Yesterday, in response to reader inquiries, Nick revealed the credit and debit cards he carries in his wallet. Now it’s my turn. But please note that these are not recommendations for what you should do. Everyone’s circumstances differ. What’s best for me likely is not best for you. Further, I’m not arguing that what I have is necessarily best for me either (although I think it’s pretty good). It’s just a list of cards that I happen to have in my wallet at the moment of writing.

Citi Premier Card for gas

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: Very strong earnings for spend. Excellent bonus categories. Points transferable to select airlines. Recommend pairing this card with Citi Double Cash and Citi Rewards+. Click here for our complete card review $95 Annual Fee Earning rate: 3X grocery ✦ 3X dining ✦ 3X gas stations & EV charging ✦ 3X flights, hotels, travel agencies ✦ 10X hotels, car rentals, and attractions booked through Citi Travel℠ Card Info: Mastercard World Elite issued by Citi. This card has no foreign currency conversion fees. Noteworthy perks: Transfer points to airline partners ✦ $100 Annual Hotel Savings Benefit ($100 off a $500+ hotel stay, excluding taxes and fees, when booked through Citi Travel) ✦ Travel protections See also: Citi ThankYou Rewards Complete Guide |

I’m an authorized user on my wife’s Citi Premier account. We use this card solely to earn 3X for at gas stations. We don’t spend much on gas, though, so I don’t plan to hold onto this card long term.

Citi Prestige Card for dining

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: The Prestige card's best in class 5X rewards for dining, airfare, and travel agencies is hard to beat. Sadly, this travel card doesn't provide any travel protections. $495 Annual Fee Earning rate: 5X airfare, dining, and travel agencies ✦ 3X hotels and cruise line ✦ 1X everywhere else Card Info: Mastercard World Elite issued by Citi. This card has no foreign currency conversion fees. Noteworthy perks: $250 travel rebate per calendar year ✦ Free lounge access: Citi Properietary Lounges; and Priority Pass Select with free guests ✦ $100 Global Entry application fee credit ✦ 4th night free hotel benefit See also: Citi ThankYou Rewards Complete Guide |

I use this one to earn 5X at restaurants. My wife and I eat out a lot so this is big. We often eat out when traveling internationally too, so the Amex Gold Card (which earns 4X for dining) isn’t a great alternative since Amex isn’t widely accepted outside of the United States.

Some readers will remember that I had previously decided to cancel this card after Citi removed all the travel protections last September. I had decided that the ability to earn 5X at restaurants was great, but not enough to justify the card’s huge annual fee. Well, I got a one year reprieve due to an interesting mixup when I tried to product change my card but then changed my mind. I don’t think the outcome is reproducible, but the end result was that I wasn’t charged a membership fee. Also, in looking back at my restaurant spend in 2019, it’s clear that I eat out more than I had earlier estimated. I’ll take another look next time the annual fee comes due, but at this point the card may have reverted to being a long-term keeper for me.

Amex Gold Card for grocery

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: This card offers an awesome return on US supermarket and worldwide dining spend, putting it at or near the top-of-class in both categories. Dining credits and Uber / Uber Eats credits go a long way towards reducing the sting of this card's annual fee. $325 Annual Fee Earning rate: 3X points for flights booked with airlines or on amextravel.com ✦ 4x points at US Supermarkets (up to $25K in purchases, then 1x) ✦ 4x at restaurants worldwide ✦ 1X points on other purchases. Terms apply. (Rates & Fees) Card Info: Amex Pay Over Time Card issued by Amex. This card has no foreign currency conversion fees. Noteworthy perks: Up to $10 in statement credits monthly with participating dining partners (Goldbelly, Wine.com, Milk Bar, Shake Shack, Seamless/Grubhub, Cheesecake Factory) ✦ $10 monthly Uber or Uber Eats credit (use it or lose it each month) ✦ $100 hotel credit on qualifying charges on stays of 2 nights or longer, plus a room upgrade upon arrival, if available with The Hotel Collection at americanexpress.com/hc ✦ Enrollment required for select benefits. |

This is my wife’s old Premier Rewards card which was automatically converted to an Amex Gold Card (but we never ordered a new metal card). When I had decided to cancel my Prestige card, this card became more valuable for its 4X dining benefit. So we paid the annual fee. It was only after it was too late to cancel and get the fee back that I realized that I’d be keeping the Prestige card after all. We’ll reassess this card next year, but for now we use it for all grocery spend. We also use it to order food through Grubhub since this card offers up to $10 back each month at certain restaurants, Grubhub, and Boxed.

Bank of America Premium Rewards: My “Everywhere else” card

| Card Name w Details & Review (no offer) |

|---|

$95 Annual Fee Earning rate: With Platinum Honors status with Bank of America's Preferred Rewards program, earn: 3.5X travel and dining ✦ 2.625X everywhere else Card Info: Visa Signature issued by BOA. This card has no foreign currency conversion fees. |

A while ago I moved the management of a chunk of my retirement funds to Merrill Edge. This accomplished two things: 1) I got a nice bonus from Merrill (I think they were running a $900 promo at the time — usually they offer up to $600); and 2) I qualified for Platinum Honors with Bank of America’s Preferred Rewards program. This means that I automatically earn 75% more rewards on certain Bank of America cards, including this one (read full details here). This means that my Premium Rewards card now earns a minimum of 2.62% back everywhere. That’s awesome. Plus it is a Visa card and so it is accepted worldwide and it has no foreign transaction fees. As icing on the cake, the card’s $95 annual fee is offset by the card’s $100 in annual airline fee rebates.

Chase Private Client debit card

About five years ago we moved to a new house. In the process, I temporarily deposited the money from the sale of the old house into my Chase account. This resulted in a call from Chase inviting me into their Private Client program. Initially, this was awesome because it used to mean that I qualified for better signup offers and was exempt from Chase’s 5/24 Rule. Neither seems to be the case anymore. But I still use the Private Client debit card which has no foreign transaction fees and rebates ATM fees. If it wasn’t for this card, I’d switch to using my SoFi debit card for international ATM use since it too has no foreign transaction fees and it also rebates ATM fees.

Altitude Reserve 3X Mobile Wallet

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: With points worth 1.5 cents each towards travel, this card offers an excellent signup bonus. For ongoing use, this card is a winner for those who spend a lot on mobile payments (at 3X, rewards are worth 4.5%) Click here for our complete card review $400 Annual Fee Earning rate: 5x prepaid hotel & car rental through Altitude Rewards Center ✦ 3X travel and mobile wallet payments Card Info: Visa Infinite issued by USB. This card has no foreign currency conversion fees. Noteworthy perks: $325 in travel/dining credits per membership year ✦ Points worth 1.5 cents each towards travel ✦ Real Time Mobile Rewards (redeem points at full value at time of purchase) ✦ Priority Pass Select airport lounge access (8 per year) ✦ Primary car rental coverage ✦ No foreign transaction fees ✦ Free authorized user cards |

The US Bank Altitude Reserve card isn’t in my physical wallet, but it’s my default mobile wallet (Apple Pay / Samsung Pay) card since it earns 3X (worth 4.5%) on all mobile wallet payments. A while ago I picked up a Samsung watch which lets me use Samsung Pay everywhere, even where mobile payments aren’t accepted, but I hate wearing that watch. As a result, I usually just use Apple Pay when available.

