Are the rumored Bonvoy Brilliant changes real? Yesterday Marriott and Amex may have tipped their hand when they unveiled limited time enhanced welcome bonuses for their Bonvoy cards. In particular, the Bonvoy Brilliant welcome bonus now includes an 85K free night certificate. Where have we heard of such a thing before? Oh yeah… among the rumored upcoming changes to the Bonvoy Brilliant card (which I detailed here) was the idea that the card would offer annual 85K free night certificates instead of 50K as they do today.

To be clear, the new Bonvoy Brilliant welcome bonus doesn’t promise earning 85K free night certificates each anniversary. The details still say that the annual certificate is 50K. But here’s the thing… 85K free night certificates have never existed before. Now they do. To me, that lends extra credibility to the rumors in general…

Rumored Changes

I detailed the rumored changes to the Bonvoy Brilliant card in the post “The Rumored Marriott Bonvoy Brilliant Card. Is it worth $650?” Please see that post for full details and analysis. For now, though, here’s a summary of what would change if the rumors are true:

| Rumored New | Current | |

|---|---|---|

| Annual Fee | $650 | $450 |

| Statement Credits | $300 Dining ($25 / Month) | $300 Marriott Spend |

| Free Night Award | 85K Certificate | 50K Certificate |

| Free Night w/ Spend | 85K Cert after $50K Spend | N/A |

| Annual Card Choice Award | After $50K Spend: Choose 50K points, 40% bedding discount, gift set, gift Gold status, or 15% off Ritz Yacht Collection | N/A |

| Automatic Elite Status | Platinum Elite | Gold Elite |

| Elite Status w/ $75K Spend | Titanium Elite | Platinum Elite |

| Automatic Elite Credits | 25 Elite Nights | 15 Elite Nights |

| Earnings from Spend | Same as current | 3X airfare charged by airline; 3X US restaurants, 6X Marriott; 2X on all other eligible purchases |

| Travel benefits | Same as current | Priority Pass Select with 2 free guests + Global Entry fee credit |

85K free night certificates

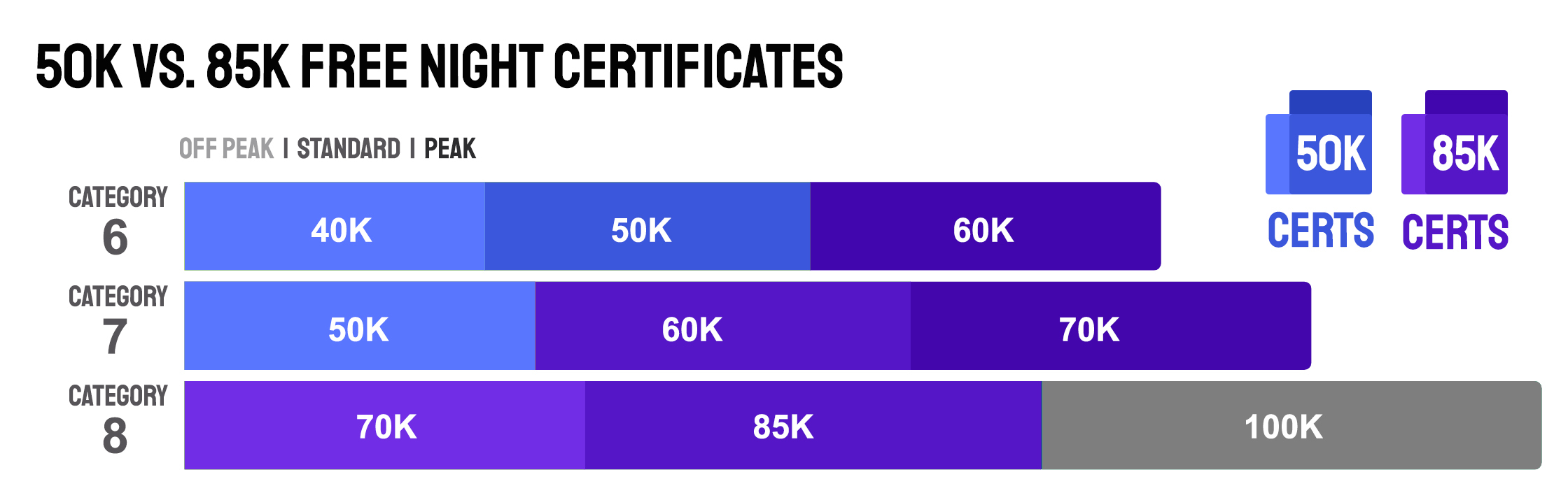

85K free night certificates are way more useful than 50K certs. 50K certs can be used at any hotel up to category 5, or category 6 hotels at off-peak or standard pricing, or category 7 hotels at off-peak pricing. Sometimes you can get great value, but it can also be hard at times to find a desirable property that meets those conditions. With an 85K cert, though, all category 1-7 hotels will be fair game and even category 8 hotels would be bookable except when peak priced.

