Several years ago, we wrote about a short-lived promotion that essentially made it possible to buy American Airlines miles at a price of about 0.41c per mile (long dead, but here it was). I bought thousands of dollars worth — and it wasn’t enough. I ran through more than a million American Airlines miles in just a few years and have often wished that I’d bought more. I was therefore delighted when Citi bought back American (Airlines) muscle this week by launching transfers to AA from the Citi Strata Premier, Strata Elite, and Prestige cards. In fact, that was enough to move my wife’s Premier card from a sock drawer to physically sit in my wallet given its stable of useful 3x bonus categories.

Between the Premier card’s bonus categories (3x grocery, dining, gas, flights, hotels, and travel agencies) and the U.S. Bank Altitude Reserve offering 3x on mobile wallet (which, while set to be nerfed in December, is still valuable for now and might continue to yield value later when they launch transfer partners), I feel like 3x transferable points per dollar might become the new floor for most of my spend. To be clear, those cards have long offered me the chance to earn 3x, but the addition of American Airlines to Citi’s lineup significantly increases my interest in ThankYou points for now and I’m hopeful that U.S. Bank will launch a set of exciting transfer partners that will make me glad to be earning 3x on mobile wallet spend down the road.

This week on the Frequent Miler blog…

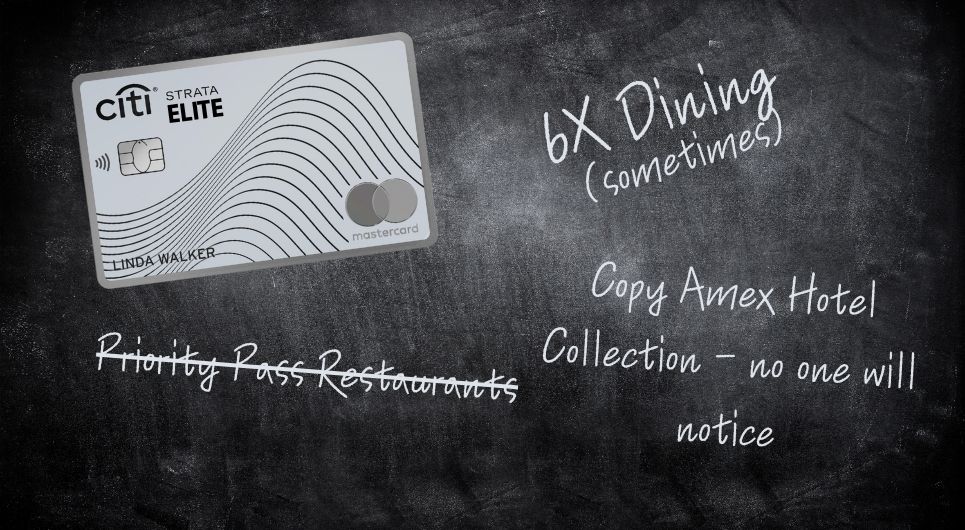

Citi Strata Elite now live (with AA transfers!). Complete details and my personal analysis

The Citi Strata Elite card launched this week and the final card was a bit surprising. I’ll give credit where credit is due: Citi kept the coupon benefits super simple to use in one shot, which is what I want to see on an ultra-premium card rather than the monthly time suck of trying to use piddly $10 benefits that other issuers have moved toward. The coupon benefits can yield excellent value in year one, but there isn’t much in terms of bonus categories other than ones that involve booking travel through Citi’s travel portal. Oddly, the Premier looks like a better long-term keeper in many ways, but with the ability to transfer points to partners that now include American Airlines AAdvantage, it is hard to ignore the potential value of the 100K bonus offer if you can get it.

