Some people are justifiably unhappy with the latest announced changes to the Citi Premier Card, but for many I think that the changes are a big win. Most of the changes will hit on August 23rd 2020. We detailed the changes previously, but here’s a summary of the August 23rd changes:

- Earn 3X at grocery stores (previously 1X)

- Earn 3X at restaurants (previously 2X)

- Earn 3X for air travel, hotels, and travel agencies (previously 3X for all travel)

- Earn 3X at gas stations (unchanged)

- Earn 1X for entertainment (previously 2X)

Other details:

- Beginning April 10, 2021, cardholders will no longer be able to redeem points for 1.25 cents each through the ThankYou Travel Center.

- Beginning August 23rd, cardholders are eligible for a new $100 Annual Hotel Savings Benefit. Once per year, get $100 off a single hotel stay of $500 or more, excluding taxes and fees, when booked through thankyou.com or 1-800-THANKYOU. This benefit cannot be combined with the Prestige card’s 4th Night Free benefit.

Why this is a win for many

The Premier card was already an excellent choice for many thanks to the fact that it offered 3X for travel and gas stations. Now, while some travel will no longer earn 3X, the addition of 3X for grocery stores and restaurants is huge. I bet that food and fuel are big portions of most American’s spend. We now (or soon) have a transferable points-earning card which offers 3X uncapped in these critical categories for only $95 per year.

Combine this card with your Citi Double Cash and Citi Rewards+ and you have an awesome, but very cheap combination.

Start with Double Cash for 2X Everywhere

Citi’s Double Cash card is a no-brainer for most. It has no annual fee and earns 2% cash back for all spend. Even better, cash back can be converted to ThankYou points to make the rewards worth even more. See this post for complete details: Citi Double Cash Complete Guide.

If you have an old Citibank card lying around that you no longer want (an American Airlines card perhaps?), you can ask Citi for a product change to the Double Cash. The Double Cash doesn’t usually have a signup offer, so you wouldn’t be missing out in that way. Plus, even though you’ll get a new account number, it won’t show up as a new account on your credit report.

If you want to sign up new for the card, you’ll find the latest offer (if any) here.

Add the Premier for 3X categories and point transfers

The Premier costs $95 per year. If you spend $9,500 per year in the card’s 3X categories (grocery stores, gas stations, restaurants, and most travel) and if you value ThankYou points at only 1 cent each, then the extra rewards you earn compared to the Double Cash will offset that annual fee. To put this in perspective, $9,500 is only $183 per week. I bet that many of us spend a lot more than that at grocery stores and restaurants alone.

Importantly, the Premier gives you the ability to transfer points to airline partners. For example, you can transfer points to Avianca or Turkish miles in order to book Star Alliance awards (book flights on United, Lufthansa, ANA, etc.); transfer points to Cathay Pacific or Etihad to book AA flights; or transfer points to Virgin Atlantic or Air France to book Delta flights. If you know what you’re doing, it is often possible to get far more value from your rewards by transferring points to airline partners.

Sprinkle in the Rewards+

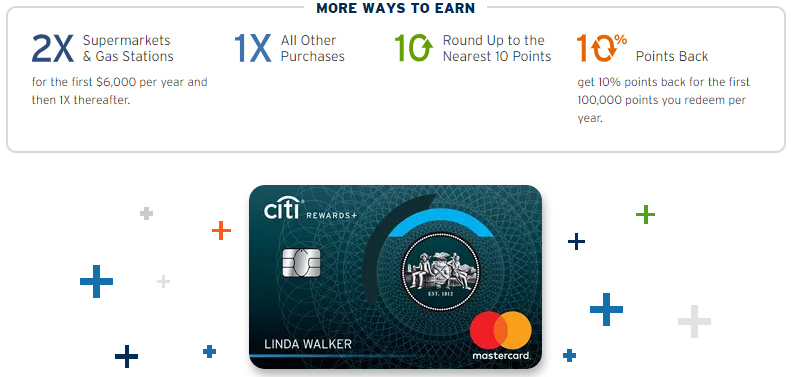

The Rewards+ card is a strange one. On the normal side, it has no annual fee and offers 2X at supermarkets and gas stations, up to $6,000 spend per year. That latter part is not interesting since the Double Cash gives you 2X everywhere, uncapped. The interesting and strange parts of the card are it’s 10 point round ups and 10% points back:

