| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

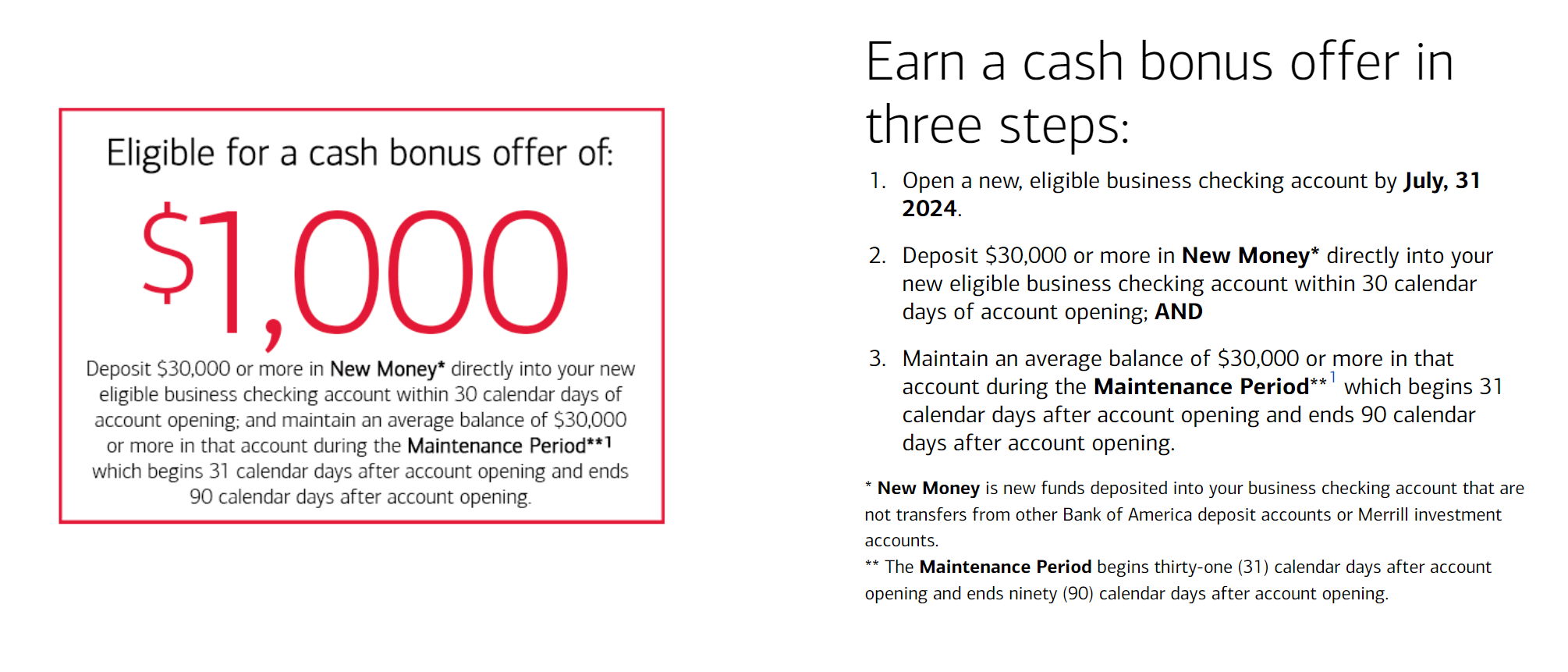

Bank of America is running a promotion for new business checking accounts that offers a $1000 bonus with fairly simple requirements. Deposit $30,000, keep it there for a minimum of 61 days, and you get $1000. Depending on how long you deposit the money, this effectively works out to an interest rate of ~18-20% on the money while it’s there.

Because of the $30,000 deposit requirement, BOA has added Preferred Rewards for Business Gold tier benefits right off the bat. This gets you a 25% bonus on eligible business credit card earnings and a 5% interest rate boost on a Business Advantage Savings account.

Note that this offer is officially targeted per the terms. That said, whenever there’s been a public landing page for these bonuses in the past and you sign up through that link, it has worked. Take screenshots of the landing page to be sure.

The Deal

- Bank of America is offering a bonus of $1000 with a new business checking account.

