NOTICE: This post references card features that have changed, expired, or are not currently available

This past month I’ve spent about three weeks in Europe: two weeks in Italy and then nearly a week in London. Just as I do at home, when visiting Europe I tend to pay for everything by credit card. Of course I make sure to use a card with no foreign transaction fee.

Today, almost all US credit cards have chips, but fewer have PINs. Even those with PINs usually default to chip & signature. Even the Barclaycard Arrival Plus card, which used to proudly advertise its chip & PIN capability, defaults to chip and signature. This means that when you pay with a credit card you still have to sign for the purchase unless you’re using a system that doesn’t have signature capability (such as an unattended train ticket kiosk).

The whole chip & signature thing isn’t really much of a problem. Yes, it slows down the process by a few seconds (or more if the vendor has trouble finding a pen). But when everyone else in Europe happily makes purchases with a PIN, or by simply waving their credit card over the terminal (Did you know that they have contactless payment capability?!), you may feel like an idiot abroad when the vendor sighs as the terminal spits out a signature slip. I know I do.

I don’t know why it took me so long to realize this, but there’s an absurdly simply solution if you have a modern smartphone. Simply use Apple Pay or Android Pay. When you do so, the phone uses its fingerprint reader (or facial recognition reader in the case of the new iPhone X) to verify your identity. There’s no need for a signature or a PIN.

After realizing this simple solution while in Italy, I used Apple Pay for all purchases without a single issue. At restaurants I used my Sapphire Reserve card which earns 3X for dining and travel (and actually earns 4X via mobile payments through November 4th). Unlike in the US, restaurants do not abscond with your credit card when you pay. Instead, they bring the credit card reader to the table, and it usually has contactless payment capability. I used my US Bank Altitude Reserve card for all other purchases since that card earns 3X for all mobile payments, and travel payments too.

In London, I continued using Apple Pay everywhere. Only a single store had a card reader without mobile payment capability. It was awesome.

Preparation

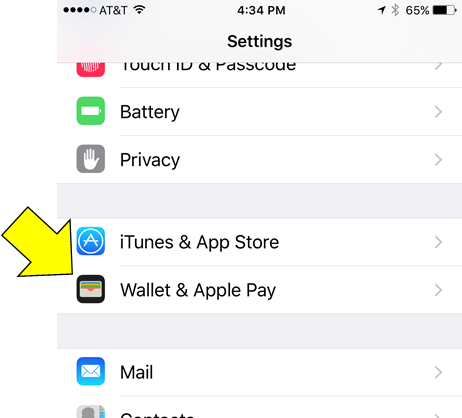

Before traveling abroad, make sure you’ve learned how to use mobile payments on your smartphone. It’s super easy, but not necessarily intuitive. Also, I highly recommend setting up a card with no foreign transaction fees as your default card for mobile payments. Here’s a post showing how to setup the Altitude Reserve as your default Apple Pay card. Obviously you can follow the same instructions to setup any card of your choice. I expect that Android Pay works similarly.

YMMV

Obviously I can’t promise that mobile wallet payments will work everywhere you go. I may have been lucky with getting very close to 100% acceptance on my recent trips. But, hey, it can’t hurt to try it.

[…] capability that comes in handy abroad for things like train kiosks (though Greg has written that Apple Pay / Google Pay can obviate the need for Chip & PIN in many instances). If you like to stay at AirBnB’s now and then or want to use points to […]

[…] A simple alternative to chip & PIN for US tourists. […]

[…] A simple Chip & PIN solution for US tourists […]

The lack of true chip + PIN is one of those things which drives me nuts. So many of these banks market ‘travel cards’, but they don’t have chip + PIN! How the hell am I supposed to use it whilst traveling if it doesn’t support what 98% of the countries use? I always put this in bank surveys, hoping for a change.

I’ve learned to always carry a pen when traveling, since most cashiers abroad don’t have pens at their registers. Even when there is a physical cashier, I’ve run into issues because the POS didn’t understand Chip+Signature or other minor glitch.

