NOTICE: This post references card features that have changed, expired, or are not currently available

By Julian, author of Devil’s Advocate…

UPDATE: As of August 2015 new reports indicate that the shopping cart trick now results in a hard pull for all Visa cards issued by Comenity, which includes the Virgin America Visa. You may still be able to get this special $50 statement credit offer via the method described below, but applying for the offer will almost definitely result in a hard pull appearing on your credit report.

================================

The shopping cart trick has changed. Maybe. Or maybe not.

I actually didn’t know there was even the possibility it had changed until I started reading reports about it. Then I decided to try it personally and had a somewhat different experience. Which goes to show once again that successful points and miles techniques are a constantly moving target. What worked yesterday does not always work today, and as the kids say, YMMV. At least I think that’s what the kids say. I’ve gotten so old they won’t even tell me what they say anymore.

But first, for those of you who might not know…

What is the shopping cart trick?

Perhaps you’ve been in the middle of buying something online at a store like J. Crew or Victoria’s Secret. You put the items you want to buy in your online cart, and as you proceed to checkout and sign into your account with that merchant, a promotion pops up offering a credit card branded by that store.

In the past there’s often been a special advantage to these offers. When you applied for these cards the normal way, you’d get dinged with an inquiry like any normal credit application. But when getting approved via an online store checkout, it’d be done purely on the basis of a soft pull so no hard pull appeared on your credit report. Hence the term “shopping cart trick.”

Often the credit lines offered were relatively small (think $700 or $800), but it was still useful in picking up another account and extending your credit history at no extra cost in inquiries. So if you were new to the game and trying to expand your credit profile, or if you had suffered issues in the past and were working to rebuild credit, this was a valuable way to do it without getting hit with a credit pull.

Historically there’s been just one or two banks that offered the shopping cart trick, and unfortunately most of the merchant credit cards from those particular banks haven’t been terribly exciting from a rewards or travel perspective. Except…

The Virgin America Visa.

One of the main banks who specializes in shopping cart offers is Comenity Bank, and starting about 18 months ago they took over the Virgin America credit card portfolio from Barclaycard. Virgin America offers a loyalty program called Elevate that gives fixed-value redemptions on their own planes, which isn’t bad in and of itself if you can take advantage of their limited routes. But they also have a separate redemption system for their partners, which in some cases can be particularly useful.

Comenity currently offers two different flavors of Virgin America cards, with the standard offer being 10,000 bonus points for the cheaper $49 annual fee “black” card and 20,000 bonus points for the more expensive $149 “white” card. It’s important to note that in both cases the annual fee is not waived for the first year on these standard offers.

Some folks have recently received targeted offers of 20,000 bonus points for the $49 version, which is a good choice if you’re looking for extra Virgin America points. But that offer appears limited to those who have been targeted or who apply while on an actual Virgin America flight. Will at Doctor of Credit, who is becoming such a regular friend and neighbor to this column that I may start going over to his house and asking to borrow his weed wacker, has written about those targeted offers here if you’d like to know more about them.

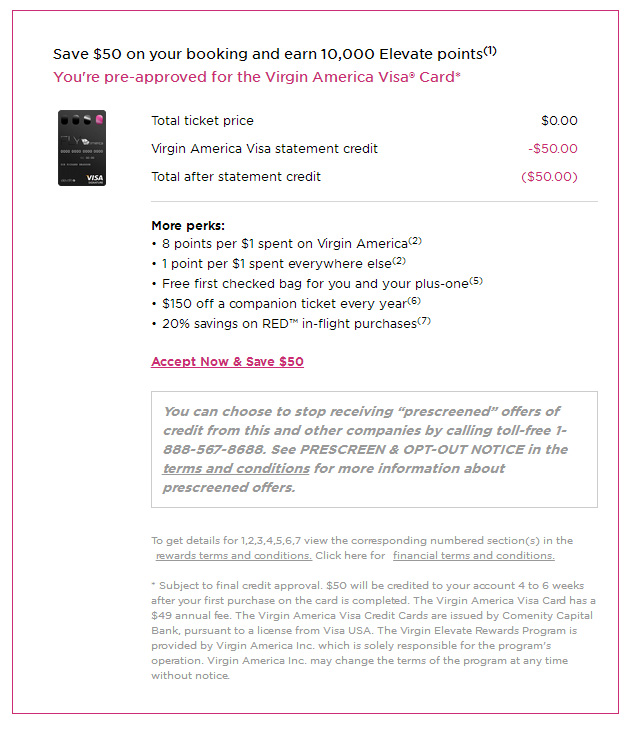

But if you can’t get targeted or if cash is more important to you than points, there’s currently an offer for the Virgin America Visa available via the shopping cart trick that offers the standard 10,000 points plus a $50 statement credit.