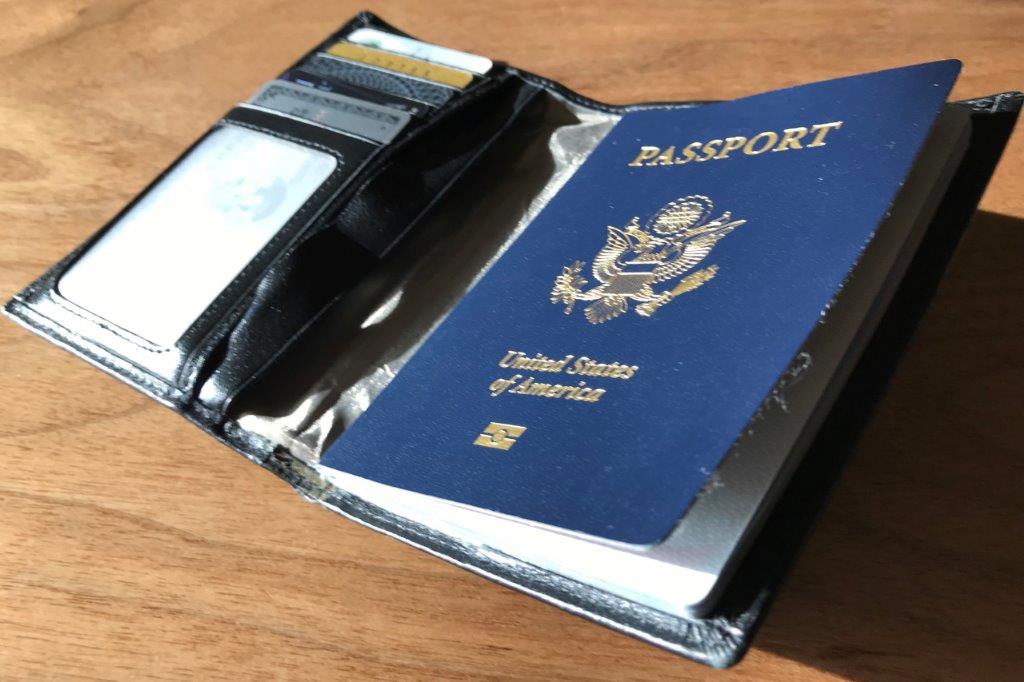

My Travel Wallet

My travel wallet is a wallet that never goes in my pocket. Instead, I keep it hidden away in my backpack. It contains all of the cards that I might need while traveling. Some of the non credit-card items in my travel wallet include my passport, my dive certification, Priority Pass (for lounge access), public transport cards, and travel related gift cards.

Credit cards found in my wallet include my Platinum card (for lounge access and emergency medical evacuation), my Chase Sapphire Reserve card for travel purchases, various hotel cards for in-hotel payments, and various airline cards for in-flight food discounts.

What’s not in my wallet (but is at home)?

I have a lot of cards that aren’t kept in either of the wallets shown above. I’m not going to list every card I have here, but there are some key cards missing from the story above that are worth noting:

Citi Double Cash: 2X Everywhere

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: 2X rewards for all spend with no annual fee makes this card a winner. Earn 2X everywhere and redeem for the equivalent of 2% cash back or 2X ThankYou points. Pair with the Premier or Prestige card to make points transferrable to airlines. Click here for our complete card review No Annual Fee Earning rate: 2% cash back everywhere (1% cash back for each purchase + 1% when paying your credit card bill for that purchase). ✦ For a limited time: Earn 5% total cash back on hotel, car rentals, and attractions booked on Citi TravelSM Portal through 12/31/24. Base: 2X (2.9%) Card Info: Mastercard World Elite issued by Citi. This card imposes foreign transaction fees. Noteworthy perks: 1X when you make a purchase + 1X when you pay for those purchases See also: Citi ThankYou Rewards Complete Guide |

This fee-free card offers 2X rewards everywhere and cash back is transferable one to one to Citi ThankYou Rewards. This, in turn, makes it possible to transfer points one to one to a number of airline programs. For full details see: Citi Double Cash Complete Guide. This is a great option for Plastiq bill payments for things like mortgage payments that can be made with Mastercards, but not with Amex or Visa cards.

One problem with this card is that it does incur foreign transaction fees so I recommend leaving it behind when traveling internationally.

Citi Rewards+

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: The fact that you can get 10% Points Back when you redeem, up to the first 100,000 points redeemed per year, makes this a great choice to pool with ThankYou Premier, Prestige, and/or Double Cash Click here for our complete card review No Annual Fee Earning rate: 5x on travel booked through Citi Travel℠ Portal through December 31, 2025 (excludes air travel) ✦ 2X at supermarkets and gas stations on up to $6,000 per year ✦ Round up to nearest 10 TY points on all purchases Card Info: Mastercard World issued by Citi. This card imposes foreign transaction fees. Noteworthy perks: Round up to the nearest 10 points on all purchases with no cap. ✦ Get 10% Points Back when you redeem, up to the first 100,000 points redeemed per year. See also: Citi ThankYou Rewards Complete Guide |

This fee-free card is awesome because it offers a 10% rebate on rewards (capped at 10K points per year). By pooling this card with my Double Cash and Prestige, I automatically get up to 10,000 points per year without thinking about it. My wife also has the card and has it pooled with her Premier card so that we can get additional points rebates that way. The Rewards Plus card also offers great rewards very small purchases so I should probably stick it in my wallet, but I don’t think I have enough small purchases to make much difference. See: Citi Rewards+ is a great companion to Premier or Prestige.