For that matter, I don’t understand why the US went to chip + signature. Signing for things is a major hassle compared to Chip+PIN, many consumers already have PINs for debit cards & such so it’s not unfamiliar to them, and most importantly, not all readers use it. My mother’s card got skimmed at a Sam’s Club gas pump last month, which shows the magstripes are still in use, and still as easily copied as ever. The pump had contactless & chip readers installed…but they’re not turned on. Synchrony Bank took an $8k hit on that one since they never caught it before the car max’d out. Good thing it was a low limit card.

Isn’t the Apple Pay only good for up to $30? We do find the lack of a PIN a bit of a pain, but I just keep a pen handy and it doesn’t take more than a second longer. However, they tend to really freak out over the signatures so I also have my Driver’s License in my hand if I need it. Loved it when we were in Australia and everything was pretty much contactless… wave and go. Nice!

I’ve used apple pay for much more than $30. Perhaps 10 times that amount, buying dinner for half a dozen people in Sweden. Whoever told you there was a $30 limit was misinformed.

In Sweden they mostly think the signature thing is idiotic, and half the time don’t even ask you to sign. As one guy pointed out, “I can afford it if someone occasionally uses a stolen card to buy lunch. It’s not worth my time to check a signature.” He also pointed out that it’s never happened. So few tourists with signature cards compared to the vast majority that have chip+pin.

In England we have our signatures checked at nearly every transaction. In Italy and France it happens occasionally. Oddly, in Croatia, Bulgaria and Serbia almost never.

On the Apple pay – we’ve tried to use it and had it fail here in the UK, and in Italy – and were told that it only worked for up to $30 by the person at the till.

I’ve had my signature checked in New Zealand – I didn’t even understand what she wanted when she asked to see the card. It’s literally been decades in the USA since anybody looked at the signature. I was surprised to discover that I’d even signed the card – of course it was just smeared ink that bore no resemblance to my signature on the paper. And then they just shrug and say “OK”. They have to check, but the signatures don’t actually have to match. 🙂

It’s not impossible that the place in the UK where Apple Pay failed has explicitly set their till up that way. If that happened to me I’d almost certainly complain to Apple. I am sure the agreement with the merchant precludes that sort of behavior. People expect to just work.

I always use Apple Pay when ever possible. Apple Pay transactions cannot be hacked or stolen. I use specific cards for Apple Pay and different cards if I need to insert for swipe. I was able to use Apple Pay in Canada tied to USA cards even though Apple Pay says it needs to be linked to a Canadian card.

FM. I think this post gets lost in the actual message via your title. NFC is NOT a “A simple Chip & PIN solution for US tourists”. Its a “potential alternative” if NFC is readily accepted. Maybe thats just semantics. My bad, but I was actually looking for a REAL solution. Meaning, a CC with PIN PRIORITY is desired. NFC is not a solution if the vendor doesnt even accept NFC.

Furthermore, your statement of “Simply use Apple Pay or Android Pay” is incomplete. This is especially true for Apple. Apple Pay and NFC enabled Apple Pay are two completely different things that nobody understands.

Your post may confuse people who dont understand NFC and the differences between Apple and Android. Not all terminals will allow NFC and Samsung Pay is a form of Android Pay.

Fair enough. But the title got both of us reading the post. 🙂

I don’t have an Android phone, but Android pay seems like an Android variant of Apple pay, although not as extensive for non-phone transactions.

Apple Pay is much more than paying at a terminal with your phone. But most people experience Apple Pay that way. The other features (sending money to other Apple users, paying on the web) are less well known. I’ve been using my iPhone to pay for years and only just dug into other features of Apple Pay.

NFC payments are accepted a lot of places you’d not expect, but it’s still a bit of a jungle. At the Perth airport the parking machine accepted Apple Pay, but then rejected the transaction. My friend’s NFC-enabled card worked. Parking meters in Fremantle, if I remember correctly, worked with Apple Pay. Most bars and restaurants worked with it, except one where the owner went into a rant that basically said “I’m a Luddite” and I needed to use my card. And then he ranted about stupid American banks and needing to find a pen.