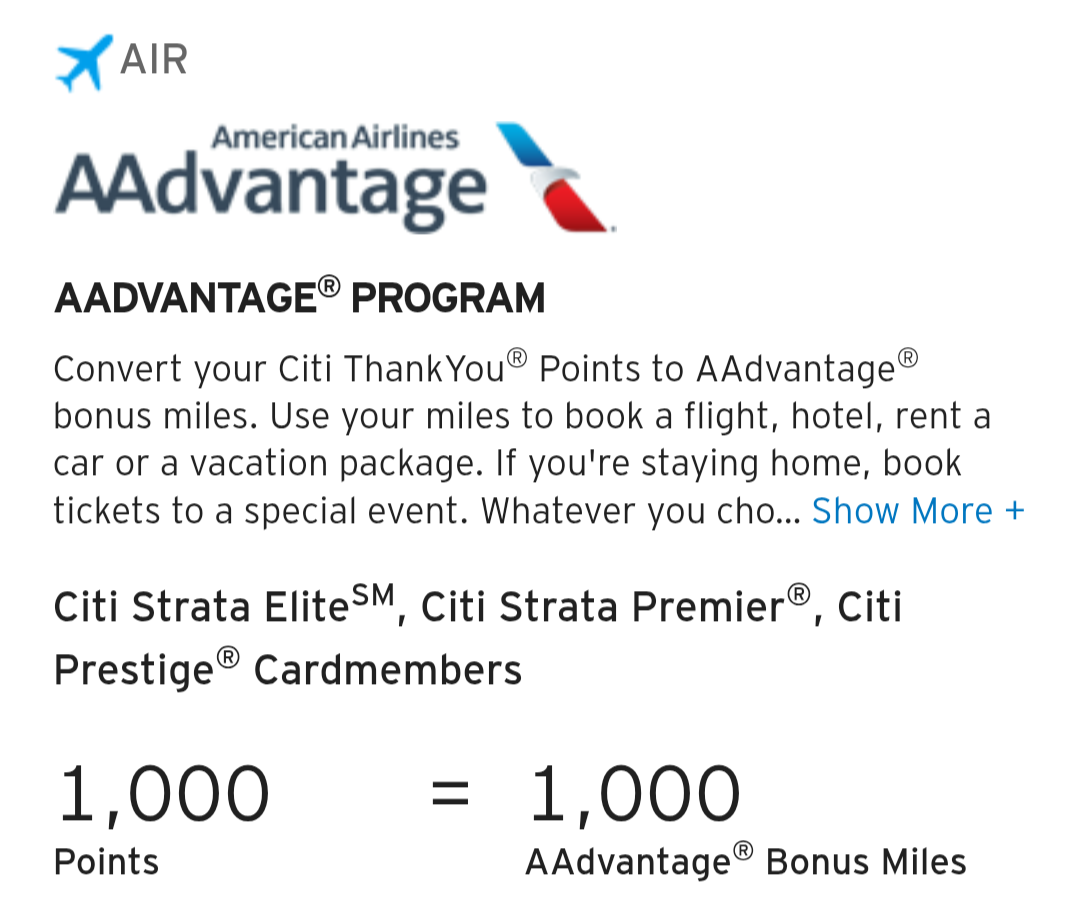

Citi now offers transfers to American Airlines from Strata Elite, Prestige & Strata Premier

In the most surprising news in recent memory, Citi this week launched the ability to transfer ThankYou points from the Strata Elite, Strata Premier and Prestige cards to American Airlines AAdvantage. That’s a great value-add for ThankYou points collectors that we expected to see down the road, but definitely didn’t expect to launch right now. Between American’s excellent partner award chart and its own dynamic model which sometimes offers great deals on its own flights, this is great news for the value of Citi ThankYou points.

Now transfer from most Citi cards to most ThankYou partners (even from Custom Cash)

Also notable this week from Citi: you can now transfer from most cards that earn ThankYou points to most ThankYou airline and hotel partners. The notable exception is American Airlines, which can only be accessed through the Strata Premier, Strata Elite, or Prestige card. Note that the transfer ratio when transferring from no-annual-fee cards like the Custom Cash or Citi Strata card is poorer at about 70% of the ratios available on the more premium cards, but it is nonetheless good to see the ability to transfer to partners expanded to additional cards.

How to apply for the Strata Elite 100,000 point offer | Coffee Break Ep65 | 7-29-25

The online offer for the Citi Strata Elite is only good for a maximum of 80,000 points after qualifying purchases, but all it takes is a phone call to get a link that’s good for 100,000 points. On this week’s coffee break, we discuss how many folks are finding success in getting an additional 20,000 points with minimal effort by reaching for an ancient piece of equipment: the telephone.

Citi Strata Elite Q&A

Have questions about whether you qualify for the welcome bonus on the Strata Elite, how many guests you get with Priority Pass, how you might save $145 on the annual fee, and more? This post collects the most common questions we’ve received and provides all the information you need to know.

Best uses for Citi ThankYou Points (2025)

Transfers to American Airlines aside, what are the other best uses of Citi ThankYou points? From Hawaii for 10,000 points each way to a unique collection of lodging partners and some of the usual suspects on the airline front, this post collects some of the best uses of ThankYou points to help you get outsized value from your shiny new ThankYou points.

