NOTICE: This post references card features that have changed, expired, or are not currently available

In light of the news that Citi has reduced many of the Prestige card’s travel & purchase protections, I expect that readers are wondering whether to dump their Prestige card when the next annual fee is due. I’m wondering the same. First, though, it makes sense to review the Prestige card’s benefits. Specifically, lets look at the benefits that are not readily available with other ultra-premium cards. I bet that you’ll be surprised by a few of these…

4th Night Free: This is the big obvious benefit that keeps most of us loyal. Just one or two uses of this benefit per year could justify keeping the card. This could be especially beneficial for those hoping to earn hotel elite status: as long as you book through the Citi Concierge, rather than online, the stay will earn hotel points and elite credits. For full details about this benefit, see: Complete Guide to Citi Prestige 4th Night Free.

Missed Event Protection: I was barely aware of this benefit until I started researching this post, but now I’m intrigued. The Prestige benefits guide (found here) lists these valid reasons for getting reimbursed for missing an event purchased with your Prestige card:

- The venue or producer cancels the event (or delays the event more than 12 hours) and does not reimburse or replace the ticket or provide a rain check.

- The Ticketholder can’t find the ticket, or it’s stolen or destroyed.

- The Ticketholder has an accident on the way to the event that causes the event to be missed.

- The Ticketholder or anyone living with them has an injury or illness that requires medical care.

- The Ticketholder or their family member dies.

- The Ticketholder is called to jury duty or receives a subpoena from the court, neither of which can be postponed.

- The Ticketholder is called to emergency duty as a member of the National Guard, Active Reserve or the United States Armed Forces.

- Severe weather or natural disaster prevents the Ticketholder from attending the event.

- A catastrophe causes a government authority to cut off access to the immediate area near the event site, preventing the Ticketholder from getting to it.

I love that “can’t find the ticket” is included as a covered reason! I’m not sure that I’d use this benefit enough to justify keeping the card, but as long as I have the card I’m going to try to remember to pay for all event tickets with my Prestige card!

Golf Benefit: Last year Citi took away free rounds of golf, but the Prestige card still offers access to many golf courses that otherwise require an expensive membership. I’m not a golfer, but I expect that this benefit is extremely valuable for some.

Priority Pass immediate family: There’s nothing special about an ultra-premium card providing Priority Pass access. It would be unusual not too. But with Chase Sapphire Reserve reducing Priority Pass access to two guests, those with families of 4 or more may value the Prestige version that allows unlimited numbers of immediate family members. On the other hand, the Ritz Carlton Rewards Visa Infinite card and the CNB Crystal Visa Infinite cards still allow unlimited guests regardless of whether or not they are family.

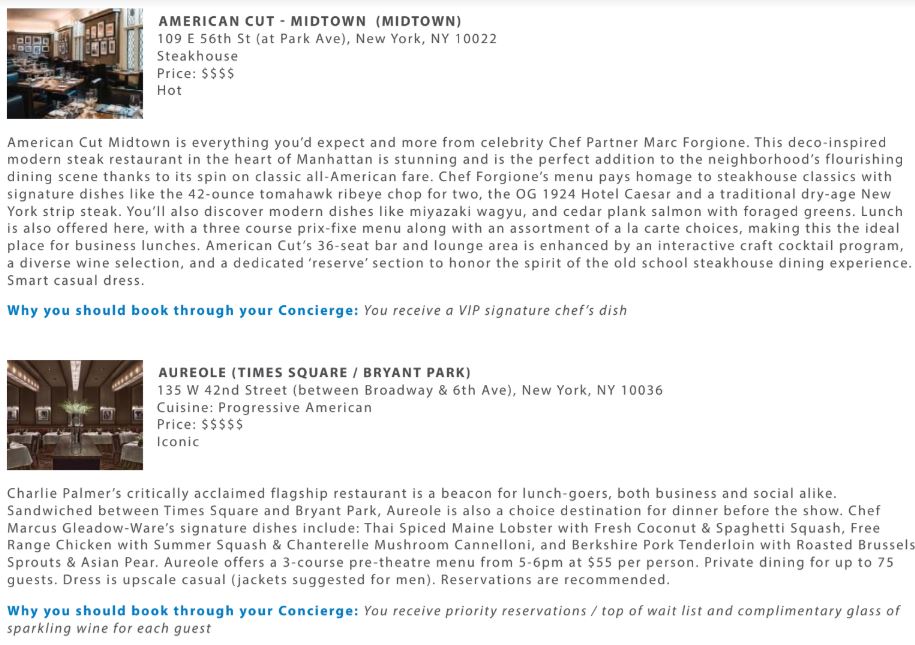

Citi Dining: When you book certain restaurants through the Citi Concierge, you’ll get some freebies at the restaurant such as free drinks or appetizers, or an overall discount. Unfortunately, the current selection of restaurants is extremely limited. A landing page for this program can be found here: www.citiprivatepass.com/dining.html (scroll down). Unfortunately, the page has never been updated with an actual list of restaurants. If you want to eat out in New York, Los Angeles, or Miami, I recommend emailing the Citi Concierge (concierge@yourconciergecenter.com) to ask about participating restaurants. When I recently contacted the concierge for restaurants in New York, I was sent a PDF listing available restaurants and the perk that each offered. Here are a couple of examples from the PDF:

Bottom Line

The Prestige card offers several unusual benefits that can be quite valuable for some. Personally, the 4th Night Free benefit is the only one that I’d consider paying up front for (which is essentially what I’m doing each year when I renew). The rest, for me, are nice to haves. Your situation, though, is likely to be different and you may value these perks differently than I do.

