NOTICE: This post references card features that have changed, expired, or are not currently available

In September, I started an experiment with the Citi Prestige card. I knew that its benefits were changing drastically as of October 19th and so I wanted to see if I could double up. Specifically, could I earn the $200 airline fee credit before October 19th and then earn the new $250 air travel credit after October 19th? I finally have the answer: no.

That said, I’ve still come out way ahead…

Background

If you’d like to catch up on the details of what I’ve written so far about this experiment, please read the following:

- Pondering Prestige. When 30K beats 60K.

- Citigold, Citi Prestige. From $400 to 200K. What does $200 + $250 equal? And, a pile of…

- More Citi fun…

- My progress towards Citi Prestige 30K and $700

$700 Experiment = $500

Before October 19th, the Prestige card offered cardholders up to $200 in airline fee reimbursements. As of October 19th, cardholders now receive up to $250 in air travel credits. The latter is not only a bigger dollar amount, but it is easier to get too. All air travel qualifies, including airfare purchases. Before October 19th, reimbursements were specifically for fees such as checked luggage.

My hope was to earn $200 before October 19th, $250 after October 19th, and then another $250 in 2015 for a total of $700 cash back. That would be a nice haul in exchange for the card’s $450 annual fee ($350 if you have a CitiGold account).

As I reported before, the pre-October 19th $200 airline fee reimbursement came in as expected. After that, I just had to spend $250 or more after October 19th on airline related stuff and wait for my next statement to close. Well, my statement finally closed and I have the final answer:

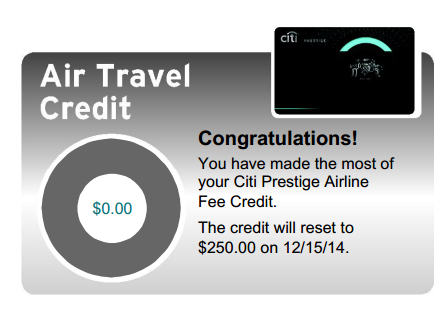

![]()

Citi counted the original $200 reimbursement towards the $250 of air travel credit available this year, so I only ended up with a total of $250 for this year. This is exactly what Citi representatives told people when they called to ask. It doesn’t surprise me at all that they limited my total to $250 altogether. What really surprises me is that the call center agents knew the right answer. In my experience, the chance of getting a right answer, from any company, about something as esoteric as this is close to zero. This time, though, Citi agents got it right. Good job Citi!

Overall, I won’t get $700 worth of statement credits from this one application, but I will earn $500, so that’s still very good!

Important note: As you can see in the image above, Citi resets the clock on Airline Fee credits on a date based on your statement cycle rather than the calendar year. Why this is important: If I had waited until late December to put airline spend on the card, the reimbursement would have counted towards next year’s total rather than this year’s and I would have missed out on some of the reimbursements.

Flight Points post and boost my earning rate

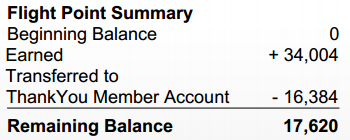

One of the features of the Prestige card that disappeared on October 19th was the ability to earn Flight Points. Flight Points were earned when you used the Prestige card to pay for flights. Before October 19th, I earned Flight Points by booking a number of long distance award flights. Now, with my latest statement, the points are visible to me:

As you can see above, I earned 34,004 Flight Points and about half were converted to ThankYou points. In order to convert the rest to ThankYou points I need to match the remaining Flight Points with an equal amount of points earned on my Prestige card. Theoretically that would mean that I would have to spend another $17,620 in order to covert the last of my Flight Points to ThankYou points. That said, I discovered something interesting in my latest statement…

The number of Flight Points transferred to my ThankYou account corresponds to the number of points earned in 1X, 2X, and 3X categories in my latest statement plus only the base earnings in my previous statement. So, it appears that Flight Points now get matched to all ThankYou points earned on spend. That means that, while my Flight Points last, my Prestige card earns ThankYou points at the following rates:

- Airlines, Hotels, & Travel Agencies: 6X (usually 3X)

- Dining and Entertainment: 4X (usually 2X)

- Everything else: 2X (usually 1X)

Wow. That’s really good! I wish I had earned a lot more Flight Points!

Bumping the signup bonus to 60K

You may recall that when I first considered signing up for the Prestige card, I convinced myself that the 30K bonus which required $2K spend was better than the 60K bonus which required $15K spend. In reality, the 30K bonus was the only one realistically available to me since the other requires visiting a Citi branch office.

Flash forward a bit to the time when I realized I had about 30,000 Flight Points on my account. I suddenly realized that this Prestige card had become my single best option for non-category bonus spend (and I now know that it is, by far, my best option for airline, hotel, and travel agency spend!). And, so, I realized that the 60K offer with $15K spend really was the better offer for me.

I called up Citi and told them that a friend of mine had signed up for the 60K offer (which is true, see this post), and I asked if I could be bumped up to that offer. The agent on the phone couldn’t help me directly, but she was able to give me instructions, as follows:

- Fax a copy of the 60K offer to 1-866-799-5591

- Include a cover letter with your Prestige credit card number and a message asking Citi to review your account for this 60K offer

- Wait 10 business days for a written response, or call the number on the back of your card in a few days to check on the status.

So, I did all of the above. I wrote the cover letter as described and I sent in the image that I downloaded from Rapid Travel Chai’s post. I used FaxZero.com to send the fax from my laptop, for free.

Yesterday, I called Citi to check on the status. Success! I’ve been bumped up to the 60K offer! Specifically, since I’ve already earned the 30K signup bonus, they added the second part of the offer to my account: earn 30,000 points after a total of $15,000 in purchases within the first 12 months. Well, that will be easy! I’m only about $1500 away right now!