Citi Strata Elite: the good, bad, and ugly | Frequent Miler on the Air Ep317 | 8-1-25

If you haven’t yet gotten your full fix of Citi, this week on Frequent Miler on the Air, Greg and I discuss the card in depth, including what we like, why we don’t think it is a keeper for most of us, and why that doesn’t really matter for the first year.

Seismic summer shifts in the points & miles game

Greg’s post about the huge changes we’re seeing in the points & miles game over the past couple of weeks is all stuff that was top of mind for me as well. Citi has gone from an afterthought to the forefront with a more powerful transferable currency and an ultra-premium card that is really easy to understand even if somewhat overwhelming. Meanwhile, Chase complexified its most broadly useful card into near irrelevance and my Altitude Reserve card is living on borrowed time. I agree with all of Greg’s sentiments here and I’m curious to see where we head next.

U.S. Bank Altitude Reserve: Major changes in December confirmed. Is it the end?

The U.S. Bank Altitude Reserve has become my regular, day-to-day workhorse in terms of being the card that sees the majority of my purchase activity from ordinary every day expenses thanks to 3x on mobile wallet purchases and the ability (at the time of writing) to redeem points toward travel at a rate of 1.5c per point. However, major changes are coming in December: mobile wallet spend will be subject to a monthly cap and redemption value will be reduced to 1c per point. On the bright side (maybe), U.S. Bank says we will be able to transfer points to hotel and airline loyalty programs. Time will tell whether those partners are of value, but there’s no doubt that these changes are a big hit to a long-held favorite card that will make many question whether it is worth keeping for the slight bump in transferable currency earning.

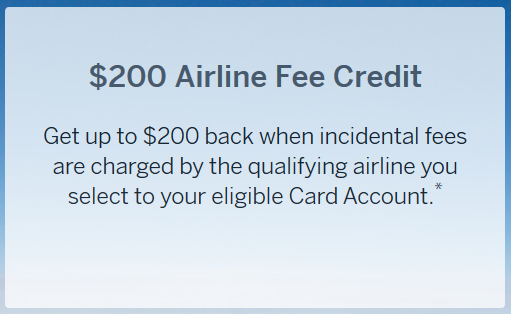

Amex Airline Fee Reimbursements. What still works?

For those hanging on to ultra-premium American Express cards, we’ve updated our guide to what still works to trigger Amex Airline Fee reimbursements. As always, if you see an older positive data points that remain, that’s because we haven’t received a failure report, which means that technique is still working.

How to maximize your Hilton cards (with upgrades and downgrades)

These days, many of us want all of the Hilton Free Night Certificates we can get. Thanks to the techniques outlined in this post, you might be able to get more of those free night certificates than you realized with less effort than you may have thought necessary. At the core here are the attractive Amex product change rules, which also came in handy for me recently in a different scenario. While I haven’t done much of this with the Hilton cards, Tim outlines some slick moves here that I probably should be making.

Nick’s weekly JetBlue 25 for 25 update: 6 airports down, shark teeth found

Last week, my family picked up a couple more airports in our quest to reach 25 Jetblue destinations. In this post, I share what we did, how I booked hotels and car rentals and what we did to save a few extra bucks. I’ll likely publish similar posts over the weekends moving forward, though you’ll want to keep an eye on Instagram to follow our travels closer to real-time.

That’s it for this week at Frequent Miler. Keep an eye on our last chance deals to make sure you get them before they go.

![Cutting our collections, comparing free night certificates, and expediting new cards [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/07/Nick-Platinum-cancel-218x150.jpg)

![Re-Bilt already, Fixing Marriott, the best Hyatts for Free Night Certificates and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2026/01/wp-1768653765552601913603261308925-218x150.jpg)

Can you get both the Elite and the Premier? Downgrade the Elite to the Premier? Does getting one lockout the SUB for the other?

Wondering what is the right two year strategy for Citi TY.

Time for update on Ritz Carlton airline fee credits?

Honestly, I don’t find it all that useful. Anything can work — it’s all up to the agent. I could tell you that X worked for person Y, but that won’t necessarily be helpful for you because you may not get Agent Z who allowed it. If you look at that post, DPs are all over the place — some people have had hotel stays reimbursed, airport parking, etc. It’s really just up to the agent you get, so it’s worth trying almost anything. I find it to be among the easiest cards on which to use incidental credits because agents have so much latitude. If I try something and it doesn’t work via either phone or secure message, I just try something else. I rarely have to try more than once to find something that works.