We’ve recently learned about the latest in “Bad Bonvoy behavior” that will lock you out of a Bevy bonus and as you’ve heard on this week’s podcast, I sniffed a whiff of wisdom in Wells Fargo’s coldly calculated plan to be a contender. Read more about all that and more in this Frequent Miler Week in Review.

This week on the Frequent Miler blog…

Amex adds more restrictive Marriott card language

If you have had the Marriott cards on your mind, you might need to think again. This week, we published this post noting new, more restrictive Marriott card language that will now make it harder to get the Bevy card based on which Bonvoy cards you’ve had before. It’s a bummer that you’ll get Bonvoyed based on behavior that was baited by their bulky bonuses. Ok, I’ll stop right there.

Bright spots in the latest award devaluations

It can sometimes seem like it’s all doom and gloom in award travel, with one sweet spot soured after another. But if you’re a glass-half-full type, you know that the sun will rise again — so allow us to shine a light on the brighter spots mixed in to changes that you might have considered to be largely negative across several different programs.

Best Hyatt Category 4 Hotels & Resorts [Book soon!]

One of those “devaluations” of sorts is the annual Hyatt category shuffle. More than a hundred hotels will soon increase in category, some of them moving out of range for your Category 1-4 free night certificates. Furthermore, we assume that the days of the SLH partnership are numbered — and I’m not betting on a very big number there. I wouldn’t be surprised to see that partnership end either when the category changes happen later this month or on April 1st, but the truth is that it could end any day and I don’t expect that there will be any further warning before it does. On that note, there are some fantastic SLH properties that fit within Category 1-4 scattered around Europe, so if you are planning a trip to Europe within the next year and you have certificates to burn, consider this paragraph your book of matches.

A case for cash back with the Schwab Platinum card

With all this talk of devaluations, you might find yourself questioning how long you should be holding points, hoping for the right opportunity to pop out. Is it possible to have “too many” points? I think there comes a point where you need to consider whether cashing out might be a better option than waiting for a rainy day. In this post, I review a couple of decisions I made in 2021 and 2022 and I consider that the growth of the money probably made more sense than letting the points sit in an account unused. Still, not everybody agrees with the approach, so it’s worth reading the comments as well.

Podcast: Where’s the best place to live for miles and points? | Coffee Break Ep03

On the other hand, if you do want to keep earning points, it’s interesting to consider how where you live might influence your ability to accomplish those goals. Stephen and Carrie have long made up the Frequent Miler team’s nomad division — though Carrie recently settled down and Stephen is getting ready to do so when his 50-state road trip ends early next year. In this coffee break episode, Stephen and Carrie chat about the factors to consider when deciding where to settle down if you don’t want to settle for fewer miles and points.

Wells Fargo launching Autograph Journey Visa Card: transferable points, up to 5x earnings & more

In a bit of brighter news, Wells Fargo is stepping into the ring, and if you expect this to be a totally lopsided exhibition match (like that coming Mike Tyson v Jake Paul insanity), think again. Wells Fargo clearly intends to be a contender, but they are also clearly pacing themselves to come out of the gate slow and steady while they learn the ropes. The initial welcome bonus is a little weak in my opinion and the initial transfer partners are limited, but as I said on this week’s Frequent Miler on the Air, I catch a whiff of brilliance in the way they are handling this. I have to imagine that they have more transfer partners lined up already, but they went with three solidly useful partners to start the party. Next, I imagine that they’ll introduce new partners slowly, giving themselves a chance to build buzz every month or month and a half for the rest of the year. I’m excited about where this is headed.

