I’ve just wrapped up about two weeks in Europe, with more than a week of that time spent shopping the Christmas Markets of Cologne, Germany, and Strasbourg, France. We wanted to buy everything we saw, and if you saw our luggage by the end of the trip, you might have thought we did.

My go-to credit card for most of our Christmas Markets purchases was the U.S. Bank Altitude Reserve. Most merchants accepted credit card payments (a handful in Cologne didn’t). Since the Altitude Reserve earns 3X on mobile wallet, like with Google Pay or Apple Pay, my wife and I were constantly taking our phones out of our pockets and tapping to pay. We earned 3X on most of our holiday shopping! I should note that I did run into some annoying declines without receiving any fraud alerts, especially toward the end of the trip (U.S. Bank can be super annoying for foreign purchases from time to time).

Sadly, the value proposition of the Altitude Reserve is about to change: Those points have long been redeemable via real-time mobile rewards to erase travel purchases at a value of 1.5c per point, but effective on Monday, 12/15, travel redemptions will only yield 1c per point. After that, there won’t be an advantage to redeeming for travel over redeeming for a deposit to an eligible U.S. Bank checking account (which also yields 1c per point). U.S. Bank also claimed that points will become transferable to partners, but we haven’t yet heard more about that.

I opted to continue using my Altitude Reserve card anyway, in the hopes that U.S. Bank does launch a transfer partner program that includes useful partners (and if they do, we will probably continue using it for regular mobile wallet purchases since we’ll still earn 3X on up to $5K per month). However, I could certainly see the argument for using your U.S. Bank points right now to get full 1.5c value (assuming that you are reading this prior to 12/15). Even if you don’t have near-term plans to travel, you can see our guide to what works to trigger real-time mobile rewards and probably find some ideas about how to redeem those points now for flexible future plans.

On the blog this week, we talk Edit Credits (and other year-end coupons), a debit card worth getting, whether the end is near for 1:1 transfers to travel programs, and more.

