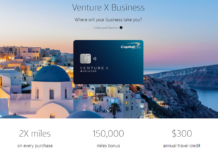

A couple of years ago Capital One launched the premium Venture X card. They followed that up earlier this year with a business version of the card.

For people interested in the Capital One Venture X Business card, it came with an added hurdle – you could initially only apply for it via a Capital One Relationship Manager. They softened that requirement slightly in recent months by allowing you to apply via a business banker, but that still meant having to make a phone call or going into a Capital One branch.

Well, there’s good news on that front as they’ve made it much easier to apply for the card as Capital One is now accepting applications for Venture X Business cards online.

Key Card Details

| Card Offer and Details |

|---|

150K Miles ⓘ Affiliate Earn a one-time bonus of 150K miles after $30K spend in the first 3 months$395 Annual Fee Recent better offer: Expired 3/31/23: 250K Miles after $50K in spend. FM Mini Review: Similar to the Venture X consumer card, the business version offers annual rebates that easily mitigate the fee for those who travel often and could be worth it for the lounge access and travel protections given the cost/benefit ratio. Unlike the Venture X, free authorized users do not get Priority Pass access. The card earns 2 "miles" per dollar on most purchases just like the Capital One Venture X Rewards card, which are worth exactly 1 cent each toward travel. This makes the return on most spend similar to a 2% cash back card (though in this case you must redeem your miles to offset travel in order to get 1 cent per mile). One big advantage over cash back: Capital One allows transfering their "miles" to airline miles & hotel points. Click here for our complete card review Earning rate: 10X miles on hotels and rental cars booked via Capital One Travel ✦ 5x on flights booked via Capital One travel. ✦ 2X everywhere else. Card Info: Visa issued by CapOne. This card has no foreign currency conversion fees. Noteworthy perks: $300 annual credit for bookings made through Capital One Travel ✦ 10,000 bonus miles starting at first anniversary ✦ Up to $100 application fee credit for Global Entry or TSA PreCheck® ✦ Capital One Lounge Access ✦ Priority Pass w/ unlimited guests (includes restaurants) ✦ Plaza Premium lounge access ✦ Cell phone insurance ✦ Trip insurance ✦ Primary CDW coverage ✦ Redeem miles for travel at 1 cent per mile ✦ Convert "miles" to airline miles & hotel points |

Quick Thoughts

I imagine there’s quite a few people who’ll be far more interested in applying for this card now that there’s an easier application method. Being able to apply online without any need for human contact will definitely remove the friction for some people.

The Capital One Venture X Business is certainly a compelling card. It’s much the same as the personal Venture X card, although there is a potentially key difference that makes the business version even more appealing. While the personal Venture X card comes with Priority Pass membership, that can only be used to gain access to lounges at airports. The Priority Pass membership that comes with the business version of the card is also eligible for use at restaurant locations in airports too. Depending on your home airport and/or those you travel to, that could be a valuable additional perk.

The Venture One X Business card does come with a steep spending requirement though to earn the bonus from the welcome offer. At the time of publishing this, you have to spend $30,000 within 3 months in order to earn the 150,000 transferable miles. That means you’re effectively earning 5x on $30,000 spend on top of the card’s 2x standard earnings for a total return of 7x on that spend. That’s certainly not a terrible return, but if you’d struggle to meet that level spend you might be better off getting different business cards for their bonuses instead if they have lower spending requirements.

When the card first came out, Capital One Spark Cash Plus cardholders were ineligible for the card. On the application page for the Venture X Business card, that’s not explicitly stated although it does say “The bonus may not be available for existing or previous Spark cardholders.” That might be a good thing in that it sounds like some Spark Cash Plus cardholders might be eligible, but it could also be bad news in that a Spark cardholder of any flavor might now be declined – not just Spark Cash Plus cardholders.

~

Update: I decided to lob in an application for the Venture X Business card despite already having the Spark Cash Plus card. Capital One declined my application, but did offer me the Spark Miles Select Business card instead. While that wouldn’t have been my first choice, I decided to take them up on the offer as it’s the first time I’ve been able to get approved for a Capital One card offering miles rather than just cashback. I just wanted to give that data point in case anyone else is in a similar situation with wanting a Capital One miles-earning card. There’s obviously no guarantee they’d give you the same offer if declining you for the Venture X Business card, but at least there’s the possibility.

~

Are you planning on applying for the Capital One Venture X Business card now that it’s available for applications online? Let us know in the comments below.

counts against 5/24?

A data point – I applied for this card today and was told that I’ll get an email about decision soon. An hour letter, I received an email that I was approved for this card.

