NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

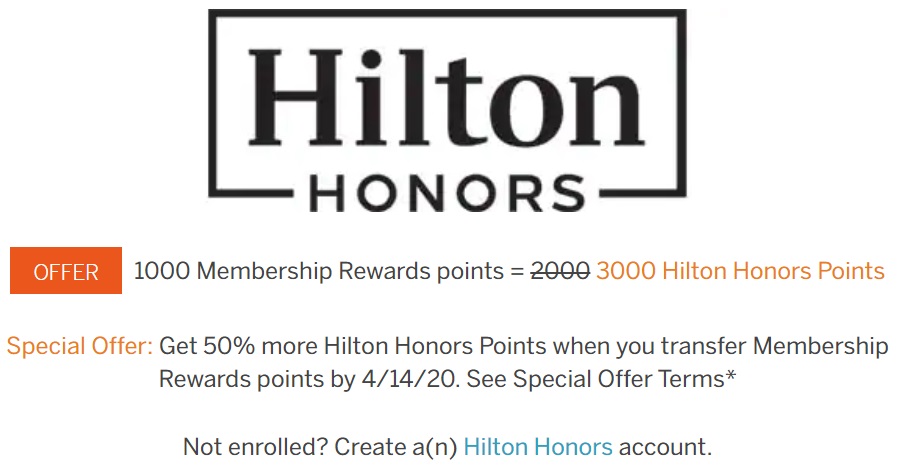

American Express launched a new transfer bonus a couple of days ago, offering a 50% bonus when transferring Membership Rewards to your Hilton Honors account. While it might make sense for some people to take advantage of this, for most it’s not a great use of Membership Rewards.

The Deal

- Receive a 50% bonus when transferring American Express Membership Rewards to your Hilton Honors account (1,000:3,000)

Key Terms

- Expires April 14, 2020.

Quick Thoughts

Membership Rewards usually transfer to Hilton Honors on a 1,000:2,000 basis, so with this 50% transfer bonus that becomes 1,000:3,000. That means, for example, an Amex Gold card effectively earns 12x Hilton Honors points on grocery store spend during this transfer bonus period – double the amount you’d earn by putting that spend on a Hilton Surpass card seeing as that earns 6x at grocery stores.

Having said that, I personally wouldn’t go that route seeing as your 4x earning potential is limited to $25,000 of spend per year at grocery stores on the Amex Gold card. You can also redeem Membership Rewards for much higher value with some airline transfer partners than you can get with Hilton.

While I’ve gotten 1.69cpp of value from Hilton Honors points in the past without even using the fifth night free benefit, you can often buy Hilton points for 0.5cpp. When looked at from that perspective, this transfer bonus is only worth 1.5cpp. That’s certainly not bad, but given how relatively easy it is to rack up (or buy) Hilton points normally, I’d much rather save my Membership Rewards for other redemptions.

Can you expand on this?

‘but given how relatively easy it is to rack up Hilton points normally’

There are a few ways:

1) Paid stays can earn you up to 54 points per dollar at times depending on what promotion they’re running and which Hilton Amex cards you have.

2) You can normally get 100-150k bonus points as welcome offers on each of the Hilton Amex cards.

3) Although welcome offers are limited to once per lifetime, Amex frequently offers upgrade offers from their no-fee card to the Surpass and/or Aspire, and from the Surpass to the Aspire, with no lifetime language. The number of bonus points you earn are usually the same as standard welcome offers, so ~150k. After a year, downgrade the card, then you’ll hopefully get an upgrade offer again.

4) The Hilton Surpass card earns 6x at grocery stores, so some people find it a good card to MS on. If you spent $15k at grocery stores in a year, you’d earn 90,000 points plus you’d earn a free weekend night certificate. There’s no limit on how many Hilton Honors points you can earn from grocery spend in this way, unlike the Amex Gold card which restricts you to $25k per year.

5) Amex sometimes sends emails offering 5,000 bonus points when adding an authorized user to a Hilton card and having them spend $250. Seeing as each Hilton card earns at least 3x per dollar, that’s 5,750 points per AU added.

To make a long story short, 1-5 doesn’t apply to me.

What I do know, is this:

1) I recently got the Hilton card for 100Kpts (as opposed to the 75K+$100). If I had taken the 75K and used the $100 to buy @ 0.005 = 20K, I would have ended up short with a total of 95K. This tells me that @ 0.005, it is expensive?

2) If I use a platinum with 60KMRs @ $550, I would get 180Kpts for a cost of 0.003 per point < 0.005? Not to account for the perks.

3) From what I have read, it doesn't seem like it is easy to get the 50% transfer for a ratio 1:3? On other occasions, there have been a range 10-50%.

4) Last year, without going into details, in one occasion, I got a 3+cpp.

On the other hand, the COVID-19 may open up incredible airline award availability and even more so if there is a stock market crash (long over due and getting long on the tooth).

1) The fair value for Hilton points is ~0.4cpp, so buying at 0.5cpp can be more expensive than the value you’d receive from the average redemption. I just gave that cost as an example in the post to note how “cheap” you can pick up points normally.

2) That’s certainly an option, but it doesn’t feel like an optimal way of earning Hilton points, especially seeing as the 60k bonus is lower than the welcome offer sometimes goes on the Platinum card (unless this was an upgrade offer).

3) During previous transfer bonuses you’re right that they’ve offered a range, or not offered a bonus at all. From what I can tell, this particular 50% transfer bonus is available to all cardholders.

4) Sweet! I’ve gotten that from IHG before but only about half that with Hilton.

2) From MS (I wouldn’t go this rout anymore), Mercedes-Benz (dead), NLL vanilla, Ameriprise (dead).

I’ve been concerned about buying gift cards with the Amex gold from grocery- I gather at moment you don’t believe that is a problem? No

Known Amex RAT problems there?

I appreciated your useful analysis.

I did transfer some Amex points to Hilton figuring that it’s roughly 12 points per dollar, at least considering the way I’ve collected them. I have so many airline miles and currently scheduling flexibility so they “should “ last me many many years. I have fewer hotel points and this hobby has spoiled me with getting accustomed to staying in some pretty nice hotels, such as Conrad Maldives and Conrad Tokyo. I think you’re absolutely right I could in theory get better value transferring to airlines.

I just got out of a ~4 month suspension and it is not fun at all. If you hold a large amount of MRs, I would not mess with the RAT at all (not worth it). The RAT has just as much interest in the travel comments community, jus as we do.

Also, the AA ‘carpet bomb’ of the ‘AA graAAvy’ sure sends a chilling message to this game, to say the least.

Of course, all of this is just my opinion.

Thanks, JB I think I’ll play it conservatively, just collect points with real spending.

There’s certainly no harm in playing it conservatively. Having said that, I think Amex clearly expects that there’ll be some kind of MSing going on with the Amex Gold card which is why they put in place a $25k limit for 4x earning at grocery stores, whereas they didn’t do that when it comes to 4x earning at restaurants.

I’m with you, Kate. I’m not MSing at grocery stores, have plenty of airline miles and Amex MRs.

I’ve been waiting for a Hilton transfer bonus and thought it might be the 20 – 30% of previous times. I was thrilled with 50% and transferred points right away. My husband and I have narrowed our hotel focus to Hilton & Hyatt. So, this is great in my book.

RE: MSing with Amex – my husband got an Amex Delta flyer in the mail yesterday. There was a long paragraph about being “engaged in abuse, misuse, or gaming in connection to the offer in any way….” Essentially Amex saying, “We’re serious. Organic spend. Period. Or, we’ll shut down all of your accounts.” I, for one, am going to believe them. I’ve been in this hobby for over 10 years and was frozen by Chase once. Not fun. Not going there again.