Here at home in Colorado I can successfully use Apple Pay at Whole Foods and Natural Grocers, but not at Safeway. T-Mobile accepts Android Pay but not Apple Pay.

I recently surveyed my credit cards, and unlike in Canada none of them are NFC -enabled. “Tap” payment (their terminology for NFC payments) is common, as is Chip & PIN.

But things will sort themselves out soon enough. Apple Pay is both convenient – everyone always has their phone with them – and more secure than using an actual card, be it signature or chip & PIN.

And finally, for a solution to the problem you were looking to solve – there are a couple of chip+PIN priority cards that are PIN priority.

Target Red *credit* cards appear to be PIN-priority, with no foreign transaction fees. No real rewards. But they are a way to pay when you travel.

And for a 2% back rewards credit card that is chip+pin, First Tech Federal credit union has a few:

https://firsttechfed.secure.force.com/HelpCenter/Credit_Card_Calculator?display=comparison#

Now, if only Chase would get with the program. 🙂

In Moscow tried to use Citi Exec at a supermarket, didn’t work, the kiosk asked for pin which the card doesn’t have. Luckily had my bank debit card with pin, but lost the miles.

To read this just highlights just how backwater the U.S. is. Can’t believe people there wouldn’t already be using contactless payments!

It’s not so much being a backwater as that it’s complicated to get thousands of small banks to change overnight.

But it’s coming – I rarely use anything other than apple pay in my day-to-day life. Occasionally chip+signature – but that was an explicit decision on the part of Visa and Mastercard when we moved from swiping cards.

Soon enough even chip+pin will go away and everything will be contactless.

Australia has had NFC (Contactless payments) in all Debit and Credit cards since 2009, and banned signatures in around 2014 or 2015. Could never believe the US was so far behind, in 2016 35% of all transactions and 65% of all card purchases in Australia were made with Contactless, and that was before Android/Apply pay was introduced, that number is only higher now.

Been doing this for a couple of years. Lots of vendors don’t even know their system supports it. It’s vastly amusing when they hand you the machine to insert your card and you hover your phone for a moment and the machine starts printing the receipt…

[…] A simple Chip & PIN solution for US tourists by Frequent Miler. Mobile payments do make things so much easier, even better when card issuers are offering some sort of bonus for using them. […]

Awesome solution, but my travel backup is always going to be my First Tech Federal Credit Union Choice MasterCard (the Platinum is equivalently good). No annual fee, no foreign exchange fee, true primary chip+PIN — even here. It’s the only US-based card I’ve found like it.

The Target Mastercard is true chip+PIN without any annual fee too. It works flawlessly in Europe.

Ooh, good tip! Is there a foreign exchange fee?

Nope – no foreign fees.

My United Nations FCU card is true chip+PIN and works flawlessly in Europe. It also has Verify by Visa capability which is important for pre-trip.online purchases of such things as European train tickets and timed admissions to museums. Chase, to my annoyance, does not have Verify by Visa. They make you call a customer service rep.

One more good reason to set up Apple Pay…. We were in London on vacation a few months ago. We also did one night in Paris. Coming back on the Eurostar I was notified of a charge going onto my Sapphire Reserve that we did not make. We called and Chase disabled our matching cards and expedited new ones to us. Still took a few days because it was over a weekend. But I noticed the day after I called it in that my Sapphire card in Apple Pay showed a different last four numbers, so I was able to use the new card two days before it arrived UPS at our London hotel!

I have friends who have a Barclay Arrival+ who complained that it did not work in unmanned kiosks (train) or French toll booths. I have the Barclay AAviator Red MC and have successfully used it with pin to reload my Oyster card in London, my OV Chipkaart in Amsterdam, and I’ve also used it in French tollbooths (if I recall, I didn’t need to use the Pin with those). Yes, it’s chip and sign elsewhere, but I don’t find that a big deal.

Just got back from Ireland and had the same experience with the Barclay AAviator Red MC – wokred like Chip + Pin at a gas pump, but read as chip + sig everywhere else I used it.

Even stranger is that my Arrival+ worked at some French toll booths (A7), but not others.(A8 booth 10 miles from the A7).