So, what am I going to do? I’ll keep the card another year. I tend to use the 4th Night Free benefit at least once or twice each year. That more than pays for the incremental annual fee after getting $250 back by using the card to pay for airfare (plus, I seem to have been grandfathered into a $350 annual fee). And from now on I’m going to try harder to remember the other benefits that have gone unused…

Does the fourth night free count if you receive a government rate on the room for the first 3 nights? Or does it need to be full rate ?

I imagine a government rate isn’t eligible, but you’d have to call the Prestige Concierge to see if you can price it out. If you can, it ought to work. Here’s the complete guide:

https://frequentmiler.com/the-complete-guide-to-citi-prestige-4th-night-free/

Btw, lots of discounts *do* work — AAA, AARP, promo codes offered by the hotel in many instances, etc. I just don’t know whether or not a government rate would. You’d have to call and give them the code.

Yes, simply ask the Citi Concierge to book the hotel with the government rate.

The Q&A in our complete guide states:

What discounts can be applied at the time of booking? People have reported success with many different discounts including AAA, government rates, and even hotel specific promo codes (such as 3rd night or 5th night free!). Ask the travel concierge to apply any discounts you’re aware of.

I’m finding that the 4th night free price as calculated on the Citi portal is no different than paying for 4 nights via the hotel booking sites directly. This has been true twice in the last month. It seems to me that Citi is taking the lowest prices available at the hotel site and multiplying it by 1.333, then giving you 25% off that number.

Just tried this — Rochester NY Fairfield Inn / Greece, June 10-14, 2 adults, 2 Queen, Refundable:

Booking.com: $526 + 14% tax = $599

Citi’s Portal: $602.26 (with the 4th night free already taken out, i.e., it is $193.74 / night – note you pay 3 nights room plus 4 nights of taxes/fees to get to the $602 number)

Marriott.com: 599.64 (a bit less if you use the “Member” rate; drops to $491 if you’re a AAA member)

So I’m not sure this 4th night free is anything anymore. I’ve stopped using it. (And at Hiltons, you don’t get any points unless you book through the Hilton website.)

Am I missing something here?

Book 4th Night Free through the Citi concierge in order to get the rate you want. See our guide for full details. https://frequentmiler.com/the-complete-guide-to-citi-prestige-4th-night-free/

Paul

I check on Hotels.com then check with Citi before booking.I’m running like 50% citi will work better SOoo look before u book .Maybe I’m to picky but the card is $$$$$$$$$$$ 450 !!!!!

CHEERs

[…] towards food & drinks. This morning, Greg wrote about some Citi Prestige hidden benefits (see: Citi Prestige: Weird but valuable benefits); one of the not-so-hidden benefits of premium cards like the Prestige is Priority Pass access, […]

Greg, curious how Citi would denote between “immediate family member guests” vs regular guests. Doesn’t the lounge just put in the number of guests and your credit card company charges you for any overages?

This. Considering switching to carrying around the PP card from the Prestige now that CSR PP is nerfed, but I just can’t understand how I won’t end up fighting charges left and right on this given that family relationship doesn’t seem to me to be indicated when the PP card is swiped.

My favorite benefit is the trip cancellation/trip interruption insurance. Citi covers up to $10,000 per trip. I’ve used the benefit twice and was paid both times in about 1 week (as opposed to Chase where payment took 2 – 4 months).

was that recent or awhile ago?

Max per trip is going down to $5K soon: https://frequentmiler.com/ultra-premium-credit-card-travel-insurance/#TripCancel

Last year I had booked an Antarctic cruise on Silversea schedule for 11/15/17. The total cruise cost for 2 people was $40,000. To get full cancellation coverage I charged $20,000 to my CSR, $10,000 to my Chase Ink Preferred, and $10,000 to my Citi premier.

We needed to cancel the cruise for medical reasons and I received $40,000 reimbursement from Chase and Citi. The Citi payment was received about a week after my clain (in October 2017) and the two Chase claims were received in Jan. 2018.

If you don’t mind me asking, when was a scenario you’d use this?

I’ve booked this Trip and the rest with this card to Keep it Simple & 4th nite but it could pay off big time with Ins ..I like that tip use 3 cards for $40K ins .Wow

CHEERs

I called Citi a few months ago to confirm that PP visits for Prestige cardholders bringing 3+ “immediate family” guests are allowed. I ended up speaking with a manager who admitted that the language was misleading, but insisted that only 2 guests were allowed, immediate family or not, and that the third guest/family and beyond would be charged $28.

Any successful DPs out there of Prestige cardholders who have brought 3+ family members to a PP lounge without incurring a charge?

I brought wife and 3 nephews into the AirFrance lounge at BOS 2 months ago, no charge.

I don’t have a big family, but I’m always curious how the logistics of this works. Does the priority pass person checking you in have some way to designate whether the three guests are family or whether they are just friends. I’m guessing not.

You should have already been using this card on ALL entertainment as it pays 2X. And some wineries classify themselves as roadside attractions gaining 2X

The Premier and Preferred cards also offer 2X for entertainment. Previously I didn’t know that the Prestige had this big advantage.

International auto insurance is quite good

Better than CSR insurance somehow? Keep in mind that it changes on 7/29. Latest info here: https://www.cardbenefits.citi.com/~/media/CPP/Files/LegalDocs/SOAPI/M_039092_CITI_MV6704_Elite-Prestige_PG_CAR20_FINAL.ashx

Thank you for the updated benefit brochure. I did not realize the trip cancellation insurance was dropping by 50%. Chase still covers $10,000 per person I assume.