- 10 point round up: On all purchases, Citi automatically rounds up rewards to the nearest 10 points. For example, if a purchase would have earned 204 points, you’ll get 210 points instead. This is especially interesting for very small purchases. A $1 purchase which would normally earn just 1 point will earn 10 points. Same with a 1 cent purchase. On all purchases of $3.30 or less, the card earns over 3X rewards… up to 1000X rewards for 1 cent purchases. While these numbers are eye-popping you would have to somehow do a huge number of tiny purchases to make the reward earnings meaningful.

- 10% points back: Get 10% points back for the first 100,000 points redeemed each year. This is the real value of the card. Combine this card’s ThankYou account with the ThankYou account associated with your Premier and Double Cash cards and you’ll get 10% of points back even if the points were earned on those other cards. In other words, the Rewards+ card is valuable even if you never put a penny of spend on it.

Combo Pros and Cons

The combination of cards listed above is great, but not perfect. Here are some pros and cons…

Combo Pros

- $95 total annual fee

- Earn 3X in several popular categories

- Earn 2X everywhere else

- Earn 10% of points back, up to 10,000 points back per year

- Transfer points to valuable airline transfer partners

- Citi occasionally offers transfer bonuses so that you’ll get more than 1 airline mile per ThankYou point.

Combo Cons

- Citi doesn’t offer travel protection or purchase protection for any of these cards.

- The Double Cash and Rewards+ cards charge foreign transaction fees.

- Cashing out points at a value of 1 cent each can be tricky (unless you also have the Prestige card).

- Redeeming points to pay for travel will no longer make sense once the 1.25 cent value goes away on April 10th, 2021.

- Citi doesn’t offer any hotel transfer partners.

- Some may prefer transfer partners from other programs such as Amex Membership Rewards, Chase Ultimate Rewards

To compare this combination to other powerful combinations, please see: Awesome credit card combos.

Bottom Line

Citibank’s Double Cash, Premier, and Rewards+ trio offers outstanding reward earning power for only $95 per year. One problem I have with recommending it, though, is that it’s not necessarily a great combination for beginners. The Double Cash alone makes sense for most people, but once you branch into ThankYou Rewards things get more complicated. To get full value from your points, you need to know how to leverage airline partners. And to cash out points at 1 cent each you need to know a trick for doing so.

Still, for people who know how or are willing to learn how to get the most from airline transfer partners, I think this is an awesome combination. The ability to earn 2X to 3X transferable points everywhere with no annual caps for $95 per year is terrific. Throw in up to 10K points back per year with the Rewards+ card and the combination becomes a no-brainer since 10K points are easily worth more than $95.

[…] In the future, Jen’s husband may also be interested in picking up the Citi Premier and Citi Rewards+ cards in order to setup the awesome trio of cards that I wrote about previously here: Citi’s awesome trio: Double Cash, Premier, Rewards+ […]

[…] Citi’s biggest downfall in this category is that they don’t offer many signup bonuses. Plus, if you sign up for one Citi ThankYou card, you have to wait 24 months after receiving the welcome bonus before you can qualify for another one.On the other hand, their cards offer fantastic earnings on spend. The fee-free Citi Double Cash Card isn’t really a ThankYou Rewards Card, but cash back can be converted to ThankYou points. This makes the Double Cash capable of indirectly earning 2 ThankYou points per dollar on all spend. Plus, the Citi Premier Card will soon offer 3X at grocery stores, restaurants, gas stations, air travel, hotels, and travel agencies. For more, see: Citi’s awesome trio: Double Cash, Premier, Rewards+. […]

[…] wish I could share the enthusiasm about Citi’s awesome trio: Double Cash, Premier, Rewards+. Citi’s transfer partners suck in comparison to Chase and Amex but that is just my […]

Just got an email offer to increase the DC to 2.5% for a year (1.5 for spend, 1 for payment, through 4/30/21) when opening a Citi Priority banking package.

