| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

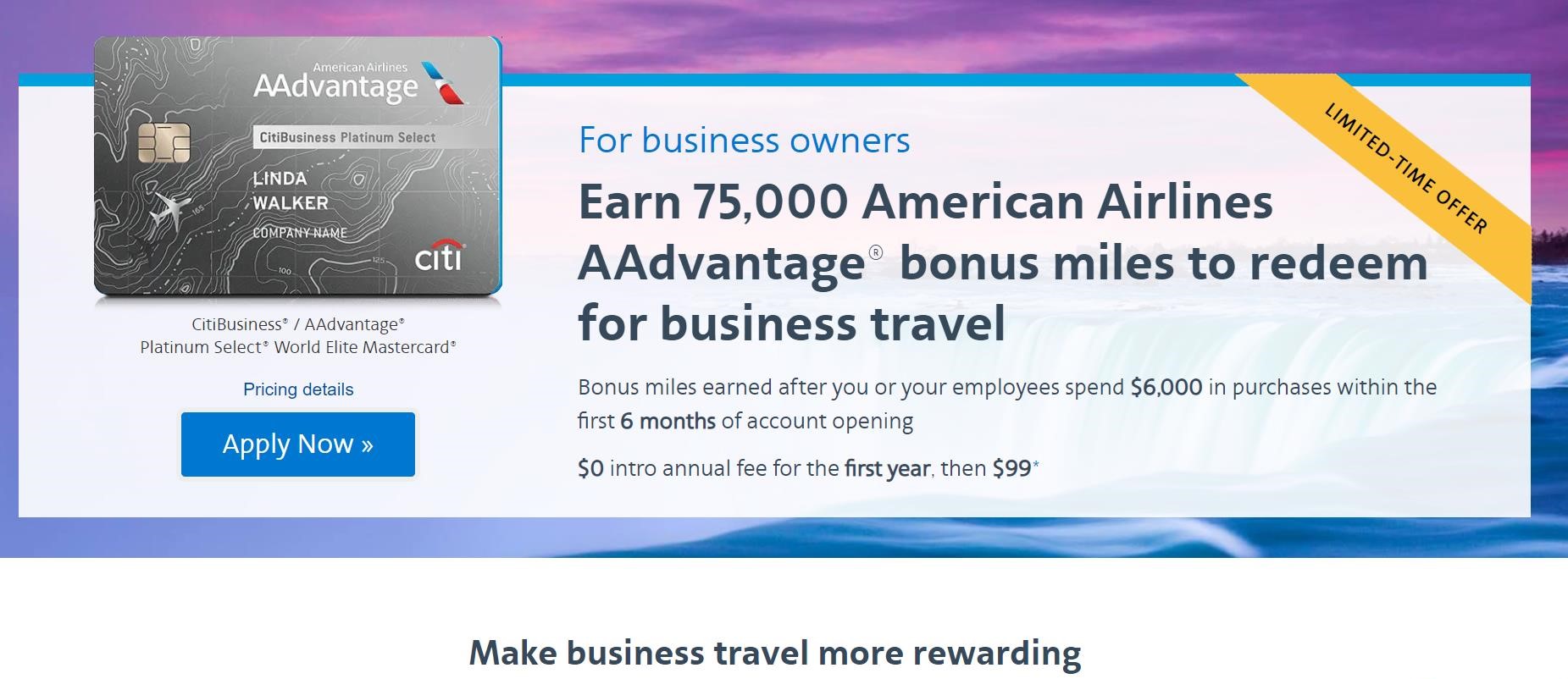

There is a new, limited-time offer for the CitiBusiness AAdvantage Platinum Select card: earn 75,000 miles after $6,000 in purchases within the first 6 months. In addition, the annual fee is waived for the first year. This is a 10K increase from the previous offer and I believe it matches the best that we’ve ever seen on this card.

The Offer & Key Card Details

| Card Offer and Details |

|---|

ⓘ $842 1st Yr Value EstimateClick to learn about first year value estimates 65K miles 65K miles after $4K spend in first 4 months$0 introductory annual fee for the first year, then $99 Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: This card usually has a great welcome offer, but if you're looking for a card to keep long term, you'll find better options. Earning rate: ✦ 2X AA ✦ 2X certain telecommunications merchants ✦ 2X car rental merchants ✦ 2X gas Card Info: Mastercard World issued by Citi. This card has no foreign currency conversion fees. Big spend bonus: Earn $99 plus taxes domestic companion certificate after $30K spend Noteworthy perks: ✦ First checked bag free ✦ Priority Boarding ✦ Save 25% on inflight purchases |

Quick Thoughts

The Bilt Rewards program and Marriott Bonvoy are the only two points programs that transfer to American Airlines, making AA credit cards the primary way to quickly accumulate a large stash of miles. The good news is that both Barclays and Citi issue American Airlines credit cards (including both consumer and business versions). That means there are several possible bonuses to collect.

When looking at this offer, keep in mind that the Barclays-issued Aviator Red card currently gives the same amount of miles after the first purchase whereas this CitiBusiness card requires $6,000 in purchases within the first 6 months. That will make the Barclays card more appealing for most folks, but if you already signed up for that and/or need a business card to stay under 5/24, this could still be a worthwhile option.

There are some American Airlines partner award chart sweet spots that remain attractive as oneworld has expanded and other programs devalued. That said, I probably wouldn’t prioritize this over the monster offers that we’ve seen recently from other issuers unless you’re specifically looking for AA miles.

Citi Application Tips

- 48 Month Rule: With most Citi cards, you can only receive a welcome offer every 48 months. This applies to the same exact card, not families of cards and is counted from the date that you receive the welcome offer, not from when you're approved.

- Velocity Limits: Citi allows a maximum of one card per 8 days and a maximum of two cards per 65 days (includes both business and personal).

- Inquiries: Citi is thought to be more credit inquiry-sensitive than other issuers. We've heard reports that it's difficult to be approved for a new Citi card if you've had more than 6 hard inquiries within the last 6 months. That said, data points abound of people being approved despite being above that, so it's certainly not a hard and fast rule.

- Card Limits: Citi doesn't have a strict limit on the amount of cards that you can have, but it does place limits on the total amount of credit that they will issue you across all cards. Unfortunately, unlike most banks, Citi does not allow you to move credit from one existing card to the another card.

- Application Status: Call (866) 606-2787 or go here to check your application status. For Costco cards, call (877) 343-4118.

- Reconsideration: If denied, call (800) 695-5171 for personal cards or (866) 541-7657 for business cards.

I am a CEO of a nonprofit organization 501c3. Citi instantly approved the card with outstanding credit limits. This is my first time having the card from Citi. It did not ask for any docs to verify business etc. Citi pulled credit from Equifax. My score is 797 on Credit Karma. It dipped to 795. I just leaned that the bonus will be deposited to the Aad Business account with a possibility to transfer miles to personal Aad account. Not sure it is a good a bad. I have Delta and United biz credit cards and the bonus have been deposited to my personal accounts not the business account. Questions or comments?

deleted

It seems like this card has changed. I had it 6+ years ago and miles posted to my personal AA account.

T&C state they post to an AAdvantage Business account. You can then transfer from that account to employee accounts. Plus employee spending earns LP on their own AA account, not the primary. That’s a unique feature, giving the ability to help earn status for more than 1 person.

https://creditcards.aa.com/cbaa_standard/

“The primary cardmember must have or open an AAdvantage® account in their own name. Miles earned on the primary cardmember’s credit card will be allocated to the AAdvantage Business™ account. Loyalty Points earned by the primary cardmember will be posted to the AAdvantage® account of the primary cardmember. Loyalty Points and miles earned by primary cardmember on any other Citi® / AAdvantage® credit cards where they are the primary cardmember will post to their individual AAdvantage® account.”

“Miles earned on an Authorized User’s credit card will be allocated to the AAdvantage Business™ account. Loyalty Points earned by Authorized Users will be posted to the AAdvantage® account of the Authorized User.”

Business program:

https://www.aa.com/i18n/aadvantage-program/aadvantage-business/how-it-works.jsp

“Transfer miles* from the business account to employees for flights, upgrades, car rentals and more.”

Tried applying as a sole prop, so used the same name (first and last only, I don’t have a middle name). But then it throws the following error: Please make sure the Authorized Officer name is different from the Business name.

Any suggestion/solution for this issue?

I’ve heard of that issue pop-up from time to time, no idea why it hits some folks and not most others. The solution I’ve seen most people use is to put a middle initial in the authorized officer box (or add an initial to the name of the business). Alternatively, you could try using a different version of your first name. For example, call the business Rob Smith and then have the AO name be Robert Smith.

Thanks for the quick help Tim.

For business name, I just used “FIRSTNAME<space>FIRST-LETTER-OF-LAST-NAME” and the application was done!

Great!

Tim, the number you provided for application status, 888-338-2586, that’s the hotline for Chase

Fixed that. You can call (866) 606-2787 or go here.

in the past I had issues with 48 month rules as Citi was also counting my personal aa card. Are you sure that I need only 48 month for the business version ? thx

Is the 48 Month from receiving the SUB or from closing?

Got this card in 2019

How is Citi on auto approving these? I get really annoyed when they ask for documentation of a business, it’s additional steps that make the process less worthwhile and you never know if they will approve based on what you provide.. I’ve had it happen with Barclays and BofA and Barclays denied me in the end despite having an actual sole proprietorship.

Got this card in 2019 same 75000. I see american airlines is not adjusted for their own devaluation. That would get 3 round trip flights in 2019. with 2023 dynamic pricing, you could sometimes* get 3 round trip flights for 75000.

I think domestically AA has gotten more lucrative and is by far the best of the domestic carriers. I consistently am now able to find 6-10,000 one way redemptions many last minute and many not short flights. I recently found a 5,500 redemption. Had never seen that. It is usually +10k for first. 16,000 for one way first is a steal in many markets. And don’t say they don’t exist. They do.

Does the waiver this card provides in the new AAdvantage Business program move the dial on this card (for some readers with very small businesses)? And, if so, what is the best play?

I believe this card only waives domestic baggage, does anyone know of a card to get international baggage waived on AA?

1st bag is always free on transoceanic flights.

Definitely not true https://www.aa.com/i18n/travel-info/baggage/checked-baggage-policy.jsp

That link says $0 1st bag fee fee for transatlantic and transpacific flights in economy

Got this card in early August for $4.5k min spend and 65k miles. Already met the spend and miles are in AA account. Does Citi match offers if they increase after you are approved for the card?

I have the same exact question.

Looks like they do.

IDK … But the answer is definitely no if you don’t ask 🙂

On Sept 4, I was approved for the $4K spend for 65K miles offer. I called Citi today and was told pretty definitively that Citi doesn’t match offers after being approved for a prior offer.

What would be a reasonable time to close this card later, after the second year before the second AF posts?

This has the AF waived the Barclays does not.

Will they allow 1 personal and one business on the same day?

I don’t think the Barclays business card is taking applications currently?