NOTICE: This post references card features that have changed, expired, or are not currently available

There are many reasons why you might be interested in increasing credit card spend, such as:

There are many reasons why you might be interested in increasing credit card spend, such as:

- Meet minimum spend requirements to secure big credit card signup bonuses.

- Earn credit card big spend bonuses.

- Earn credit card rewards, ideally when the cost of increasing credit card spend is less than the value of the rewards. See: Best rewards for everyday spend.

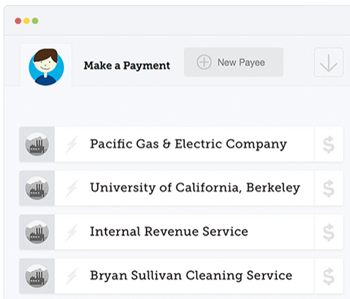

On the page, “How to increase credit card spend,” I list many options for manufacturing spend. Most are fairly complicated. One that stands out as easy, though, is Plastiq. If you have large expenses that can’t normally be paid via credit card, Plastiq offers a simple solution: Use their service to pay bills. In exchange for a fee (normally 2.5%), you can pay those bills with credit cards. Here are example uses:

- Car payments (monthly leases)

- Rent

- Mortgage

- Tuition

- Contractors

- Nannies, babysitters

- Landscapers

- Purchase car, boat

- Professional services: Law firms, Accounting firms, PR agencies, etc.

- (more examples can be found here)

Unlike a few similar services, Plastiq is not limited to payees in their database. If the payee (AKA biller) is not in the database, you can pay them through Plastiq by check or by bank transfer (ACH). In fact, as a test, I recently succeeded in paying a landscaper through Plastiq. I gave him the choice of receiving the money by check or direct deposit to his bank account. He chose the latter and he gave me his account number and routing number so that I could pay him. I initiated payment on a Saturday evening and the money appeared in his account the following Friday morning (or possibly sometime on Thursday).

For detailed information about Plastiq, please see: The Complete guide to Plastiq credit card payments. The guide includes complete information about types of bills that can (and cannot) be paid through Plastiq, reasons businesses may be interested in Plastiq, gift card usage with Plastiq, and more.

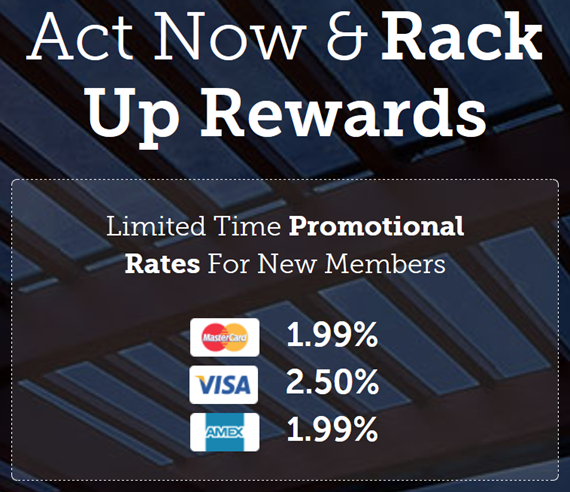

Promotional Rates

As announced via Quick Deals, Plastiq is currently offering reduced rates for bills paid by MasterCard or American Express credit cards. To get this rate, you must sign up for Plastiq using my link or a similar link from another publisher (Disclosure: I will receive a $5 referral fee for each person who signs up with my promo link).

Please refer to this Quick Deals post for full information about the promotional rate, including how to lock in those rates long-term:

Pay mortgage, rent, and more by credit card. Plastiq offers 1.99% Amex and MasterCard promo rate

When it makes sense to use Plastiq

Even when cash flow isn’t a motivator, there are times when it can make sense to pay Plastiq’s fees in order to earn credit card rewards:

- Use Plastiq only for bills that cannot already be paid by credit card. Many billers accept credit cards and usually do not charge a fee for accepting them. In those cases, I’d argue that it’s almost always better to pay those billers directly by credit card rather than going through a service like Plastiq. Note: one exception is when the biller does not accept a certain type of payment, such as American Express.

