NOTICE: This post references card features that have changed, expired, or are not currently available

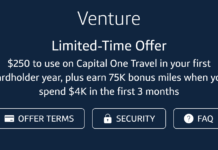

Capital One has increased the bonus earned from the welcome offer on the Venture card to 75,000 bonus miles, although many will still be better off going for the Venture X card instead.

The Offer & Key Card Details

| Card Offer and Details |

|---|

ⓘ $1205 1st Yr Value Estimate$250 travel credit valued at $220 Click to learn about first year value estimates 75K Miles + $250 Capital One Travel credit 75k miles after $4k spend within first 3 months + $250 to use on Capital One Travel in your first cardholder year$95 Annual Fee Alternate Offer: Alternate offer for 75k miles + $300 travel credit available for some via referral pre-approval Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 75k miles after $4k spend within first 3 months + a one-time $250 Capital One Travel credit to use in your first cardholder year FM Mini Review: This card earns 2 miles per dollar, which are worth exactly 1 cent each toward travel. This makes the return on spend similar to a 2% cash back card (though in this case you must redeem your miles to offset travel in order to get 1 cent per mile). One big advantage over cash back: Capital One allows transfering their miles to airline miles & hotel points. Click here for our complete card review Earning rate: 2X miles everywhere ✦ 5X miles on hotels, vacations rentals and rental cars booked via Capital One Travel ✦ 5X miles on Capital One Entertainment Card Info: Mastercard issued by CapOne. This card has no foreign currency conversion fees. Noteworthy perks: Receive up to $120 application fee credit for Global Entry or TSA PreCheck® ✦ Redeem miles for travel at value of 1 cent per mile ✦ Convert miles to airline miles & hotel points ✦ No foreign transaction fees |

Quick Thoughts

This is a solid welcome offer on a solid card. The Capital One Venture card earns 2x miles everywhere, with their miles now being transferable to more than 20 travel partners. You can also earn 5x miles on hotels and rental cars booked through Capital One Travel, as well as 5x on Turo rentals through May 16, 2023.

As you can see in the summary above, the card also comes with some other perks like an application fee credit for Global Entry or TSA Precheck (up to $120) and no foreign transaction fees.

The thing is, if you’re interested in getting into the Capital One ecosystem, it might make more sense to apply for the Capital One Venture X card instead. Although that card has a $395 annual fee, it comes with $300 in annual credits when booking through the Capital One Travel portal. If you value those $300 credits at face value, that effectively reduces the annual fee to $95 which is the same as the Venture card, with both cards having the same welcome offer – 75,000 miles after spending $4,000 in the first three months.

The Venture X card comes with a bunch of other benefits too – Priority Pass Select lounge access, cell phone insurance, primary CDW coverage, trip delay/cancellation insurance and more. The card also earns 2x miles everywhere, as well as 5x on flights booked through the Capital One Travel portal, 10x on hotels and car rentals booked through their portal and 10x on Turo rentals through May 16, 2023. With the same welcome offer on both cards and a similar net annual fee, getting those bonus categories, perks, additional benefits, etc. via the Venture X card makes it a better choice than the Venture card for many people.

I have VentureX (opened >6 months ago) — will I be allowed to open this Venture card (to get the 75k bonus)?

Do you think the venture x will increase the sub?

Can you have both cards?

Better use those points quickly! Lol!