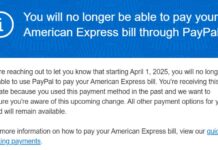

NOTICE: This post references card features that have changed, expired, or are not currently available

Is the PayPal debit card worth a look?

PayPal confusingly offers three different physical cards:

The PayPal Debit card

This is just like any standard debit card that comes with a bank checking or savings account. When you spend money with this card, money is withdrawn directly from your PayPal balance. The PayPal Debit card is free.

The PayPal Prepaid card

PayPal also has a prepaid card which differs from a regular debit card primarily in how you load money to it. Rather than pulling directly from your PayPal balance, you must load money to this card. The card comes with a convenient $4.95 monthly fee.

The PayPal payment card

PayPal offers the ability to use PayPal to pay in specific stores. These stores have special PayPal keypads for making your payments, so you don’t need a physical card. If you really want a physical card, though, PayPal will send one. Why would you want a physical PayPal card? I have no idea. You can read about an experiment I did with this card / payment approach in the post “Pursuing the Other Vanilla Reload card.”

An eye on the PayPal Debit card

OK, so you see above that there are several types of PayPal cards. The one I’m looking at here is the standard debit card. Not the prepaid card.

A marketing bullet for this card caught my eye:

- Earn 1% cash back whenever you sign for a purchase1

That’s not very interesting in itself because when you sign for purchases that means that you are applying a credit card transaction not a debit transaction, and we know that many credit cards offer better than 1% return. What is interesting is the footnote:

- 1 Requires enrollment in the PayPal Preferred Rewards Program.

Actually, I lied. That’s not interesting. What’s really interesting are the details in the PayPal Debit Card Cardholder Agreement (bolding is mine):

Eligibility. To be eligible for the cash back program:

- You must have a PayPal Premier or PayPal Business Account.

- Your Business Debit Card purchase must be an online or signature-based purchase that does not require a PIN (personal identification number). Some merchant locations offer you the option of choosing “Credit” or “ATM/Debit” when making a payment. To qualify for cash back, you must choose the “Credit” option.

There appears to be a bit of a loophole here. According to the above text, online transactions that do not require a PIN should get 1% cash back. So, what about online debit transactions… Would those qualify? For example, I know from experience that you can pay taxes online for a lower fee with a debit card than with a credit card, and they do not require a PIN for these transactions. Hmmmm….

Taxes

The service Pay1040.com will let you pay your federal taxes online with a debit card for only $2.99 per transaction. With a $300 payment, that comes to a fee of only 1%. With larger payments, the fee is much smaller as a percent of total. Theoretically, PayPal ought to pay 1% back if you pay with the PayPal debit card since these online services do not require a PIN. Unfortunately, the PayPal card has a $1000 per day limit for “purchases”. So, it looks like $1000 is the biggest transaction you could make. And, most tax payment services limit you to two transactions per tax period. If this trick works, you could make a profit of $7 per transaction and you could scale up a little bit by making quarterly estimated payments and even by using multiple tax payment services. Still, that seems like a lot of trouble for little gain, so I haven’t yet tried this. If anyone does try it, please let me know what happens!

Prepaid Reloads

Some prepaid cards and services allow funding from debit cards online. It would be interesting if one could get 1% cash back from PayPal to fund a prepaid card that could then be used for bill payments or cash transfers. Amex Serve would be worth a try now that they’ve added Bill Pay, but I don’t have a Serve card. Bluebird allows online debit loads but charges a $2 fee for the max $100 load so that’s no good. You can load Bluebird in-store at Walmart with a debit card, but there you do need to use a PIN, so those loads would not qualify for 1% back. GoBank originally allowed debit card loads online, but they now restrict those loads just to the initial account setup. There are other options worth exploring, but I haven’t had a chance to look into them yet.

Experiments to-date

Even though I signed up for the PayPal debit card quite a while ago, testing it hasn’t been a high priority for me, so I’ve tried just few things so far. Here is what I found:

Regular online spend

I wanted to see how the cash back process works, so I made a very ordinary credit card type of purchase online.

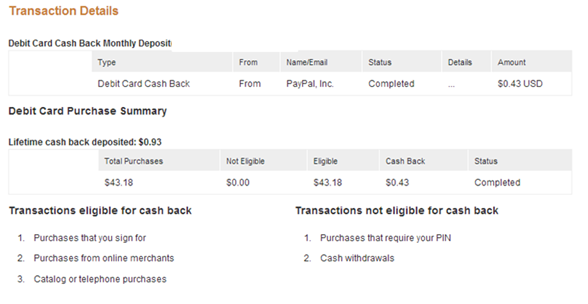

I couldn’t find any indication that I got cash back until 3 weeks later when I received an email congratulating me for earning almost 50 cents:

Congratulations. You’ve received a cash back reward of $0.43 USD after spending $43.18 USD with your PayPal Debit Card.