50K certs can often be used at excellent hotels, but they can be extremely frustrating when category 6 hotels of interest are peak priced. With 85K certs, we’ll be able to book almost any Marriott hotel in the world.

When will the new features kick in?

If the rumors are true (that’s still a big “if”), my bet is that the new card structure will be unveiled in early November. The reason is that the current enhanced welcome bonus is valid through November 3rd 2021. If Amex is going to increase the annual fee, they’ll wait until after the current offer is over.

UPDATE: VIS points out that the Bonvoy Brilliant card is already earning $20 per month through December 2021. This leads me to believe that the card changes won’t happen until January 2022.

Now or later?

Assuming you can qualify for the current Bonvoy Brilliant welcome bonus, it may seem like a no-brainer to go for it while its available. After all, it’s the best bonus we’ve ever seen for this card. And, if the rumored changes are true, by signing up with the current offer, you’ll lock in a year with the lower $450 annual fee. Plus, you’ll still get all of the enhanced benefits once the changes kick in.

On the other hand… If the rumors are true, I think it’s very likely that Amex and Marriott will unveil the changes alongside a new and even more compelling welcome bonus. It wouldn’t surprise me to see something like 150,000 points plus three 85K certificates. Or maybe five 85K certificates and no points. These are obviously just guesses, but I do believe that they’ll have to unveil a big and compelling bonus in order to get people to look past the $650 annual fee.

I’m not eligible to sign up for a new Bonvoy Brilliant card, but if I was eligible I’d probably wait to see what happens. But either way is a gamble. Worst case for those who wait would be that Amex would increase the annual fee and offer a smaller welcome bonus. I don’t think that combination is likely, but it is possible.

UPDATE: Thanks to a conversation in the comments of this post, I’ve changed my recommendation. For those eligible, your best bet is to sign up for the current offer, ideally close to when the offer expires (i.e. before November 3rd 2021). The reason is that the current Bonvoy Brilliant card offers $300 in Marriott hotel credits per membership year. If you sign up while that’s in place, you’ll have 12 months to use those credits even if the card is changed as rumored. And if the rumored change does happen, you will likely be able to double dip. I expect that the $25 per month dining credits (which replace the $300 per year Marriott credits) will be available to you as soon as the card changes are implemented. Depending upon how quickly that happens after you sign up, you might get about 10 months of dining credits ($250) along with your $300 in Marriott credits. Another way to look at it: the current offer is about $450 better than it appears when compared to whatever offer comes out with the revised card: $200 lower annual fee first year, plus $300 in Marriott credits, minus a couple months of dining credits ($50). The new offer may be better than the current offer, but will it be more than $450 better? It might be, but that’s a heck of a gamble.

Are you eligible?

Marriott has bizarre rules about which cards and card bonuses you may be eligible for. The post “Are you eligible for a new Marriott card?” breaks down the rules into readable chunks. But for those who aren’t interested in clicking through to that post, here’s the relevant section for the Bonvoy Brilliant card…

Navigate this chart to figure out if you qualify. If you answer “No,” to all of the following questions then you should be eligible for the Bonvoy Brilliant welcome bonus…

What do you think? What will you do?

I’m interested in hearing what others think. Do you agree that the emergence of 85K free night certificates suggest that the rumored changes are more likely to be real? And, if you’re thinking of signing up for a Bonvoy Brilliant card, will you go for the current offer or wait and hope for better? Please comment below.

would like to apply, for the business as well…got the dreaded pop up! 8/24 or so. Been spending on Platinum P1. Not P2 so much. Does P2 lack of spending affect P1?

I’d be VERY surprised if P2’s spending has any effect.

Did you get the pop up for the business card or the Brilliant?

Good to know.

Both. I just tried the Brilliant yesterday – popup.

P1 (me) –

AmexPlat – reg spending, will renew for $550.

ED card – not much these days – used to get more. Little since I got AmexPlat late last year.

Aspire (free/$95 upgrade offer) – not much – decided I need to spend more on this too

Old Marriott (The gray colored one, used to be SPG) – not much – but planning on putting more

Delta Gold – not much, not sure if I will keep past next renewal next year.

So bottom line. 1 CHARGE card with regular spending, but my FOUR credit cards have been getting minimal spending. So if I increase on my CREDIT cards, maybe this will help get out of popup jail?

A couple months ago I canceled my Amex blue to free up a spot. Had that for many many years.

Its hard to say. My son has been trying to get out of pop-up prison with spend on a consumer card in each of the last 4 months, but so far no luck.

