NOTICE: This post references card features that have changed, expired, or are not currently available

In 2012, after setting up an LLC for my blog, I opened a business checking account at a local Chase branch. Since then, Chase has been my primary bank for both business and personal checking. Last year, my Chase banker called to invite me to the Chase Private Client program. For years, my wife had been invited to join the program whenever she logged into her Chase account, but the same didn’t happen to me. Anyway, we had previously ignored her invitations, but I accepted mine. And, I’m glad I did since I’ll soon be 65,000 Ultimate Rewards points richer.

Chase Private Client Benefits

The Chase Private Client website advertises benefits such as having a dedicated team that works with you, exceptional service, and premium banking solutions from JP Morgan. Those aspects may be nice, but I haven’t really taken advantage of them at all. However, there are a few concrete benefits I’ve enjoyed:

- Fee free checking and savings: No need to worry about keeping a minimum balance to keep the account fee free

- ATM fee rebates: Chase rebates non-Chase ATM fees up to five times per statement period

- No exchange rate fees for debit card usage or ATM withdrawals abroad

- Access to special credit card offers (see below)

The above benefits apply to family members as well. I realize that there are some banks that offer similar fee-free benefits without having to enter into anything like a private client relationship, but I’ve found it extremely convenient to have these benefits apply to my primary checking account. For example, I used to carry a separate ATM card that rebated ATM fees, but now my Chase debit card does that. Similarly, when traveling, I use my Chase debit card for foreign ATM withdrawals. Not only is the ATM fee rebated, but there are also no foreign transaction fees.

Private Client has other benefits that may be of interest to some, but I haven’t yet had use for:

- Fee free safe deposit box

- Fee free wire transfers

- $750 discount on closing costs for all loans (including mortgages)

Joining Chase Private Client

There is no fee to join Chase Private Client, but they do look for people that could potentially move a lot of money into Chase’s banking and investment products. In other words, if you don’t have a high income or large savings and investment accounts, it’s probably not worth applying. However, if you do have a high income, or savings, or you’ve been maxing out your retirement savings account options for many years, as my wife and I have, then Chase might be interested in you.

The Chase Private Client website offers an easy way to request an invite. Through this link, you can request to be contacted by email or phone.

Credit Card Offers

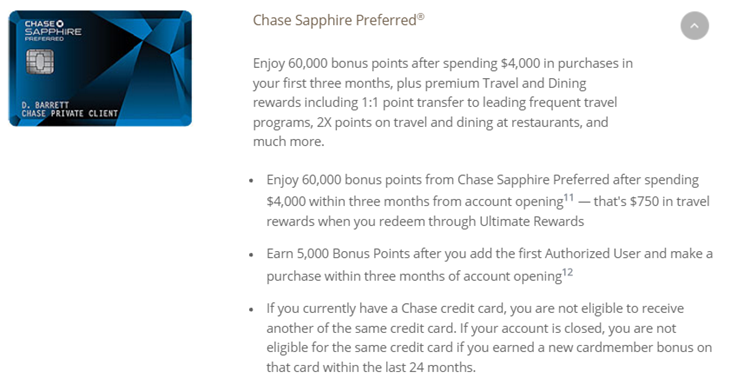

One really cool thing about being in the Private Client program is having access to special credit card offers. Last Friday, I visited my Chase Private Client banker and signed up for the Sapphire Preferred card. The current public offer for the Sapphire Preferred Card (found here) is 50,000 points after $4K spend in 3 months plus 5,000 points for adding an authorized user. By signing up through my Chase Private Client banker, I qualified for 60,000 points after $4K spend in 3 months plus 5,000 points for adding an authorized user. Just like the public offer, the $95 annual fee was waived for the first year.

Breaking the 5/24 rule

In the past year, Chase has frequently denied applications for the Sapphire Preferred and Freedom cards due to having opened 5 or more credit cards (with any bank) in the past 24 months. This has become known as the “5/24” rule (see this post for details). This is the reason I now advise everyone who is new to the points & miles hobby to sign up for the Sapphire Preferred card first thing. The card has a great signup bonus, but it may be more difficult to get the card once you’ve signed up for a number of other cards.

I, of course, have opened far more than 5 cards in the past 24 months. In fact, it’s not unusual for me to open 5 or more accounts in one day. Luckily for me, though, it appears that those who are pre-approved for the offer may be immune to the 5/24 rule. As far as I’m aware, there are at least two ways this can happen: 1) go to a Chase bank and ask if you are pre-approved; or 2) you may receive a targeted invitation to apply. In my case, my banker was able to tell me that I was preapproved, so he submitted my application. The application was approved instantly.

My guess is that my Private Client status was the reason I was pre-approved.

