NOTICE: This post references card features that have changed, expired, or are not currently available

Recently, Personal Finance Digest posted a summary of American Express’ no-fee business cards (see “Amex’s no-fee business cards have some good deals for consumers“). He posted the following table that does indeed show good returns on spend from these cards:

The first thing I did after seeing this post was update my page showing “Best rewards for everyday spend.” I previously had no idea that the Amex Blue for Business card earned a 30% bonus on points each year Update: This offer has expired and/or is not currently available at Frequent Miler.. That makes the card a solid, middle of the pack, everyday spend card. Then, I double checked my “Best Category Bonuses” page and found that I had missed a couple of entries for the SimplyCash card, so I added those.

Next, I wondered how these cards compared to those from other banks. I searched each major bank’s website for no-fee business rewards cards that offered more than 1% returns. Many cards offer no fee the first year, but this list is limited to those cards that never have an annual fee:

- American Express Lowe’s Business card

- American Express SimplyCash

- Amex Blue

- Capital One Spark Select

- Capital One Spark Miles Select

- Chase Ink Cash

- Chase Ink Classic

- Citibank CitiBusiness ThankYou

- US Bank Business Cash Rewards

Comparing cards

There are three things I look at when comparing credit cards:

- Welcome offer

- Earnings on spend

- Perks

Let’s dive into each…

Welcome Offer

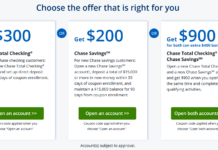

Cards with no annual fee often have no intro bonus at all. Of the cards we’re looking at, though, here are the ones with public welcome offers as of June 2013:

- https://frequentmiler.com/go/amex-blue-for-business-expired/ Update: This offer has expired.

- Chase Ink Cash: 20K Ultimate Rewards points

- Chase Ink Classic: 20K Ultimate Rewards points

- Citibank CitiBusiness ThankYou: 15K ThankYou points

Clearly the Chase Ink cards have the best intro offers of the lot. Note that you may receive better welcome offers through targeted mailings or by visiting a branch office.

Earnings on spend

Let’s look at the point earnings from each card:

|

Card |

Reward |

Base |

Gas |

Restaurant |

Office |

Cell |

Other |

| Amex Lowe’s | Points | 1% | 3X | 3X | 3X | ||

| Amex SimplyCash | Cash | 1% | 3% | 5% | 5% | ||

| Amex TrueEarnings | Cash | 1% | 4% | 2% | 2% travel | ||

| https://frequentmiler.com/go/amex-blue-for-business-expired/ | MR Points | 1.3X | |||||

| Chase Ink Cash | UR Points | 1X | 2X | 2X | 5X | 5X | 5X landline & cable |

| Chase Ink Classic | UR Points | 1X | 2X | 5X | 5X | 5X landline & cable, 2X Hotels | |

| CitiBusiness ThankYou | ThankYou Points | 1.03X | 3X rotating categories | ||||

| US Bank Cash Rewards Visa | Cash | 1% | 3% | 3% | 3% | ||

| Capital One Spark Select | Cash | 1.5% | |||||

| Capital One Spark Miles | Points | 1.5X |

Note that I didn’t list 2% earnings for travel with the Amex Blue for Business card (Expired) because that requires booking through the Amex travel service. You can get similar rewards from any card by going through cash back portals to book travel.

Ignoring variations in point values for a moment, we can see that different cards are best for different types of spend:

- Gas: Amex TrueEarnings 4%; Amex SimplyCash 3%

- Restaurant: Amex Lowe’s 3X; Amex TrueEarnings 2%; Chase Ink Cash 2X

- Office Supply: Amex SimplyCash 5%, Chase Ink Cash 5X, Chase Ink Classic 5X

- Cell Phone: Amex SimplyCash 5%, Chase Ink Cash 5X, Chase Ink Classic 5X

- Misc: Chase Ink Cash 5X landline & cable; Chase Ink Classic 5X landline & cable & 2X Hotels; CitiBusiness rotating categories 3%; Amex TrueEarnings 2% travel;

- All other spend: Capital One Spark Select 1.5%; Capital One Spark Miles 1.5X; https://frequentmiler.com/go/amex-blue-for-business-expired/ 1.3X

Best for category spend:

The Chase Ink cards have more bonus categories than any other card on the chart and earn 5X in several important categories. Even when they do not have the top earnings within a category, between them they offer at least 2X in all represented categories. Additionally, the Ink cards include landline and cable charges within their 5X categories. The Ink cards earn Ultimate Rewards points worth 1 cent per point. However, it is possible to transfer those points to a premium Ultimate Rewards card (Sapphire Preferred, Ink Plus, Ink Bold) and then transfer those points to airline and hotel programs for the chance to get much more value from those points.

