When it rains, it pours.

After recent hits to manufactured spending due to both GiftCardMall and GiftCards.com reducing the amount of cashback that can be earned through shopping portals from $60,000 of spend per month to $2,000 and GiftCardMall reducing the maximum Visa gift card amount to $250, American Express has unsurprisingly decided to join the party by clawing back bonus points earned on grocery store spend from their recent card “enhancements”.

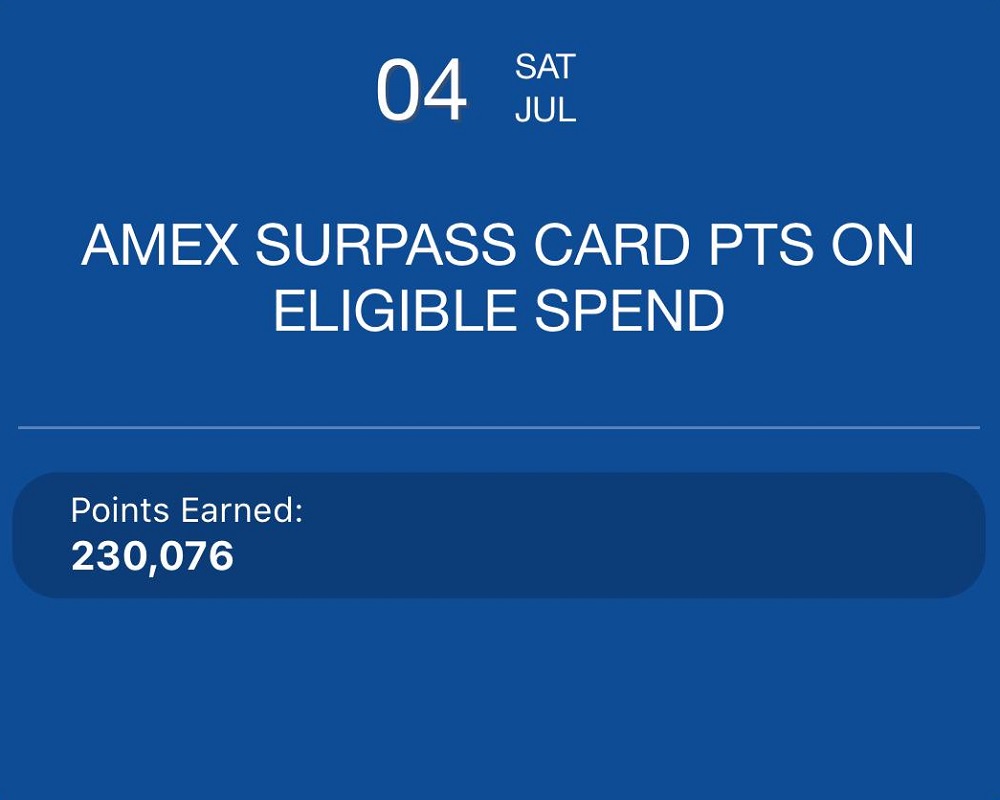

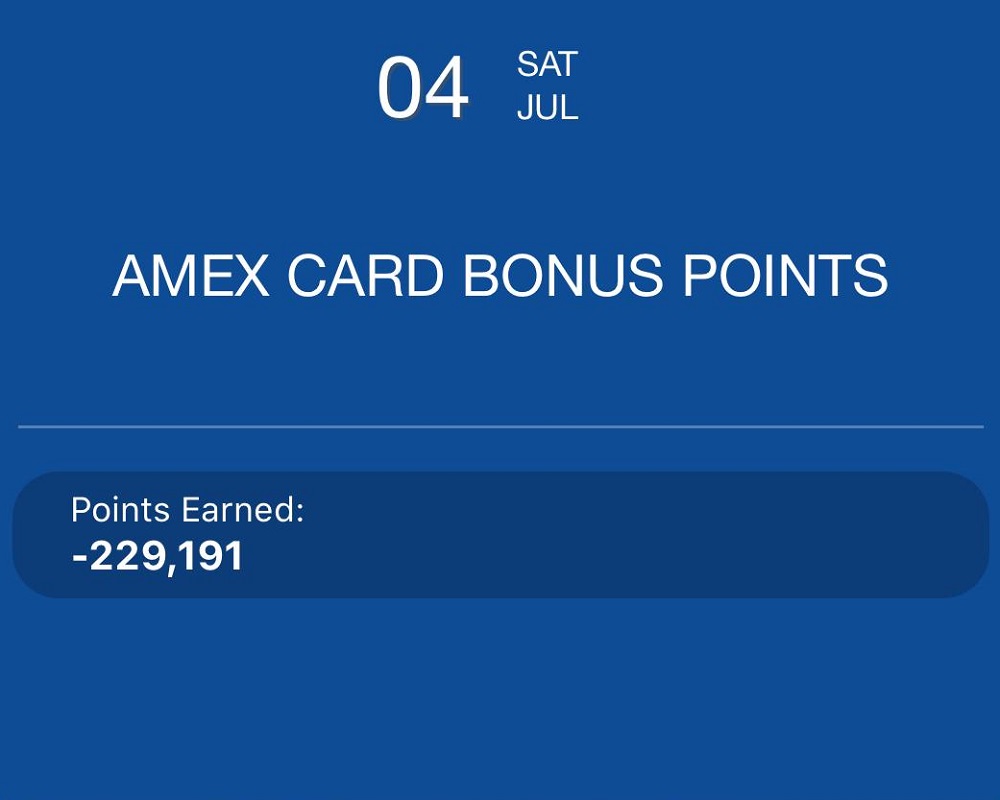

They’re performing not-so-subtle sleight of hand by initially awarding all the points you’d expect to see on your account.

Those points haven’t lasted long though because Amex has promptly clawed back the bulk of the points.

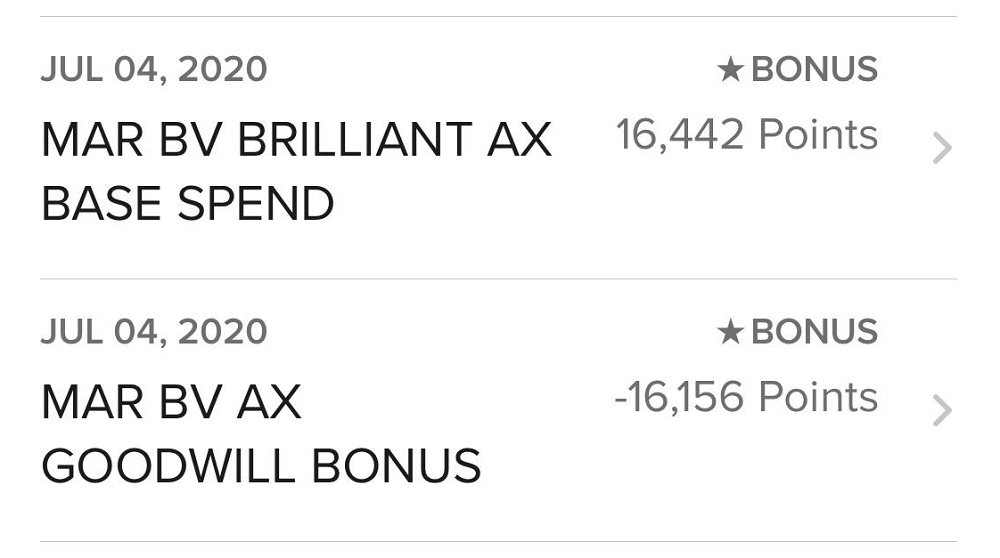

Some Delta cardholders have been experiencing the same issue, as have some Marriott cardholders. The clawbacks have been initiated by Amex and so it’s not like people are getting Bonvoyed in the traditional sense, but Marriott isn’t helping matters by referring to reversals of large numbers of points as a “goodwill bonus”.

There are four weeks left to take advantage of grocery store bonused spend on Amex cards, but these clawbacks certainly make their cards less appealing if you’ll be doing any kind of gift card buying activity.

Question

Have you had any points clawed back on any of your accounts? If so, was it for spend on Hilton, Marriott or Delta cards and what kind of sums have been clawed back?

Thanks to the person that allowed me to share the screenshots of their clawbacks for this post.