FWIW, I got Spark Cash Select last Nov (my firct C1 card) and Venture in June this year, so this is my third C1 card in less than 12 month. Apart from these I have applied and been approved for 1 Chase personal, 1 chase business, 1 Citi business, and 1 AMEX business cards during the same 12 month period. No card applications have been rejected in the traditional sense, although Chase and US Bank each declined one of my business card application since they thought it was a fraudalant application – this was my mistake as I forgot to unfreeze my credit files before submitting those applications, and they wouldn’t reconsider those applications since they couldn’t access the credit files in the first place. Fair enough!

Stephen,

Ive had mixed reports on this being a MC vs a Visa.

Can you confirm?

I found it, this is a Mastercard

Thank you

Does this give you a virtual card number immediately?

Just approved yesterday, still no virtual card a day later

I want this card but just got approved for spark cash plus on Aug. Capital one still have rule for only one card approval in six months?

And, is that true I am not eligible to apply VX biz because I have spark cash plus? If it’s true, can I downgrade to any card after I get the $1200 bonus then apply VX biz? Thank you!

DP: Instant approved. I have a lot of inquiries in the last 24 months, but most of those were business cards. Not entirely sure where I stand with 5/24.

I have a legit business that’s been open 10+ years. I’m a 5+ year CapOne customer, have the Venture X, and previous had the Spark Miles Biz card (closed only 6 months ago).

I’m very happy to bolster my CapOne points balance by 210k, as the VX is my go-to card for miscellaneous travel costs. Just recently used 180k points to pay for my Inca Trail trip in its entirety.

Glad this became a public link!

I just applied for this card a couple of weeks ago and got denied. When I talked to the biz rep I contacted on LinkedIn, she told me If I have the Spark Cash Plus card I won’t be eligible for this card. Maybe that’s the reason they didn’t approve you and offered you a different product.

Yep, those were the rules when the Venture X Business card first came out, but they seemed to soften the language on the application page as it now only says “The bonus may not be available for existing or previous Spark cardholders.”

How long does the Spark Plus need to be closed before applying for the Business Venture X? Thanks

Disappointed the SUB is only 5x, I can get that everyday on my existing cards on a lot of my spend.

technically it’s 7x. including the 60k points you earn by meeting the spend

Thank you, Stephen. I was instantly approved. Now spending $30k all on one card can be challenging for us. I rarely needed to manufacture spending, maybe this time…

I don’t know if you do product or gift card reselling, but if you do there should be plenty of deals to assist with that over the course of the next few months thanks to Black Friday deals, Amazon’s next Prime event (I think that’s due next month), etc.

Definitely will look into them. Thanks!

So, gift card purchasing is ok for capital one to get bonus?

I’ve never heard of any issues. I met much of the spend on my Spark Cash Plus card when buying gift cards.

Reporting back on this, I’ve received 150K points, 32 days ahead of deadline. Didn’t really need to manufacture spendings. Large purchases include a $6000 5-night Disney world deluxe hotel + ticket package for 5 people, a (partial) remodeling of rental property, a Canada Goose jacket (I’ve not bought a new winter jacket for 2 years), one of kids’ soccer club (spring session), tickets to Square Enix’s Final Fantasy concert for 3.

Long story short, having 3 kids, I don’t really need to manufacture spendings. Insert LOL + smiling face + smirk + sad emoji.

Don’t forget the 1099 for the perks.

DP: P2 approved today and has the Spark Miles (2000).

Thanks Stephen – I, too, have been declined for Venture X , so this might be a solution. Just curious – does CapitalOne have a reconsideration line?

Yes, you can call recon on (800) 625-7866

Besides the crazy high spend requirement for many, the other problem is that Capital One is one of the few banks that also reports business cards to your personal credit report, taking away a 5/24 spot. Unlike Chase, Amex, BOA, US Bank business cards which don’t report to personal credit at all.

venture x biz and spark cash plus are two of the cap1 biz cards that don’t report to personal credit reports.

not enough bonus points for the spend required

Two Questions:

1) Some Capital One business cards do; I’m not sure about this specific card though.

2) I just added an update to the post. I applied for the card and they declined me, but did offer me one of the Spark cards instead. I suspect that if you’re not eligible they’ll just decline your application rather than approving you, but might give you an alternative card option instead.

Thank you for the prompt response! 🙂

Hi Stephen, actually for the Spark Cash for Business, Capital One no longer reports to personal credit bureaus since October 2020, as long as your account remains in good standing. The Venture X Business and the Spark Travel Elite business cards are also an exception and do not report to personal credit bureaus either.

However, the Spark Miles Select Business card, that you got offered and approved for does report to personal credit bureaus. So if one puts heavy business spend on the card, the credit utilization can also be affected, thus impacting the credit score. Compared to the majority of all the other banks’ business cards, which usually come with 0% APR offers, you can run it up and not be impacted by utilization at all.

The worst for me is Capital One pulling ALL three credit bureaus affecting hard inquiries and then taking away a 5/24 spot with a business card that shouldn’t be there at all.

venture x biz and spark cash plus are two of the cap1 biz cards that don’t report to personal credit reports.