NOTICE: This post references card features that have changed, expired, or are not currently available

When I sat down to write this post, I expected boring results. I wanted to write a post about Capital One Travel since Capital One Venture X Rewards Card cardholders get an annual $300 travel credit for travel booked via Capital One. I expected the Capital One portal to be reliably overpriced on hotels (which isn’t a huge deal to me since I could use my travel credit on flights in a normal word). I was wrong. I tried a bunch of random stuff and while many hotels were not any cheaper through Capital One than through other channels, I was really surprised at how good the Capital One Travel Portal is in some instances, particularly considering the flexible cancellation policies. If you have a Venture X card or are thinking about getting one, check this out . . .

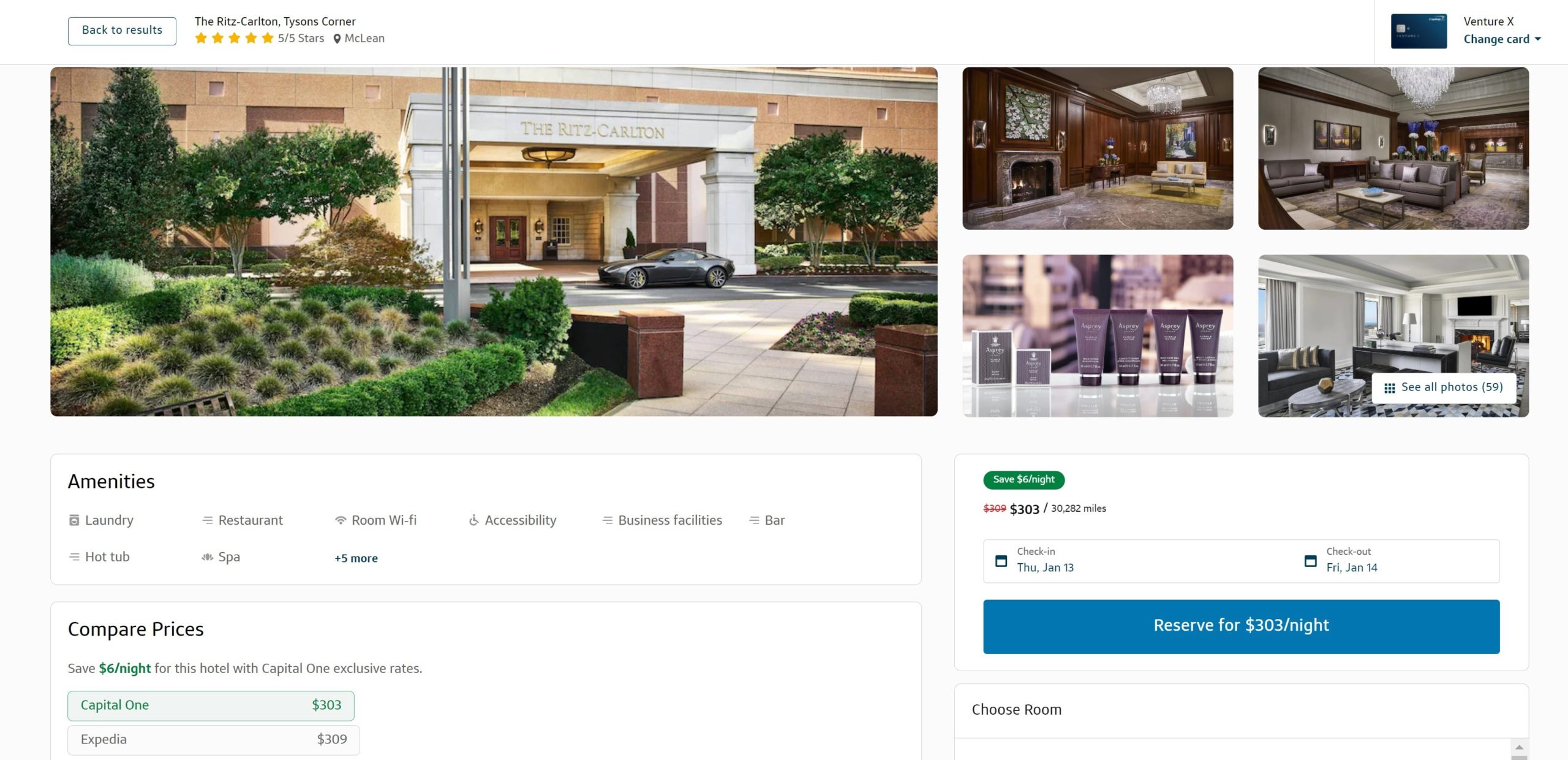

Ritz-Carlton Tysons Corner

A couple of months ago, I enjoyed a nice one-night stop at the Ritz-Carlton Tysons Corner booked via Amex Fine Hotels & Resorts. The Ritz came to mind to check via Capital One and I looked up a single night later this week.

For the night I tried, Capital One Travel showed its rate of $303 for the evening, beating Expedia by $6.

While not a huge savings, it did turn out that $303 was also $6 cheaper than the price through Amex Fine Hotels & Resorts. Obviously you’d get a $100 hotel credit, 4pm late checkout, and free breakfast for two via Fine Hotels & Resorts, making that a much better deal than Capital One Travel in this case.

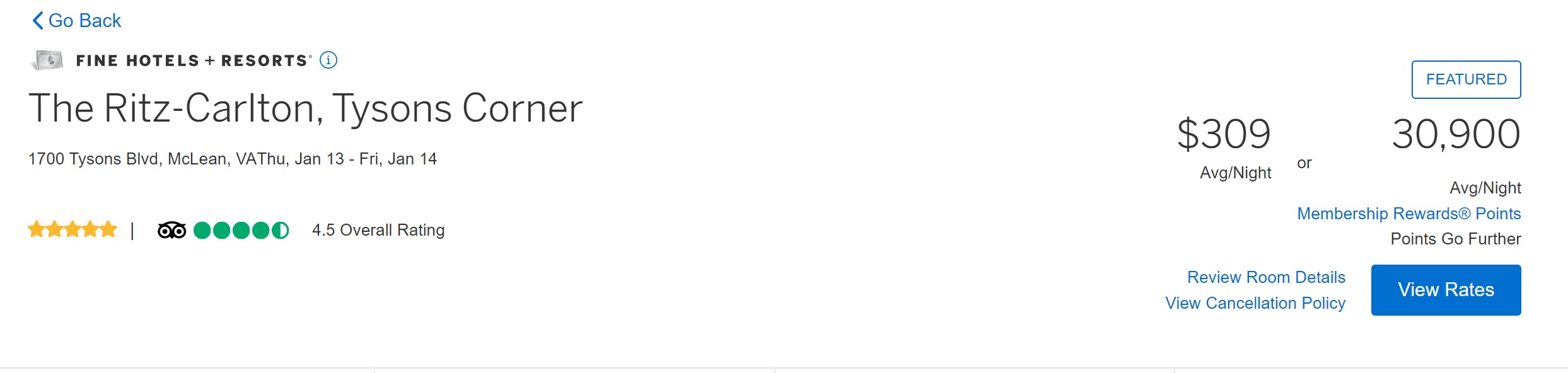

Interestingly though, you could do even better. While the “standard” flexible rate is indeed $309 via Marriott.com, the “Member” flexible rate is $303 and the AAA rate, which is also flexible, is only $294.

In this case, Capital One didn’t fare great because of the value possible when booking via Fine Hotels & Resorts. Truthfully, when comparing against Marriott, Capital One Travel did pretty well, matching the discount given to Marriott Bonvoy members over non-members. But the AAA rate was a bit better than booking via Capital One.

That said, a savvy Marriott Bonvoy member will know that even without an Amex Platinum card, one could probably book through Marriott STARS and get FHR-like benefits using whatever credit card they would like.

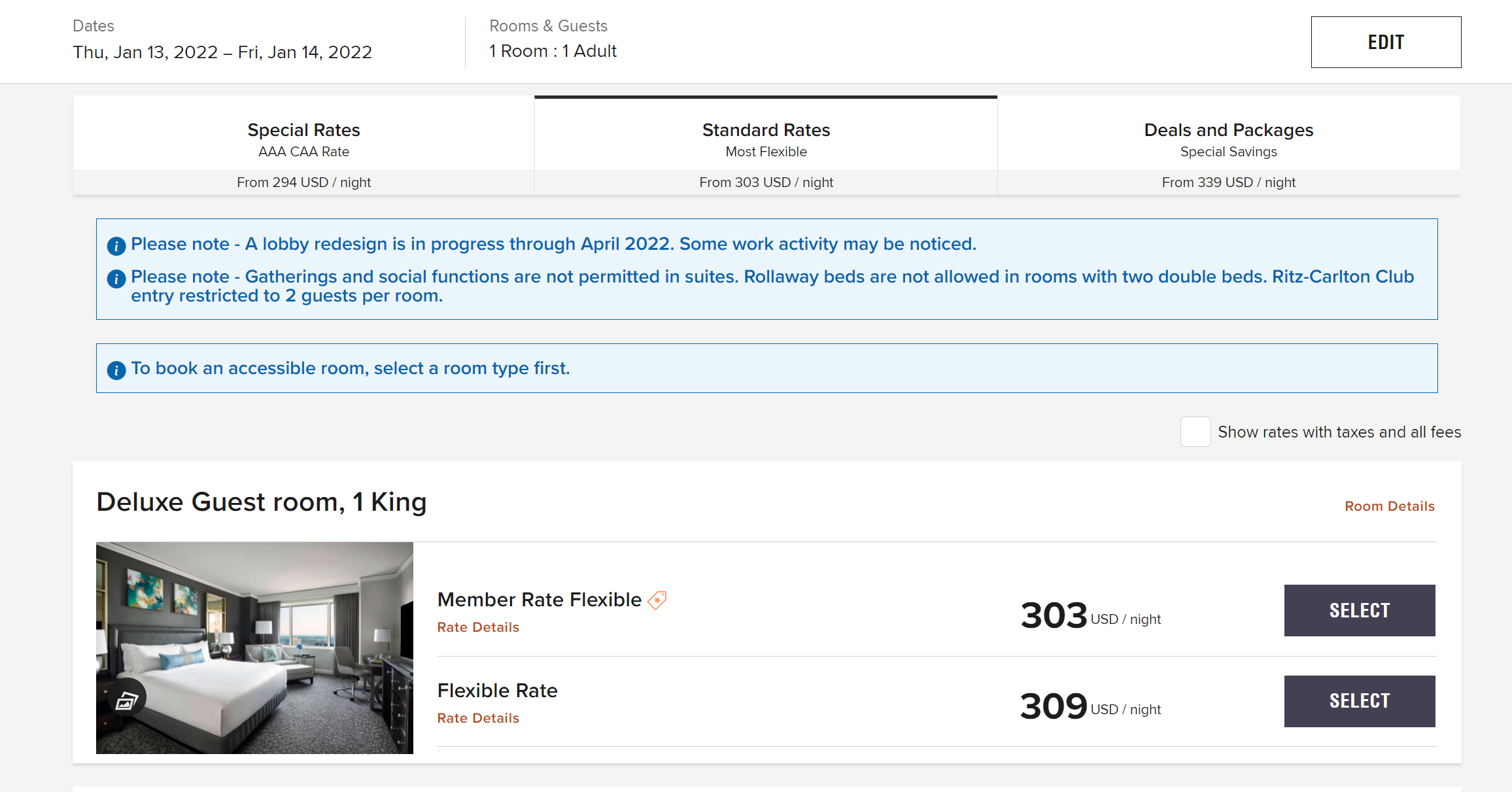

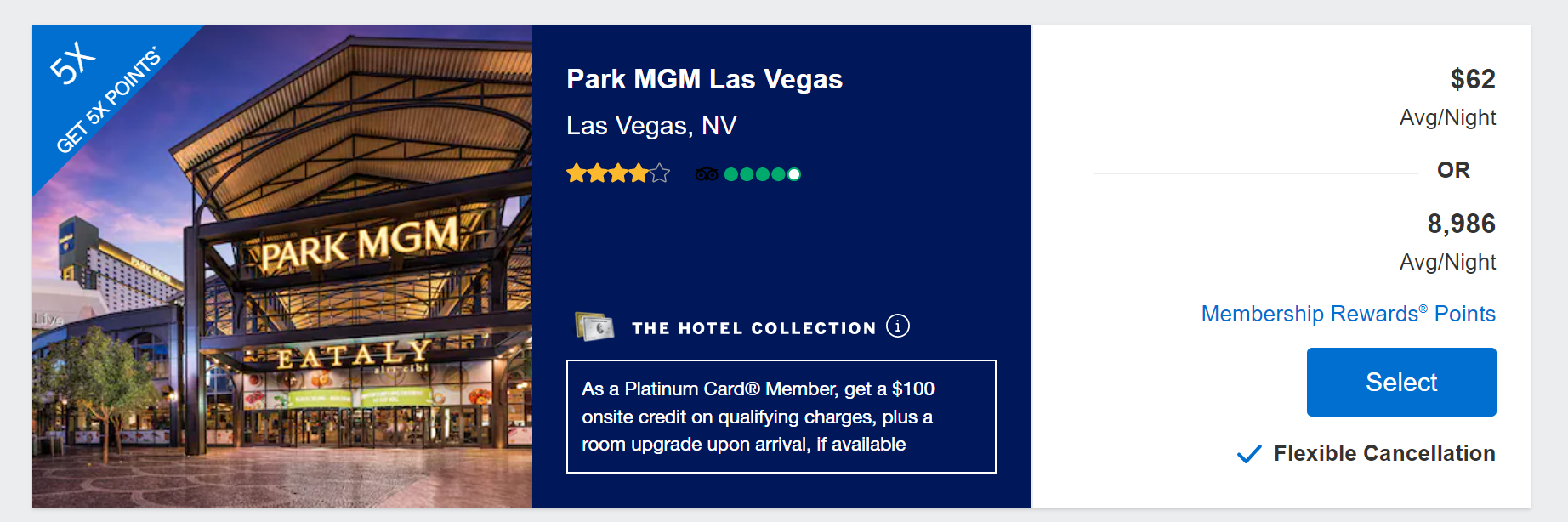

Park MGM

I next decided to set Capital One up for failure (sort of) with an MGM booking. I first wanted to see how Capital One compared to a booking made through “The Hotel Collection” from Amex since Platinum cardholders get an annual $200 rebate on either Fine Hotels & Resorts or The Hotel Collection bookings. I chose the Park MGM in Las Vegas during dates when I knew rates were cheap (for those who haven’t been to Las Vegas in many years, Park MGM is the remodeled Monte Carlo).

Capital One showed a rate of $62 per night (which it said was $1 cheaper than Expedia) for a two-night stay.

Sure enough, The Hotel Collection also showed $62 per night.

It looked like the going rate for the dates I selected was indeed $62 or $63 per night.

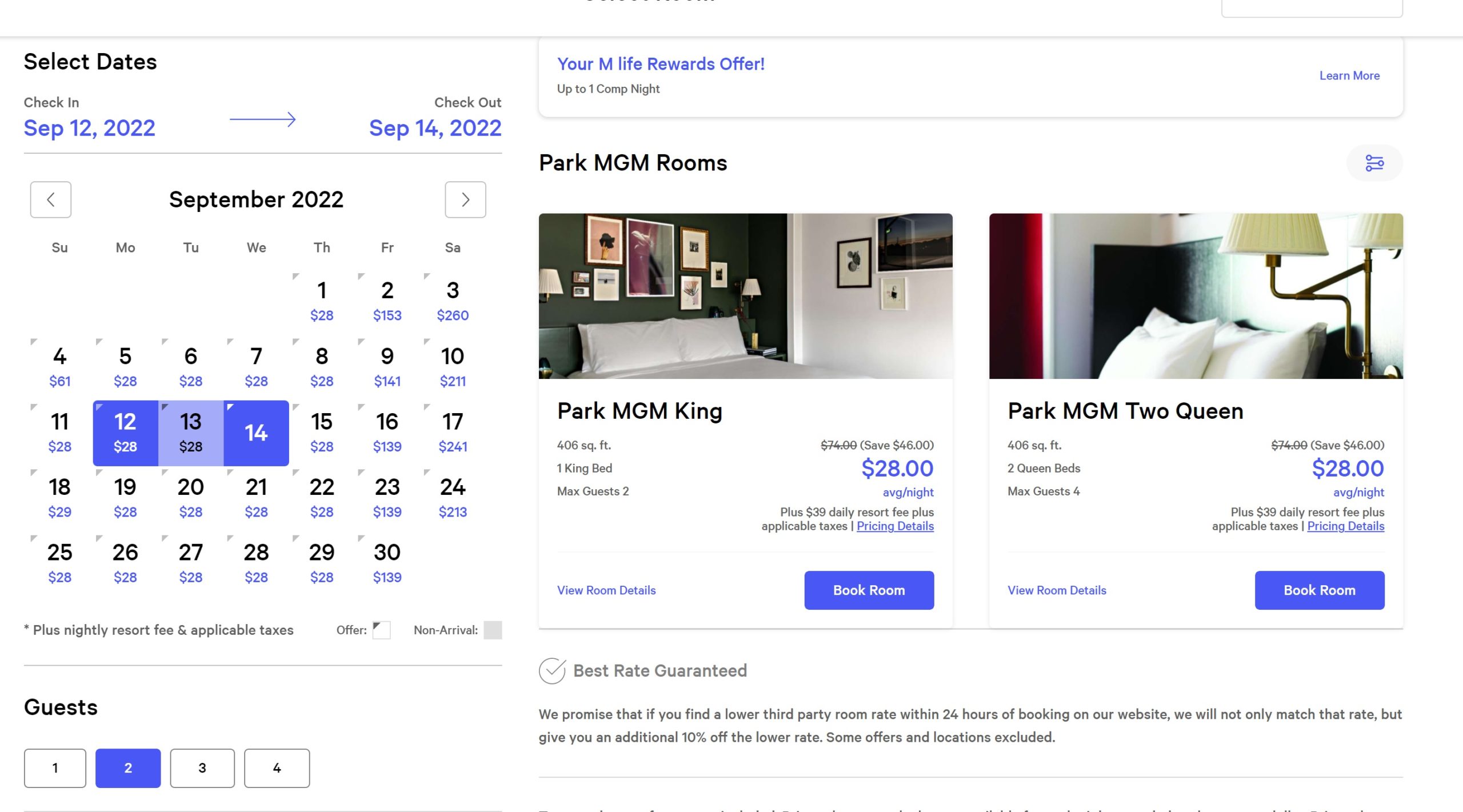

I then logged in to my MGM Mlife account. I’ve always found far better rates when booking directly with MGM and this time was no different. I have MGM Gold status by virtue of matching over from Hyatt. While I was known to hit the blackjack tables now and then 15 years ago, I’m pretty sure I didn’t even play a single hand of blackjack on my last trip or two to Vegas. I still get deeply discounted room offers.

Sure enough, I had an offer in my account for “up to one free night” at Park MGM. While none of the nights in the month I tried (September) were complimentary, the rate was indeed a lot cheaper at just $28 per night.

All of the rates above exclude the resort fee. When the new program launches on February 1st, I expect that I’d need to book direct through MGM to avoid the resort fee — at which point the gap in price with Capital One will only widen.

In fairness, this isn’t really a knock on Capital One as my Mlife price is a targeted deal, but I included this example to remind that Las Vegas is often much cheaper via the casino loyalty programs.

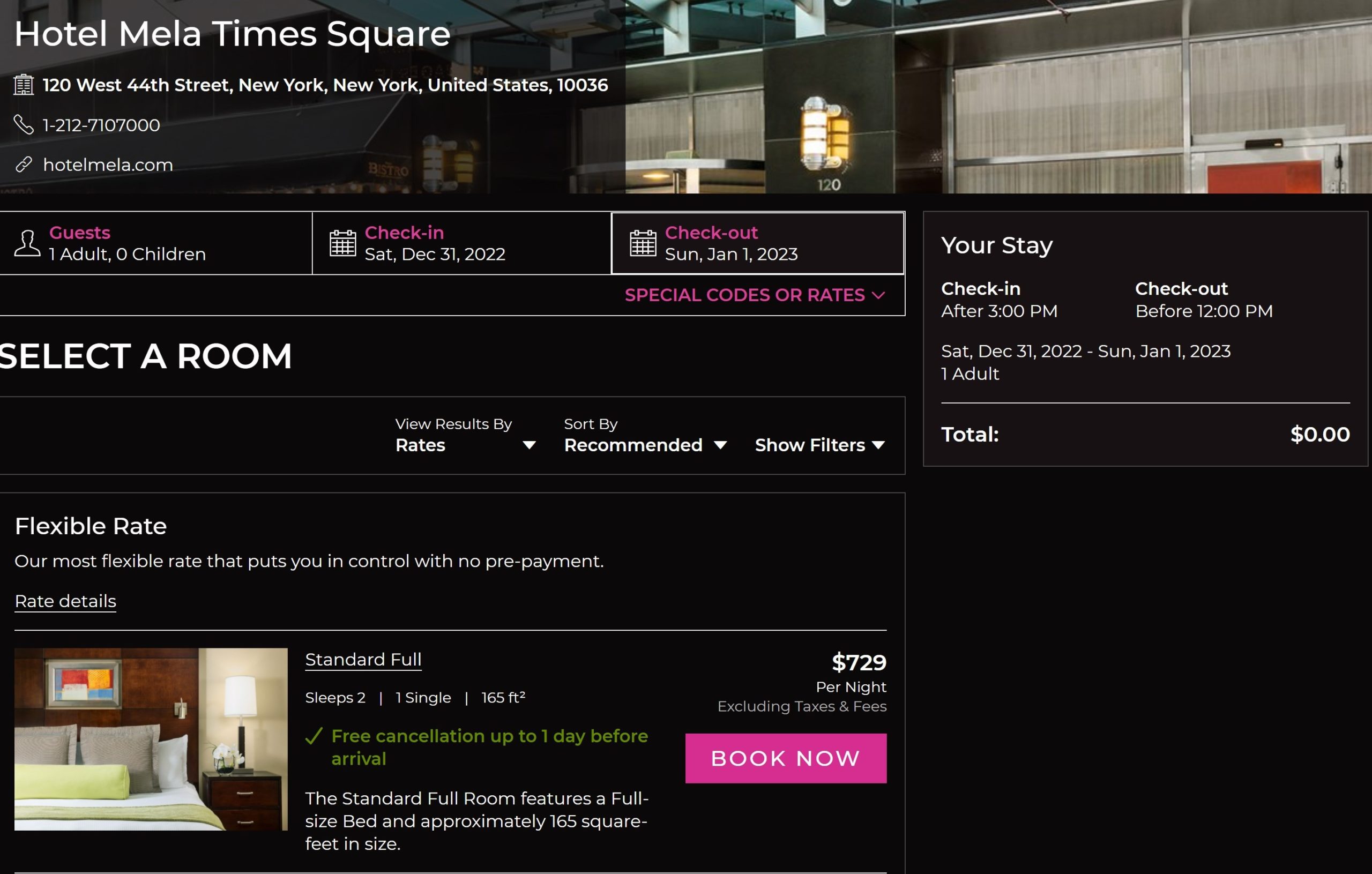

Hotel Mela Times Square on New Year’s Eve

New Year’s Eve is where things really started to turn around for Capital One. Take the Hotel Mela Times Square for instance. I don’t know anything about the Hotel Mela beyond the fact that it stretches the definition of “Times Square” in the same way that every other hotel within a 6-block radius of 42nd and Broadway does. On New Year’s Eve, it’s an expensive place to lay your head (as one would expect).

If you book directly through the Hotel Mela’s website, you’ll shell out $729 for a standard room.

If you book through Expedia without becoming an Expedia “member”, you’ll pay the same $729.

However, if you join the Expedia program, you’ll get 10% off for a price of “just” $656.

Still too rich for your blood? Capital One’s got you covered. They’re charging $394 for New Year’s Eve at the Hotel Mela.

And even on New Year’s Eve and at that deeply discounted rate, the cancellation policy via Capital One is free cancellation up to two days before arrival. That’s not quite as good as the free cancellation up to the day before arrival when booking directly via the Hotel Mela, but it’s better than I would expect for a hotel in the vicinity of Times Square on New Year’s Eve.

Crazier still, Capital One isn’t giving themselves much credit for this deal. Whereas in many instances, they display a little green banner showing the total savings when they are even just a dollar per night cheaper than Expedia, they didn’t mention at all on this listing that they were $262 per night cheaper than Expedia’s members price.

Are you going to need to stay at the Hotel Mela on New Year’s Eve for $394? Probably not, but the huge price discrepancy there is certainly interesting and means that there is even more room than I’d expect for Capital One to beat the traditional OTAs on indie / boutique hotels.

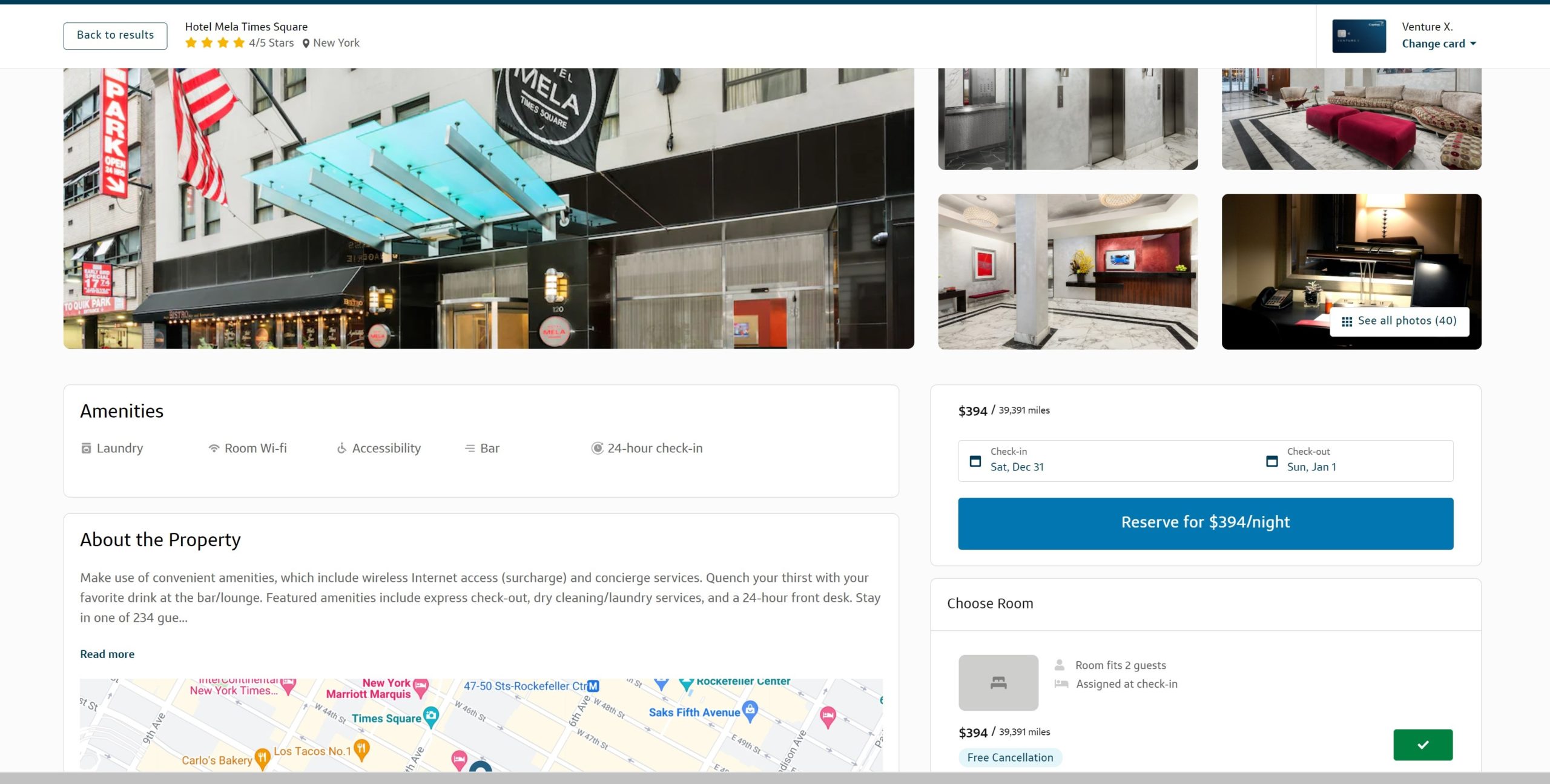

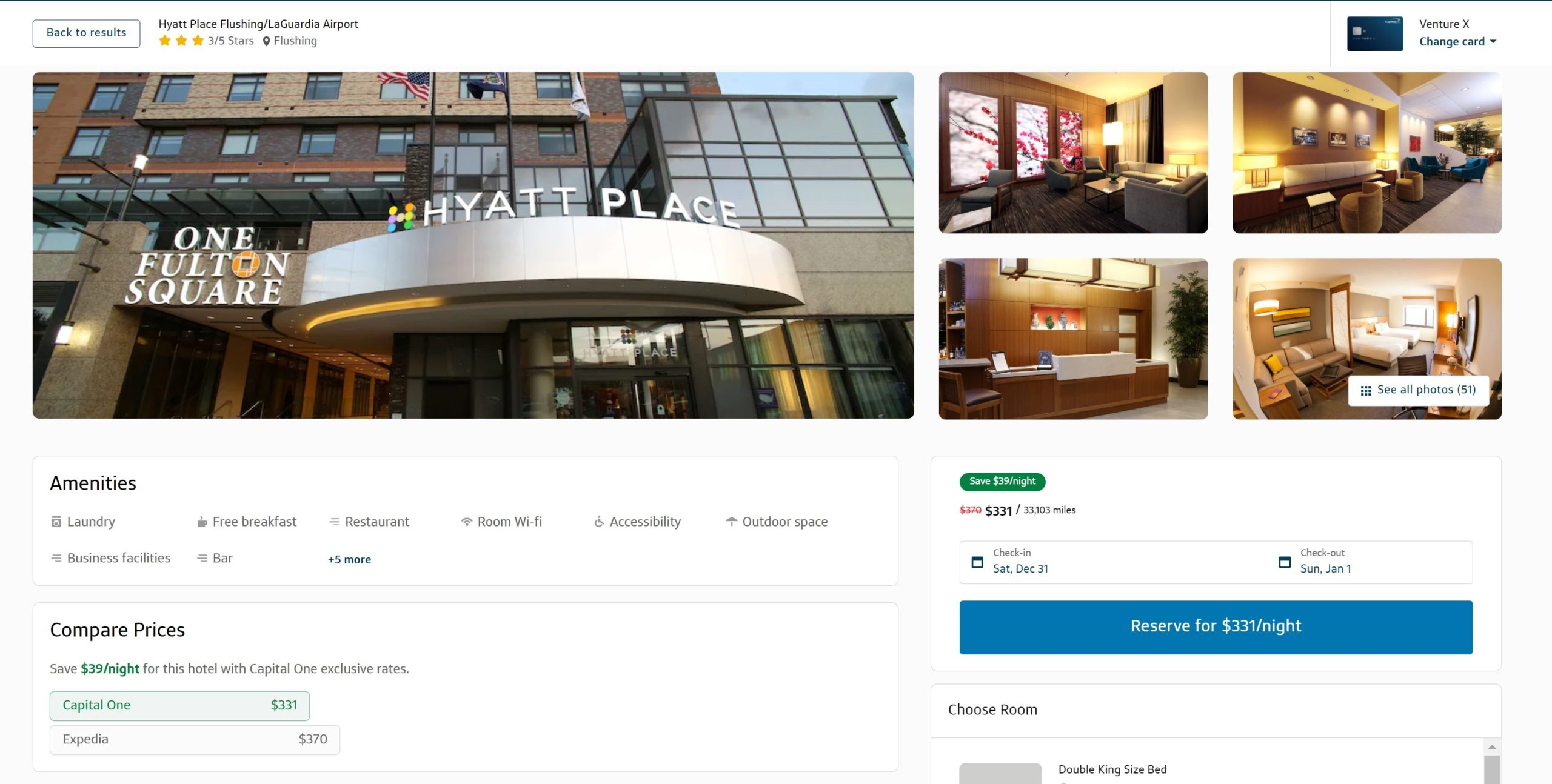

Hyatt Place Flushing / LaGuardia

While not as impressive a discount, this one surprised me even more than the Hotel Mela. I pivoted to New Year’s Eve via Hyatt and I picked a hotel where you surely will not spend New Year’s Eve unless your flight gets cancelled: The Hyatt Place Flushing / LaGuardia Airport. To be clear, that’s not a knock on the Hyatt Place, it’s just not the place to be on New Year’s Eve (pro tip: the last time I stayed, I booked a parking space in the hotel’s garage via either ParkWhiz or SpotHero for less than the hotel charges for parking).

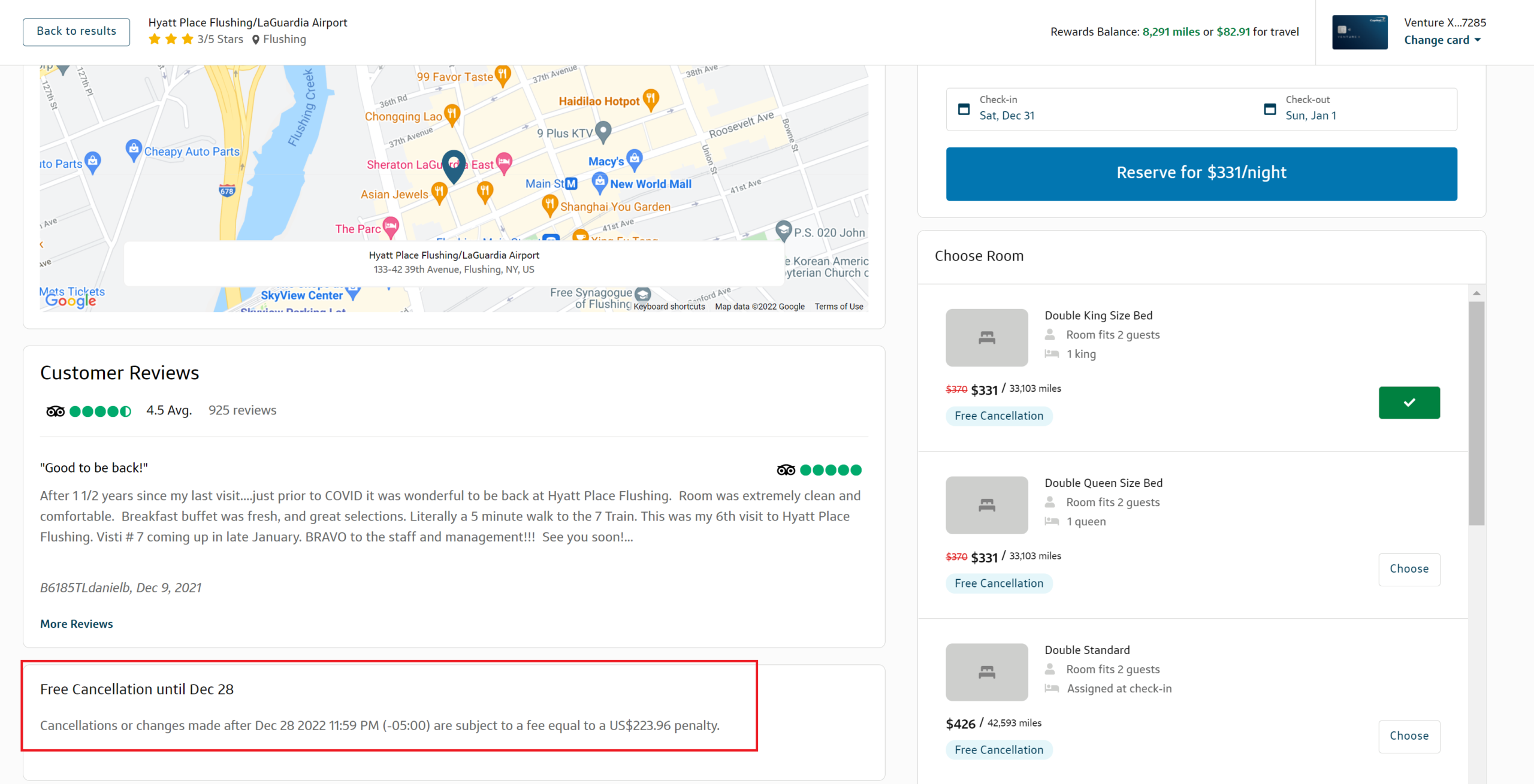

What surprised me here is the rate that Capital One is offering and its cancellation policy. Capital One Travel shows this hotel for $331 per night on New Year’s Eve.

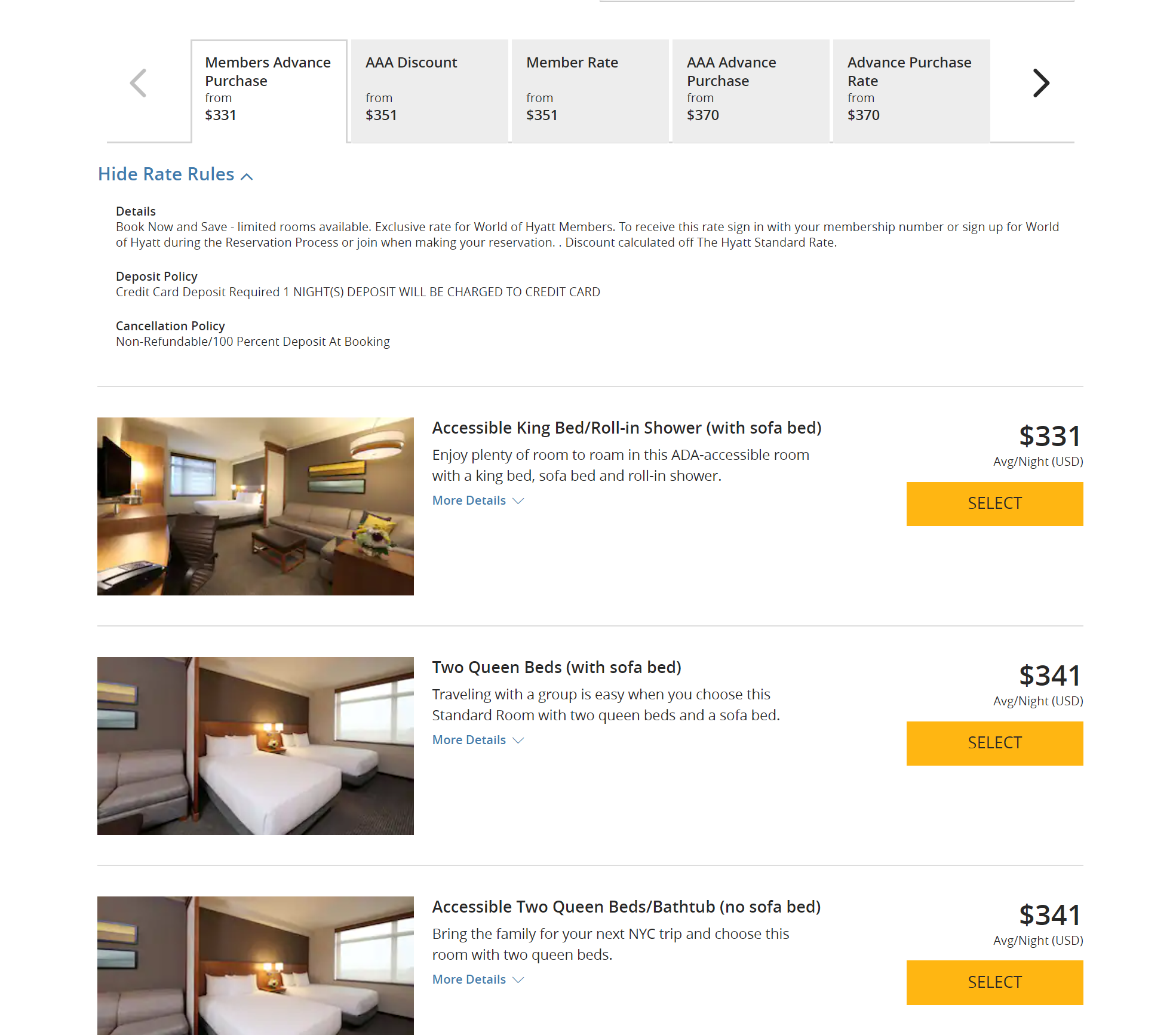

According to the graphic in the bottom left of that screen shot, that’s $39 per night less than what Expedia was charging (which I can confirm). I went to Hyatt.com and I could see that Capital One is offering a rate that matches Hyatt’s Members Advance Purchase Rate.

See the cancellation policy on the $331 rate via Hyatt.com above — it is fully nonrefundable. Digest that for a second. A rate of $331 that you can’t get back is the special deal Hyatt is offering just for World of Hyatt members who are willing to trade away flexibility for their members-only savings.

But those World of Hyatt members who value both saving money and flexibility should at least consider booking via Capital One. No, you won’t get elite credit or benefits or hotel points, but you will get free cancellation until December 28th (and even if you cancel after that you’re still not subject to losing 100% as it shows a $223.96 cancellation penalty).

I found that really interesting. I’ve often questioned the value in loyalty programs for those who primarily stay at limited-service properties like Hyatt Place where there are few loyalty benefits if any. If you’re able to get the value of Hyatt’s advance purchase rate without the punitive cancellation policy, booking via Capital One could certainly make sense.

I found that really interesting. I’ve often questioned the value in loyalty programs for those who primarily stay at limited-service properties like Hyatt Place where there are few loyalty benefits if any. If you’re able to get the value of Hyatt’s advance purchase rate without the punitive cancellation policy, booking via Capital One could certainly make sense.

That said, keep in mind that official Hyatt policy is now that free breakfast is only for those who book direct. Theoretically, you won’t get free breakfast at a Hyatt Place when booking via Capital One (enforcement on that probably varies, but I haven’t stayed at many Hyatt Place properties since that policy changed). Still, imagine the same scenario with a Residence Inn or Hampton Inn or other limited-service property where everyone gets free breakfast. Capital One could be a great option.

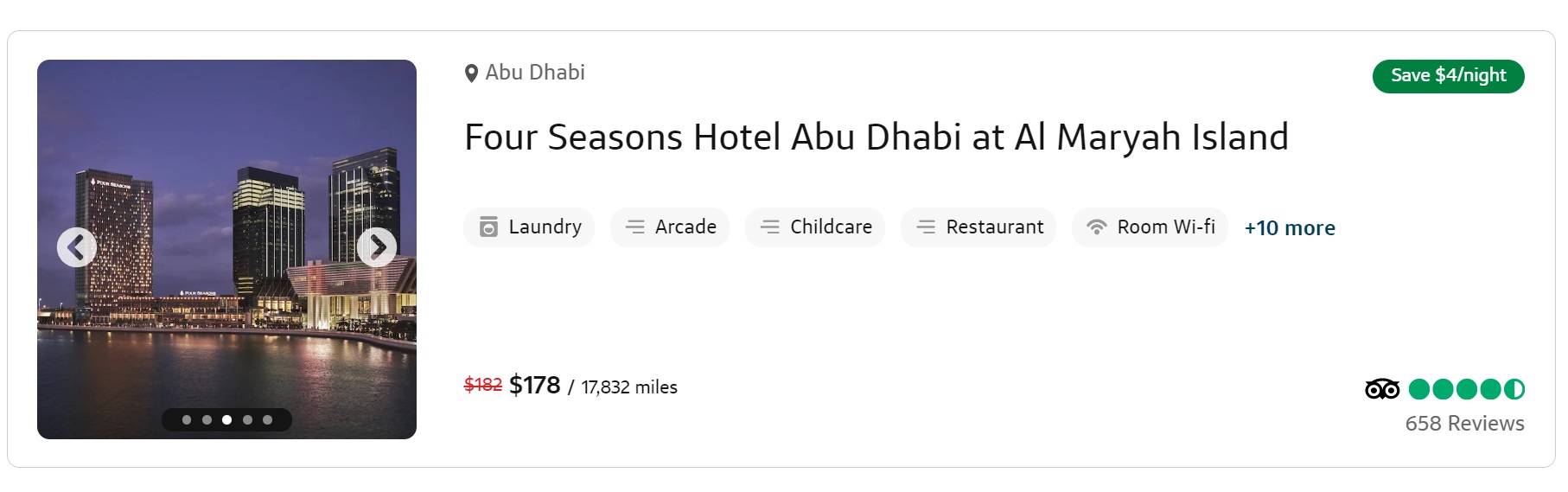

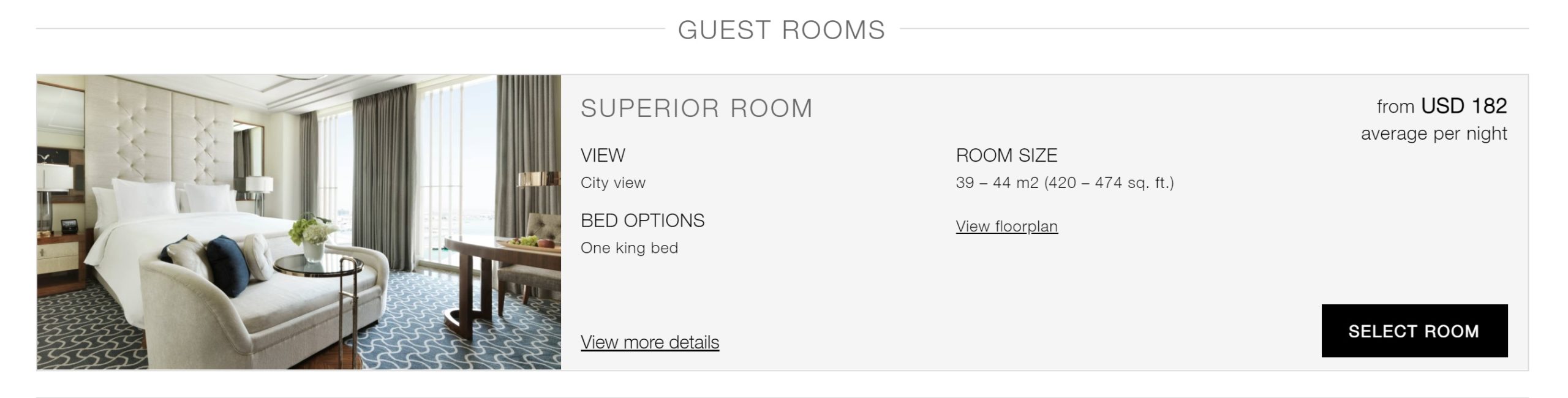

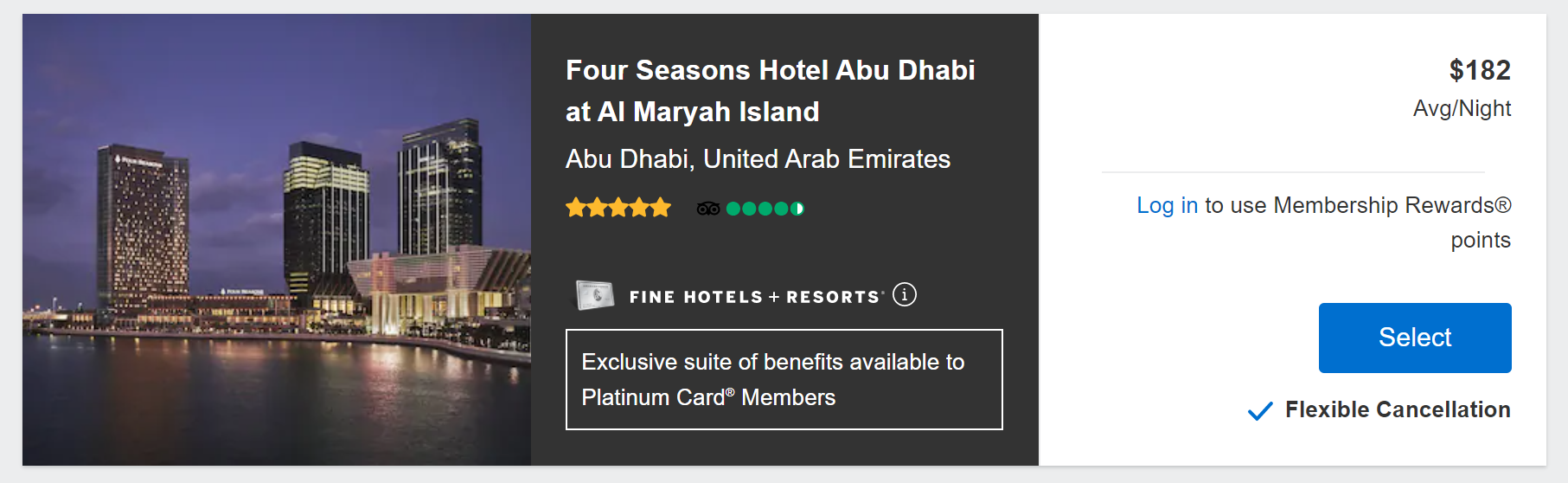

Four Seasons Abu Dhabi

This hotel came to mind because Greg and I had an excellent short stay there this past fall. The price difference here is tiny, but what is this sorcery? Sure, it’s only four bucks, but Four Seasons is famous for not discounting their rooms. How is Capital One underselling them by four bucks?

Of course, your best bet on a stay like this is to do what we did and book via Fine Hotels & Resorts so you can get free breakfast and a $100 hotel credit.

Of course, your best bet on a stay like this is to do what we did and book via Fine Hotels & Resorts so you can get free breakfast and a $100 hotel credit.

Stay on a Thursday night. Get Friday brunch with your credit. Don’t argue.

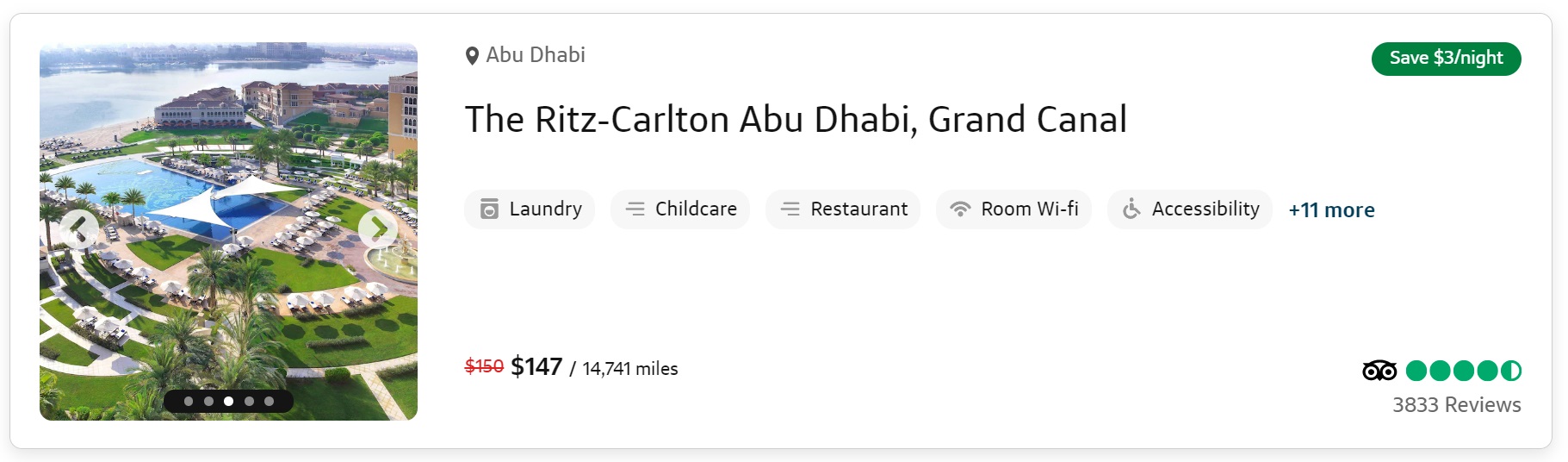

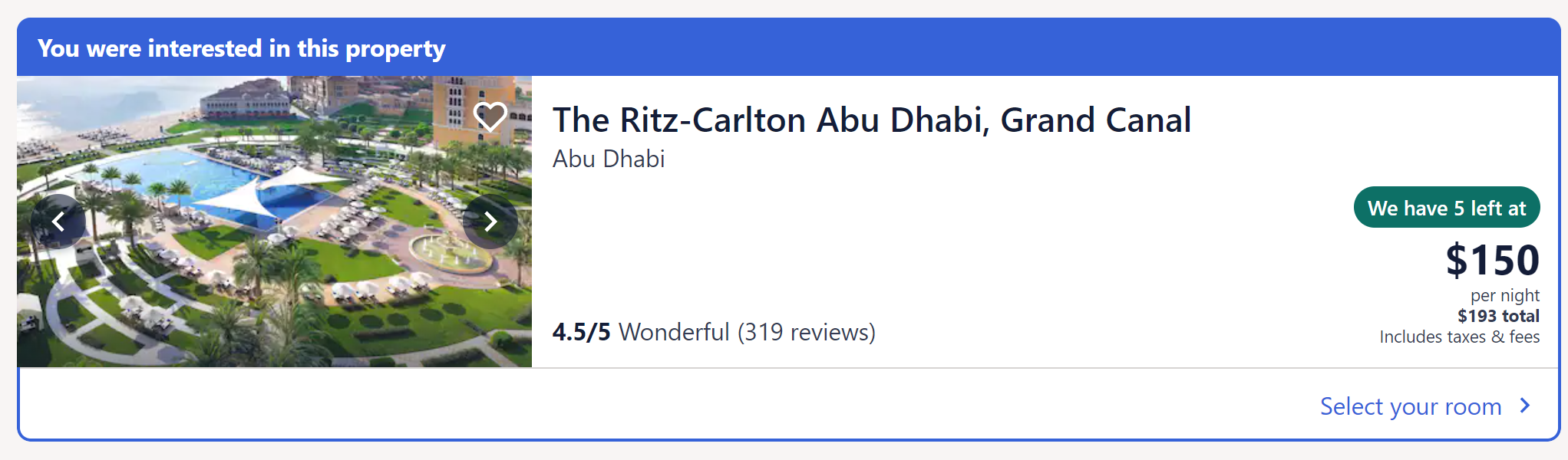

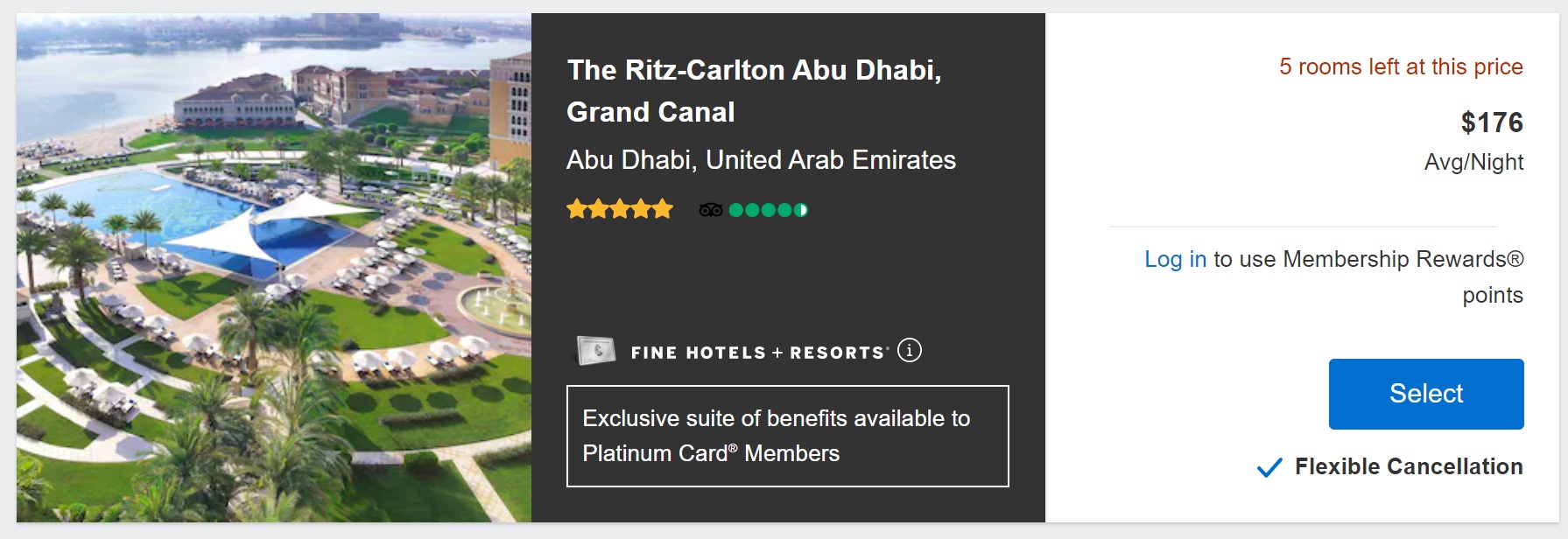

Ritz-Carlton Abu Dhabi

I pivoted from the Four Seasons to the Ritz-Carlton Abu Dhabi because I knew this hotel is often available pretty cheaply and I wondered whether Capital One would have an even better price.

In this case, Capital One yet again offered a surprising savings. The Ritz was just $147 via Capital One on my sample date.

At first glance, that only looks $3 better than Expedia.

However, the difference in cancellation policy once again makes Capital One much better. That $150 rate via Expedia is nonrefundable — you’ll need to pay $177 through Expedia to have a flexible booking.

Sure enough, booking directly through Marriott.com, prices matched Expedia: $150 nonrefundable or $177 flexible. There was also a AAA rate of $150 per night that was flexible (I frequently use AAA rates specifically because I often find that they match advance purchase rates while also being flexible).

Capital One’s rate was flexible, so it beat having a AAA membership by three bucks.

Unfortunately, I kept running into an error when trying to move to the booking page. I actually ran into this same error a whole bunch of times on Capital One Travel, which got kind of annoying. The site seems pretty buggy still.

And of course in this case you would once again probably want to book this hotel either via Amex Fine Hotels & Resorts or the Marriott STARS program rather than via Capital One for free breakfast and a $100 credit.

I mention the Marriott STARS program specifically because I know that the Ritz Abu Dhabi participates and it doesn’t require any special credit card to book and get free breakfast for two (a benefit that nobody gets with status at a Ritz property) and a $100 hotel credit. Capital One does eat into the value of that a bit since you will pay $27 more per night to book the FHR or Marriott STARS rate, but the combination of free daily breakfast for two people and the $100 property credit balance that out unless you’ve got a long stay where that $27 per nigh will add up.

See more about Marriott STARS and other preferred partner booking programs here: Getting the elite experience without elite status via credit card and preferred partner programs.

Bottom line

While I wasn’t aiming to cherry-pick properties for this post, my eye was obviously drawn to opportunities where I spotted savings. I skipped over many instances where the savings of booking through Capital One would only be a buck or two or where prices were merely equal. However, even a savings of a buck or two is a remarkable advantage over Citi’s hotel pricing and is notable when you consider that most bookings appear to be flexible / cancellable. Overall, I am very impressed: in many instances, I wouldn’t give up anything but elite benefits/credit by booking through Capital One. While I enjoy my hotel points and elite status, I’ll be happy to use a Capital One Travel credit here and there whether for a limited-service property where benefits don’t matter much or one of the outliers where Capital One comes out far ahead.

Thanks for the very nice article! I have started using it for flights and am liking it. So I decided to use it for hotels, but then stopped at one confusing info: when I am about to confirm and book it shows the taxes and fees amount, but at the same page under the hotel info there is a Fees info (like breakfast, transfers). Are these the same fees? I ended up using booking dot com to book the hotel. And it seems CO travel only have a phone number for contact 🙁 Thanks again!

Priceline $72 a night Palm Coast, FL Days Inn. Capital One $93. Not always a great deal.

The portal seems great so far, although I’ve only booked with our once, and I was promptly awarded my 10x for the booking. However, I’m still waiting for my annual $300 credit to kick in for the booking from December 14. I’m told it could take up to two full billing cycles. I’m loathe too spend more on the card before I see if they comply with their promises or not. I just don’t trust this bank!

Nick, Do you know if they can send the card via express delivery?

yes…received the card in 2-3 business days

Sent via Fedex

Has anyone use the C1 portal to book Hertz and gotten President Circle recognition?

No hertz options even showed up when I tried to book last month

Hertz is now showing up on the portal.

Have you done a review of how Venture X travel insurances compare vs Sapphire? Sapphire Preferred has always been my goto for booking trips because of all the travel benefits but wondering how Venture X compares. The 35 page Venture X benefits guide is not easy to decipher.

From what I’ve seen you can expect the same from both and coverages seems pretty similar. That means a lot of hassle if you ever make a claim. The only one that stands out in that regard is Amex bc they don’t outsource their insurance claims processing and thus aren’t incentivized to make customers jump through dozens of hoops to get a claim the way that insurance companies do. So much easier to deal with Amex when filing claims.

I’ve been checking C1 Travel for my upcoming hotel stays and I’ve found it’s actually beating Hilton’s member prices by about 10% for a Tapestry Collection stay I have coming up in February. (Comparing refundable rates for both) For me it’s worth it to give up my Gold status benefits to get the cheaper price – particularly since the Hilton breakfast credit isn’t that valuable to me. The hotel is just doing coffee and pastries instead of their normal full breakfast anyways.

@Nick Reyes The Cap1 portal still doesn’t have jetBlue right? So if you want to book flights on the largest carrier in Boston and JFK then you’re SOL. Many of the shill sites(you know the lot) don’t mention this major downside or bury it down the page, I hope you highlight this major issue for east coast flyers. Mind you I believe almost all other portals have jetBlue, this is only a Cap1/hopper problem.

You’re totally right that they don’t have JetBlue. I never would have noticed — I haven’t flown JetBlue in almost 10 years because they never line up with my plans anymore so I hadn’t thought about it. You’re right that’s a huge drawback for people in big JetBlue markets.

FYI, as a result of their new alliance, I’ve noticed that JetBlue flights ticketed by American Airlines do show up on the Capital One portal. I haven’t thoroughly investigated but did see a few flights show up when you click into the details.

Good morning! I booked a standard rental car thru Cap One Travel that had a glitched description and an economy car rate. Initially I only paid the base car rate and was supposed to pay taxes and fees at the counter. The car was reserved under Thrifty but had the description of a Hertz car rental, plus the bad reservation number I got from Cap One couldn’t be found by either rental company (by phone or website!). I called Cap One next and they promptly fixed my reservation and switched it to Budget with no additional fee. I ended up paying only the base rate (of an economy car no less), no taxes, for a standard car. Safe to say that their customer service exceeds my expectation for a premium card.

I got the VentureX right after it came out and have received SUB. Cap1 site says I can get 25,000 points for referral, but it must be a new Cap1 credit card customer. P2 has the Cap1 Spark Biz under our jointly-owned LLC (and the LLC EIN). Would a personal card under his SSN be considered a new credit card customer?

Most likely no.

Agreed with Aloha808 that “most likely no” is the most likely answer. That said, this is a little unique since the Spark Biz is under the LLC EIN maybe? Assuming that C1 required his SSN at some point, I’d lean toward thinking that you won’t get the bonus. I didn’t get the bonus when I referred someone who had another Spark card (not sure if it was through an LLC).

That said, you’ll know pretty quickly one way or another — referral bonuses tend to post pretty quickly. I’m curious: are you able to generate a referral link from your Spark card? Our household Spark referral links aren’t working. They load a page with a big empty box where the card info and buttons to apply should be.

I know we used the LLC EIN, but can’t remember if they also required P2’s SSN. If i’m correct that there isn’t another revenue-generating link, I guess I might as well try this as there is nothing to lose. I can generate a referral link, but I’m doing it from my C1 personal VX account (P2 doesn’t have the VentureX card–yet). Thanks.

Which version of the Spark biz card did P2 get, the Spark Cash or the Spark Miles? There was a short period of time when the Spark Cash was still available for signups that applicants didn’t get the account to show up on their credit report. The reason why I bring this up is that if you check P2’s credit report you should be able to see if their Spark credit card is attached to their SSN.

If one applies for a Spark credit card now, on the first page of the application it asks for the applicant’s SSN.

Also tagging @Nick Reyes

Great thinking! It’s the Cash version and you are correct that it shows up on P2’s credit reports. We enjoyed the $1000 cash bonus in March, so I’m not complaining or generating a referral now. Certainly don’t want to poke the C1 Bear! Thanks for your help…

Thank you, Nick, this is so helpful.

A helpful addition/post would be how the Capital One portal’s prices compare with the new Chase travel portal’s prices. VentureX vs CSR Hotel Showdown

Good suggestion!

Interesting – I just used my $300 credit to book the Omni New Haven for a 2 night stay in February. New Haven is a terrible hotel market (and not in a Nashville everything is overpriced but there are tons of hotels kind of way). There are a couple of college-town boutique type places for >$200/night, an old looking Courtyard for $190 or 35k! points, and the Omni. All the other points options are miles away. Was going to use Marriott certs but they don’t expire soon and I figured I can get better value. Through CapOne, the Omni was $180+tax (same as Omni direct) and I’ll get 2 nights for $100 total out of pocket plus earn 4k CapOne points for the 10x.

Second half of this year we’ll probably be looking to invest in a new, non-Chase, non-Amex ecosystem. Would benefit from posts “Game Plan for Capital One” and “Game Plan for Citi TYP” discussing the cards, order to apply, best combinations, etc.

I love this suggestion. Thank you!

Hi Nick and everyone,

My P2 is ready to apply for another CC for SUB. We are looking at the Capital One VentureX and the Citi Premier. I was thinking the Citi Premier since it sounds like the current offer is about to expire, but am no rush to enter either program. We have only been UR and MR points users but was looking to diversify some of our points. Hopefully we can combine points to take a flight on Singapore Suite to see family when travel is safer would be the main goal. Any suggestions? I was leaning towards the Capital One card for all the benefits, but since the Citi offer is ending soon, would it be better to apply for that? My P2 doesn’t like having a lot of CC so she wouldn’t be open to applying for both at once. Her credit score is also 84x, so she should be a good candidate.

If you have no plans for how you’ll use the points, I’d probably get her the Venture card first. That’s a bit counter-intuitive because the points don’t have an automatic cash out potential and you can’t necessarily downgrade (though you could open a fee-free Venture One to keep the points alive if you didn’t want to keep the Venture X). But on the other hand, the welcome bonus is a lot bigger — 100K plus the $200 first-year vacation rental credit (which has been triggered by charges much broader than just vacation rentals). You would have to value the Citi points at 1.5c each and the Capital One points at just 1c each for those offers to be equal — and I’d say that’s an overvaluation of Citi and undervaluation of Capital One.

In general, I’d say that Capital One has a broader and more useful set of transfer partners, but whether they are more useful to you is easier for you to know than me. If you would use Citi for transfers to Choice Privileges, you could probably come out ahead, but otherwise Capital One has Citi’s most useful transfer partners and more. It also represents much better return on “everyday” spend. The Venture X is a card you could keep and use for “everywhere else” spend and feel decent about that.

But then you’ve got the argument that the Premier is only $95 per year and it includes a useful 3x grocery category bonus (and 3x dining and a lot of travel, etc). If you don’t have another “grocery” card and you’d put a lot of bonused spend on the Premier, that could make it worthwhile. It’s also potentially valuable for Citi Merchant Offers (though personally I don’t get any offers and other people get a bunch).

Even though the Premier bonus is fleeting, I think the Venture X is a stronger long-term value / keeper card with a generally better set of partners. If I had to pick, I’d go Venture X. But I wouldn’t argue with someone who wanted to get into the Citi ecosystem.

If you wait long, your decision will be made for you though. If you want the Premier, you need to decide on that prontissimo.

Thank you Nick for the comprehensive answer. So the Choice Privilege’s was the transfer we were looking at for possible use at the Nordic Choice locations, but I am not sure when we will make that trip. I don’t see the Venture X being much more costly per year then the Citi because we will use the $300 credit and get the bonus points and the $200 credit this first year is just gravy. I guess I made up my mind, Capital One here we TRY. I hope we don’t pull a Greg 🙂

Citi does have a better ecosystem if you want to build a portfolio. Double Cash gives u 2 pts which match with Venture X, and with Rewards+ you get 10% back on redemption you are effectively earning 2.22 pts on double cash. Citi custom cash give you useful 5x categories.

In terms of transfer partners, if you are not into international business/first class, airline transfers represent poor value. Good hotel partners like Hyatt (Chase) or Choice ( Citi 1:2) offer better and easier returns.

If you can use Jetblue, it could be an easy value to use Citi points for flight. Jetblue points can be used like cash (~1.3c) for booking. With Rewards+ (10% back), occasionally 25% transfer bonus, you can get 1.8c return for TY points.

Thank you Snowmt. This is why I was initially looking at the Citi Premier over the VentureX, but my P2 is hesitant on opening multiple cards and still warming up to the idea so I was thinking the VentureX might be a better option for now (if she can get approved). One of the main goals is to save up to fly Singapore Suites to Asia to visit family so I might go with the VentureX for the additional 10k points annually as well. This is all assuming we can get her approved for the VentureX.

Just a follow-up – my P2 agreed to opening a single card so we went with the Capital One and added myself as an authorized user. Once she lets me, we will build up her Chase or AmEx set of cards since she has the Sapphire Preferred and the Gold AmEx. She doesn’t like changing cards, but I think she is coming around since we were out this weekend and she was asking me which card we should use and if we had any Rakuten in-store bonuses lol. Thank you Nick and SnowMt for your feedback.

Helpful and surprising. I’m assuming this also matches or beat hotels.com, which is what I use for their good rewards program (almost matched by 10x on Cap1 portal). Now I want to know about their car rental prices. If cancelation and prices are same it would be a game changer to use Cap1 and get 10x points, as I never benefit from the loyalty programs anyway, except for getting free upgrades with National but I get my exec privileges with them even when I have booked through Priceline. Will you run a comparison of car rental prices/benefits?

One note on car rental status: when I booked an Avis reservation through Cap1 Travel, there was no place online to put your loyalty number. But, I was able to call customer service afterwards and add the loyalty number to the reservation. It took a few minutes for the rep to figure out how to do it but there was no hold time and they were super friendly. (The Cap1 Travel portal feels very new to me and I bet they’ll get loyalty numbers added as an online feature eventually)

Prices are not as good as other options in many instances (alamo last minute specials, costcotravel), fewer companies and fewer vehicle types available

Also have to cancel booking by phone, no option to cancel online, which is a pain because speculative bookings