Getting it now. Zero interest in a dining credit. Would rather have Marriot credit and lower fee. Anyone with referral yet?

Have had the Brilliant Card since it was first introduced. I will likely retain it unless some yet to be revealed negative surprises are in the new terms and conditions.

If one were to product change Ritz-Carlton to a lower tier Chase Marriott card to qualify for this offer, is there anything that would prevent you from product changing back to the Ritz-Carlton after being approved for Bonvoy Brilliant welcome bonus?

Follow up question: If you product change Ritz Carlton to Bonvoy Bold, would that trigger “Have you acquired any of these cards in the past 90 days?” since it’s a product change to the Bold and not a new sign up? If it does trigger that condition, are there any cards you could product change RC to for eligibility to apply in 30 days or do you just have to cancel?

To answer your first question, I don’t think there’s anything stopping your from product changing to one card and then back. However, to answer your second question, the way I read the requirements, a product change would probably count as having acquired the card. It seems like the only sure way to become eligible is to cancel the Ritz card and wait 30 days, but that’s risky if you hope to get the Ritz card back in the future. I don’t have a good solution for you.

I guess I’ll be the guinea pig toward the end of next month, having downgraded from Ritz to Bold last week. I read “acquired” as new card, not product change, largely because the restriction appears to be intended as a backstop for the limitation on getting a new bonus if you’ve received a bonus in the past 24 months (i.e. it’s there to catch applicants who are working toward a bonus but haven’t received it yet). But the wording is ambiguous and I could be wrong. If I am wrong, it should be safe to go ahead and apply in the expectation that Amex will warn me rather than just accepting the application and then denying the bonus, correct?

Yes, correct. Please let us know what happens

Are there data points indicating Amex might allow a bonus on this card earlier than expected, i.e., less than 24 months after a chase card bonus? I ask because last year, Chase gave me a bonus on the Bonvoy Bold when I wasn’t eligible for one, only 60 days after getting the Amex business Bonvoy card.) It seems like the chase and Amex systems might not always talk to each other.

I haven’t heard such datapoints before yours. Very interesting.

Got a “no bonus for you” popup 30+ days after downgrade, which is pretty good evidence that your interpretation is correct and mine was wrong (the other possibility being crappy IT).

Does anybody know if you sign up now, if AMEXP would hold you to the 50,000 reward night for 2022 and beyond? I know that some people get value out of the 50,000 reward night but after a lifetime of travel, I’m into aspirational properties only.

No, if they do change it to an 85K annual night in the future, I expect that all existing cardholders would get that benefit too (along with the bigger annual fee)

RIP Chase Ritz. You had a good run, but I’ve never managed to use a Ritz upgrade certificate, and the family Priority Pass collection doesn’t get enough use to make up for all the Amex goodies I’ve been missing. Now to wait out the 30 days.

I think I’m right there with you

My calculation is different. I use at least one Ritz upgrade cert per year (at the Pentagon City Ritz while attending an annual business conference). I also get great use of the AU priority passes – for my wife and two adult sons. This is a card that, at a $450 AF, stays in my wallet. I also occasionally use the $3k spend for 1 elite night credit to make sure I continue my string of yearly re-qualifications for Platinum (or Titanium) status. I need only two more years to get lifetime Bonvoy Platinum status. Only hope that Chase/Bonvoy does not: 1) discontinue the card altogether, or; 2) ruin it by increasing the AF and issuing 85k, instead of 50k, free nite certs.

I don’t think Chase has ever raised the annual fee on a discontinued card, or modified it very much for that matter. I personally wouldn’t mind if Chase raised the annual fee and included platinum status and an 85k cert. Again, I doubt this would happen. If Marriott has an agreement with Amex to carry the high-end card, I would think making Chase’s Ritz Carlton card more appealing would hurt their agreement with Amex. I think they matched Amex when it was first discontinued to keep those who just got the card content. Overall the card had a short life. I do use club upgrades and airline incidentals, so I am still getting value. The 50k certs are quickly becoming harder to use at higher-end properties. On the other hand it would be nice to have a current card that is still getting attention and being revamped.

I ALMOST feel bad for springing for the 100k + 25k at first year renewal + Platinum offer on this card.

Then I remember that I grabbed it in December 2020 and will get a second year of Platinum fairly easily, and $220 in dining credits for 2021. Their AMEX offer for an extra 1x per $7500 in spend moved the needle a bit as well (to where this card was a reasonable fallback for a 2% cashback card on general spend considering you got $520 of that spend “for free” as Marriott/dining credits).

I don’t know if the Brilliant value prop works for me as a $650 card the same way as a $450 card, especially with the Marriott rebate becoming a dining rebate.