- Requirements to Receive a $1,000 cash bonus:

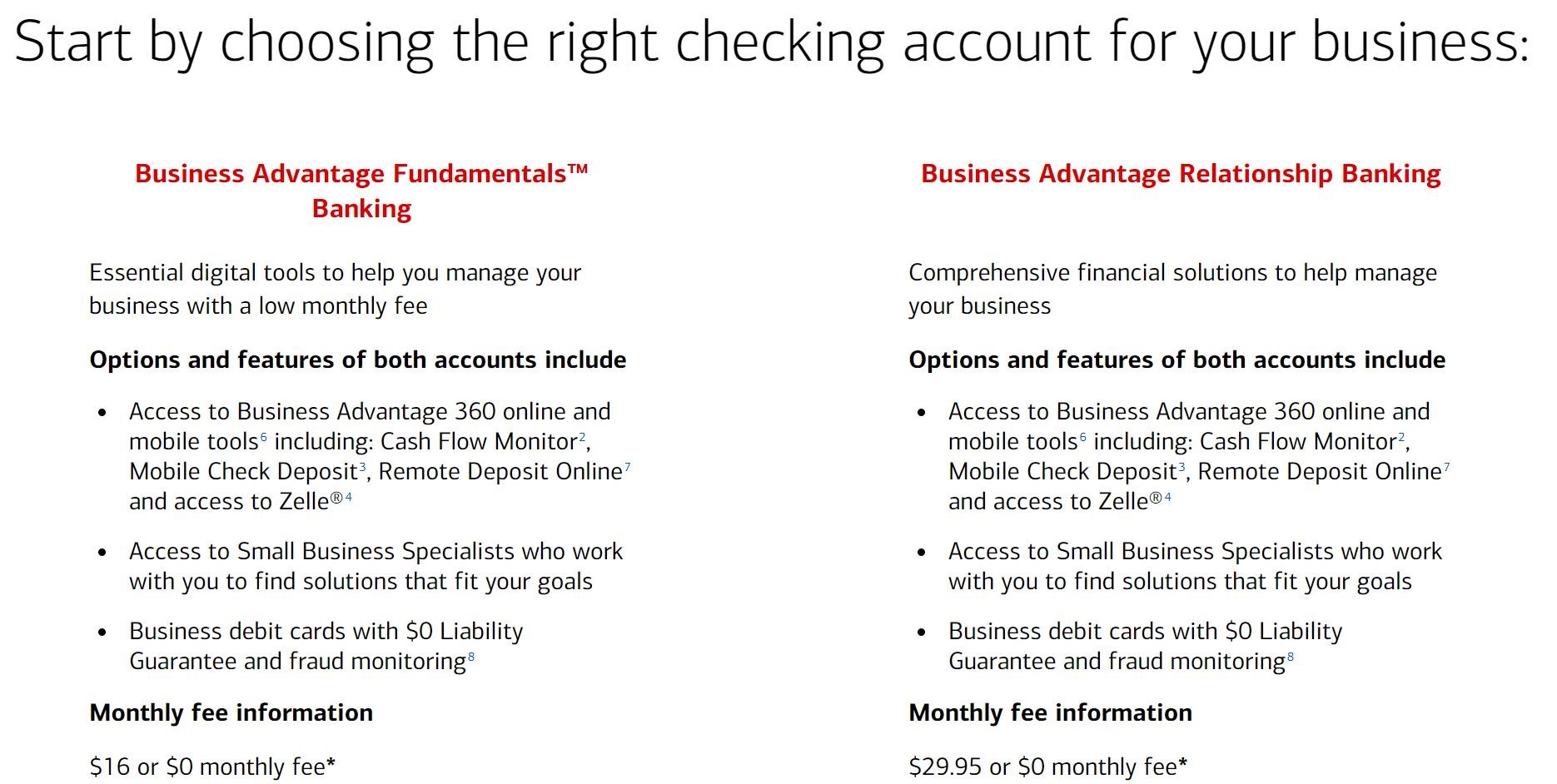

- Open a new Business Advantage Relationship Banking or Business Advantage Fundamentals™ Banking account by July 31, 2024.

- Make Qualifying Deposits of $30,000 or more in new money* into your new business checking account within thirty (30) days of account opening; AND

- Maintain an average balance of $30,000 or more during the Maintenance Period** into the new Business Advantage Banking account (days 31-90 from account opening).

- Promo code=SBBT016

Key Terms

- This offer is only available to business owners who receive this offer via a direct communication from a Bank of America Specialist or from a Bank of America communication.

- This offer is intended for new customers only; you are not eligible for this offer if you were an owner or signer on a Bank of America Business Advantage Banking account within the last twelve (12) months. Only one bonus ($1,000) per business customer, regardless of the number of businesses owned or operated by the customer.

- Offer expires on July 31, 2024, and all qualifying activities must be completed within the stated time frames in order to be eligible for this offer.

- *New money is new funds deposited into your Business Advantage Banking account that are not transfers from other Bank of America deposit accounts or Merrill investment accounts.

- **Maintenance Period begins thirty-one (31) calendar days after account opening and ends ninety (90) calendar days after account opening.

- The value of this bonus may constitute taxable income to you.

How to get Fees Waived

- The Monthly Fee for Business Advantage Fundamentals Banking will be waived when you meet one of the following requirements during each checking statement cycle:

- Maintain a $5,000 combined average monthly balance

- Use your Bank of America business debit card to make at least $250 in new net qualified purchases

- Become a Preferred Rewards for Business member

- The Monthly Fee for Business Advantage Relationship Banking will be waived when you meet one of the following requirements during each checking statement cycle:

- Maintain a $15,000 combined average monthly balance

- Become a Preferred Rewards for Business member (first 4 checking accounts, per enrolled business)

Quick Thoughts

The nice thing about this business checking account bonus is that it is very simple: deposit the money within 30 days of account opening, leave it there for 60 days, collect a nice bonus and also get Bank of America Preferred Rewards Gold status (which waives the monthly fee without needing to meet any requirements).

While the offer appears to be targeted based on the terms, I’ve seen multiple data points from people who have received the bonus despite not being targeted. YMMV — there is could obviously be a chance that it won’t be honored if you weren’t targeted. Take screenshots just in case.

Nick did a similar bonus in 2020, depositing $20K for 60 days, and he quickly received his $500 bonus (see his 2020 bank bonus tally post for more info about the all the bank bonuses he did).

@Tim – lower requirements for the banker $1,000-$1,500 offer, finding bankers is the main issue.

It’s 90 days for me… not 60.

What is 90 days?

Did this last year, and like many others, wasn’t target and BoA did not honor the bonus. Tried pushing back and to no avail.

You win some, you lose some. Oh well.

Cheers,

AVI Kerendian

Just did this in December 2023. Saw on end of March I got the $1000 bonus. I was not targeted but I did get a letter about how to the meet bonus after I opened the checking account. Now that I received the bonus, can I take the money out?

Also never got my bonus for this last year, they asked me to send in evidence of the targeted offer

I did this at the end of 2023, even though I wasn’t directly invited.

Was a bust. Bonus never posted, and I waited plenty long (3 months past the ‘completion’ date.

So, BEWARE and think about the negative ROI of parking $30k there and eventually getting nothing.

Also, depending on how you move your money there, they charge $15 for a wire transfer IN.

I’m sorry to hear that, you’re the first negative DP that I’ve heard. A couple of quick questions:

1) The bonus can often take as long as five months from account opening to arrive in your account (90 days for maintenance period, 60 days to deposit the bonus). When did you open your account?

2) Did you contact BOA to find out what happened? They shouyld be able to tell you what the issue was and, if not, you can escalate to someone who does. If you took a screen shot of the landing page that you signed up through, that could come in very handy.

3) Did you get Preferred Rewards Gold when you hit $30K in your account?

Thanks for the info, would like to learn as much from your situation as we can. Sorry it’s been a pain!

This is the first negative DP you’ve heard? Check the comments at DoC. Most people who weren’t targeted didn’t get the bonus.

I was also not targeted. Opened the account on 10/26/2023, and kept the money in for 90 days. Have not received the bonus yet. Planning on contacting BofA about it once I stop procrastinating.

Same, I did this on the last round and it was also a bust. I think they changed something in the coding. There is a guy who runs a podcast “ChurningLife” who was actually targeted and after approval, didn’t have the bonus offer attached. He had to escalate it to the executive office to get his bonus.

Given the recent change and the high opportunity cost of $30k at 5% interest rates, I do not recommend this one if you aren’t targeted.

I’ve heard about that glitch, but was under the impression that, like Connor, it was happening to people regardless of whether they had been targeted or not, and required manual intervention from BOA (and non-targeted folks were successful when sending in a screenshot).

What did BOA say when you contacted them?

Where can I get the screenshot? I have a case that’s currently pending from BOA

BoA said there wasn’t a bonus offer attached to my account and asked for the promo code I used. I gave them the promo code, but they again said it wasn’t attached to my account. Since I wasn’t actually targeted, I didn’t have any grounds to push back. I agree with you, sounds like it’s happening regardless of if you’ve been targeted or not, but at least in Connor’s case he was actually targeted and could push back.

I didn’t originally see your comment about non-targeted folks being successful with a screenshot. I guess that may work. Personally, since I wasn’t actually targeted, I didn’t bother pushing back. The way I personally see it is that they caught me trying to game them out of $1k and I don’t care enough to escalate further. I lost some opportunity cost with 90 days of 5% interest but oh well, that is just the game. I have moved onto new deals.