This week on the Frequent Miler blog…

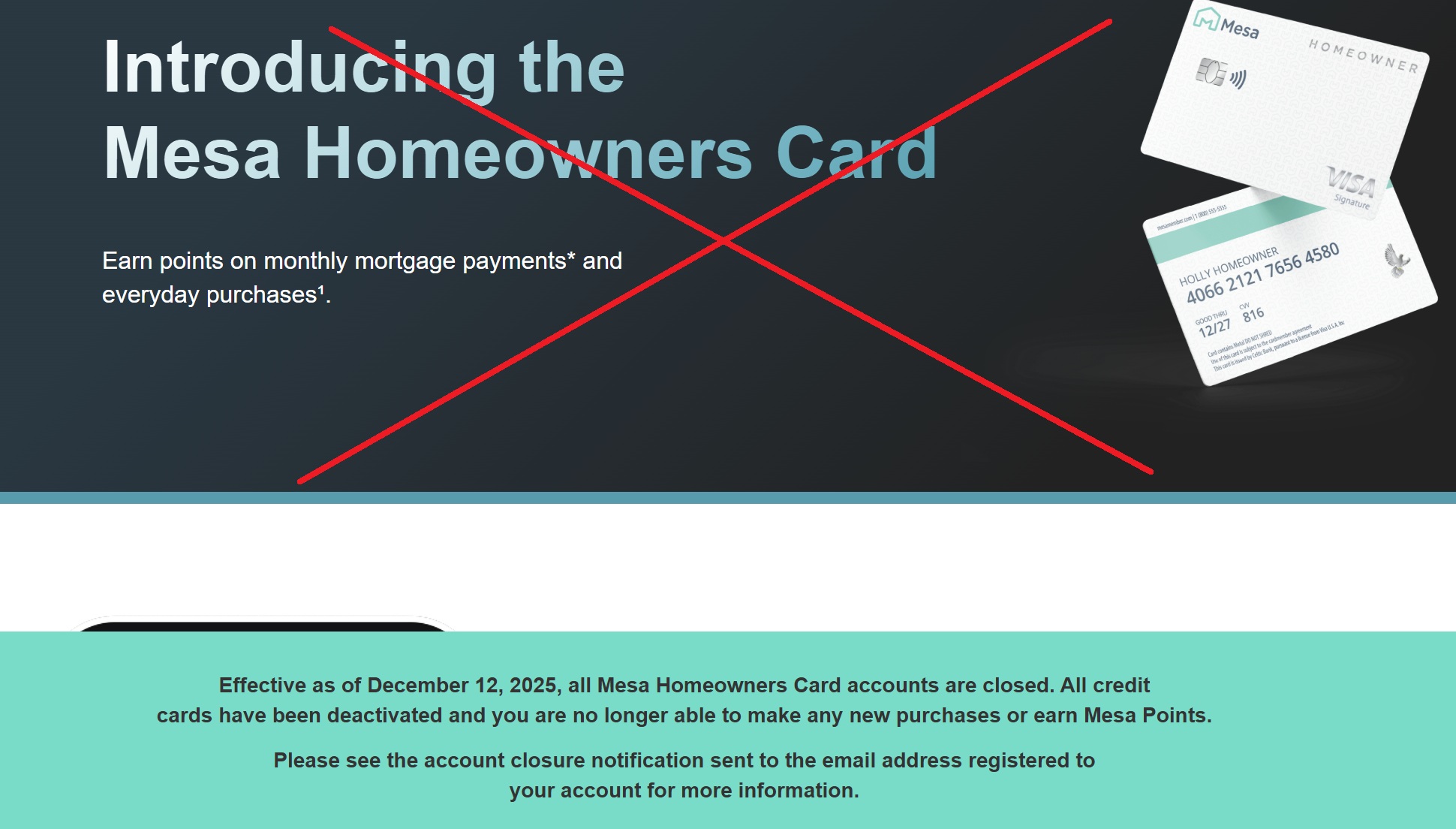

All Mesa Homeowners credit cards closed, effective immediately

In a late-breaking addition to this week in review, we reported late last night that Mesa Homeowners credit card holders received emails yesterday (12/12/25) indicating that their credit card accounts were closed, effective immediately, and card numbers were deactivated. Furthermore, though not addressed in the email, transfers to partners were mostly suspended (some readers in the comments note being able to transfer from older non-updated versions of the Mesa app), but at the time of writing the post, it was still possible to redeem points for custom statement credits at 0.6c per point (YMMV as to whether that is still available). This is an incredibly disappointing development as Mesa had only just launched a partnership with Omni Hotels very recently — there was no advance notice nor indication that Mesa would be closing up shop. And to be clear, we still don’t know for sure that Mesa is done, only that cards were closed — but the lack of further detail would certainly suggest that the end is not just near but here for Mesa. Making matters worse, many readers were still working on the spending requirement for the intro bonus offered a couple of months ago (and/or had recently received it and not yet redeemed points). If this is indeed the end for Mesa, they will have handled that wind-down exceptionally poorly.

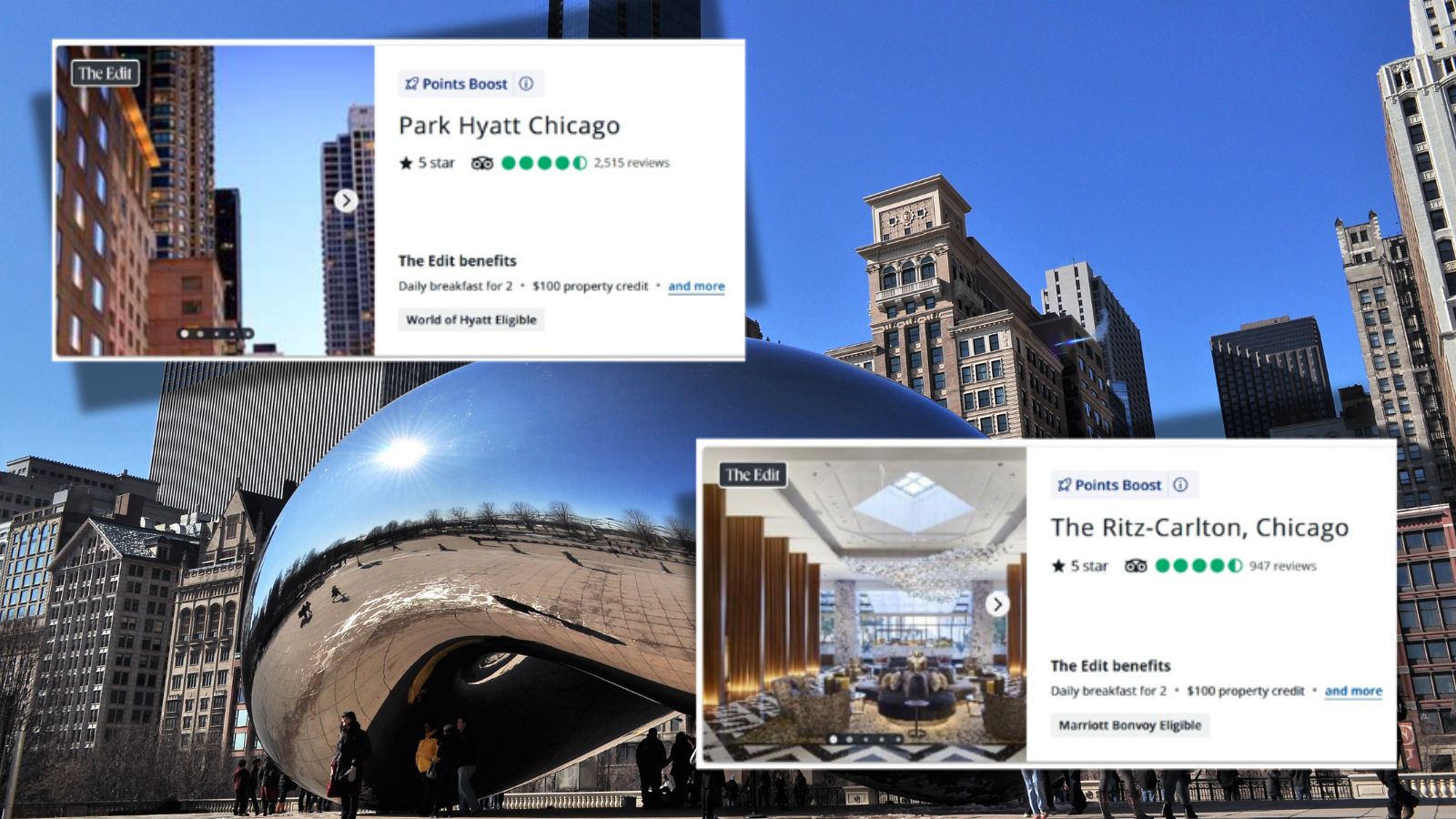

Rethinking The Edit by Chase Travel℠

On this weekend’s podcast, Greg and I discuss our end-of-year checklists, including how we are using or planning to use various credit card coupon credits. Chase’s The Edit Credit is one that has certainly frustrated me. In this post, Greg tries to make the argument that we should change the way we think about it. and that rather than think about it as $250, we should be thinking of it as a small discount of 6,250 points per night on a two-night edit booking, and as such we shouldn’t feel so much pressure to use it since it is a relatively minor coupon to let go if you don’t find a use. The problem I have with that way of thinking about it is that a lot of the value of the Sapphire Reserve rests on your ability to use this credit, so I want to use it, I just can’t seem to find a situation where I both need a two-night stay and The Edit has properties at the price point that interests me. That’s a problem, because if i don’t use this benefit, I’m not going to feel like I got my money’s worth on renewing the card.

Our end-of-year miles & points check-lists | Ep336 | 12-12-25 | Podcast

On this week’s Frequent Miler on the Air, Greg and I discuss our progress and plans toward things like earning elite status, opening new credit cards, and making sure to use up calendar-year and quarterly credits. I’m mostly pretty happy with my plans, and now that I am finally under 5/24 for a brief moment, I am looking forward to picking up a couple of cards I’ve been eyeing for a long time — though an attempt at a triple dip will mean more coupons to clip and use before year’s end.