The 24 month rule

Chase has another rule that applies to most of their cards. If you want a new bonus, you can’t currently have the card and 24 months must have elapsed since the last time you got a signup bonus for the same card:

If you currently have a Chase credit card, you are not eligible to receive another of the same credit card. If your account is closed, you are not eligible for the same credit card if you earned a new cardmember bonus on that card within the last 24 months.

In my case, I use a spreadsheet to track the date I signup for each card and the date that I cancel (or product change) each card, but I don’t track when bonus points are earned (but maybe I should). In this case, it’s been more than 3 years since I opened my previous Sapphire Preferred account, so I knew that I was safe. In general, bonus points should post no later than 4 months after signup (3 months to meet the spend requirement then wait for statement to close). So, as long as I signed up more than 28 months ago and no longer had the card, I knew I’d be fine.

65K for my wife too

Chase Private Client benefits extend to family members. While I met with my banker, I asked if my wife would qualify for the Sapphire Preferred 60K + 5K offer as well. He looked at her account and found that, yes, she too was pre-approved for that offer. Awesome. Now I just need to find a time to drag Mrs. Miler into the branch…

[…] It will still be possible to get those Chase cards, but it will take real strategy if you can only have five new card accounts among all of the banks every 24 months in order to get approved. Perhaps there will be some situations where the 5/24 rule isn’t strictly enforced such as if you are targeted for an offer, apply in-branch via “pre-approved” applications, are a Chase Private Client customer, or otherwise get lucky. Read about a great example of breaking the 5/24 rule here. […]

[…] you’re a Chase Private Client, then this rule likely won’t affect you. Frequent Miler has shared his experience about that in this post here. There are also other reports of this happening elsewhere. It doesn’t seem to matter whether […]

[…] I’ve shown by being approved for the Sapphire Preferred card, the Marriott personal and business cards, the United Mileage Plus card, and the Ink Plus card all […]

[…] while ago, FrequentMiler detailed how those enrolled in Chase Private Client can get a 65,000-point bonus on th…. This is a fantastic bonus in and of itself, since the public offer is “only” 55,000 […]

[…] to be the case that members of Chase’s Private Client program were immune to 5/24 rules. I first wrote about this here. Unfortunately, as reported by Doctor of Credit, that is no longer the […]

I became a CPC after moving 250k into Chase. I kept the money in checkings and savings because I don’t trust Chase’s investment (my primary investment vehicles are Fidelity and Vanguard). Soon after I got CPC status, I have been slowly withdrawing funds and now I keep a pretty steady balance of ~50k with Chase.

My question is, is there any investment that is safe with Chase? I mean, I appreciate them giving me CPC, but I don’t want to pay higher investment fees than I have to. Is it too bad an idea to transfer my Roth IRA account to Chase for them to manage?

My understanding is that they do offer no-fee ETFs and the like. I haven’t tried it, but I don’t now why it wouldn’t be safe.

[…] said than done” kind of things. Chase Private Client status is great in lots of ways (details here), but getting that status may or may not be an option for you. Here are a few […]

[…] with approvals, CPC’s are known to get higher signup offers than ordinary folks. For example, Private Clients might be offered a 65k bonus on the Sapphire Preferred instead of […]

I reached out to CPC and they responded: “To get started, we can begin a Chase Private Client relationship with any client who has the intention to meet a minimum balance of $250,000 between deposits and investments in personal assets. This would not include real estate, loan balances or business assets.”

I’m fortunate that I could move over $250,000, but I really don’t want to. What would happen if I told them that I have the “intention” of moving it over, but never do. Will anyone look at my account and ask when the funds are coming over? Can they revoke CPC if I don’t follow through with a vague intention?

I don’t know

[…] backs up the anecdotal evidence that various sources around the net have purported, specifically FrequentMiler, that there are different rules for Private Clients. It wasn’t an immediate approval and it […]

Does anyone know on the $250k investment asset requirement: does Chase offer a self-directed-type investment account with no management fee? I.e. a similar offering to Merrill Edge or Scottrade? Was thinking of moving over some assets if that’s possible in a low-to-no fee, self managed brokerage account.

I believe so. I asked my Private Banker and he said yes, but that I would have to talk with the investment guy for more details

[…] This is another situation where I don’t know for sure that it helps with credit card approvals, but I believe it does. Read all about Chase Private Client here: Chase Private Client and Sapphire Preferred 65K. […]

[…] Note that the 5/24 rule doesn’t seem to be set in stone. There are plenty of reports of people getting approved for new cards despite having opened 5 or more accounts in the past 24 months. In fact, it happened recently for me: Chase Private Client and Sapphire Preferred 65K. […]

[…] Increased sign up bonuses on some Chase credit cards (you can view what they are currently offering by clicking here) […]

[…] you’re a Chase Private Client, then this rule likely won’t affect you. Frequent Miler has shared his experience about that in this post here. There are also other reports of this happening elsewhere. It doesn’t seem to matter whether […]