Amex Blue Business Plus

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: 2X rewards for all spend (up to $50K per year) with no annual fee makes this card a winner. Click here for our complete card review No Annual Fee Earning rate: 2X Membership Rewards points on all purchases, up to $50K spend per calendar year (then 1X thereafter). Terms apply. (Rates & Fees) Base: 2X (3.1%) Card Info: Amex Credit Card issued by Amex. This card imposes foreign transaction fees. |

This fee-free card offers 2X Membership Rewards points on all spend, up to $50K per year (then 1X).

Like the Citi Double Cash card, this card incurs foreign transaction fees so I recommend leaving it behind when traveling internationally.

Ink Plus and Ink Cash: 5X Office Supply

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: This one should be in everyone's wallet. Incredible welcome bonus for a no-annual-fee card. Great card for 5X categories. Excellent companion card to Sapphire Reserve, Sapphire Preferred, or Ink Business Preferred. Click here for our complete card review No Annual Fee Earning rate: 5X office supplies and cellular/landline/cable (on up to $25,000 in total purchases in 5x categories annually) ✦ 2X on the first $25K in combined purchases at gas stations and restaurants each cardmember year ✦ 5X Lyft through March 2025 Card Info: Visa Signature Business issued by Chase. This card imposes foreign transaction fees. See also: Chase Ultimate Rewards Complete Guide |

$0 introductory annual fee for the first year, then $95 Earning rate: ✦ 5X office supplies, 5X cellular/landline/cable ✦ 2X gas and hotels ✦ 5X Lyft through March 2025 Card Info: Visa Signature Business issued by Chase. This card has no foreign currency conversion fees. Noteworthy perks: ✦ Points worth 25% more when redeemed for travel ✦ Transfer points to airline & hotel partners See also: Chase Ultimate Rewards Complete Guide |

I use these to earn 5X by automatically paying our phone, cable, and internet bills. And, since these cards offer 5X at office supply stores, I take these on field trips to Staples and/or Office Depot / OfficeMax when they offer in-store gift card sales. And I’ve been known to use these cards online at Staples.com to buy gift cards.

Citi AT&T Access More

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: Excellent choice for those who shop often online (thanks to 3X earnings) $95 Annual Fee Earning rate: ✦ 3 points per $1 on products and services that are purchased directly from AT&T ✦ 3 points per $1 on all purchases at online retail and travel sites ✦ 1 point per $1 on all other purchases Card Info: Mastercard World Elite issued by Citi. This card has no foreign currency conversion fees. Big spend bonus: 10,000 anniversary bonus points after $10,000 in annual spending See also: Citi ThankYou Rewards Complete Guide |

This card is no longer available for new applicants, but it offers 3x at many online retail & travel merchants. Just as Nick said, this one is never in my wallet, but it gets monthly use. Each year in which I spend $10K, I also earn 10K bonus points, making this a keeper despite its $95 annual fee.

Delta Platinum and Reserve cards

I use these cards to manufacture Delta elite status (see this post for details).

Bottom line

The cards in my day-to-day wallet (and phone) offer an excellent rate of return for my in-person spend: 5X restaurants, 4X grocery, 3X gas, 3X Apple Pay, and 2.62% everywhere else. But, I could do better. If I were willing to carry around my stupid Samsung watch everywhere (see this post for details), then I could use Samsung Pay as my everywhere else card in order to get 3X with my Altitude Reserve card (worth 4.5% back towards travel). But I don’t spend heavily enough in that in-person everywhere else category to make much of a difference. And I don’t like wearing that bulky watch. I could also get the Ducks Unlimited card to get 5% cash back at gas stations and sporting good stores, but I don’t spend enough in either category to want to expand my wallet further.

I’m pretty happy with the selection of cards I have now. I know I could do marginally better, but I don’t really care. The difference in earnings from day to day spend are minor compared to the rewards I earn through credit card bonuses and increased spend techniques.

If you’re struggling to decide which cards to keep in your wallet, don’t forget that we’ve put together a resource to help you decide which of the expensive cards are worth keeping. See this post for details: Which Ultra Premium Cards are Keepers?

[…] for every possible scenario. For full details about what was in my wallet and why, please see: What’s in Greg’s wallet? A short summary, though, is that I carried the following […]

I’m not sure why are you using BofA Premium Rewards card, when you have Altitude Reserve for in-person and AT&TAM for online? And since you have $100k at BofA, you can also get Cash Rewards (or convert Premium Rewards to it) and get 5.25% for online, in case ATTAM doesn’t work. Rakuten card can also be used for some online purchases.

I also think you should replace our recommendations for FU and PR cards on top right of this page with something else, such as BBP, Citi DC, or AR. Those are outdated.