- Use Plastiq when credit card rewards outweigh fees. Unfortunately, there are very few cards that earn significantly more than 1.99% for non-bonus spend (see: Best rewards for everyday spend). That said, there are times when a card’s earnings are better than usual. For example, Shawn at Miles to Memories recently reported getting a retention offer for his wife’s Citi ThankYou Preferred MasterCard. For the next 6 months, the card will earn an extra 2 points per dollar for all spend. This means that Shawn’s wife would earn 3 points per dollar paying bills with Plastiq. With a 1.99% fee, that’s like buying ThankYou points for .66 cents each. And, considering that ThankYou points are worth between 1.33 and 1.6 cents per point for flights when you have a Citi Prestige card (which Shawn does have), that’s a great deal!

- Use Plastiq with gift cards bought at a discount (or with cash back). It is often possible to get up to 2.25% cash back when buying Amex gift cards. Similarly, Visa and MasterCard gift cards are often available at discount from certain stores (such as with this recent deal).

- Use Plastiq to meet large spend requirements for new credit card signup bonuses – if you can’t meet that spend in ways that incur no fees. It may also make sense just for peace of mind of knowing that you can meet those spend requirements quickly, despite the fees.

- Use Plastiq to help meet spend thresholds in order to secure big spend bonuses. Make sure that the benefits outweigh the fees.

Caution!

A number of readers have complained to me about their experiences with Plastiq. A common issue is that payments take longer than expected. Some readers reportedly have had to pay late fees as a result. My impression is that Plastiq is a young company that has been overwhelmed by demand since I and a few other bloggers started writing about them. I believe that they are working towards rectifying issues, but that is little consolation for those who experience these issues.

If you plan to try out Plastiq, I highly recommend sending in payments far in advance of their due date until you get a better idea of how long those payments take to process by Plastiq and by the payee.

Related posts and resources

- More about the Plastiq promo: Pay mortgage, rent, and more by credit card. Plastiq offers 1.99% Amex and MasterCard promo rate.

- More about Plastiq: The Complete guide to Plastiq credit card payments.

- Alternatives to Plastiq for increasing credit card spend: How to increase credit card spend.

- More about whether it makes sense to pay fees when manufacturing spend: Options for paying to manufacture spend. Are they worth it?

- Some ideas about what can be accomplished when increased credit card spend becomes easy:

I agree — even in 2017, Plastiq is still super slow in processing its payments. It should be noted that they send their “checks” from a payment processor in Florida (despite their corporate headquarters being in SF, California), so their 5-7 promise is a bit optimistic when there is inclement weather.

Very unreliable. Caused my payment to be late and I was charged fees by both plastic and $50 late payment by my complex! Payment was received days after the 5-7 day promise.

Now they have a new referral program. Referree gets 200 fee-free dollars after making a $20 payment, and referrer gets 400. Here’s my link. I’d appreciate it.

https://try.plastiq.com/391256

Use the posted link, and then leave yours for the next person.

https://try.plastiq.com/401060

Please use mine next https://try.plastiq.com/398964

Thanks!

I made some payments via Plastiq and it is taking more than a month. Their service is deplorable. Anyone know any other alternative to Plastiq?

How do you set up ACH payment if you have to manually add a payee? Couldn’t find that option anywhere.

Unfortunately, since I wrote this post, Plastiq has taken away the option of paying by ACH unless the biller is in their database (and very few are)

I recently tried Plastiq to pay my power bill on 9/28 to see if I can get double points on my Barclay Rewards. Today it finally showed up complete on my transactions. I did get double points. Under the category when you pick what it is, I picked Utility. I hope this helps.

