| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

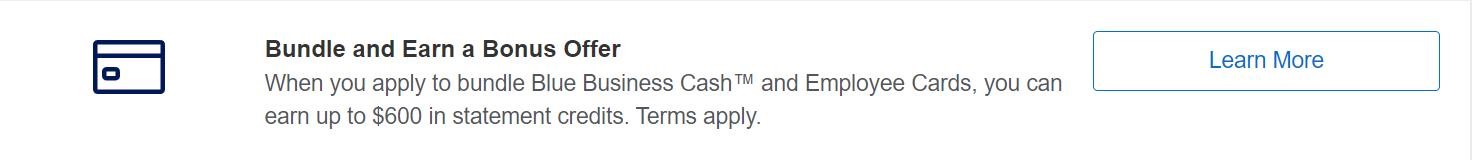

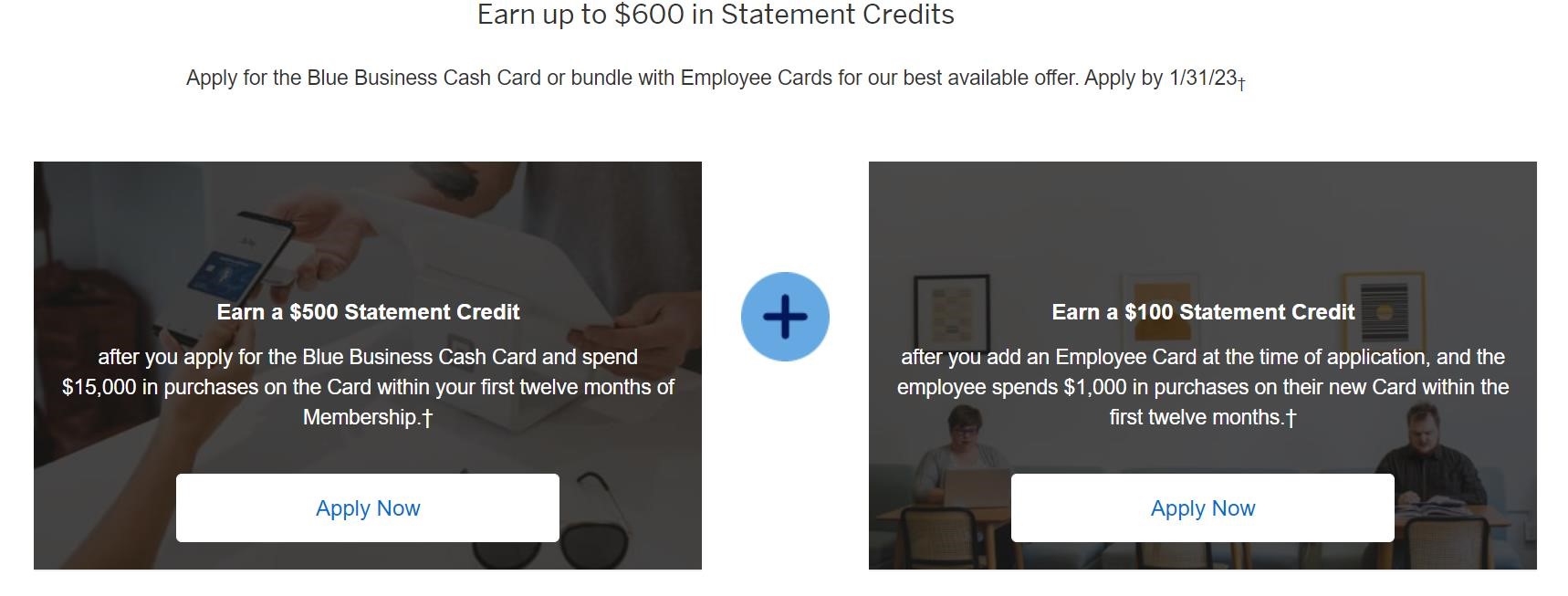

Similar to the Blue Business Plus offer we saw earlier this week, there is a targeted offer available for the Blue Business Cash card. Those folks that are targeted will earn $500 in statement credits after $15,000 in purchases in the first 12 months and an additional $100 in statement credits after adding an employee card and spending $1,000 on that card within the first 12 months. The $1,000 in spend on the employee card will count towards the $15,000 total spend.