If your business spends heavily on gas, though, you might do better with the Amex TrueEarnings Costco card that offers 4% cash back for gas.

Best for non-category spend:

The Capital One Spark cards offer 1.5% earnings on all spend. If cash back is your objective, then these cards are best (of the no-fee business cards). If you prefer points that can be transferred to airline programs, though, consider the https://frequentmiler.com/go/amex-blue-for-business-expired/ card that earns 1.3X Membership Rewards points. By itself, you wouldn’t be able to transfer points to airlines, but if you add a premium Membership Rewards card to your account (personal or business), your points will be upgraded to those that can be transferred.

Credit card perks

As far as I can tell, all of the evaluated cards offer various degrees of the basics:

- Extended warranty

- Fraud protection

- Travel insurance

- Car rental insurance

Here are some areas where they differ:

- The Chase Ink cards offer primary rental collision insurance, and they offer additional savings and perks through the Ink Insider’s program.

- The Amex cards offer American Express OPEN Savings (see Business card benefits). The OPEN Savings program offers automatic cash rebates when you use your Amex business card at various merchants (As long as you meet the criteria of each one. Check the fine print).

- The CitiBusiness ThankYou card offers a “personal business assistant” (concierge service).

- All MasterCards offer MasterCard Easy Savings (see Business card benefits). The Chase Ink cards are MasterCards. The CitiBusiness card gives you the choice of MasterCard or Visa. The Easy Savings program provides automatic cash rebates at various merchants including 1% cash back at all Fuelman network gas stations. These savings are in addition to points and cash back earned automatically with your credit card.

Overall, it appears that the Chase Ink cards offer the most in the way of extra perks.

Conclusion

Among the no-fee business cards, the Chase Ink cards (Ink Cash and Ink Classic) offer the best combination of sign-up bonus, category spend bonuses, and perks. If you don’t spend much within the listed categories, consider either the Capital One Spark cards that offer 1.5% everywhere, or the https://frequentmiler.com/go/amex-blue-for-business-expired/ which earns 1.3X everywhere plus offers decent perks and a small intro bonus.

This report focused solely on no-fee business cards. It’s important to note that there may be no-fee personal cards that offer more (such as the no-fee Fidelity Investment Rewards Amex which earns 2% cash back on all spend). Also, don’t dismiss business cards that charge a fee. Capital One, for example, offers a version of their Spark Business Card with 2% cash back for all purchases. This card comes with a $59 annual fee. If you were considering the no-fee 1.5% cash back Spark card, you would do better with the $59 card simply by spending $12,000 or more each year.

See Also:

- Best small business cards with annual fees

- The best mix of Ultimate Rewards cards

- How to sign up for Chase Ink cards

- Best intro bonuses

- Best Category Bonuses

- Best Big Spend Bonuses

- Best rewards for everyday spend

[…] June, I wrote “Best no-fee small business cards.” My intent was to quickly round this out with additional […]

Grado: I don’t know about international insurance. I would have to check the T&C

rxgeek: Isn’t that a personal card?

PaulG: Yes, the 2% cash back card from Cap one has an annual fee

Thanks all. Sadly, looks like the chase sapphire master card is a thing of the past.

I just Googled the capital one spark business credit card and found a link to a 2% cash back credit card. It looks like its working as a CS Rep “chat now” box popped up, but YMMV.

Although the Ink cards do offer primary insurance, they are business cards and your car rental must be for business use under the terms of use to be covered. Another choice would be the Sapphire MasterCard, which also provides primary coverage. In addition, that card covers rentals in Ireland and Israel, which most cards do not.

I know United Explorer card does because I just rented a car for my vacation trip.

Penfed Platinum Cash Rewards Visa for 5% off fuel.

You mentioned travel insurance. Do any of the chase cards cover that internationally? It would be nice not to have to pay extra for it on upcoming cruise.

@FM I think that I remember the coverage as being primary only for business rentals not leisure rentals.

I’ll be darned, I never noticed the Citi Business ThankYou card before.

Ha, if you were any other blogger, you could’ve set a world record for biggest affiliate link carpet bomb with this post. But seriously, why go for no-fee business cards when the banks helpfully waive their annual fees for their better cards? 😉

Do all Ink cards (Bold) get PRIMARY rental insurance?

JohnnieD: Yes, I believe that all Ink cards get primary rental insurance (if anyone knows otherwise, please let me know).

gbert: Not everyone likes to open and close card accounts regularly, so this post is mostly for those who prefer solid rewards cards with no fees