NOTICE: This post references card features that have changed, expired, or are not currently available

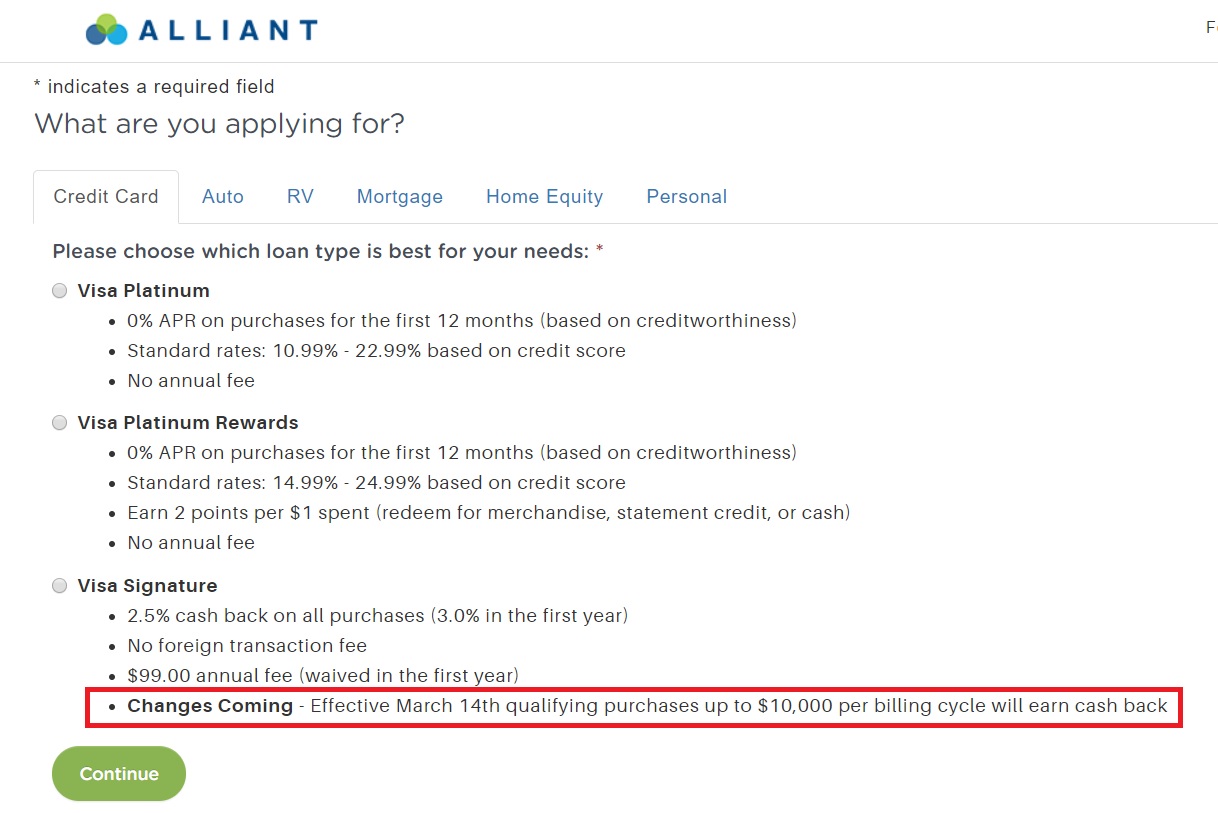

Alliant now indicates on its website that beginning on March 14, you will only earn cash back on up to $10,000 in purchases per billing cycle on the Alliant Cashback Visa Signature card.

Cash back on the Alliant Cashback Visa Signature card is currently uncapped. At 3% back for the first year and 2.5% back in subsequent years, it has been one of the highest-earning cards on the market in terms of uncapped rewards on non-bonused spend.

Note that this coming change is reflected on the application page as shown above but is not noted anywhere that I can see for existing users, including on our most recent statement (which cut within the past week).

The first year on this card is still a win for those looking for a great “everywhere else” card. In subsequent years, when you’re charged the $99 annual fee and only earn 2.5% cash back, the value proposition can be more questionable.

While 2.5% back can still come out ahead of traditional 2% back cards, this cap is definitely a blow to the card for a number of reasons. When Alliant increased the annual fee from $59 to $99 last year, I asked whether the Alliant Casback card was still worth it and came to the conclusion that it is only worthwhile for big spenders after the first year (3% back the first year with the annual fee waived is still a solid offer). In fact, in that post, I noted that in order to actually earn a true 2.45% cash back after considering the fee, one would need to spend $198,000 over the course of a year on the card (see that post for the math). With this new cap, earning that much won’t be possible.

In fact, with the new cap, it will only be possible to earn 2.4175% cash back at best after the first year:

- $10K / month x 12 months = $120,000 spent

- 2.5% back on $120K spend = $3,000

- $3,000 – $99 annual fee (after year 1) = $2,901 net back

- $2,901 / $120K = 2.4175% back

That’s still an excellent return for anyone who can’t qualify for the Bank of America Premium Rewards with Platinum Honors (which is a better option for those can meet the requirements), but getting that rate is contingent on spreading out exactly $10K in purchases each month.

While I’m sure that most customers likely spend less than $10K per month on average, I’m also sure that there are times when some customers may encounter a large medical bill or tax bill. Only earning cash back on the first $10K is disappointing and further decreases the actual net cash back rate.

Doctor of Credit aptly points out that the cap means the maximum margin by which you’ll out-earn a 2% back card is $50 per month, though after accounting for the annual fee, it’s really a net win of $41.75 per month ($501 per year) — again, assuming you put exactly $10K per month on the card. Keep in mind that Alliant cards no longer earn cash back at Plastiq. I imagine it would be hard to hit the sweet spot on the dot with ordinary purchases.

Bottom line

I expect that many of those who hold this card will be mostly unaffected by this change since many customers will not have expenses above $10K per month. On the other hand, it kind of stinks for those who may use the card for large expenses or for all unbonused spend. It makes the card less of a win over a 2% cash back card and makes the Double Cash potentially even more appealing since that card earns a base line of an effective 2% back and the points can additionally be pooled with a Premier or Prestige card to transfer to airline partners. It’s further disappointing that this change has not been communicated to current cardholders (the wording certainly does sound like this change will apply to both new and current accounts, but there has been no notice as of yet). I had literally paid the annual fee yesterday afternoon before seeing this last night. While this card is still a good value for the first year, its long-term value is declining.

H/T: Doctor of Credit

[…] There goes another one: Alliant to cap cash back at $10K spend / month. […]

2.418% CB if you maximize it

2.335% if you spend $60K

2.005% if you spend $20K

That minor boost over a flat no AF 2% card isn’t really worth it and a double cash + premier duo even at just 1.25cpp is better at all levels:

$120K spend = 240K points -$95= at least 2.421% on travel

$60K spend = 120K points -$95= at least 2.342% on travel

$20K spend = 40K points -$95= at least 2.025% on travel

Not to mention the added value when a Rewards+ rebate is added in or when points are redeemed for miles.

Plus the added hassle of watching that you don’t go over 10K. This card now becomes a lame cash back card with an exorbitant annual fee.

Thanks for the update. Mindreader. I was just thinking of cancelling. Citi Double cash FTW until they cut that back

Rob’s prediction: The heavy hitters move to the Citi Double Cash which makes Citi torpedo the Double Cash.