Next steps

Due to the timing of my Prestige application, I still have nearly a year to use the global companion ticket benefit. The idea behind the companion ticket is that the cardholder can buy one round-trip flight and add on a companion for free. In reality, cardholders have found that the companion is charged pretty high fees so that the benefit became more of a two person discount than a true buy two for the price of one type of thing. Now, Citi is in a transition state where the usual website for booking these flights is no longer available. I think it is possible that they will therefore handle the companion ticket differently. Will it become a true two for the price of one deal? We’ll see soon…

Any idea on the current status of this “plan”? I am looking to diversify and Amex won’t offer me any big bonus right now even with my recently increased spending for work (60k in last 4 months).

I was thinking this might be a good option. But I have a few questions:

– Does the credit apply only in one billing period or does will it apply if you spread out your airline costs over several statements? (e.g. $150 on tickets in march, $50 in bag fees in April)

– Has anyone had success recently with the method described above to get the extra bonus offer?

[…] the same. For an account of applying with the public offer and requesting a match to 60K, check out this post by The Frequent Miler. You may also be able to get this offer without any CitiGold account as Rapid Travel Chai did in […]

[…] card in September in order to take advantage of both expiring and new benefits to the card (see “Citi Prestige experiment failed, yet I’m way ahead. Here’s how…”). Thanks to the Flight Points feature of the card (which is no longer available to those […]

[…] FrequentMiler had success getting a bump from 30,000 to 60,000, see the details here. […]

I was about to apply for my wife’s card today (I already have one) but after reading this article, I am debating. What I am concerned about is if I apply for this card, when will I get this and more importantly, when will the first statement close for me to be able to get $250 airline credit for this year and $250 for next year? Any thoughts?

It’s a reasonable concern, but I think you would likely be OK. I applied for my card on Sept 23rd and my first statement closed mid October. So I’d guess that if you applied now, you would get a late December close date (you can also ask to change the close date, I believe).

Thanks for the info! Any idea if this card is churnable, much like the Executive card? If so, this could mean a lot of $250 airline credits and ThankYou points!

the companion ticket is a pain to use now that the website is down. you have the email or call concierge and they will usually get the details wrong. their turnaround time is about 48 hrs so you can waste a week without really going anywhere. what i try to do now is give them the exact dates and flights i want but they will usually still mess up

It sounds like you’ve tried it recently. Do you know whether the pricing is any different now that its a new process?

Surely the Citi Thank You Preferred is better?

50K total after spending much less in 15 months and only $125 in fees.

I think you mean the Premier card, not the Preferred card.

Anyway, it depends on a lot of factors. If you plan to keep the card only one year, the Prestige is hard to beat since you can get two $250 airline fee rebates if you straddle two calendar years. So, that more than covers the first year fee plus your points are worth more when used for AA/USAir, plus you get lounge benefits and more.

Yes, I did mean the Premier. And I see your point.

Thanks.

Just faxed Citi a letter asking to be bumped up to the 60k offer…fingers crossed!

Good luck!

Greg, I had success in getting both the $200 and $250 credits. I think the difference is that I thought Citi would automatically issue statement credits a few days after the airline charges post (like Amex does) and when they didn’t post within a week, I called and they manually issued me a credit (was listed as a courtesy credit or something. When my latest statement closed, it indicated I had an unused $250 balance for the rest of the year, so I purchased another $250 in gift cards.

Paul, which airline were you able to purchase gift cards from and get the credit? Thanks

rrr – I bought Southwest, but any airline should work so long as the purchase is made thru them (rather than thru Points.com)

Ha, awesome! Yes, I’m sure you were able to double up since the first credit wasn’t handled automatically. Nicely done 🙂

For me the citipretige has been the card that keeps on giving. I have always found them accommodating when called. I hesitate to mention this but this is my third year of having the card and although the citigold relationship should have reduced the fee to $350 instead the fee was reduced to ZERO.

My next renewal comes in March 2015 and I am anxiously awaiting to see if the fee will be $350’or $0. Since my wife also has the grandfathered citifoward. 5x Amazon , Dining ,etc plus the now defunct 5x offer for preferred groceries,drug stores, etc (a bunch of points). I now simply use the prestige to maximize my wifes TYP for redemption via strategic transfers. I also have ~ 60000 flight points to work off at the increased categories. One last example of the prestige cards ability to keep on giving was the gratis offer last year of an AU card for my wife which added a second set of companion tickets already fully exploied.

Thank you Citi

Wow, that’s fantastic!

If I apply now, will I still be able to take advantage of $250 flight credits this year and last year? I could probably call and push the statement up so it doesn’t go into 2015.

Probably. You just need to make sure you spend $250 or more on airfare or airline fees before your December statement closes

Maximizing this card requires plenty of future activity I can’t guarantee will happen, and if it did happen it would require time I could have spent getting at least three other good cards. Second, none of those possibly chimerical benefits exist anymore for new customers anyway, and I don’t have to worry about it. But if you’ve already got the card, I guess you better make some lemonade.

Actually I think its an excellent card with its new benefits, especially for those who purchase a lot of travel (3X)

What are some other things you can purchase to get reimbursed? Buying airline gift cards? Buying miles? Purchasing an upgrade? Is there a comprehensive list somewhere?

I think that any charge that comes from an airline will count. Citi says this:

Airline Fees are defined as purchases made with airlines including Air fares, baggage fees, lounge access and some in-flight purchases

Any idea how long after you have applied for the card you can ask to bump the bonus?

I’ve always heard 60 days….though SPG refused to bump me from 25k to 30k and it was only 28 days since I applied.

So. YMMV.

I don’t know if they have a rule, but I did it about a week before my second statement closed