NOTICE: This post references card features that have changed, expired, or are not currently available

A few months back, I mentioned that there was a big coming change in my life (See: Baby Reyes is on board and scheduled for arrival). Regular readers might have noted my absence from the blog for a few weeks recently — and I’m excited to announce that the much-anticipated arrival of Baby Rey came with only a minor delay (and it was a welcome one since I fell down a set of slushy stairs and broke a rib the week of our due date; I’m glad he decided to stick it out a few more days to let me heal up a bit!). The first weeks of parenthood have been even more of a joy than I ever could have anticipated and have gone (dare I say) so smoothly that we’re already making plans for travel with Baby Rey. Greg and I are at distinctly different stages of parenthood — with him Planning a teen’s first credit card and earning miles for college. I’m planning for a baby’s first passport and stacking for savings on diapers. Still, there’s planning going on, so I thought I’d share some of the “Baby Steps” I’m taking with an eye towards setting Rey up for miles, points, travel, and financial security (while earning a few miles for mom & I along the way!).

(P.S. No, his name isn’t really Rey Reyes. As much as I think that was an opportunity lost, my wife woudn’t allow it. Names have been changed in this post and henceforth on the blog to protect the innocent).

Step 1) Set up Gift of College and 529 plan

I’ve already gotten part of this done, creating a GiftOfCollege.com account for Baby Rey shortly after birth. We’re still trying to figure out which 529 plan makes the most sense. Sticking with the New York plan for its tax advantages (since we live in New York) sounds like it makes sense, but we haven’t yet determined whether or not there is a plan that makes more cents. There’s work to do here.

Once we pick a 529 plan, we are ready to load it up with Gift of College gift cards that were purchased last year at Toys R Us (See: Best options for buying Gift of College gift cards). My wife was working on a signup bonus and purchased a few thousand in Gift of College cards while picking up a crib, rocker, and associated stuff. Our closest Toys R Us store didn’t carry these cards for a long time, but they began carrying Gift of College gift cards late last year. Saving for college will help us meet minimum spend, and when we’re not working on that, we’ll use the Alliant Cashback Visa to buy them, getting 3% back the first year and 2.5% back thereafter — a net win of $9.22 on each $500 card after accounting for the activation fee this year at 3% cash back and $6.70 in future years. That’s not amazing — but a win is a win.

Step 2) Finish buying stuff off the registry

We had created a registry with Amazon for ease and generally decent prices. However, we found a crib we liked at Toys R Us/Babies R Us and my parents were looking to have us pick one out so they could buy it for us. When my wife went to buy it, the sales associate asked if we had registered at Babies R Us. My wife explained we had registered at Amazon, which led the rep into her pitch as to why we should still create a Babies R Us registry. It turned out to be a pretty good idea. There were a few things I didn’t know about Babies R Us and the registry.

- Babies R Us will price match, so if we found things cheaper on Amazon, we could get that price and buy off the registry.

- Babies R Us offers a gift card at some point after your due date good for 5% back on the first $300 spent off of your registry and 10% back thereafter (up until a month after your due date). You can add an item right before you purchase it…meaning that anything we bought during the months leading up to Baby Rey’s arrival got added to the registry first.

- Babies R Us accepts Buy Buy Baby coupons. We got several 20% off coupons — so we were able to stack 20% off on several large purchases with an eventual 10% back (since we spent more than $300). Also note that Buy Buy Baby accepts Bed, Bath & Beyond coupons, so you can basically always get 20% off there, too.

- While you technically can’t stack a price match and a coupon, I’m not convinced it can’t be done as there were a couple of times we used a 20% off coupon that was supposed to be good for one item and the rep said she’d go ahead and take it off the entire purchase. YMMV.

I’m going to add diapers to my registry and try my hand at price-matching them to stack a decent price with 10% back. If we come up with anything more that we need to buy, we’ll be sure to add it to the registry and see if we can price match it. For someone looking to pick up a nice savings on an expensive furniture or gear item right now, I see they are running a trade-in event. I imagine one could hop on Craigslist and find something cheap or free to trade in for a 25% off coupon (the goal of the trade-in event is to remove unsafe items from circulation and they specifically take damaged items — see the promotion page for details as I don’t know much about how this works).