It’s a little tricky to get the offer to appear and I can’t guarantee it’ll work for everyone, but the steps I used successfully are as follows:

1) Create an Elevate account at virginamerica.com. Having an account or signing up for promotional offers is usually necessary to make the shopping cart trick work. As with most loyalty programs, it’s free to sign up. Create your account, making sure your name and address info matches the name and address that appears on your credit reports, then sign into that account.

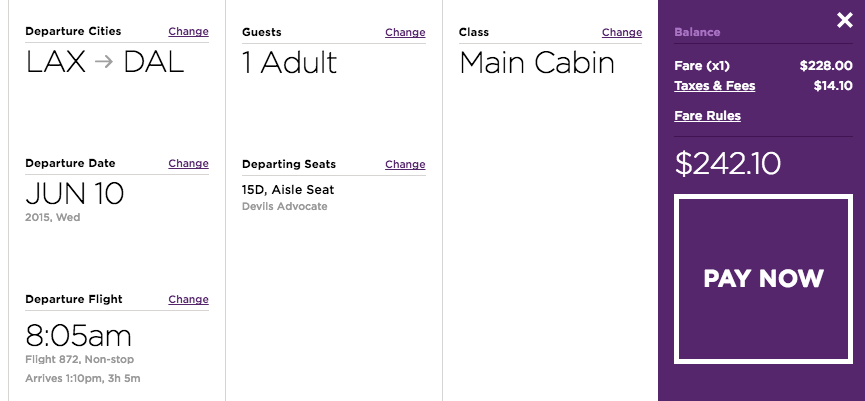

2) Pick a flight, any flight. Seriously, it doesn’t matter. Just search for any route on Virgin America, choose a flight, and pick a seat as if you’re going to book it so that it’s loaded into your “shopping cart” and ready for checkout.

3) In order to get the Virgin America card offer to appear, you’ll need to click “Pay Now” and actually add a credit card to your booking as if you’re going to pay with it. But between the step in which you add the credit card and the step in which you complete the purchase, the offer we’re looking for will hopefully pop up on the right side of the screen…

Note that this offer does not require you to complete the purchase of your Virgin America flight. You only have to use the card to make a purchase anywhere in order to get the $50 statement credit. There is a $1,000 spend requirement to get the 10,000 Virgin America points, which is identical to the standard offer.

4) Click on “Accept Now & Save $50” and you’ll be taken to the simplest credit card application you’ve ever seen. Your name, address, phone number and e-mail will already be populated from your Virgin America Elevate account. There’s an option to edit this information, but I can tell you from personal experience that if you change it here, you’re likely to not get approved. So make sure it’s correct in your Elevate account before you start.

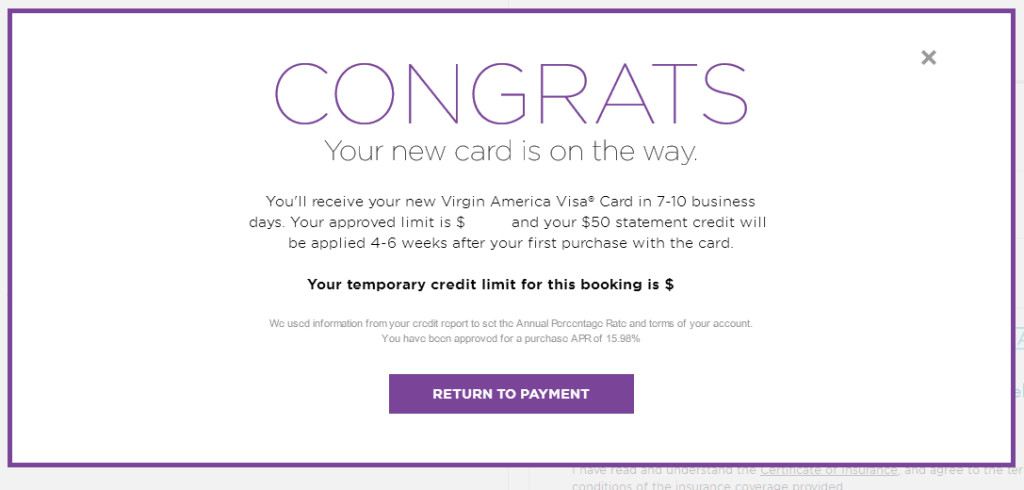

The only other info that Comenity is looking for is your date of birth, the last 4 digits of your social security number, and your annual income. That’s it. Click the “Submit” button and after a few moments, hopefully you’ll see something like this…

If you actually want to book the Virgin America flight you’ve selected, Comenity even gives you a temporary credit line to complete the transaction without having the actual card in hand. Of course, if you don’t want the flight, just close the booking window without clicking purchase and you’re done.