Greg, I have the Citi DC + the Citi Premier. I am new to the world of TYPs (though an old hand at Chase URs and Amex MRs). Can you please explain what issues may exist for someone like me with regard to the expiration of TY Points (earned with the Premier) and either unredeemed or converted “cash back” (earned with the DC)?

I intend to keep both cards open and use them regularly. My worry is my lack of clarity on whether the “cash back” expires, whether I just leave it piling up for years in my DC account or if I convert it to TYPs. Is there any reason I should/should not just let all my DC “cash back” sit there in the DC account, or any reason I should/should not convert it to TYPs as soon as I can?

To clarify, I will only use the “cash back” by converting it to TYPs and will then transfer them to an airline program. I will only use TYPs by transferring them to airline programs. No immediate need to do either (like most of us, I’m not going anywhere for the foreseeable future). I have only some vague recollections that some points expire…and want to ensure nothing vanishes if I sit on it for years. Thanks for the help.

No worries here. As long as you keep your DC card open neither the cash back nor the cash converted to ThankYou points will expire. In general I’d recommend keeping the rewards as cash back until you need them only because you never know when you might want/need the cash back, but if you’re 100% sure that you’ll only use them to transfer to partners then converting anytime to ThankYou points is fine.

Earl’s questions were the same I had. Thanks for the information!

Thanks for the speedy reply – much appreciated.

Greg wrote “In general I’d recommend keeping the rewards as cash back until you need them only because you never know when you might want/need the cash back…”

I was wondering about this: would it be better to have DC account combine/merge with a TYP account (Premier in my case and future case, combine TYP with Premier and Rewards+ account)? Based off of Greg’s statement, it would be better to keep DC in its own account for the possibly of utilizing the “cashback” feature if need be.

Greg, you answered my question without me even asking it…thanks.

Actually, that’s not how it works. You can think of the Double Cash as having two rewards accounts: one is cash and one is a ThankYou Rewards account. At any time, you can move the cash to the ThankYou account, but not the other way. Also at any time, you can combine the ThankYou account with your other ThankYou accounts. Doing so doesn’t change the fact that the Double Cash first earns cash back in a separate account from the ThankYou account.

Listen to FM’s podcast that talked about this. Thank you.

I got a better understanding of how DC and it’s TYP account works. I didn’t realized that it is two accounts: DC-CB and DC-TYP and that if you want to covert CB to TYP that it must be done manual each time.

Was also informed/inferred that DC-TYP is the account that I would want to combine/merge with Reward+/Premier-TYP account.

Not sure if it’s still possible but Virgin Atlantic points used to transfer to Hilton points at 1.5. With citis transfer bonuses to them at 1.3 sometimes this may be an indirect way to transfer to hotels. Maybe not the best value but still an option

Yes, that’s a good point. We have a section of “indirect transfer partners” at the bottom of our post listing Citi Transfer Partners: https://frequentmiler.com/citi-transfer-partners/

I have two Premier cards. I have had one more than a decade. It is so old that there is no $95.00 AF. My second Premier card is about six months old. I got the second card solely for the 60k signup bonus. After one year can I downgrade the second Premier card to a Rewards+ card and keep my points indefinitely?

Yes that’s exactly what you should do. Awesome about your old Premier card not having an annual fee!

Just started to consider jumping into Citi pts. Already have the Double cash. Is the sub the highest that they have offered? In the current situation, would waiting for higher sub be prudent?

Current SUB is 60K and you have to pay the $95 annual fee. This year they did have 65K with in branch applications (or you can try to match the offer online). Within the past 2 years we have seen 60K with a waived annual fee (at least with referral). So the SUB is not the best we have ever seen, but still not bad.

I do not have enough information to answer the second part of your question.

As NK3 said, 60K is very close to the highest we’ve ever seen. It is possible that they’ll also waive the first year annual fee at some point, but no guarantee. Conversely, they’ve been known at times to withdraw the signup bonus altogether so in general I recommend going for it now rather than waiting.

