NOTICE: This post references card features that have changed, expired, or are not currently available

Many credit card issuers have developed various incentives designed to get you to keep their card at the top of your wallet: whether it is a big first-year bonus like 3% everywhere with the Alliant Cashback Visa, a bonus on micro-purchases like with the coming Citi Rewards+ card, a drawn-out welcome offer like the new Southwest 60K offers, or various offers for bonus points on digital wallets or at specific stores. One such incentive that has been around for a long time now is the monthly bonus opportunity on the Amex Everyday Preferred card: complete 30 or more purchases during your billing cycle and you earn a 50% bonus on points earned during that billing cycle. We recently messed that up in my household, and it will likely cost us thousands of points. In the end, the valuable takeaway was this: if you’re a couple transactions short of 30, just buy Amazon gift cards. It also led us to an interesting question: when an EDP transaction posts after your statement cut date with a transaction date before the end of your statement period, when does it count towards 30 transactions? I still don’t know the answer to this part, but transactions near the edges appear to disappear into a black hole at least temporarily.

The mistake

My wife and I had put a few large purchases and a number of small purchases on her Everyday Preferred card during the month of December, intending to put 30 purchases on the card and earn the 50% bonus. Of course, the benefit is designed to get you to use the card every day. I’ll admit that when opening the account, I thought that feat would be easier to accomplish than it is for us. Back when my wife and I used to commute to jobs, there were near daily purchases: filling up on gas, grabbing a snack / coffee / lunch, etc. Since we’ve now both worked from home for years, we have less frequent small purchases. That has led to a challenge in meeting the 30 transactions required for the bonus. I guess I should have long been buying my bananas separately.

My wife’s statement was set to cut on December 26th. On the evening of December 25th, we realized that we had only completed 26 transactions. That put us 4 transactions short of the 30 required for the bonus. That would make a difference of thousands of points based on our purchases.

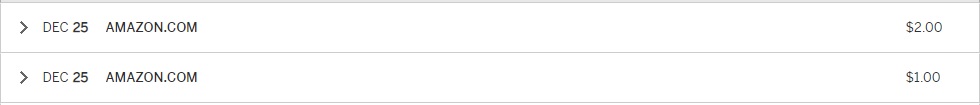

We scrambled to place some Amazon orders. There had already been a couple of gift cards sprinkled in during the billing cycle, so I was hesitant to place four orders for $1 Amazon gift cards. In hindsight, that was stupid — I doubt a few Amazon gift card orders would have raised any red flags (I imagine it might if you buy a dozen of them at the end of every billing cycle, but that wasn’t the case for my wife). My wife did order two small gift cards (for $1-$2) and two small merchandise orders (household stuff we needed that was prime-eligible and less than $10).

Ordering merchandise near the end of a billing cycle can be risky as it is hard to know when the charges will post. Some merchants charge you immediately, others charge when the merchandise ships. In the case of Amazon, I think the practice has long been that items sold directly by Amazon charge when the order ships (which might not be for a day or two depending on the situation), but third party purchases are charged right away. As these were prime-fulfilled 3rd party purchases (i.e. items sold by someone other than Amazon but shipped from Amazon’s warehouse and therefore eligible for Prime 2-day shipping), I expected that they would likely charge on the 25th and (hopefully) post with the statement on the 26th. I figured that either all four purchases would post in time or none of them would.

As it turns out, I was wrong. Those gift card purchases did in fact post with her Dec 2018 statement and count towards her required purchases.

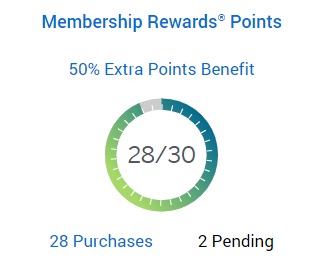

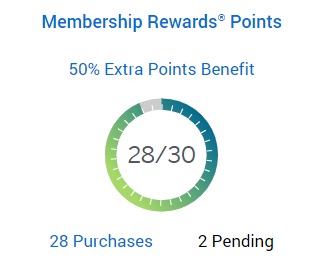

However, when her statement cut, the two Amazon merchandise purchases were still pending. The meter that shows the number of purchases completed during the billing cycle was still showing 28 completed and 2 pending on the morning of December 27th before her statement generated.