At that point, the cash back was viewable in my PayPal account:

Suntrust account setup

I opened a SunTrust account in March because I really wanted a debit card that earns 1 mile per dollar for all purchases. Unfortunately, it didn’t work out very well for me (see “Million Mile Headaches: SunTrust“). SunTrust allows you to make your initial deposit to your new account with a debit card. I first tried a gift card for this purpose, but that didn’t work, so I then used my PayPal debit card. Even though it was processed as a debit card signature purchase, I did not get cash back.

GoBank

GoBank is a new prepaid card very similar to Bluebird (see “GoBank takes on Bluebird. Which is better?“). When you open your account, you are asked to make an initial deposit and you are allowed to use a debit card at that point. So, I used my PayPal card:

I don’t know how this was different from funding my SunTrust account, but this time I did get cash back (again, it took about 3 weeks):

I compared the “details” page between the Suntrust and GoBank loads to see what was different, but they looked exactly the same other than the date of purchase, merchant, and net amount. Strange. The only thing I can think of is that the Suntrust transaction was handled by a person whereas the GoBank transaction was entirely automated. Maybe that made a difference? Anyway, it’s too bad GoBank doesn’t allow reloading via debit card anymore!

Bottom Line

Finding ways to eek out 1% cash rewards isn’t going to make anyone rich, but it’s the type of challenge I love exploring. Is there a perpetual money machine to be found here? Could one use the PayPal debit card to fund an account which could then be used to fund PayPal? Any ideas?

@DFW

Ya Rly Brah.

@Jeremy, I haven’t used the card in a few years, but historically I would earn cash back on all purchases as long as I didn’t have to enter a pin number.

I read the bolded part as “online ‘purchase that doesn’t require a pin’ or signature based ‘purchase that doesn’t require a pin’.” Since they didn’t include the word purchase after online it reads that way to me. So not sure if this would work, but do report your findings.

@DFW

Cool story, bro..

Greg, if you had a Paypal Business Debit card from a few years ago, the cash back rate is 1.5%. They lowered it to 1% a few years ago. Also, you may want to look into the Paypal Extras MC. Its from GE bank and becomes the default payment method when paying with Paypal. If you were to buy something on ebay, you go through paypal and the default payment method is the Paypal Extras MC. After the statement closes (or during the month), you can pay your bill with your Paypal balance. You earn 2 points per dollar when you use the Paypal Extras MC for any ebay/paypal purchase. I haven’t tried loading a Paypal money card to my account and using that to pay this card, but theoretically it should work. If you have any experiments you want me to help with, let me know.

I run PayPal debit against an interest-bearing checking account (+1.5% on balances below 10K). The checking account is the backup funding source for Paypal (which stays at a zero balance most of the time)

This means I get 1% back on purchases, plus interest on the float of 2-3 days (since it takes time for the transaction to be processed by Paypal and then sent to my bank), plus I have decent fraud protection (emails when the card is run, so if I see something I don’t expect, I can immediately handle things).

Oh, and Paypal’s international transaction fee is 1%, so this basically operates as a no-fee card overseas, too.

I don’t think Paypal would like it very much if someone tried to game the system, but this isn’t really gaming the system.

Echo what Andrew C says – and I’d add that I need my PayPal account, so it’s not one I’m likely to play with.

I have a PP Debit card and was thinking exactly the same thing regarding taxes, but I got an error when running through large tax payments. I believe there is a $500 limit for debit transactions, so it is not worth the effort. PayUSATax charged me the $3.95 debit fee even though the payment didn’t go through, so be careful. I did however run it as a credit transaction and it went through. By loading my PayPal account through reloads at CVS, I was able to goose my return by a few basis points (1% cash back but only 0.8% to load via CVS).

One point of clarification: you wrote that the cash back took “about 3 weeks” to deposit. The trick here is that your PayPal cash back is based on the calendar month, and always posts on or about the 3rd of the month for the preceding calendar month (so transactions have time to clear). You can actually view your cash back earned so far each month by clicking “PayPal Debit MasterCard” from your PayPal homepage.

Miler,

I think I don’t have enough time to work on this, but I just want to give you props for an “old school” post. These are the types of post us old schoolers love as it gets our minds thinking how to make this thing work…

Seems like someone is issuing a challege to FM!!

I frantically scrolled through the post to see if the one of the cooler unpublished tricks has been spilled. Thank goodness.

Nice post thumbs up 😀

The problem with the PayPal cards is that they are run by PayPal… few companies are as infuriating to deal with as they are.

The 2 best perpetual machines were

1

Mr Pickles and his Mint Coins maximization

2

Citi Savings accounts funded with credit cards

I do a lot of selling on Ebay and use the card to pay my fees and receive 1% back.