I’ve talked to many people lately who are struggling to decide whether to keep their Sapphire Reserve® cards when their next annual fee comes due. I’m in the same situation, so I figured it would make sense to walk you through how I’ve been thinking about it and the decision I made.

If you decide to cancel, I recommend using as many of the card’s new coupons as possible before it’s too late. See: Still got the Sapphire Reserve® card? Your new benefits are now live. Here’s what to do next.

Overview

Last year, Chase overhauled the Sapphire Reserve card. The old version was easy to understand and easy to recommend: it offered 3x points for travel & dining, and 1.5 cents per point value for travel booked through Chase Travel℠. Plus, a single easy $300 travel rebate brought the annual fee, after rebate, down to around $250. The new Sapphire Reserve card is more expensive, more complicated, and loaded with coupons. Now, depending on how you book your travel, you’ll earn 1x or 4x for travel (or 8x when booking through Chase Travel), and you can redeem points for up to 2 cents per point through Chase Travel, but you’ll usually get just 1 cent per point unless you got your card before June 23rd 2025, in which case points earned prior to October 26th 2025 are worth 1.5 cents each through Chase Travel, but only until October 26, 2027. Clear?

If you haven’t already been charged the new $795 annual fee, you should expect that fee a year after your last payment of the old $550 fee. I paid $550 on August 1, 2025, so I expect to be charged $795 on August 1, 2026. Until then, I can (and will) take advantage of as many of the card’s features & coupons as possible, regardless of whether I renew.

Is the card worth $795?

The Sapphire Reserve card comes with coupons that can be worth at least $795, but it depends on how and whether you use them. For example, the card offers $250 back, twice per calendar year, for 2-night or longer prepaid bookings through The Edit. Obviously, those coupons are worth nothing if you don’t use them. Less obvious is the fact that The Edit often charges much more than other booking channels for the same hotels. In those cases, you could get negative value from these coupons if you pay more than $250 extra.

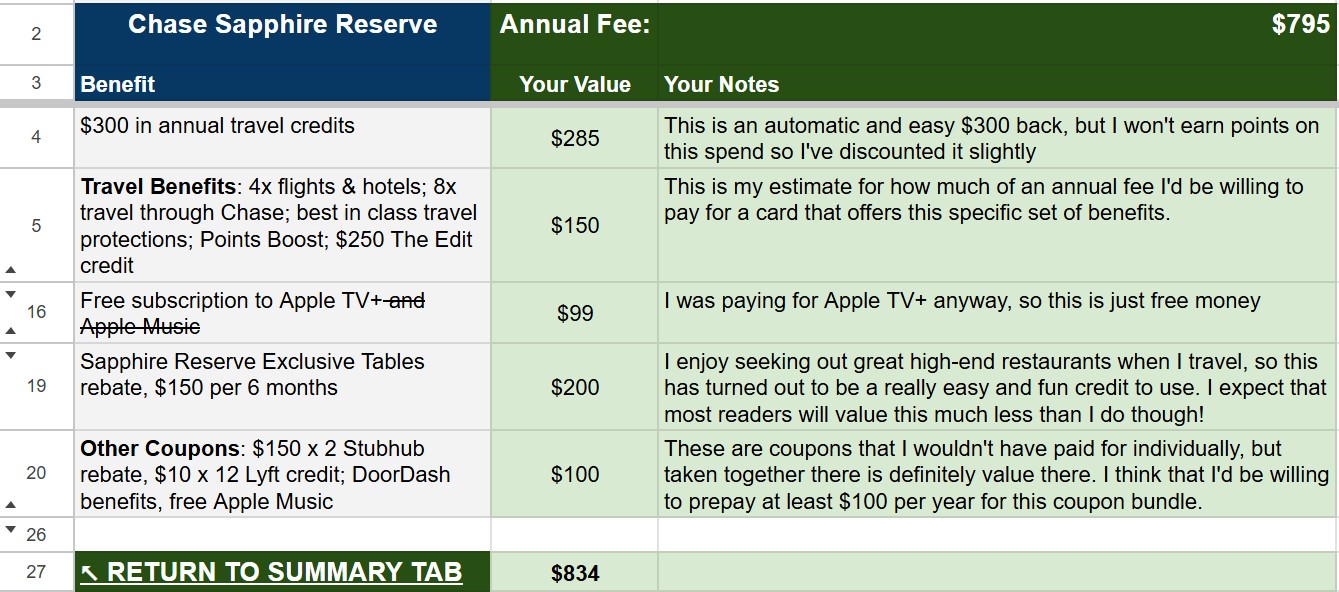

One way to decide whether to keep the card is to fill in “Your Value” in the “Which Premium Cards are Keepers” spreadsheet. The idea is to decide, for each benefit, how much you’d be willing to prepay for it if it were available as a stand-alone subscription. Record that amount. If the total across all benefits equals or exceeds the annual fee, then the card is worth keeping. See the post about this spreadsheet for more information.

Bundling

One problem I have with the spreadsheet shown above is that there are many perks and coupons I wouldn’t even consider buying as a subscription, yet they still have value. For example, I would never consider prepaying for StubHub credit, but since it’s there, I happily used it to get free seats at a basketball game. Similarly, with Points Boost and The Edit credits, I wouldn’t prepay for them, but I like having them available in case good opportunities come up to use them.

The solution I came up with was to bundle perks and coupons that have some value but that I wouldn’t be willing to prepay for individually. For example, rather than trying to figure out how much I value each travel perk individually, I bundled a bunch of them together:

- My Travel Benefits Bundle: 4x flights & hotels; 8x travel through Chase; best in class travel protections; Points Boost; $250 The Edit credit

Similarly, I bundled together the miscellaneous other coupons that I like having, but have a hard time valuing individually:

- Misc Coupon Bundle: $150 x 2 Stubhub rebate, $10 x 12 Lyft credit; DoorDash benefits, free Apple Music

When taken as a bundle like this, I have an easier time assigning a “how much would I prepay” estimate. I’d be willing to pay at least $150 per year for those travel benefits, and at least $100 per year for those miscellaneous coupons. Meanwhile, coupons and perks that, individually, are valuable to me stayed separate:

- $300 travel credit: $280

- Free subscription to Apple TV+: $99

- Sapphire Reserve Exclusive Tables $150 per 6 months: $200

On my personal copy of the spreadsheet, I edited some rows to bundle items and hid rows for perks and coupons I don’t value. The result was this:

| Benefit | How much would you prepay? | Notes |

|---|---|---|

| $300 in annual travel credits | $285 | This is an automatic and easy $300 back, but I won’t earn points on this spend, so I’ve discounted it slightly |

| Travel Benefits: 4x flights & hotels; 8x travel through Chase; best in class travel protections; Points Boost; $250 The Edit credit | $150 | This is my estimate for how much of an annual fee I’d be willing to pay for a card that offers this specific set of benefits. |

| Free subscription to Apple TV+ |

$99 | I was paying for Apple TV+ anyway, so this is just free money |

| Sapphire Reserve Exclusive Tables rebate, $150 per 6 months | $200 | I enjoy seeking out great high-end restaurants when I travel, so this has turned out to be a really easy and fun credit to use. I expect that most readers will value this much less than I do though! |

| Other Coupons: $150 x 2 Stubhub rebate, $10 x 12 Lyft credit; DoorDash benefits, free Apple Music | $100 | These are coupons I wouldn’t have paid for individually, but taken together, they definitely have value. I think that I’d be willing to prepay at least $100 per year for this coupon bundle. |

| Total | $834 |

Your bundles and values may (& should) vary

There are coupons in the list above that you may not value at all, so you should remove them from your analysis. For example, I know people who subscribe to Apple One family plans. For them, the card’s Apple TV+ and Apple Music coupons are worthless. Also, there are many perks and coupons that I hid because I don’t value them at all, but you probably do. For example, the card offers Priority Pass Select & Sapphire Lounge access for you plus 2 guests. I don’t value this because I get the same benefit from my Ritz-Carlton card. If you don’t have the Ritz card, you should include a value for it, or bundle it with other travel perks. Other examples of perks I don’t value but you might include: IHG Platinum Elite status, roadside assistance, $10-per-month Peloton rebate, and perks you get with $75K in annual spend.

Is the card a keeper?

Bundling perks and coupons made it easier for me to come up with concrete amounts that I’d be willing to prepay for those benefits. In my case, the sum total came to $834, which is $39 more than the card’s annual fee, so it’s a keeper… for me.

Please, please, please understand that I am not saying that the Sapphire Reserve’s $795 annual fee is worth it for you. Your situation is different from mine. You should value things differently. I expect that most readers will decide that the card isn’t worth keeping! Regardless, I hope the concept of bundling perks & coupons helps you find your answer, as it did for me.

Haven’t totally decided yet if i”ll keep it. If I downgrade to a chase freedom card, is the fee prorated if keep after annual fee due? Thanks for all the info.