What goes around, comes around: “Federal Investigators Probing AmEx Card Sales Practices”

https://www.wsj.com/articles/federal-investigators-probing-amex-card-sales-practices-11610039815

[…] could be a good way to earn some bonus points before those offers finish. Although Amex has been clawing back some bonus points earned at grocery stores, that’s tended to be for people buying gift cards for large amounts […]

[…] at grocery stores on select Amex and Chase cards. While Amex has sucked the joy out of some of that due to clawbacks, they’re still decent offers for regular grocery […]

[…] It’d be worth avoiding paying with a Hilton card through the end of July though seeing as Amex has been clawing back points from some cardholders for purchases such as […]

[…] Pay with a credit card that earns more at grocery stores, but it might be worth steering clear of Amex cards right now due to recent clawbacks. […]

quit Amex when they went to one bonus per lifetime….greedy credit cards company making profits off of people who cant afford it. …and for the haters: hate the game not the player…and guess who made up the game and wrote the rules? Amex, Citi, Chase….which one do you work for?

I don’t hate them but there is an obvious incentive for them to nerf you for MS. I’m in this for the long haul, not to accrue points and then get shut down like those AA/Citibank players were.

this subject has been discussed for years, since the days of the mint. Someone mentioned the addage: Pigs get fat, hogs get slaughtered. Statistically the losses they sustain from MS are insignificant. The MS game is harder to play and they make so much more off of the people that pay interest that catagory and sign up bonuses are loss leaders It is bait that actually make the company way more than it cost them…..the people that treat MS like a part time job are not the norm….but billion dollar profits every quarter for Amex are…the reason they may be getting tighter is they made 76% less this quarter than they did last year.

I stayed home like a chicken, only bought a pack of cigarette in supermarket. I was tempted to go for the hilton lifetime diamond, oh well

Why do bloggers even push these AMEX cards? Shouldn’t they be doing their customers and readers a favor and ban AMEX adverts?

Money from signups. Pretty good obvious who is buttering bread. But i haven’t been seeing clawbacks and I am gunning for an AMEX Hilton bonus. But it’s normal grocery and restaurant spend not buying gift cards.

I had 14,155 post and they took 14,103 away. I’m just glad they didn’t touch the 38k points I received on the May Statement plus I received 45,000 on my Marriott card.

Those are some seriously low numbers for Amex to bother with. I normally spend around $2,500 a month at grocery stores including a few gift cards to pay my mortgage, so I’d be in a similar range if I was going with anything but my gold card.

That is a pretty darn low number. Not to worry you but one wonders if they are so anxious to stamp out MS at least at the COVID bonus level whether they go back and clawback already posted points. I put somewhat low odds on that but as I see lower and lower numbers reported for clawbacks on recent statements one wonders if they won’t revisit already posted statements with COVID bonuses.

What they did was give me 3x points on all of my grocery purchases and then they took them all away and just left me with 12 points from from a $4 purchase at a non bonus category store. The other 43,000 bonus grocery points never showed up.

One more interesting thing is although I didnt get the points, they didnt take the amount away from my free night benefit tracker.

MSing with Amex cards these days is a pretty bad idea. Stick with MSR, and Chase cards.

Wow. For those of you thinking this is so rotten and sinister, why are you even reading this blog? Or have a points card?

Because I know that if I don’t MS, AMEX will honor their side of the bargain, and my needs aren’t grandiose enough that I need to churn a six digit number of Hilton points in a month.

As of now no points from grocery spending on my Delta Reserve have been clawed back, but I only have done normal spending and haven’t purchased gift cards. Honestly this is why a lot of the analysis on how you could max out these categories was dubious – with Amex, you should only do organic spend

Same. I haven’t been buying thousands of dollars of gift cards on my brand new Hilton Aspire because I’m not an idiot. Pigs get fed, hogs get slaughtered.

LOL Dave “Bank Lies Matter”. Toppling the statue of Henry Wells

Negative goodwell. LOL

I wonder if they are looking at only “large” transactions. I would love to know.

I think we’d all love to know

Base on what doctor of credit is reporting. Anything above $100 is getting place on hold for further review

That’s crazy. I normally spend $250-$350 a week on our normal grocery purchases. $100 is absurdly low.

Absolutely, we spend right about the same, as long as your are not buying gift card you should be just fine.