Does this watch provides Samsung Pay when paired with Apple? I was under impression that it’s will only work on Android.

It has to be paired to an Android phone. So, for Apple phone people (like me), it works as long as you pair it to an extra Android phone (which I have at home). The downside is that the watch is almost useless for anything but telling the time or using Samsung Pay when I’m out and about. I can’t pair it to both phones unfortunately.

[…] week, Greg, Stephen, and I shared the contents of our everyday wallets. Quite a few readers seemed surprised […]

Greg,

Given that you qualify for Bank of America platinum honors rewards, I think you are missing some easy cash back by not having a Bank of America cashback carD which gets 5.25% in very popular categories for platinum honors members . We use it for restaurants and Internet purchases. My wife and I have one each and it works very well that way.

Thanks, yes I’m aware of that but I’ve been trying to get under 5/24 for a while and the limits on that card mean that I’d have to have multiple of them for it to make much of a difference.

Greg, what’s in your wife and son’s wallet? Curious about how your whole ecosystem works together your family and your travels

My son still uses his Discover It card. He doesn’t spend much so I don’t worry about the lost opportunity there. My wife primarily uses her AU copy of my BOA Premium Rewards card (3.5% travel & dining; 2.62% everywhere else). This keeps it super simple for her without missing out too much on optimized rewards.

[…] Greg and Nick have both recently shared what’s in their wallets, so I figured I’d get in on the act. I’ve a feeling my post will be a little longer than theirs as I have more cards in my wallet than most people likely carry and, to be honest, more than I probably need at any one time. […]

I know you mentioned you are still using the Prestige because of a fluke, but if you weren’t would you still keep the Premier to partner with your Citi double cash? My premier’s fee is coming due. I could keep it and commit to it as my gas card? But still $95 just to transfer points doesn’t seem worth it.

Yes I’d be inclined to keep the Premier if not the Prestige since the whole point (for me) of earning ThankYou points is the ability to transfer them. That said, I expect that you could downgrade to a no-fee ThankYou card and upgrade to the Premier right before you need to do a transfer.

Greg, I know it is up to personal taste, but some recommendation here since you want to hear different opinions, right?

AAA card: if you install AAA app, it has a digital AAA card that you can add into say Apple wallet. So no physical card is necessary.

Citi Premier Card for gas: Assume you monthly gas spending is about $100, $1200 yearly, By using this card instead of say 2.62% BOA, you have 1% net cashback difference, it is $12 saving per year. In a word, not worthy it.

Blood donor card: what’s this for? Save money for emergency blood transfusion… Too rare to use.

Personally, I will keep the minimum cards in the wallet everyday. Actually when I travel, I will remove all cards but keep 2 cards inside. There is always a risk that you lose it somewhere. So only keep those necessary and keep it slim so you won’t feel holding a stone..

AAA: Thanks! Good tip.

Citi Premier: Yes, that’s why I wrote “I don’t plan to hold onto this card long term.”

Greg, really enjoyed this post. I’d just like to inject a little laugh in regard to Jennifer Garner’s use of the Capital One card: a few years ago there was a photo of her which showed her walking, holding a Starbucks cup and an American Express card in her hand!

LOL

[…] but my final motivation was reading 2 Frequent Miler articles: What’s in Nick’s wallet? and What’s in Greg’s wallet? The first thing you should know about me (if you already didn’t know) is that I am a […]

Why not just use a Samsung phone instead of the watch that you dislike so much? They have the same MST tech that the watch does.

Because he’s an iPhone guy.

https://frequentmiler.com/my-full-retreat-back-to-iphone-land/

I’m certainly not optimized in my wallet but it’s simple:

Chase Sapphire Reserve – 3x Dining and Travel

Citi Costco – 4x on gas, 2x on purchases

Chase Ink cash whatever – 5x on phone/internet (no paid tv for us)

Chase Freedom Unlimited – 1.5x on pretty much everything else

Recently dumped my Plat AMEX, deciding what to do with my CSR coming in Sept

INKer Forever on house bills ..I Love Costco Gas (Top Tier) & Frozen Shrimp too $$$ ..

CHEERs

Kind of surprised there’s no ultimate reward card in ur wallet. Not even freedom unlimited. Is it bc u already have a boatload of UR and the BofA card gives u diversification? Surely the flexibility with UR is very powerful.