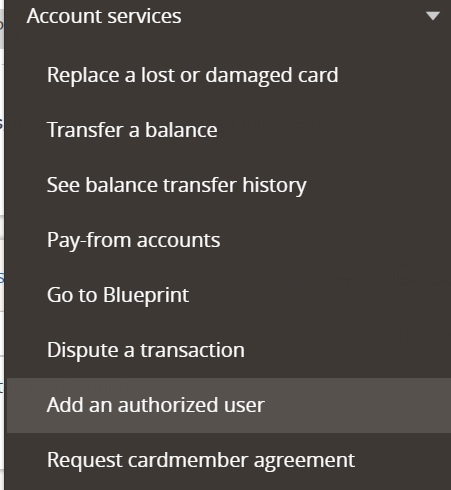

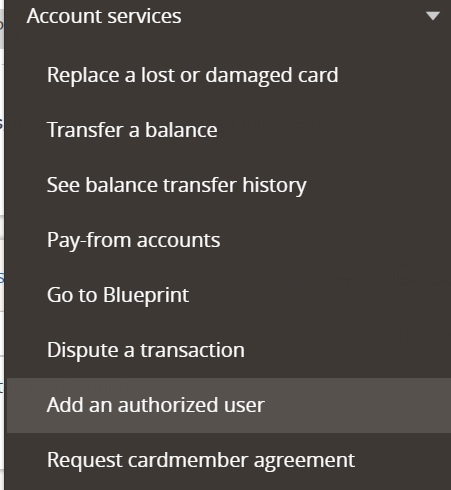

Step 3) Set up Authorized User accounts

A significant factor in determining one’s credit score is average age of account — in other words, the average amount of time your credit accounts have been open. Authorized user accounts figure in to the average age. Having a few old accounts can help keep your average age high even when you open a new account or two.

In order to get Rey started strong when he gets ready to open his own cards as a teenager, I’ve already added him as an authorized user on a couple of cards. Some issuers have a minimum age for authorized users. For example, Amex states that authorized users must be at least 13 years old.

However, other banks don’t have any age restriction — Chase and Citi have no minimum age (update: Discover actually does have a minimum age of 15 for authorized users). Note that if you allow your statement to close with a balance, this will affect your authorized user’s utilization ratio. I made sure to add Rey to accounts I rarely use (just enough to keep them active) and I’ll be sure not to let a balance report. Hopefully, this will put him in good shape when it comes time for him to apply for credit later. Of course, I know the responsibility for helping him learn how to use credit responsibly rests firmly on my shoulders. Wish me luck.

Step 4) Open loyalty accounts

While Baby Rey will fly for free as a lap infant for the first two years domestically and will likely fly as a lap infant on international award tickets as well (more on that in posts to come), I’ll still create loyalty accounts in case there comes a time when he would earn miles on a flight.

Initially, I thought that I’d set up accounts for him to take advantage of shopping portal bonuses. Airlines often run shopping portal bonuses around holiday periods (like the ones that expired yesterday for example), and Baby Rey might want to make a purchase with his credit card now and again. However, the terms of most of the airline shopping portals state:

- Activation. You represent that you are a person of legal age in the state in which you live (generally at least 18 to 21, depending on the state) and are a legal resident of the United States and its territories. You agree that it is your responsibility to keep your Member information current, complete and accurate by periodically updating your information in the appropriate section of the Program Website.

Bummer. Looks like he won’t be able to earn miles shopping….but we’ll see what else comes about over time. At any rate, it makes sense to help him build history with loyalty programs, so I’ll start signing him up.

Step 5) Earn bank account bonuses?

This part is still a question mark, but I’m wondering if Baby Rey can qualify for any bank account bonuses. I know that most banks require an account holder under 18 years old to have a parent or guardian as a joint account holder. What I’d like to know is if he can qualify for any savings account opening bonuses (and whether we might disqualify him if we have gotten the bonus on the same type of account). There’s research to be done here, but I’ll start with Doctor of Credit’s Best Bank Account Bonuses and see what we can find. (Note: You have to be 18 to apply for the Discover accounts shown above).

Step 6) A child IRA for Baby Rey?

Last week, Doctor of Credit posted about an organization called Prosperity Now that publishes an online map tool with information about Children’s Savings Programs around the US. You can read more about it in the Doctor of Credit post here.