It effectively becomes “prepay $350 for a room almost anywhere in the Marriott system” and crowds out dining spend on better cards (AMEX Gold/Green).

Hi Greg, great article. We have the Chase Ritz and are into aspirational properties and have found the 50,000 reward certificate pretty useless. FYI, the Ritz in FLL is good to use but it has to be in offpeak. We are actually thinking about downgrading so your article was very relevant for us. In your chart above, were you referring to a Ritz AmEXp? It wouldn’t seem logical that AmEx would deny you a bonus because you got a Chase bonus in the past.

No, the chart does mean the Chase Ritz card. Marriott forced Amex and Chase to work together with these eligibility rules.

It never made sense to me that they thought 50k certificates were appropriate for the customer segment they are targeting with their $450 fee. A free night at a residence inn is not driving the behavior of someone with the money to throw 450 at a credit card fee.

When the new program launched, 35k certs covered some great full-service hotels and 50k certs covered some real lux properties. Then they moved every property up 1-2 categories over a few years. Combined with peak pricing, I agree the 50k cert is not compelling

Agreed, the certificates ideally need to be adjusted for award chart inflation from time to time. That would keep the cards potentially relevant for their intended target markets.

We are already getting $20 restaurant credit on current card till December 2021.

Great point. I’ve updated the section about when the card changes are likely to now predict January. I don’t think they’ll risk overlapping the dining credits.

I like to downgrade and then (re)upgrade with the Brilliant card. Just upgraded back to it in July, with annual renewal date in August. Looks like another round of downgrade coming up sometime next year just before the new AF kicks in (assuming your predictions pan out).

I would be interested in an article looking at upgrade/downgrade strategies (especially with the Marriott and Hilton premium cards).

Just got a sweet upgrade offer to upgrade my (previously downgraded from Aspire) Hilton HHonors card. $3k spend over 3 mths for 150k pts to upgrade to Surpass. Took it, and am also going for the $15k spend to bag another (unlimited) free nite cert. Sweet!

Did you get an upgrade offer to the Brilliant, or did you just upgrade for no points? I’ve been sitting on this Marriott Amex card hoping for an upgrade offer for almost 2 years.

Upgraded w/o a bonus offer. Did so as timing allowed me to capitalize on $300 credit at Marriotts 2x – once in July (then new member year started in Aug) and another in September, for a $600 credit with AFs of less than $500 (i.e., $450 for this year, and an added pro-rated AF increase for last year of $42).

Great strategy. I just upgraded to get $300 credit for upcoming stay in October. Unfortunately, my renewal is not till February so pro rata fee will be about $150 and then $450 but I will get $600 refunded plus 50k night.

FYI: I updated my recommendation in the post based on the conversation started by Travelin’Dandy. When considering the lower annual fee for a year plus the likely overlap between the $300 in Marriott reimbursements and the $25/month dining credits, signing up under the current offer seems like the winning approach.

I got mentioned by Greg! My day is made…thank you:)

No way they’d offer three+ 85k certs AND points. That’s many thousands in value. Absolutely no chance. Well… it is Amex, so I guess I’m crazy for saying never.

I’d take a guaranteed 150k + 85k cert (easy 2k+ Value) at $450 AF over the unknown, possibly marginally better offer at $600+ AF. Plus you reset your Marriott SUB clock sooner if you act sooner.

My Brilliant personal card renewed in August; I used the $300 credit at a stay earlier this month. So it would be great in the short term to double dip with the new dining credit starting in November (presumably) but overall I dislike the new structure/AF and might end up canceling the card long term.

I canceled my AMEX Plat in July due to the coupon book nature and higher AF — having to remember to use credits each month takes mental energy (and the Uber Eats credit was break even with tip and higher prices; not really a Saks customer).

I am thinking about signing up for (and keeping) the AMEX Bonvoy Biz card since it will get me over the Titanium threshold this year and that’s a juicy bonus with a reasonable long term AF (offset by free night cert) without the coupon book BS!

The real question for me is do I get the $300 statement credit until my second annual fee? because if you apply now technically you should get it for 2021 and you would have a statement credit in 2022. along with the sign up bonus that makes it compelling. but if you don’t get the statement credit in 22 then I don’t think I would sign up for this.

The $300 statement credit is per membership year so you would have one $300 credit until your renewal date in 2022. My bet is that the monthly dining credits would kick in as soon as the changes happen and so the two credits would overlap for a while.

Oh, its membership year? Still might do it for the 85K cert but I wouldn’t renew.

Good point. So this offer already has $500 more value (lower AF and credits) going for it. I will take it. I admit the potential offers you speculated are better, but only by 1 FN in my opinion. Not worth the risk imo.

FYI currently the annual $300 Marriott hotel purchases statement credit is per card anniversary year not per calendar year. Jim E