I value the 2.62% rewards from the BOA card more highly than 1.5X Ultimate Rewards. And yes I have a boatload of UR so it’s not a priority to earn more from day to day spend (but I’m always happy to earn UR via 5X office supply…)

Yeah but, the standard CSR-CFU combo gives u 2.25% MINIMUM return with CFU. That’s only 38 basis points difference with the BofA card. Of course the cash back feature is nice with BofA. But at the end of the day, I’ll take the flexibility of chase UR over 38 basis points. Am I missing something?

Let me ask you this: if I were selling Chase points for 1.75c each, would you be a buyer at that price every day? If you have the right redemption in mind right now, you may be. But eventually, you either get used to generating points more cheaply or your points balance becomes high enough that you don’t immediately need more (or both) and 1.75c each seems kind of expensive.

That’s the price you’re paying if you choose to use the Chase Freedom Unlimited and you have the option to use the BOA Premium Rewards with Platinum Honors. BOA is essentially offering you 2.625 cents every time you spend a dollar. You’re throwing those pennies away in favor of 1.5 Ultimate Rewards points — giving up the opportunity to earn 2.625c in favor of earning 1.5 UR points. Again, I’m not saying it’s an awful trade nor am I saying that I wouldn’t make that trade now and again when I need the points for a more valuable redemption. But when you get to millions of points in reserve, you won’t look at it as choosing chase over 38 basis points, you’ll look at it as choosing 1.5 of a made up currency that can only be used for specific things over 2.625c in cash.

I should also note that I don’t view the CFU as a 2.25% minimum return. I know that’s the funny math we all use sometimes (me included), but consider the fact that if you want to book a hotel using your UR points, you’re missing out on portal cash back, the AAA rate (or whatever coupon code you could have used through the hotel), hotel loyalty points (which can often represent a rebate of ~10% or more, and elite credit / hotel promotions. I’d argue that in many (most) instances, because of those opportunities you give up by booking through the Chase portal, you’re not getting 2.25% in value toward hotels. Whether or not you’re really getting that value towards tours is anybody’s guess — I’ve not done an extensive comparison against other tour sites. I can concede that you are generally getting 2.25% back toward paid flights. If you pay for a lot of flights, that’s certainly pretty strong (though obviously not as strong as 2.625%). On the other hand, you can’t book all LCCs through Chase and every now and then I report an airfare sale here that isn’t available through Chase.

In terms of flexibility, I know what you mean by that — you can leverage transfer partners to use Chase points for expensive Hyatt hotels or premium cabin flights that your cash back wouldn’t be able to buy. I’m with you on that — I like flying up front and staying in places I wouldn’t ordinarily pay for. But on the other hand, I think it’s a stretch to say that Chase gives you more flexibility than cash. It gives you opportunities for far outsized value. Cash gives you the opportunity to use it on whatever you want.

Again, I’m not saying that the CFU is a bad choice. In this instance, I know Greg is using the BOA Premium Rewards because he has plenty of URs to meet his needs for a long time to come and he will continue to add to that whenever he can earn 5x on his Ink Plus, so the CFU is adding more of a currency he already has more of than he can reasonably use in the near term. But more generally-speaking, I think the trade-off of not choosing BOA Premium Rewards with Platinum honors if you have that option available to you is more expensive than many people consider. And I say that as someone who does not have the BOA Premium Rewards card and whose UR balance is in rebuilding mode — so I might be with you on the CFU in my circumstances at the moment, but there will come a point when I want to move back to cash back.

@Greg did the ‘Frequent Miler business card’ have a good SUB how much was the MSR and can you apply with a “business”? How much is the AF – it seems like the card has great benefits and a great card to have in your wallet for EDC..

😉

@Greg,

I assume you have Chase Freedom, Discover IT, Citi Dividend, US Bank Cash+ in some combination as well, but didn’t mention them?

I’m sure Greg will respond, but to be clear, this series is about what is actually in the wallet we carry around day to day, not an exhaustive list of cards. We all have cards we keep for various benefits / bonus categories but don’t need to carry daily (maybe because we MS the bonus categories in a day or two or because we just keep them for a specific benefit, etc). Since we write about cards and maximize our use of many, Greg and I (and Stephen) each likely have many more cards than would make sense for most people. But several readers have asked what we actually carry day to day and this is that.

Yep I have all of those, but they’re not in my day to day wallet or my travel wallet.

Usually I have 1 or 2 on me based on category, ie. Freedom currently for gas, or Discover for groceries.