In my state’s resources, I came across information about how to set up a child with an IRA. Of course, the child would need to have income in order to contribute to an IRA; for most children, that means child modeling. Do I think my little guy is adorable enough to be a child model? I don’t know, but he’s sure practicing his poses for the next Calvin Klein ad campaign.

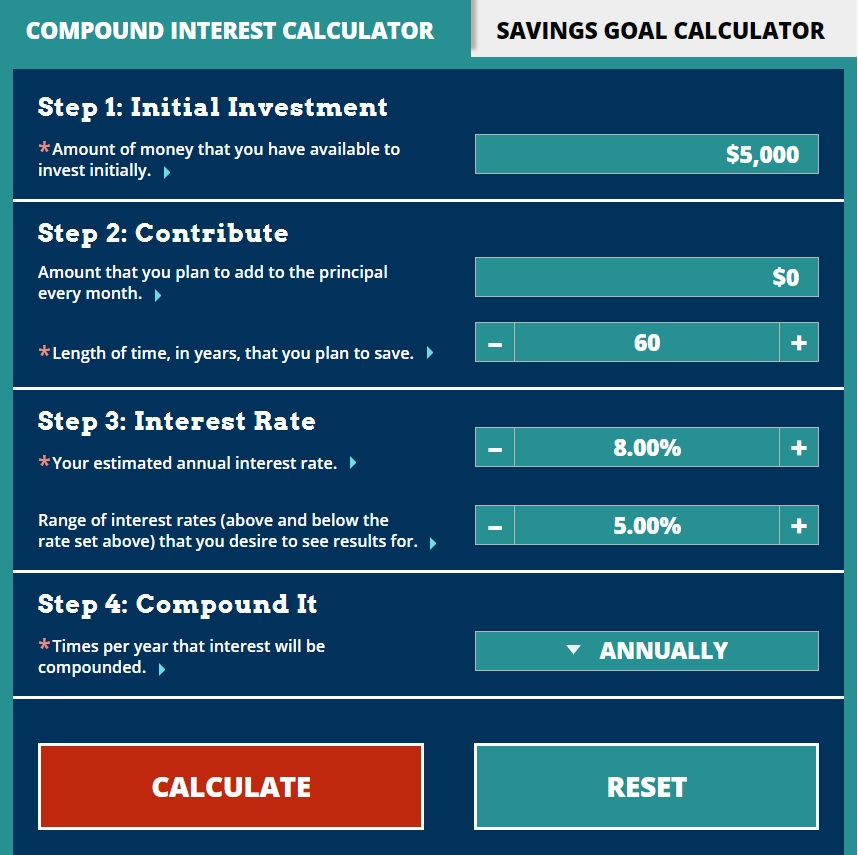

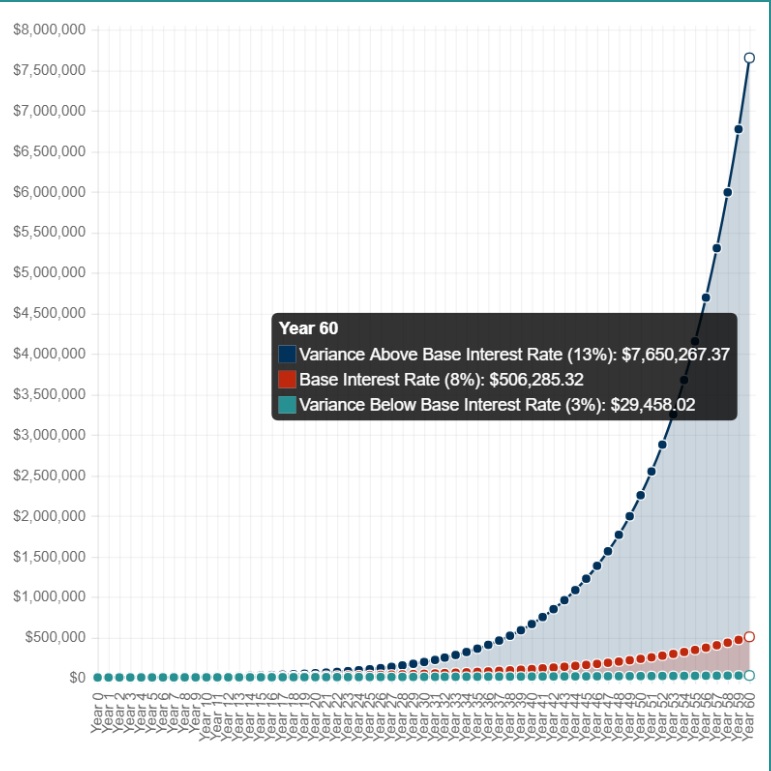

While we’d joked about this before he was born, it sounds like it may be easier than I would have thought to break into it and get a paying gig or two. Don’t get me wrong — this wouldn’t be my plan for how to spend his childhood. But I went to Investor.gov to play with the compound interest calculator and do some math. I wondered what he could earn if we were able to help him set up an IRA and he can manage to get $5,000 in it this year (probably unrealistic, but a kid’s gotta have goals). I wanted to see what he could end up with at age 60, assuming he never even contributed another dime. According to a CNBC article from last year, the average annualized rate of return of the S&P 500 over the past 90 years is 9.8%. I decided to assume an average rate of return of 8% — but for fun, I figured I’d also look at what would happen with annual returns of plus or minus 5% as well.

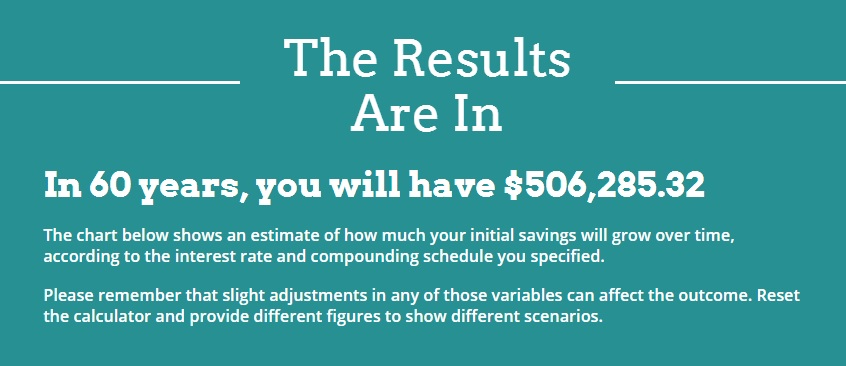

The results were staggering. At an average return of 8% per year, and nothing contributed beyond the initial $5,000, here’s what he would have in 60 years:

The chart also shows the totals if he averaged 3% or 13% in returns, and those numbers were equally interesting:

As you can see, the range there is from over $29,000 with only a 3% annual return up to north of $7.6 million based on 13% return. If he manages to pace along with the average market increase of 9.8%, he’d have over $1.3 million at age 60. Of course, this assumes a lot — that the market continues to operate the way it has in the past and that this IRA account goes untouched for 60 years among many other things. But it also assumes no more contributions — which is unlikely. That is to say that he’ll likely contribute when he begins working and have even more (if I can convince 19 year old college freshman Rey not to take an early distribution for a wild spring break 2037). So I’m not sure exactly how we’ll help him do this, but I’m convinced that we need to help him find a way.

Step 7) Baby’s first passport

In terms of more immediate and practical needs, we have a trip to Portugal theoretically planned this summer. I booked an SPG Nights + Flights package in January 2017 in order to take advantage of the SPG partnership with Virgin America before it ended. As a random pick booked almost as far out in the future as possible (to give us some flexibility), I booked the Category 4 Convento do Espinheiro shown above for summer 2018. I paid 70,000 SPG points and ended up with a 5-night stay (which would normally cost 40,000 points) and 65,000 Alaska Mileage Plan miles (initially 50K Virgin Atlantic, but those converted to Alaska at 1:1.3).

Of course, whether or not we go will depend on how Baby Rey does with flights. We’ve booked a couple of short flights on Southwest this spring to torture everyone on the plane use as test runs to see how it goes before bringing him on a longhaul flight. If we have to cancel the Convento do Espinheiro, we’ll get back 30,000 SPG points — which will mean we’ll have converted a net 40K SPG to 65K Alaska, which still isn’t bad.

Assuming we go to Europe, we’ll definitely be using miles to fly in business class, where we’ll hopefully have the space to keep him comfortable. More to come on what we book and why in terms of getting a decent deal on an infant ticket — but before we take off, we’ll need to get Rey his first passport.