That’s great. I’d be interested to hear what happens when you pay something that is not really a utility. does it still get coded as a Utility by the credit card when paying through Plastiq?

Here in Dallas, Texas, all my utilities + cable & cell phone accept credit cards. I make big prepayments to meet minimum spending for sign up bonuses and get it back from no monthly payments for some months. A no cost manufactured spending. Also, insurances.

I signed up for Plastiq during their recent 0% fee promo for utility payments. I set up 12 recurring monthly payments, entered my credit card info, confirmed the 0% promo fee and waited for first payment to occur. But things did not occur as expected.

The situation with my utility payments is that the amount varies each month depending on how much water or electricity I use. For electricity, I could pay $250 in the summer but only $70 in the winter, but Plastiq requires you to setup recurring payments that cannot be changed to qualify for the 0% fee promo. If you change the recurring amount for this promo after you set it up, the 0% fee promo no longer qualifies and you would get charged up to 3%.

So, Plastiq only worked for this promo if you had static (non changing) utility payments every month.

In addition, Plastiq messed up on my first payment saying “our processor encountered issues that caused one or more of your payment to fail.” That’s a vague way of saying that we are not going to make the payment for you, because I could not find any payment history on my Plastiq account. Luckily I discovered this prior to my utility payments due date because I scheduled the Plastiq payment to occur 7 days prior to due date.

I promptly cancelled my Plastiq account and have no intentions of using this unreliable service again.

[…] Link to article on Paying Bills with Plastiq (Frequent Miler) […]

Honestly, with as piss poor as my experience has been (12 business days-still waiting for ACH payments to show up!), they’re toast in my opinion. If they can’t fix their problems soon, all of their venture capital will go toward fighting off the class-action lawyers.

FM, I’ve been a long time supporter and always follow your links for my AORs. I’m so disappointed by this recommendation. Plastiq has been a nightmare. The payments are late, their CSRs are clueless (They “escalate” promising a phone call response in 24 hours but it never comes.) I was excited about this opportunity and jumped on it immediately because you backed it but now I’m in trouble with my mortgage and car payments and have late fees for utilities. Either they are completely incompetent or have crashed under the weight of new customers. Either way, you need to distance yourself from this as it has blemished my experience with you.

I’m sorry to hear about that! I’ve heard similar complaints from maybe 5 or 6 people, but my own experience has been fine. Clearly I should continue to provide cautions about what can go wrong (as I’ve done in a couple of newer posts about Plastiq). And, I’ll edit some of the older posts with cautions as well.

.

The interesting question, to me, is whether I should really distance myself from opportunities based on reader experiences? When I first started writing about double dip opportunities at Sears, I heard a number of horror stories from readers about Sears’ terrible service and I even published a reader’s story. Since then, though, Sears has continued to be a great option for earning points & miles for many people. Same story with TopCashBack. Many people told me that they would never use TCB again after initial poor experiences. Years later, many of the same people have been happily earning 2.25% cash back from Amex gift cards via TCB (until the recent change in terms).

i signed up with ur link but i get 2.5%!

For Amex or MasterCard? If so, please email support@plastiq.com. You definitely should get the 1.99% rate!

Any feedback from the chase Ink charge you ran back on the 5th?

No go. 1X only

I signed up for Plastiq a month ago. I’ve never used it. Can I still get the promo offer? How do I ensure that I get the 1.99% offer? Thanks! I really want to give this a try…

Yes, you can get the promo rate, but you have to sign up with a different email address. If you use gmail you can simply add a period to your email address. For example, instead of JeffIsCool@gmail.com, you can put in Jeff.IsCool@gmail.com and it will look like a new email address even though all email will go to the same place.

My experience has not been a good one, payments taking forever to get there that made me nervous. I mean what happens if you send a payment and then these guys fold? You can kiss your money goodbye.

How long after mortgage payment is submitted is my credit card actually charged? I want to meet minimum spend within the next 4-6 days.

In my experience it is charged right away