Interestingly, the first two times I tried this, I changed my address in the middle of the process and ended up getting a message that my application was under review and that I would be notified by mail within 10 business days. And both times I never heard a thing. No letter, no e-mail, no credit pull. No nothing. Apparently if you’re not approved, it’s as if you never even tried to apply. There wasn’t even an application number to call in and find out what happened. Only when I corrected the address in my Elevate account before starting and let the process unfold without changes did it work fine with an instant approval.

But what about the credit pull?

That’s the big question. It’s certainly nice to get that $50 statement credit to offset the first year annual fee, but did we just get a Virgin America card with only a soft pull?

Here’s the answer… yes, but it’s not a sure thing. NO. (See the update at the beginning of this post.)

Apparently sometime this past January, reports started to come in that Comenity was doing hard pulls even on applications completed using the shopping cart trick. However, some people still reported only getting a soft pull. I can report that I personally did not get a hard pull for this application on any of the three credit bureaus (and yes, I checked them all). I will say I’m a bit surprised, but inquiries tend to show up immediately and all of my reports are clean several days after the fact. (UPDATE: As of August 2015, all Visa cards issued by Comenity result in a hard pull, even with the shopping cart trick).

So, is the shopping cart trick dead? With cards issued by Comenity, it seems the answer is not quite, but it’s not something you can definitely count on. The best advice at this point is to only apply for cards you really want, even via the shopping cart trick, and if you’re lucky you might get a little extra icing on the cake.

Other Recent Posts From The “Bet You Didn’t Know” Series:

Two tricks for chasing Hyatt Diamond status (and 1 that won’t work)

An overlooked no-fee Club Carlson credit card

A shared secret about Amex credit pulls, plus an Offersbot update

Find all the “Bet You Didn’t Know” posts here.

I used the shopping cart trick for victoria secret the other day and it was not a hard pull. I’ve checked all 3 credit reports.

[…] “A $50 credit on the Virgin America card using the shopping cart trick” (98% learned a new tip) […]

A note about the premium card. One of the premium benefits for paying the $150 annual fee is “No Fees Period”. I have discovered that if you try to change or cancel a ticket purchased with Elevate points you are still on the hook for a $100.00 redeposit fee if you want your points back.

In my opinion “no fees period” is a false and misleading statement.

[…] A $50 credit on the Virgin America card using the shopping cart trick […]

I’ve gone to at least half the cards on the Comenity list and not once has the SCT worked. Any advice?

I was approved for this shopping card trick this morning but I haven’t checked if it was a hard pull or soft pull. My question is, what if I want the premium card? I think i was approved for the regular visa but I would like to have the premium card. Should I just call and have it upgraded? 🙂

I was approved for this shopping card trick this morning but I haven’t checked if it was a hard pull or soft pull. My question is, what if I want the premium card? I think i was approved for the regular visa but I would like to have the premium card. Should I just call and have it upgraded?

[…] ‘Shopping Cart Trick’ may work for the Virgin America card, so you may get a $50 bonus and may even avoid a hard credit pull (FrequentMiler). You may be able […]

[…] Bet You Didn’t Know: A $50 credit on the Virgin America card using the shopping cart trick by Frequent Miler. I’m definitely in the didn’t know category for this one. If you’re unfamiliar with the shopping cart trick I’d recommend reading our primer first. […]

Got the offer to pop up, accepted it and only put in last 4 digits. Next morning I saw hard pull on my credit report. Still worth it imo but be wary.

What credit bureau did they pull?

Hmmm…I’ve tried this twice now with my CSP and my Arrival+, and the offer does not pop up for me.

Any thoughts?

Hey Julian,

My mom was targeted for the 20k-30k offer via e-mail. Any data points on applying directly from inbox as far as it being a soft or hard pull?

My 3 year old daughter got a mailer for the 20k/30k offer…don’t think I can use it.

Can they even do a hard pull with just the last 4 of your social?

JW: You shouldn’t really worry about age of credit for this. If you got a soft pull and signed up for a no-fee card the same day with a hard pull, then in 10 years when the Virgin card falls off, you’ll still have 10 years history with the no-fee card.

I didn’t think they could do a hard pull with only the last 4 digits of your SS# either, but there are in fact a few reports that it’s happened. Not sure how that could be, but it’ll definitely be interesting to get more data points as time goes on.

I want to get targeted for the higher point offers…any tips? 🙂

No guarantees, but I suspect you can increase your odds by creating a Virgin America Elevate account and opting in to their e-mail promos and offers. Again, also make sure your name and address are identical to how they appear on your credit reports.

My problem is that the average age of my cards is too short. Unless these cards can be downgraded to no annual fee cards later on, having no hard pull doesn’t help me that much. But still, thank you for this interesting post!