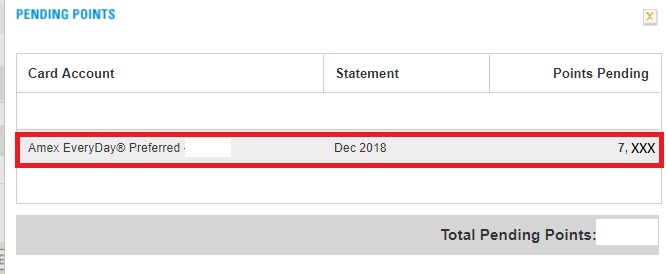

The statement cut that afternoon and of course it only included 28 transactions. Her pending points for the month do not include the 50% bonus.

That’s only mildly surprising. I should have known better than to have ordered merchandise so close to the statement cut date. I immediately kicked myself over such a silly mistake that cost us thousands of easy points.

The simple and important takeaway here: Amazon email-delivery gift card purchases are likely to post faster than merchandise purchases. YMMV, of course, but I’d recommend the gift card route over merchandise if you wait until the very last minute. Keep in mind that Amex has ratcheted up the war on what it considers “gaming”, so it is possible that they will decide not to count such purchases towards your rewards, but that has not happened as of yet.

Transactions now in limbo

Oddly, this snafu led to a weird situation regarding the two merchandise transactions that did not post with my wife’s statement. As noted above, her statement closed with 28 completed transactions and 2 still “pending” (the Amazon merchandise orders). Those charges were still pending after the items were delivered on December 27th. However, they eventually posted and now show up in “Recent Activity”. I expected that since they didn’t count towards the 30 required transactions for the December 26th statement, they would count towards the 30 transactions required for the next billing period. However, it appears they aren’t counting toward the required purchases for either month. See the screen shot here taken recently showing her activity / 50% bonus eligibility for the current billing statement. It shows 1 purchase counting towards the 30 required despite 3 transactions under her account activity.

![]()

Of course, on some level that makes sense. That recent activity says it is “Since Dec 27”. The two Amazon transactions were before Dec 27th, so it appears that they are not being counted towards the 30 transactions for the current billing cycle.

Since the transactions did not post before the statement period ended on December 26th, neither did they count towards the 30 transactions for the previous billing cycle.

So what happens to those two transactions? Are they permanently in limbo, not counting towards any month?

Calling customer service

My wife loves to collect credit card rewards. She hates to call customer service. However, there were enough points on the line here to warrant a phone call to find out what happens/happened to those 2 limbo transactions. I made some notes with talking points for her and sat in on the call.

My wife explained to the first rep that she had completed 30 purchases during her statement cycle on her Everyday Preferred card and thus should earn a 50% bonus, but that her statement is only showing 28 purchases and her pending points aren’t reflecting the bonus. The rep said he totally understood her frustration and would put her on hold for a moment while he researched it. When he came back, he asked where she saw this bonus offer for extra points with 30 transactions — was that somewhere in her online account or an email or something? I immediately motioned for her to wrap up the call so she could hang up and call again. If this rep wasn’t immediately familiar with the standard benefits on the Everyday Preferred card, we probably weren’t getting anywhere with him. Still, she pressed on for a few minutes until it was clear that he was confused and I looked like a crazed basketball ref calling a travel with fervent enthusiasm in my attempt to get her to wrap it up.

She politely ended the call and immediately called back. This time, the rep who took her call understood the issue right away, at least in terms of the purchases not counting towards the previous billing cycle’s 30 purchases. I’m not totally convinced he got the fact that they aren’t counting towards the new billing cycle’s transactions either, but that is secondary if there is a way to get them credited for last month.

I’ll note that we came in here with low expectations: I fully expect that Amex will say that they can’t control when a merchant posts a transaction and that delays in posting are out of their control. Of course we’re going to ask for Amex to count the charges with the December statement and award the 50% bonus points, but I expected they would likely say that isn’t possible and they would instead count towards the next billing cycle. Since I often tell readers that you hit 0% of the balls at which you do not swing, I figured we should take a swing at getting the points (and hopefully at least wind up with clarity about what happens to the excess transactions that post after your statement with a transaction date before the statement ended).

That second rep couldn’t explain why the transactions weren’t counting and he submitted a ticket with a back-end rewards team. He told us that we would hear back from that team with a resolution by yesterday at the latest. Alas, yesterday came and went with no call and no change to her account activity / pending points. I expect this will take at least another phone call or two to resolve. Again, I expect we’ll be told that the transactions posted after the statement ended (despite the date showing December 25th) and that they will count towards the next billing cycle’s 30 purchases. However, since the purchase tracker is not recognizing those purchases toward the 30 required, I would be willing to bet that the computer system will not automatically award the 50% bonus this month if we only make 30 purchases inclusive of those two. In that case, I expect it will take another phone call to Amex to get the points. I probably wouldn’t bother with completing 30 transactions this month, but for the sake of science I’ll try to complete the challenge and see what happens.