The Southwest Debit Card is actually interesting | Coffee Break Ep81 | 12-9-25 | Podcast

One of the new cards that I intend to open before year end is the Southwest Rapid Rewards debit card. Why the debit card? As you’ll hear us discuss on this week’s Coffee Break, the Southwest Debit card has a lot going for it. The card offers a boost of Companion Pass qualifying points that stacks with the credit card boost, and for those who could meet one of the spending bonus thresholds, it is possible to earn a decent return if you’re making a purchase that requires a debit card. With tax season coming, I imagine that many readers might be able to hit one spending threshold or another.

SAS Business Class, A330 from Newark (EWR) to Copenhagen (CPH): Bottom line review

Ever since earning one million SAS miles last year from our Million Mile Madness challenge, I’ve been waiting on an opportunity to get across the pond on SAS. That opportunity finally came through a couple of weeks ago as SAS business class award space for my own party of 5 became available a few days prior to departure. The seat could use a mattress topper for sleeping, but service was very pleasant and the price was right. I’m sure we’ll fly SAS again.

Hyatt Regency Seragaki Island (Okinawa): Bottom Line Review

This Hyatt Regency in Okinawa caught my eye when planning for a trip to Japan a couple of years ago, but we couldn’t fit Okinawa into that specific trip. I was therefore highly interested in Tim’s take on it based on his stay several months ago. After reading the review, I’d certainly be happy to spend a few days here if and when we ever plan that trip to Okinawa.

Transfer Bilt points to Shangri-La, Preferred Hotels, Marriott, & Wyndham with the right credit card

I’m including this quick post in week in review because it’s a cool trick to know even if not incredibly useful: If you have Bilt points and an Alaska Atmos Summit card, it is possible to transfer points from Bilt to Alaska 1:1 and then on to some hotel programs that don’t partner with Bilt. Again, it is unlikely that this will yield great value in most cases, but it’s great to know about this kind of thing for that rare instance where it comes in handy.