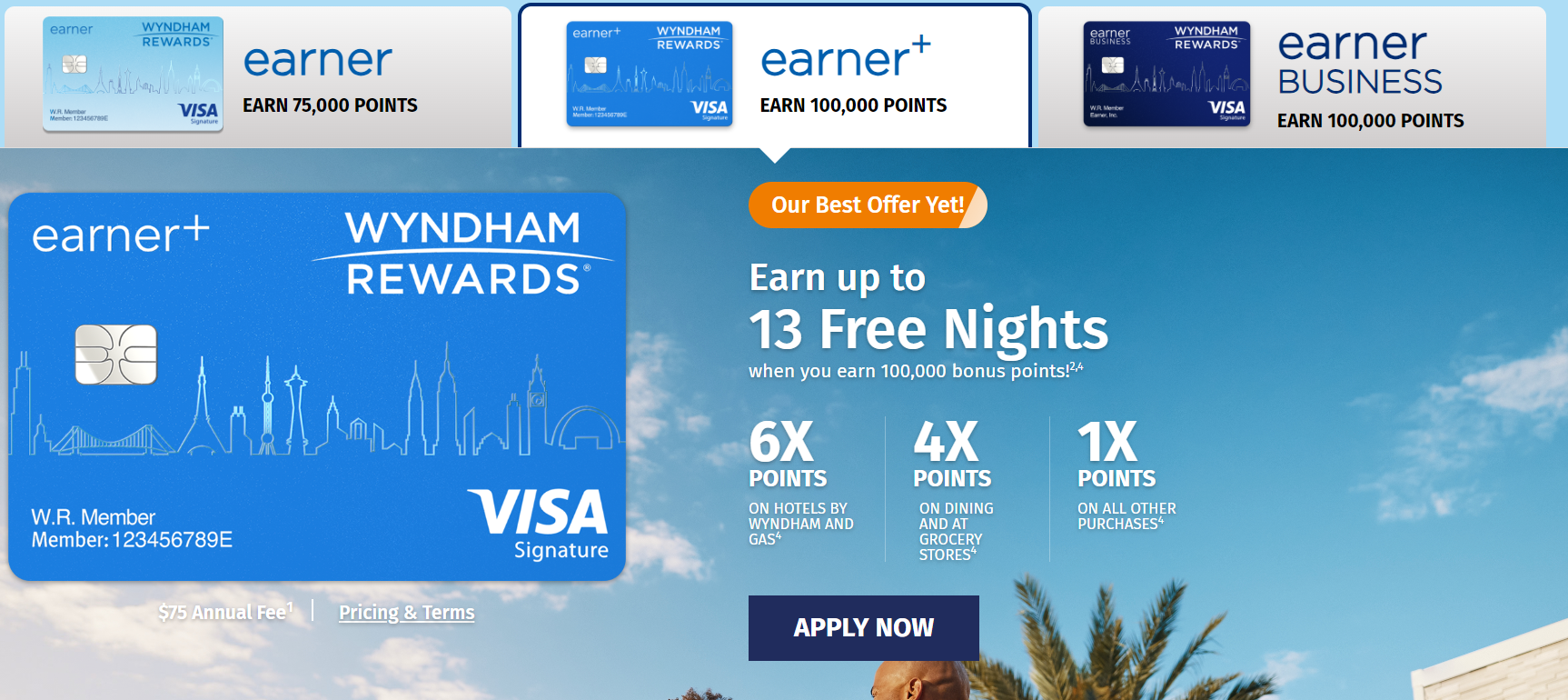

Barclays Wyndham Earner Cards: Best Ever 75K and 100K Offers

Barclays is out with new offers on the Wyndham credit cards that are anything but weak. This post focuses on the consumer card offers. We covered the Wyndham Vacasa devaluation on the podcast and talked about how you will still easily get 1.33-1.67c per point when using Wyndham points toward Vacasa vacation rentals. Therefore, the chance to earn 100,000 Wyndham points on just $2,000 spend is pretty fantastic for vacation rental fans. I might just have to add that card to my lineup since I already have the business card. On that note, keep in mind that while these cards offer terrific intro bonuses, you’ll want the business version of the card if you’re interested in matching your way to free cruises.

Best Ever 100K offer on Wyndham Earner Business card (but with big spend)

If you’d been considering the Wyndham Earner Business credit card, this new offer is the moment you’ve been waiting for. Some will find the high spending requirement off-putting, particularly in comparison to the consumer Earner Plus card. That said, I imagine that between 5x utilities and 8x gas, some folks would probably spend the full $15K requirement over the course of a year regardless of the bonus — putting them in position to turn this into a bonus of 200K or more. More importantly, this is the card to get for those looking to get into the casino status matching game since it provides Wyndham Diamond, which matches to Caesars Diamond and puts you on the path to free cruises and other casino status match benefits.

Capital One SavorOne Cash Rewards Credit Card Review (2024)

I really want to round out my wallet with a Capital One SavorOne card as I like the idea of 3x on grocery and entertainment with no annual fee. That’s particularly true given that I’ve question the Amex Gold Card’s place in my wallet. While the Citi Premier card also offers 3x at grocery stores, I like the fact that the SavorOne has no annual fee. I don’t have this card now and my main hang-up has been the welcome offer. I also wonder what’s going to happen when the Uber partnership ends later this year as I’d value the UberOne membership, but that benefit only has a limited amount of time left as things stand.

STARLUX A350-900 Business Class Bottom Line Review

I’ve been curious about Starlux, so I was glad to see that Greg flew them to and from Taiwan recently. The cabin looks very nice and it sounds like the beds were very comfortable. While I like the whining and dining part of the experience, I am starting to value the ability to get a good night’s sleep above all and it sounds like Starlux was great for that, so I’d be happy to try this out sometime despite Greg’s lukewarm review of the food.

Oceana Santa Monica, LXR by Hilton: Bottom Line Review

I very nearly booked a couple of nights at this hotel last year, having been told by a family member that it was a really special place. However, after reading Tim’s review, I’m glad I didn’t make the trip to Santa Monica just for this place. It does look nice and his review isn’t overwhelmingly negative, but it doesn’t sound like this place is necessarily a destination on its own, which is what I was looking for with Hilton free night certificates.

That’s all for this week at Frequent Miler. Keep an eye out for this week’s last chance deals and grab them before they’re gone.

![Cutting our collections, comparing free night certificates, and expediting new cards [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/07/Nick-Platinum-cancel-218x150.jpg)

![Re-Bilt already, Fixing Marriott, the best Hyatts for Free Night Certificates and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2026/01/wp-1768653765552601913603261308925-218x150.jpg)

Entertainment is 4x on the Savor not 3x

Speaking of bad Bonvoy behavior, curious what you think of this: