NOTICE: This post references card features that have changed, expired, or are not currently available

If you spend a lot at grocery stores, which credit card should you use? What if you spend a lot on dining? Travel?…

I’ve long maintained a page, previously called “Best Category Bonuses,” that lists best cards for each type of spend. That page has been a useful resource, but the title didn’t really give much of a hint as to what it was about. Another issue with the old page was that I used Fair Trading Prices (an estimate of the cost to acquire points) for point-based cards, and cash or cash-equivalent rates for other cards. This was like comparing apples to oranges.

Yesterday, I recreated the Best Category Bonuses page. It has a new URL, a new name, and now uses Reasonable Redemption Values (RRVs) to estimate the value each card offers. The new page can be found here: Best Cards for Grocery, Gas, Drugstores, Travel, Dining, More… For brevity, I’ll often refer to the new page as the Best Category Bonus page, but I think that the longer title will be more self-explanatory to many.

Back to grocery stores…

The resource page is divided into sections, with a table for each. The grocery store section currently shows two Amex cards at the top of the list (here’s a picture of just the top two table entries):

The top card is the Amex EveryDay Preferred which earns up to 4.5 Membership Rewards points per dollar at U.S. supermarkets. With the current Reasonable Redemption Value for Membership Rewards points at 1.82 cents per point, that means that you can earn up to 8.19% in rewards per dollar. If you don’t want to monkey around with travel rewards, you can opt, instead, for the Amex Blue Cash Preferred to earn 6% back, straight-up.

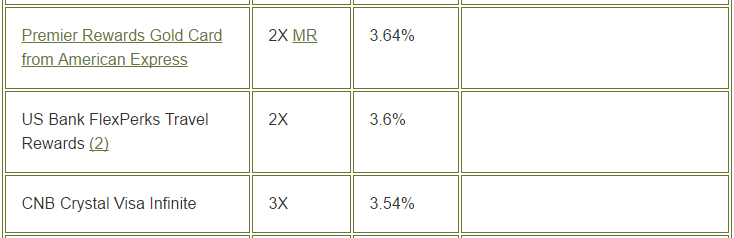

Both of the top two cards have U.S. supermarket bonuses that are capped at $6K annual spend. If you want a card that is uncapped, the next card on the list is the Diners Club Card Elite, but that card is no longer available to new applicants. If you keep scrolling down, you eventually come to several uncapped options that offer better than 3% rewards (the FlexPerks card may be sort-of capped at $120K annual spend, but the details are complicated and there may be an easy workaround):

And dining…

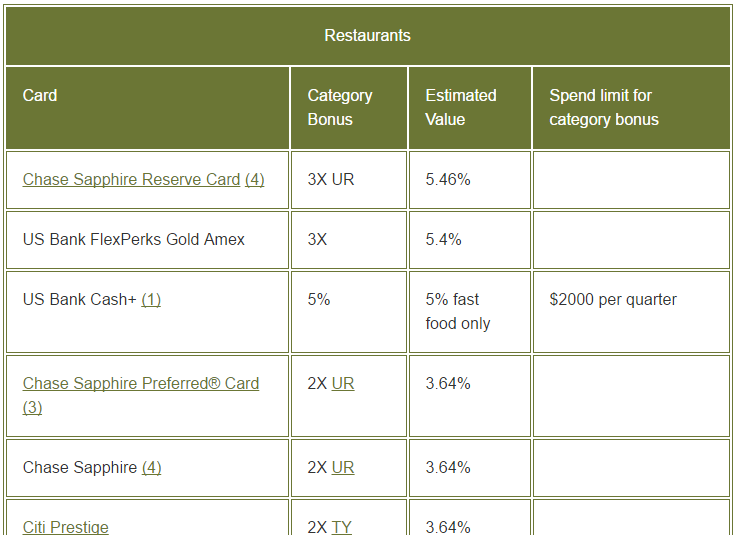

It comes as no surprise to me that the restaurant section currently shows the Chase Sapphire Reserve Card at the top of the list with an estimated 5.46% rebate on dining. Somewhat surprising, though, is that the US Bank FlexPerks Gold Amex offers an almost identical 5.4% estimated rebate. I had forgotten about that card until now!

And Much More…

The new Best Category Bonuses page has many sections for many categories of spend. Please check them out:

- Stores: Bookstores, Department Stores, Drugstores, Grocery Stores, Office Supply Stores

- Travel/Gas/Food: Car Rentals, Gas, Hotels, Restaurants, Travel/Airlines

- Other: Charities, Online Purchases, Phone, Cellular, Internet, Rotating Categories

- Everywhere Else: See: Best rewards for everyday spend.

Credit Card Info

Many of the listed cards in each section are underlined because they are hyperlinks to pages with more information about the card (annual fee, current best signup bonus, mini-review, etc.). Over time I hope to expand this to all of the listed cards so that you can easily learn more about each.

Reader Suggestions

Does the new page help you find cards that meet your spending patterns? What can we do to make the page better? Please comment below.

![Which Premium Cards are Keepers? [Updated w/ Strata Elite, Atmos Summit, and refreshed Platinum] Pile of credit cards with calculator on top](https://frequentmiler.com/wp-content/uploads/2025/06/Calculator-with-Credit-Cards-218x150.jpg)

[…] cards that can be loaded with up to $500. In that case, your best bet would be to use a card that earns a nice category bonus at grocery stores and buy a $500 gift card. You’ll come out a few dollars and a stack of […]

rabbmd: Thanks for the BOA suggestion. I’ll add it.

Re: Amex Blue Cash Preferred annual fee..

I’ve thought about adjusting the payouts by including annual fees, but I’m not sure how to do that. Most cards (BCP excepted) have other benefits that may make the card worth the annual fee. Also, what would I do where the category bonus cap is much higher, or has no cap? I could estimate how much a person would spend in each category, I suppose. Any thoughts?

The amex blue preferred is really at best 4.75% with the $75 annual fee

and 4.5% with the $90 annual fee if your use case for the card is exactly $6000

in groceries, nothing more, nothing less. I find the 6% number kind of deceptive.

I feel leaving the bank of america cash rewards cards after the preferred honors rewards bonus of 75% is an oversight. Moving a $100,000 IRA or Roth to their merrilledge platform is simple. Then being able to earn 3.5% per quarter on grocery and warehouse clubs and 5.25% straight cash back on gas on $2500 per quarter is very hard to beat.

Agreed. Especially since everyone always acts like the BCP is such a great deal with its 6% grocery earning rate, but after you factor in the $95 annual fee the effective rate is only about 4.44%, which isn’t THAT much higher than the 3.5% you mentioned on the BOA Cash Rewards card… except that in order to hit the 4.44% rate on the BCP, you’d have to be sure to spend EXACTLY $6000 per year in grocery spend; any more or less will significantly reduce your earning rate (for example, if you only spend $4000 in grocery spend on the BCP, your effective rate is reduced to just 3.625%, barely better than the BOA card… if you spend $7000 in grocery spend on the BCP, your effective rate is reduced to ~3.9%). The major advantage of the BOA cash rewards card is that you can spend anywhere from $1 to $10,000 per year and your rate will still be 3.5% straight cash back, no fancy calculations needed!

In response to person who suggested buying Whole Foods gift cards from Staples using the Chase shopping portal, I do not think that works for the shopping portal bonus as gift cards are explicitly excluded from eligible Staples purchases. In fact, I think that is true for all shopping portals.

True, the terms say that, but in my experience the 2x portal bonus does sometime post, and when it doesn’t I’ve had good luck calling in and getting it.

This suggestion doesn’t necessarily relate specifically to this post, but I think this would be a very good addition for the future…

I have yet to find a site that compares all of the various meal subscription services (Blue Apron, Hello Fresh, Home Chef, Plated, etc) in terms of which credit card would be best. Most of them offer a very similar price point per meal, so to some people (like our community), the extra potential ~5% or more by using the most optimal credit card might make a difference (and even if it doesn’t make a substantial difference in our budget, it might help lessen that feeling of anxiety we get when we aren’t sure if we are using the best credit card for our purchases). These services continue to gain popularity all of time, so having a resource like this would be very helpful… apparently I’ve read that some of them count as grocery purchases on SOME brands of card (but maybe not all brands), while some are just considered general merchandise, some are considered online purchases (AT&T access more, maybe?). Perhaps a table that shows the different meal services showing what the purchases code as on each of the different major brands of credit card would be the easiest format to understand. Might take some time to complete the table but hopefully with lots of user input we can put something useful together. Thanks!

Great idea!

I too preferentially use the Amex Hilton Surpass. I MS Hilton Diamond status every year at grocery stores. 40k *6 = 240,000 hilton points + diamond status. Especially since I can get Reloadit cards with a 3.95 fee instead of the standard 5.95 fee. Was even better in the age of the T-Mobile cards that made that process essentially fee free.

I thought you couldn’t use a credit card for the reloadit purchase. Is that not the case? Thanks.

I have been privileged enough to have a grocery store that even though they say cash only, the register allows them to be rung up. I just have to convince the cashier. It helps that a couple of years ago, they had some of the reloadit’s that did not have that text. Now, I buy a few grocery items with each card and do 2-4 cards per visit. I find that it helps to coach them and set the stage by saying, “I need to have these rung up on separate transaction with some of the groceries” or something like that and voluntarily take the card and put it in my pocket as soon as they swipe. The longer it stays visible to them they may notice the cash only line. When that does come up and they say something like “No CC for gift cards” because they do have a sign up that prevents VGC from being bought with CC, I’ll say something like, ok, but this isn’t a gift card, this is reload for my cell phone (when I had the t-mobile card) etc. Only been shut down by one cashier before – 20 year old good looking man. Those are the bane of MS. Unattractive? Success. Most women? Success. Non Caucasian? Success. My failures continue to be Caucasian young male cashiers. What ever the reason, this is my experience (I’m a 4x y/o Caucasian M)

Thanks for the info Carl and I’ll have to see if I have the same luck here. It really is a case of YMMV on the interaction with the different cashiers. I don’t have a profile on which ones work but I’m going to have to note which ones I’m more successful with to improve my odds.

If you shop at Whole Foods, use Chase Ink through Chase shopping portal for Staples Whole Foods gift cards which get 5x Ultimate Rewards, in fact I usually get 7x

What’s the 7x trick?

You get points/CB via portal for gift cards at Staples? I’ve never actually been awarded miles/points/CB via a gift card purchase.

Check the Frequent Miler Laboratory page for details. Some gcs work, but most do not.

Thank you!! I’ve bookmarked this and will be sure to use it. Question…does the new page include any temporary bonus categories?

Great question. No, it doesn’t currently include temporary bonus categories, but that’s a great suggestion!

Thanks again.

Based on valuations, amex prg should be on dining list as it gets 2x (3.6) at restaurants.

Good catch, thanks! Fixed.

? it’s the same (PRG isn’t on restaurant list)

The lists within this post are just screen captures of the page that has the full info. I haven’t updated the screen captures. You should see the full info here:

https://frequentmiler.com/best-card-category-bonuses/#Restaurants

I use HHonors surpass Amex for grocery, nets me x6 HHonor points; value those at about 2.5%. Unlimited grocery spend, Hilton Diamond status, and when combined with Giant Eagle Gas rewards for purchases, nets me another 3% value. Thats 5.5%, throw in random specials like double gas rewards for gift cards, or 1 right now for 60 cents off a gallon gas when buying a $100 VGC, that nets me 19.5% value.

Good points. There are many ways to stack extra rewards at grocery stores. Of course the techniques you describe (except for Hilton Diamond status) can be done with any credit card, not just the Hilton Surpass.

What is this current Giant Eagle promotion you speak of? Can’t find it anywhere.. Have a link?