Great post! Love the new site although it looks a lot better on the computer than on my phone. Also liked the credit intervention video you did yesterday, hope you’ll consider doing more.

Does it make sense to get this combo for someone that is already invested in another points ecosystem? The argument makes sense and looks good but are TY points and the 3x on gas and groceries sufficiently complimentary that it’s worth getting these cards from scratch if I have all the Chase cards I ever wanted.

I never know how to plan my transferrable points strategy. Cobranded cards make sense since what I get out of them is more tangible. Transferrable points each have their own pros and cons and with no MS, there is only so much spend I can spread around.

That’s really hard to answer without a much longer conversation. One way to look at it is to try to estimate how many more points you would earn with the Citi combo on top of the Chase combo you already have. If you would earn 10K or fewer points extra then it’s probably not worth the complexity of carrying additional cards. If you would earn 20K or more extra, I’d argue that it is worth the complexity. That said, if you primarily use points for transfers to Chase exclusive partners like Hyatt, United, or Southwest then stick with Chase.

This combination works well for our household. We have specific future redemptions in mind with Citi’s transfer partners, so we’ll get great value from our points, once we’re able to travel again. Our major expenses are our mortgage and groceries. Even with Plastiq’s 2.5% fee, we can pay for our mortgage with the Double Cash MasterCard and still come out ahead. And I like that we’ll earn 3x points on groceries–no more monkeying around with Amex’s annoying hoops with Gold’s ceiling limits and EveryDay Preferred’s 30 transactions. For travel insurance, we’re using CSP to pay for any fees on award flights. Thanks for such great articles!

That sounds like a great way to go.

Good info, thanks! Having the Double Cash, Premier and Prestige (along with their counterparts from Amex and Chase), the big downsides for me of Citi’s latest changes are the removal of the minimum 1.25c redemption and Prestige’s ongoing devaluations. So, I’m planning to cancel the Prestige when the fee posts and burn my 600k points as soon as intelligently possible. What am I missing? Can/should I PC from the Prestige to Rewards+? I do find the Double Cash helpful when the Blue Business Plus is unavailable or max is reached. Tia.

Why cancel and burn 600K points instead of downgrading to the no-fee TY Preferred or Rewards+ and keeping your points alive? You could upgrade to a Premier again if and when you find a good use for the points. Rather than transferring without a plan and locking them into a single program, I’d rather hold off at least until there’s a useful transfer bonus or something.

Citi allows a PC to and from almost any of their cards. It can vary a bit as to which cards are available to you for some reason, but for the most part you can PC to anything else with Citi.

When the Premier had Price Rewind, it was invaluable. After canning that benefit, along with the travel benefits, the card is essentially useless; and the additional point for groceries and dining does nothing to change that. Amex’s PRG, for example, earns 4x MRs in those categories along with a number of other benefits that easily knock down the effective AF to be on par with the Premier.

Greg says: “Throw in up to 10K points back per year with the Rewards+ card and the combination becomes a no-brainer since 10K points are easily worth more than $95.” To get the 10k points per year you need to be accumulating 100,000 Thank You points per year (which I don’t call “easy” for most people). If you are putting that kind of spend onto these three Citi cards, I agree, you have no brains.

Well, according to a quick Google, the average family of 4 spends around $12K per year on groceries. That’s 36K points without any MS or any travel or dining expenses.

Looks like the average American family spends around $2K on vacation. Assuming that most of that falls into travel and dining, that’s another 6K for 42K.

The Internet tells me that the average American family spends $386 a month on gas, so that’s $4,632 per year. At 3x, that’s almost 14K points. Now we’re up to 56K points.

That’s without any normal restaurant spend and without considering any MS — or any other purchases. If you were to put other regular purchases on a 2x card (Double Cash), I’d bet you could pretty easily be close to 100K points even if you didn’t do any MS at all. I think that fits “easy” pretty nicely, actually.

Conversely, if you only MSed and only at Simon Malls in person, you could MS 100K points at a cost of $197 in activation fees and probably another $50 in MO fees. So for $250, you could put together 100K points without many hoops if liquidation is easy in your area (YMMV on that for sure). Is that “easy” for most people? Obviously not for most people who don’t know anything about or engage in MS. But for many readers of this blog, that’s a pretty manageable number in a year.

Are you better off with the Amex Gold? Maybe you are. That’s a good debate for a future post. Without having done a full direct comparison, I don’t yet know the answer. In my case (which obviously wouldn’t apply for most people), I have no restaurants on delivery apps and the closest Cheesecake Factory is 70 miles away, so I only end up using the $10 monthly credit on that card 5 or 6 times per year. Given Amex’s enjoyment of clawbacks on the airline fee credits lately, it’s becoming less appealing for me to have so many cards with Amex incidental credits. I’ll have to do some math on the Gold vs Premier with the difference in annual fees.

But I think the Citi combo offers a lot of bang for the buck. The fact that Citi is missing travel protections from their travel cards perplexes me and I miss Price Rewind, but I do still like this combo for easy and cheap earning power.

I would add that with a DC card, you can make mortgage payments on Plastiq as well. So if you have a $3K a month mortgage, you would earn 72K TYP a year. You can decide for yourself if it is worth the 2.5% fee, though I would argue it is with the above trio of cards.

Thanks that’s a clever point!

If we’re talking a family of four, then I agree that $100k is doable; but would they want to even if they could? Putting a family’s full year spend on these cards just to get the 10% point rebate would have them forego the opportunity to meet MSR on other cards (for both P1 and P2) potentially missing out on bonuses worth $$ thousands per year. They’d also have the opportunity cost of missing higher bonus categories and periodic promos on other cards (e.g., I’m currently getting 5x URs on groceries with my no AF Chase Freedom and 5x MRs at Amazon with my Amex Gold..etc, etc.).

Despite my seeming negativity, I actually own the Premier (although my regular spend on it has ceased since they gutted the benefits), and I’ll be getting it again in a few months when the 24 month bonus restriction clears. Historically, I’ve gotten excellent value from TYPs by taking advantage of Citi’s transfer bonuses (specifically to Avianca and Flying Blue, which have transferred at 30+%). Ironically, I value TYPs slightly higher than Chase URs, and roughly on par with Amex MRs; however, Citi’s card portfolio benefits are far inferior to the other programs, IMO, and my daily spend will continue to reflect that accordingly.

Anyone is able to spend enough on Rewards+ to get 10K back? I tried to use it on Amazon to load my account, but you really need to do tons of those small transactions to make it work. Not sure how workable that card is…

I don’t ever use the Rewards+ card. I earn points on other cards and by combining the ThankYou accounts, I get 10% back when redeeming points earned on other cards.

Un related to the article, but love the new site design! Very clean and the links to podcasts and YouTube are very helpful.

Thanks!

Great post, Greg. I have this exact combination of cards now, after applying for a Premier card last summer and product changing my AA card to Double Cash and my Prestige card to Rewards+ since.

One situation in which it may make still make sense to redeem points to pay for travel after the 1.25 cent value goes away on April 10, 2021 is for people like me who earn some TYPs through Citibank accounts. These points expire and cannot be transferred to partners. I will try to use the ones I have while they have 1.25 cpp value, but after that, it appears that 1 cpp (with a 10% rebate I think) will be the best redemption value for these points.

Great point! Since points earned from bank account aren’t transferable, you’re absolutely right that the 1.25 redemption is the best use for those.

One thing I did not realize until recently–when you redeem taxable TYP (from banking, goodwill points, etc), and you have a Rewards+ card, the 10% of points that you get back are regular points that you can transfer. So if you redeem 10K banking points, you’ll get back 1000 points that you can transfer to airline partners.

Btw, above you say that Citi does not offer travel or purchase protection for any of these cards. I thought when Citi did the massive removal of benefits last year, extended warranty and purchase protection were only removed from the Double Cash and Dividend cards (looking at a post from this site on 6/24/19). I definitely value the extended warranty part, so I include an old AT&T Access card in the mix. Since I buy most electronics online, I get 2x TYP plus extended warranty protection.