According to the Bureau of Consular Affairs, for a person under 16 years old to apply for a passport, he or she must appear in person with both parents at a passport acceptance facility. The closest of those is about 25 miles away for us, but we’ll happen to be passing by one of them later this week. I’ve downloaded the forms to fill out and intend to get that application submitted. A photo is required. Unfortunately, I don’t think they’ll take the one my wife suggested.

But in all seriousness, what do they expect for a newborn’s photo? Turns out they have a list of official tips for taking photos of infants and newborns:

-

Lay the child on its back on a white blanket or sheet to ensure its head is supported without the aid of a hand.

-

Alternatively, cover a car seat with a plain white sheet and take a picture of your child in the car seat.

-

Please make sure no other person is in the photo.

-

A photo with the child looking at the camera is preferred, although not required.

Looks like we’ll have to set him up for his child modeling practice run second photo shoot.

What have I forgotten?

Well, I guess I’ve forgotten the bit about stacking savings on diapers. Fortunately, friends and family were very generous in giving us a lot of diapers before Rey arrived. Unfortunately, he is determined to run through that supply as quickly as possible. I swear he hears NBC’s Olympic theme and gets inspired to compete in the Diaper Olympiad. There will be some stacking of savings soon to follow the stacking of soiled diapers in the garbage.

But in terms of other parts of miles, points, and travel preparation, I ask those readers who are seasoned parenting experts to share with me what I’ve forgotten in terms of getting the baby steps in order.

I’m also curious about this: What baby accessory/item/gadget/thingy did you find to be completely indispensable in your travels? I feel like we’re set with the things we need…but that level of confidence before setting foot on the road probably demonstrates my ignorance more than preparation. I’m happy to hear about that thing you couldn’t have lived without during your child’s first two years of travel.

Bottom line

There’s a lot on our plate right now in terms of just being first-time parents, but we’re certainly looking to spice up Baby Rey’s life by doing what we can now to prep for a future of fun, travel, learning, and financial stability that will hopefully lay the foundation for an interesting human being to emerge. In these first weeks of just constantly staring at him, I find myself daydreaming about who he’ll be and how we’ll influence that — both intentionally and unintentionally. Hopefully, in 18 years, he and I will look back at these baby steps and how they laid the groundwork for the places he’ll go. In the meantime, about those diapers….

[…] added my first son as an authorized user on one of my cards shortly after he was born (See: Baby Rey has arrived, but is preparing for departure) and planned the same for Baby Rey […]

[…] do you get a passport for an infant? Since starting our parenting 101 course earlier this year, we had to get our little professor a passport for our first field trip abroad, so we recently […]

[…] are targeted). My wife will be passing by a Starbucks today and surely in need of a coffee after Baby Rey kept us up half the night last night, so I’m going to load up my account on her phone so she […]

[…] code on infant formula from Walmart, though diapers or wipes would have been equally good deals for Baby Rey. Previous Google Express users should check their email as there have been targeted codes going out […]

[…] since I have recently discovered the value in having the space of a Hyatt Place room when traveling with an infant. Most of my Hyatt Place bookings are direct (usually on Hyatt points transferred from Chase […]

[…] a newborn at home, my wife and I have been cost-cutting as of late to stay on budget. As a points-and-miles collector […]

[…] on the highway and nothing but regular maintenance in cost has treated us well. But we recently added to the family and realized we were going to need more space. We decided to upgrade to either a new or late model […]

[…] Angel is half right: when I’m searching for award travel, I always need 2 seats (and soon I’ll need a little more space yet). But I still often start my award searches looking for 1 seat….and it’s because that […]

Can’t you pay child modeling fees from the blog for the use of the baby’s photo in this post? I believe that’s what gocurrycracker has done in order to contribute to their child’s IRA, FWIW.

Certainly the type of thing I’ve considered. It’s certainly not unheard of for parents who own a business to hire their kids.

[…] Baby Rey has arrived, but is preparing for departure by Frequent Miler. Congratulations to Nick & his wife. If you’re having or have had a child recently this post is well worth a read as well. […]

Congratulations!!!! Impressive post.

[…] Baby Rey has arrived, but is preparing for departure by Frequent Miler. Congratulations to Nick & his wife. If you’re having or have had a child recently this post is well worth a read as well. […]

in 60 years…the earth as we know it will not exist…

Congrats! So happy for you!

Hi! Congratulations! Can you open a FF account for a baby under 2? I tried for my first one and couldn’t but didn’t look at all the possibilities as they always fly on the lap until they are 2