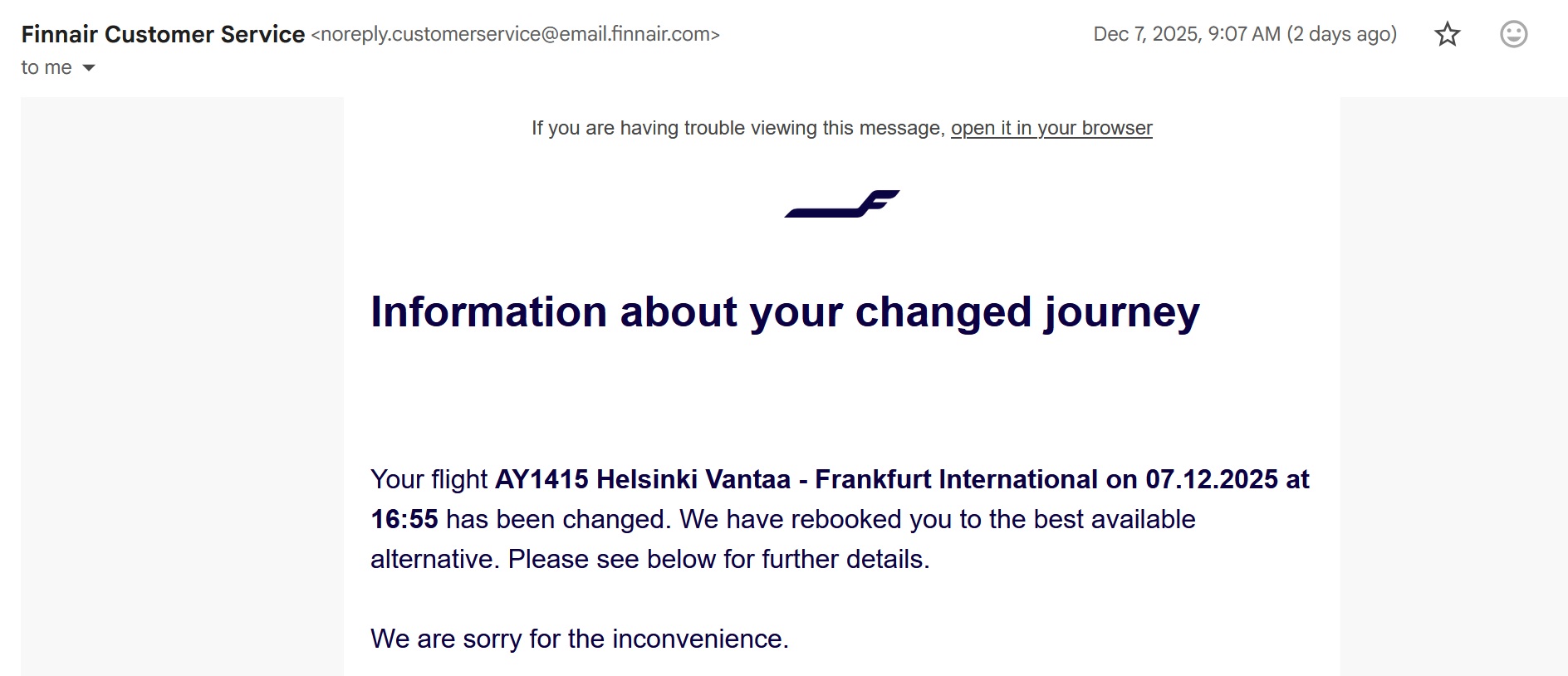

Stuck in HEL: Our experience with a Finnair flight disruption

Over the past decade+ that we’ve been using miles and points, my wife and I could count two previous times that we’ve missed a flight due to a disruption. Finnair added our third time last weekend, with a missed connection in Helsinki due to a delay on the first segment. That meant being stuck in Helsinki for the night and delayed getting to our destination by ~14 hours. The good news is that Finnair made it really simple to get the hotel and meals that they owed my family without charge thanks to EU261…..so long as you keep an eye on multiple means of communication for each passenger. While this is the type of info one hopes to never need, I thought that sharing the experience might help someone else get what they should (or at least know what they should be able to expect from another airline in a similar circumstance).

Is this the beginning of the end of 1 to 1 point transfers?

I fully share Greg’s fear over the end of 1:1 point transfers: multiple transfer ratios for different airline programs is confusing for users and it makes it hard to explain miles and points to a newcomer. I definitely don’t want to see a future where Amex starts tinkering with all of their transfer ratios. I do wonder what is motivating this change. Greg speculates in this post that maybe airlines like Emirates and Cathay Pacific want to charge more for their miles. On the podcast, I wondered whether this might have more to do with efforts at thawrting mileage brokers by taking away some value on transfers. Or maybe they want those earning miles by flying their airlines to maintain access to awards at the current price level, but they feel like those of us transferring should pay a premium? I don’t know exactly what’s behind it, but I would much rather see programs increase prices as need be than decrease transfer ratios.

Best credit card combinations for earning tons of transferable points

One of the most common questions that a miles and points blogger gets from non-miles-and-points people is, “What is the best credit card?” or “Which credit card should I get?”. The thing about this hobby is that, for most people, the answer isn’t which one, but rather which ones. This post lays out the best combination for each of the major transferable currencies. As I thought about this, I had a really hard time arguing for any one of these combinations, but I think the bottom line is that you want to focus on having at least one complete combination to get the most out of the hobby.

That’s it for this week at Frequent Miler. Keep an eye on this week’s last chance deals to be sure you get them before they’re gone.

![Leveraging flexibility, stacking Black Friday/Cyber Monday harder, re-considering the best hotel points and more [Week in Review] a stack of newspapers on a table](https://frequentmiler.com/wp-content/uploads/2021/07/Newspapers-218x150.jpg)

![Why a top travel card needs fixing, Bilt’s cunning Rakuten move, getting while giving and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/11/Book-travel-which-card-218x150.jpg)

Before coming to see what FM had to say this morning, I literally just finished buying a United flight in January with my Altitude Reserve, redeeming all but ~66 of my current balance (with a few more due to hit on the next statement), and then cancelling the flight for a refund to my credit card. I am not risking that the US Bank transfer partners are going to be enough better than the $0.015 I can get by using Real-Time Rewards. I expect to cancel the card before my next AF in Mar/Apr, but maybe by then I will know if the transfer partners are interesting enough to consider keeping it for the net AF with 3x mobile wallet earning.