Capital One has long been one of the most enigmatic banks to get approvals with. It’s fairly easy for most folks to get a first card (outside of Greg the Frequent Miler), but things tend to get tricky after that. The application paths are strewn with instant denials for 800+ credit score, never-missed-a-payment, model citizens.

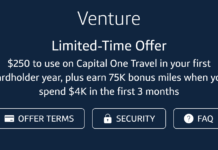

Now, Capital One has given us a little more direction as to why they’ll deny us, adding a “48 month rule” to all of their personal cards. This was pointed out to us a couple of weeks ago by our buddy Zac Hood over at Travel Freely, but the new terms initially seemed to affect the Venture X and Venture Rewards cards only. Now, it’s seemingly been expanded to the entire portfolio of consumer C1 cards. At this point, business cards seem to be unaffected.

Quick Thoughts

In the disclosures portion of Capital One applications, the terms regarding eligibility for welcome offers used to say:

Existing or previous cardmembers may not be eligible

Now, personal cards list the following:

Existing or previous cardmembers are not eligible for this product if they have received a new cardmember bonus for this product in the past 48 months

It’s hard to know if this represents a new policy for C1, or if it’s simply writing down what’s already being done behind the scenes. I’ve heard anecdotal reports of people churning the same card in shorter timeframes before, but that could have been the exception and not the rule. Regardless, it’s in writing now and will undoubtedly be enforced.

Most folks who’ve been dancing with the churlish bank in the past will respond, “Same card?! I’ve been trying to get a second card for years and am still pounding sand!” And so it goes with Capital One. Both Chase and Citi have 48 month rules for some or all of their cards and Amex has a “once-in-a-lifetime” rule. However, all of them are still fine with folks broadening their portfolio of cards within the issuer. They’re simply trying to keep folks from churning the same card over and over again. C1 seems to not like us doing either one.

It would be nice if these official, “same product” terms came with a softening of the approval odds for folks trying to get a 2nd or (gasp!) 3rd card with the bank. But I’m not holding my breath.

Capital One Application Tips

Capital One Application Tips

Call (800) 903-9177 to check your application status |

I started with a spark business card in 2019, and now have the Spark Business and 4 Personal cards through Capital One ♂️ below 700 credit and a ch7 bankruptcy discharged 2018……

FWIW, JUst this last week got my THIRD Capital One card. I had two, a Venture card (no fee) and a Quicksilver card (no fee). I used both VERY minimally for years (abt $4 per month on Patreons to keep them active).

Finally pulled the trigger and got instant approval on Vanture + Plus, or whatever you call that $395 fee card. 30k CL, too. No idea why but this was a week before the 48 month rule clarification.

Nice! You should be our C1 sensei.

At least a little more clarity with Capital One. Now they need to let Greg about the special 48-Year rule applied to his account!

LOL!

I got hurt. Had spent all my 401k just trying to hold on. I was in foreclosure. It was not a good time. Capital one stopped my credit but never sold my account to a collector. I finally got assistance and paid most of my bills. After 6 months I got my disability. But I paid two months of payments and capital One reinstated my credit.

Is the 48 month rule for the same card only or anything within the same family of cards? I had the applied for the venture x a year ago and canceled it this year. Can I apply for another venture card or will the 48 mos rule block me?

can I APPL FOR ANOTHER CAPITOL ONE CARD I HAVE ONE ALREADY BUT I NEED ONE FOR BUSINESS

Yes, nothing has changed (so far) with business cards.

According to the rule, it shouldn’t affect the Venture (as it’s a different product). That doesn’t guarantee an approval, of course, but it shouldn’t be an obstacle.