NOTICE: This post references card features that have changed, expired, or are not currently available

Note: On January 8, 2015 American Express sent out a notice to a large number of Bluebird & Serve cardholders informing them that loading capabilities on their accounts had been terminated. For more information, see: Amex kills Bluebird and Serve for manufactured spend

American Express’ Bluebird card is special because it can be loaded with money from Vanilla Reload cards (which can be purchased at some stores with a credit card), and then it can be used like a checking account to pay bills or to withdraw money at ATMs.

The Bluebird Member Agreement says that MoneyPass Network ATMs are free for Bluebird card’s receiving direct deposit. Specifically, it says, “To qualify, at least one Direct Deposit payment must have been received in the thirty (30) days before the ATM transaction.”

That’s what the Member Agreement says, but that has not been my experience. It has been many months since I last initiated a direct deposit to my Bluebird account, but I recently visited a MoneyPass ATM to withdraw money. As you can see below, no fees where charged:

The display on the ATM told me that the ATM would assess a $2.50 fee, but (as expected) that wasn’t charged either.

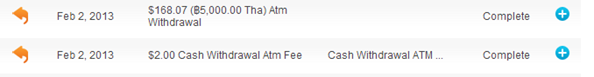

What about non-MoneyPass ATMs? In February I used Bluebird at an ATM in Bangkok. The ATM itself didn’t charge a fee, but Bluebird charged me $2:

So, from my admittedly very small sampling, it looks like MoneyPass ATMs are free to Bluebird cardholders regardless of whether any money has been direct deposited to the account recently.

Reader Experiences

Have you tried a MoneyPass ATM with Bluebird? Were you charged a fee? Had you direct deposited any money in the prior 30 days?

Note: I’m on vacation this week, so please forgive me in advance for not answering comments.

Can you find out if I can use the atm card in Myanmar? I would really appreciate it.

Speaking of Aeon Bank, if you’ve used their ATMs in Thailand, Hong Kong, or other countries, don’t expect them to be the same in Japan; their Japanese ATMs only take Japanese cards and UnionPay cards.

When in Japan, look for a 7-ELEVEN store. They all have fee-free ATMS and take U.S. credit cards.

I’ve been transferring $1 every month from my checking account into Paypal, then from Paypal into Bluebird, which shows up as a direct deposit. It sounds like that is unnecessary although it is easy and costless.

I don’t remember the bank I used in Bangkok. It was the one that was right in front of me at the airport after I passed through the immigration line.

What bank’s ATM did you use in Bangkok that didn’t have a fee for using a foreign card? I always use my Schwab ATM card in Bangkok to get the fee reimbursed. The Thai ATMs always deducts a 150 baht fee, but Schwab pays that back at the end of the month.

Did you use an Aeon Bank ATM? That’s the only one I’ve seen in Thailand that doesn’t charge a fee on foreign cards.

@frequent churner:

Set up a Schwab account. Get their ATM card. They reimburse ANY fees associated with ATM withdrawal including foreign exchange transaction fees and differences in exchange rates so no cost to do withdrawal.

Identical experience for me as well.

О трахнуть телку на природе и кончить ей в лицо а также молодой господин трахает старую служанку услишать не хоти те ли?

curious where you found a free ATM in BKK?!? what bank? i’ve spent a lot of time in BKK but never stumbled upon a free ATM…

as to bluebird MP ATM: same same- never charged even when i’ve missed my 30 day paypal ‘DD’

Anybody know the max you can withdraw from an ATM at once with BB? (Assuming no limits placed on the ATM form the bank)

when i was on the phone with them earlier today, they pretty much said it was up to the amount on your card, but depending on the limits the ATM being used had in place. vague enough IMO that one may have to fiddle with the withdrawal amounts until it gives you money. (had an issue with an ATM with another card, where it could only give me $160 instead of the $200 i asked for b/c it was running out of money. never seen that happen before.)

@Grado – you set it up in your BB account online.

Where/ how do you get a bb pin?

I never did a direct deposit and was charged $2 at the ATM

yes, you need to have an PIN when making cash withdrawals at an ATM.

i had great success using BB for cash at an ATM in New Zealand last fall. i will be attempting to use it in Japan, next week. even with a $2 fee, the exchange rates seemed to be quite fair and exactly what XE had posted within minutes of my withdrawal last fall.

What is the maximum amount that can be withdrawed?