My wife and I are both targeted in our accounts under “featured” offers:

While I prefer to prioritize all of the MR-earning offers that Amex is throwing out like candy, this is a good offer compared to what’s been available historically for this card. The application terms don’t include typical once-in-a-lifetime language, so even if you have had the card before, you should be eligible for the welcome bonus (if targeted).

The Deal

- Earn $500 in statement credits after $15,000 in purchases within the first 12 months after approval for a new Blue Business Cash card and an additional $100 in statement credits after adding an employee card and spending $1,000 within the first 12 months.

- Expires 1/31/23

You will need to log-in, then click the “apply” button to see if you’re targeted. If you don’t see the bonus on the landing page and/or get a message that says something along the lines of “Sorry, this offer is no longer available”, that means you’re not targeted.

Key Card Details

| Card Name w Details No Review (no offer) |

|---|

No Annual Fee Earning rate: 2% cash back on all eligible purchases on the first $50,000 of purchases each calendar year, 1% thereafter. Cash back earned is automatically credited to your statement. Terms apply. Base: 2% Card Info: Amex Credit Card issued by Amex. This card imposes foreign transaction fees. |

Quick Thoughts

This is one of the best offers that we’ve seen for for this card. The Blue Business Cash often doesn’t have a welcome bonus at all except when applying via a referral link, and then it’s typically only been $100-250 back after $5,000 in purchases in the first 3 months.

I personally prefer the the Blue Business Plus (BBP) in comparison to the Blue Business Cash as the BBP earns 2x Membership Rewards on all spend (up to $50K in purchases per calendar year) in comparison to the 2% cashback on the Blue Business Cash (and we value MR at much more than 1 cent per point).

That said, for those that prefer cashback, you would end up with a total of $900 in statement credits between the normal 2% on the first $15K in purchases and the $600 welcome bonus. That’s effectively 6% cashback on $15K spending anywhere over one year with no annual fee…which on its own is fairly appealing.

Hi Tim – I have a 30k MR referral offer on my Plat card that just posted.

Under “Refer a Friend” (in the app) it says “30,000

Membership Rewards® points for each eligible referral – up to 55,000 Membership Rewards® points per calendar year.” But the email I received today notifying me of the MR posting then says “CAP: 100,000 MEMBERSHIP REWARDS POINTS.”

Do you know if 55k or 100k is the max before I make any more referrals? Thank you

Once you get to the refer-a-friend page, cycle through your cards and it will show you the maximum on each card. It seems that not all cards are getting the 100K maximum. If it shows 100K on that card (that you made the referral FROM), the 30K should apply towards that.

So 55k is the referral bonus max on my Plat (in the Refer a Friend), but 100k is the MR TOTAL annual limit for ALL referrals on ALL MR cards? It’s confusing since I don’t have any other MR cards so not certain if the 55k or 100k caps apply. Thanks for your response

The referral max is per card, not per account, so you once you max out one card, you can move onto others. Amex will occasionally remove te capacity to refer from specific cards (I have a regular Platinum that I haven’t been able to use for referrals for two years for some reason).

The bummer is that it’s fairly difficult to find out which card you used for a referral retroactively, so if you’re referring from multiple cards throughout the year, it will behoove you to track them.

I just chatted with AMEX to get the right answer for my acct based on conflicting amounts. Here is the good news!

“Effective January 4, 2023, all eligible Card Members with Consumer and Small Business Card Products that participate in the Member Get Member (Refer a Friend) Referral Program will be eligible for an increase in their Referral Bonus Annua Limit (annual cap). The previous annual cap was $550 (or 55K MR

Points, etc.); the cap has increased to $1000 cash equivalent on the total referral bonus points, miles, or statement credits.”