cards, I’ll look forward to a FM deep-dive on the ROI of the 5/24 impact. I’m not convinced that I can earn enough Bilt points to compensate for an interruption in a steadyish flow of Chase SUBs (and potentially Alaska cards, too). Canceling my Bilt card preemptively to avoid the 5/24 hit of a new Cardless line is on the table, although I’ll wait to see what the card details are.

That makes sense.

I logged into my Rakuten to switch from Membership Rewards to Bilt points, but I didn’t see the option. Is there something special you have to do to set this up?

Do it from the bilt app and it changes in your Rakuten account automatically. Must use the same email in both bilt and rakuten.

You need to do this in the Bilt App. Also, the emails on the two accounts need to match or Bilt will open a new Rakuten account for you under your Bilt email. Luckily, updating your email is easy on both Rakuten and Bilt.

You switch from the Bilt app.

I can’t see myself spending enough to get Bilt elite status but I will probably more from MR to Bilt on Rakuten for the next six months, if nothing else, just for Hyatt. I’ll bet they give out elite status with that premium card too.

My fear is that Bilt will go bankrupt and all those points will have zero value. I don’t worry about this with Amex or Chase or Citi. Given that Wells Fargo cancelled the relationship based on lack of profitability for the credit card issuer, I worry about how long this can last.

It doesn’t mean I didn’t switch to Bilt from Amex. But unlike Amex, I am unlikely to let Bilt points just build up and unfortunately that means I will probably not be able to use them for Alaska flights as I won’t earn them very fast in Rakuten (unless the credit card issuer better than I am expecting). I do okay with Rakuten but 30k per quarter is gonna take me a year to earn two tickets to Europe on Alaska. But as a way to get more Hyatt points, especially for short but high CPP stays, Bilt is perfect.

Bilt is financially strong and stable — don’t think twice about this. Bilt’s leadership is strong — its chairman is the former head of Amex.

lol. Nice surface level analysis, you puppet. Any facts to back up your “financially strong and stable” claim

What a rude comment desperado!

I’m not worried about Bilt going under. The program is so much more than just the credit card at this point, that even if the card doesn’t last (and I think it will), the program itself will continue.

I am at the same boat with you, Greg! I’m mainly a Citi ThankYou Points, Chase Ultimate Rewards and Amex Membership Points earners because of my spending habits and have my ecosystem setup. I wanted to get into Bilt points but their ecosystem is not suitable for me.

For one particular reason, I am not a renter or mortgage holder. I have a house that pays off already. Obviously, it would be stupid to sell my house and go rent or do a mortgage now lol (Buying a second house with mortgage might not be a bad idea though in terms of perspective of investment).

That being said, Bilt card or Bilt neighborhood were my only two main source to earn Bilt points. Within Bilt neighborhood network, Bilt fitness and Bilt Walgreens are two most useless categories for me because their partners weren’t particularly great for me since I already have my gym membership and I don’t get sick a lot so I am not shopping at Walgreens. Bilt dining is good but it only earns 3x Bilt points while I can earn 5x AAdvantage Miles with Loyalty Points. Bilt card is mediocre at best for a non-renter. I could earn 5x ThankYou points rather than 3x Bilt points for dining, 2x ThankYou points rather than 1x Bilt point. Sure, there’s “Rent Day”, but the marginal gain to have shop around on the first day of the month is just beyond unnecessary and annoying.

But this Rakuten announcement of allowing 1-1 transfer makes me rethink my strategy like you. I earned a lot of Rakuten points through out the year (Sure, some has shifted over to AAdvantage Shopping portal for AA miles and Loyalty points. But I do compare the rate and sometimes Rakuten is just much better). Just like you suggested, in order to maintain the 1-1 transfer, you must have Bilt Silver. I currently do not hold a Bilt card because it was useless to me. So if the new cards lineup is attractive and competitive. Let’s say $495 gives out free Silver tier for example or if the no AF one still has Rent Day feature. I may MS my way on Rent Day for $833 per month to hit Silver going forward!

Important question is whether the 5/15/26 transfer date will be 1:1 without Bilt status. Six months from launch is 5/6/26.

Completely agree about the Rakuten card. Was blown away by the 30 percent offers. Was on my radar but not my list, now I am seriously considering it. But even without the card the offers are still great. And the hits keep on coming – singles day today so tons of stores are at 11%.

A golden age for earning points from hotel portals and online shopping.

I hope they make it very clear well before the 5/15/26 payout whether it will be at 1 to 1 for those without status.

I guess Bilt didn’t die like some said it would.

Just when I thought my interest in Bilt had peaked, this article piqued it right back up. Then I peeked at my credit card drawer and realized I already have enough plastic to build a small mountain peak— but apparently still not the right one. Thanks Greg for the great analysis and using piqued correctly.

LOL