Bottom line

First, don’t cut it so close on completing 30 transactions on the Everyday Preferred; make sure you’ve completed your 30 a few days before your billing cycle ends. Second, if you fail to heed that advice, keep in mind that Amazon eGift cards will likely post faster than merchandise purchases. Third, watch out for phantom transactions that dip into a black hole at the end of a statement cycle. Those transactions certainly should count toward one month or the other, but you might have to monitor and/or call to be sure they do. Perhaps they will automatically count towards the next billing cycle, but if they do not that would make this card a further headache for me and put it on the chopping block.

[…] understand the struggle that Nick from Frequent Miler is going through since I also missed out on getting out 50% bonus miles on the AMEX Everyday Preferred by two […]

Not for this specific card, but same principle – at the START of the month I simply schedule 30 appx $1 transactions towards my Comcast/Xfinity cable bill. Takes all of 5 minutes to do and then I can forget about it until the next cycle. I increment them as 1.01, 1.02, … through 1.30 so I can track that I have made all of the required transactions.

Smart way to track it!

I wouldn’t have called. If you are making $1 or $2 purchases of amazon gift cards at the end of the billing cycle then you are obviously gaming. Calling just puts eyes on your accounts, which is not a good thing for gamers like us.

That thought did cross my mind for more than one reason. We’ll see.

Your post is exactly why I’ve avoided this card. I have better things to do with my time than bother checking every month that I’m making 30 transactions. And now with Amex Gold having a close 4x on groceries, I won’t be missing much.

I have also messed up a few times. It isn’t worth the effort for an extra .5x in groceries with the EDP. Amex Gold gets 4x in gas vs 3x EDP because you can buy gas gift cards at the grocery store.

I complete 30 transactions every billing cycle. When the end of cycle comes near I have found in those last couple of days that Amazon $1+ purchases actually post much slower than normal purchases at a gas station, fastt food, etc. The Amazon purchase can take 2-4 days to post. I’ve always figured this was an Amazon processing issue.

Huh – so it might not be so consistent. Interesting.

I will say, this has happened to me with the EDP before as well. I also cut it very close to the deadline, and saw the transactions that I did the day before and the day of the cutoff disappear in both the app and online. I called and talked to Amex about it, they also opened a ticket, and I never saw them post towards the second month’s transactions.

Amex ended up finally contacting me something like three weeks later to tell me that they had resolved the problem (gee, thanks), though I had seen it fixed in my app within maybe a week. I ended up getting awarded the points based on reaching 30 transactions. I don’t know if this was because I had an open ticket for them to specifically look into it, or if they would have figured it out on their own without me calling in. But it’s something that really frustrates me with Amex. I feel like I have to go 12 rounds with them to get the points that I deserve, and I hate having to track things so far after the fact, when I can see immediately with Chase how many points I am earning on any given transaction.

Good to know! I’ll be interested to see how our experience matches up against yours.

This tip was posted a while back. I set up a daily “auto-reload” on Amazon where it charges my AMEX everyday preferred card $5. That goes into my Amazon gift card balance. I spend way north of $150 (30 x $5) monthly, so it’s easy to get my 30 transactions completed this way and I’m not needlessly buying things on Amazon. This ensures that all of my AMEX ED preferred purchases get created with the point bonus.

That’s a good idea on the one hand. On the other hand, at $150/mo in Amazon GCs, you’re sacrificing the chance to earn 5x on an Ink Plus by purchasing them at an office supply store. That’s 9,000 points per year minus the 2,700 you’re earning on your EDP. That’s a sacrifice if 6,300 points per year to do it that way. Don’t get me wrong – the upside is that you’re earning a 50% bonus on everything else — but I wouldn’t want to automate 30 Amazon transactions if I’m naturally doing 15 or 20 as the sacrifice there isn’t small.

That said, other auto-reload stuff might make more sense. Good thought overall!

I have some consistent large purchases that I put on my AMEX (new home, business items, etc), so ensuring I get 1.5 points/$ is just easier when I know for sure I’ll hit my 30 $5 transactions within Amazon. But yes, I always try to leverage my credit cards when buying gift cards at Staples (Office Depot won’t allow me to buy GCs with a CC).

Making multiple Amazon GC reloads works out well when you’re stacking with an Amex offer for Amazon spending.