So your time to keep track of all this is $0? Would you do 1hr of work for $34? 2 for $34? At 3h+ you’re approaching minimum wage…

Math might work for bloggers generating content, but others should take the time/hassle into account….Or at least I should.

that’s why I’m canceling my AmexBusPlat.

Has old CSR, not interested in new one.

Thanks for the discussion Greg. I think with the value coming in so close to the annual fee, it would behoove one to look at other opportunities for the same spend. As an example, for $100 more, an Amex Platinum would provide close to twice the value (although you may have a bunch already, but there’s always more fingers and toes to put Oura rings on). I’m sure there must be other cards with a better value proposition than the CSR to spend your pot of Annual Fee cash on. Besides, the $495 for the new Bilt card has to come from somewhere…

What Greg has done is to show us the math. The math could have been applied to any card. Each reader needs to apply that math to one’s own circumstances. And, consider your subjective factors.

PS – Given what Bilt just dropped late Wednesday about Bilt Cash coupons, the CSR might look like a walk in the park. I sense another rash of Bilt articles coming.

The Bilt Palladium card is no comparison to my CSR, I use 90% of the “coupons” at their max every year, so I come out ahead. The “slight devaluing” of some credits, like the $300 travel credit because “the amount doesn’t earn points” is a veiled shill comment attempting to make the Bilt Palladium attractive.

Pathetic of these travel sites pandering to Bilt

It is the weirdest coupon book imaginable. I sort of appreciated it, as you only earn the coupons as you want, and you use what you want within the limits of the program. Kind of nuts, but I looked at it and thought “I can do this.”

And you also buy ways to earn more points.

The whole scheme seemed utter insane, but fun.

Did I miss the new $250 credit for IHG and NH, which is far easier to use? That seems like a material improvement in value to me.

That $250 credit is one-time credit offered only for Calendar year 2026. I will use the $250 credit this Spring, but when my annual fee comes due in September that one-time credit will be irrelevant to my decision about the value of the Sapphire Reserve going forward.

Thank you Greg, good article!

Another consideration I’d take into account when my renewal comes up later this year is what else can I be doing with the account. CSR can get converted to a Chase Freedom card, and that could net a good amount of URs with 0 AF.

2025 might have been an outlier with the additional categories, but I maxed out Q1 (tax), Q3 (gas) and Q4 (PayPal) on all my Freedom cards, and could have used more. We’ll see how 2026 goes, Q1 categories have not been particularly useful to me so far.

A lot of hoops to jump through for tens of dollars.

Chase lounges are very good. But so are other lounges. For NYC folks why bother with a PITA CSR when you can have a KISS $395 C1VX card with C1 lounge access at the same LGA (coming shortly) and JFK terminals? Excellent package of travel insurance benefits though.

I’m up 2/1. Calling for a retention offer shortly. We will see.

I think the best in class travel protections are 4x on hotels/airlines are the best aspects of the card. If the CSR did not exist, what be your next card or combo of cards to achieve a good multiplier +/- travel protection? Thanks again for your great content!

Card is a keeper for me even after the egregious fee. I’m early 30s living in NYC area. So many concerts/shows/sports that I always spend money on, fine dining and im someone who likes a nice hotel when I travel. So I get my money back on the credits pretty easily, I actually already used them for the year.

for your spreadsheet, don’t forget the one time IHG credit. Easy $200.

For me, it’s a keeper, but man, it’s an annoying one, and the annoyance almost makes it not worth keeping. I value items differently than you but get at least $1k in value from the card that I would be willing to prepay for.

I won’t even bother with the Edit unless we decide to go back to Vegas in 2026, and it annoys me that it even crosses my mind.

I’d almost rather not have the DoorDash credits because I feel obligated to try to use them, and even thinking about them twice a month is a nuisance. I know I could just pretend they don’t exist.

The math only works if the coupons actually work. When credits don’t apply, disappear at checkout, or require tons of of customer service interactions to fix (if they ever are), the real value drops fast. A $795 card isn’t a keeper when Chase can’t reliably make its own benefits work.

Greg, totally agree with your analysis and like the bundle idea – these are kinda worth this much. One thing I would add is access to the Sapphire Lounges, which I find to be among the best available – at PHL I would much rather go to the Sapphire Lounge than the United lounge that I also have access to.

#nope

I have, let’s just say, a large balance of grandfathered Chase UR points which were worth 1.5X before the epic devaluation, and which will still be worth 1.5X for bookings through end of October. I am spending them (for 1.5X redemptions) at a pretty good clip, but I may have to pick up the pace to drain them all by the expiration date. After that, I plan to dump the card.