NOTICE: This post references card features that have changed, expired, or are not currently available

Yesterday I showed why I’m excited about Discover cash back (hint: it’s possible to double the value of your cash back by redeeming for car rental certificates). Today I’ll show an example of stacking Discover cash back opportunities towards extreme savings at Sears. Similar techniques are possible at other stores, but some aspects of Sears make it especially noteworthy. Note that you’ll need a Discover It credit card (and a lot of patience) to recreate this magic…

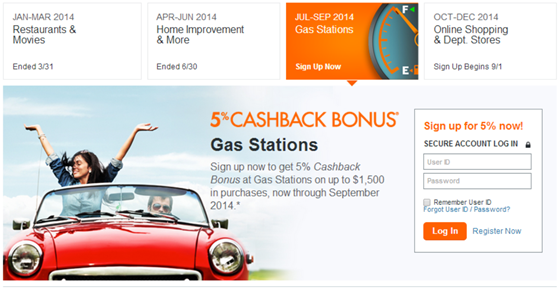

Step 1: Enroll in each quarter’s 5% cashback bonus

It is often possible to earn 5% Discover cash back from Sears through their quarterly 5% categories. Keep in mind that the 5% bonus is limited to $1500 in spend per quarter. Let’s look at the 2014 calendar (with the assumption that future calendar’s will be similar) to see how often it is possible to earn 5% at Sears…

Restaurants & Movies: unfortunately, I doubt there are many options to earn 5% at Sears with this category.

Home Improvement & More: Sears is usually thought of as a Home Improvement store, but in some cases Sears’ purchases don’t automatically qualify. Fortunately, a quick call to Discover customer support should result in a manual adjustment.

Gas Stations: Sears is most definitely not a gas station. That said, it is often possible to buy Home Improvement gift cards at some gas stations and at some convenience stores that are coded as gas stations. By doing so, you’ll earn 5% from your Discover card and then can use the Home Improvement gift card like a Discover credit card at Sears.

Online Shopping & Department Stores: Sears qualifies for 5% both in-store (as a department store) and online.

Step 2: Earn 15% by buying Sears gift cards

The Shop Discover portal often offers 10% cash back when shopping through the portal to Sears.com. Despite terms & conditions that say “Offer not valid on gift certificate purchases,” I’ve found that cash back is earned if you buy physical gift cards (even though they are technically sold and shipped by Kmart) or through reloading an existing gift card. Reloading an existing Sears gift card is the best way to go because the charge is processed by Sears and therefore should work to get 5% on home improvement in the 2nd quarter; and should work for paying with a Home Improvement gift card (Kmart won’t accept Home Improvement gift cards as payment, but Sears will).

The way to get 15% is to earn 5% from the credit card’s quarterly bonus plus 10% from the Shop Discover portal. Examples:

Quarters 2 and 4: Go through Shop Discover to Sears and reload an existing gift card up to $500. The charge will be processed from Sears.com and should qualify for the 5% bonus.

Quarter 3: Use your Discover card to buy a Home Improvement gift card at a gas station. Register your home zip code with the Home Improvement gift card. Then, go through Shop Discover to Sears and reload an existing gift card up to $500. Use the Home Improvement gift card as a Discover credit card to pay for the reload.

Step 3: Earn 10% by rolling gift card credit into Sears’ Shop Your Way Rewards

This part is optional and very hard to scale up. Every now and then, Sears offers products for sale with 100% back in points. An example is shown below of a cell phone charger that was recently selling for $14.99 will $14.99 back in points.

The reason to go for deals like this, even if you don’t really want the item, is that you can go through the Shop Discover portal to get 10% back for the purchase. And, by picking “Free Store Pickup” you can avoid shipping charges. Unfortunately, the only way to avoid sales tax is to have the item shipped to a tax free state. Hopefully, though, the item will be worth at least the cost of sales tax to you. Alternatively, you can most likely resell the item at a yard sale or on EBay for more than the sales tax charged.

Through this process, you would be essentially exchanging gift card credit for Shop Your Way Rewards (SYWR) credit (minus sales tax) and earning extra Discover cash back along the way. The downside to this is that SYWR points are less flexible than gift cards. For example, you cannot use points to buy gift cards in-store at Sears. Also, points expire — sometimes within months of acquisition. Sears’ gift cards never expire.

To find deals like this, I recommend setting an alert on the SlickDeals Hot Deals forum with keywords Sears and SYWR.

Step 4: Earn 10% buying items you want

Now we’re finally up to the step where you’ll buy something you want from Sears. First click through the Shop Discover portal to Sears. Then, find the things you want to buy. As long as there is an “Add to Cart” button, the item should qualify for Shop Discover cash back.

Before buying anything, compare prices at other merchants (use a price comparison tool such as PriceGrabber, for example). If you find a lower price at a merchant with a retail store presence, you can open a chat window while on Sears.com to request a price match. Details of Sears’ price match policy can be found here.

Make sure to pay with Shop Your Way Rewards points and/or gift cards. You can use up to 15 gift cards per order.

Add up the savings

- Buy Sears’ gift card: 15% (5% from credit card + 10% from portal)

- Roll gift card credit into SYWR points: 10% (from portal)

- Use points to buy merchandise: 10% (from portal)

- Total Rebate: 35% Discover Cash Back

- Use for rental car certificates: Up to 70% rebate value

Realistically, most people won’t roll all of their gift card credit into SYWR points since the 100% back in points deals tend to be few and far between. But, even without that step, you can get 25% back in the form of Discover Cashback. If used for half price rental car certificates, it’s possible to get up to 50% value from these rebates!

![SearsShopDiscover10X[2] SearsShopDiscover10X[2]](https://frequentmiler.com/wp-content/uploads/2014/08/SearsShopDiscover10X2_thumb.png)

![Sears100pctbackpoints[7] Sears100pctbackpoints[7]](https://frequentmiler.com/wp-content/uploads/2014/08/Sears100pctbackpoints7_thumb.png)

[…] A few readers have commented that while Sears counts as a department store for in-person purchases, Sears doesn’t count for online purchases. Here’s an example comment from an old post: […]

I love your blog and has been very very useful to me. But I would recommend you stop misguiding people about sears and discover portal earn rates.

sears.com = purchases code as merchandise and are not eligible for “home improvement” or “department store” 5% quarterly bonus

sears.com = purchases do get 10% discover deals bonus

sears instore purchase = you get 5% “department store” bonus

So max you can earn,without the double bonus at end of year, is 10% not 15%.

In the past Sears.com has always counted as a dept store as far as I recall, so I expect it to count again this quarter. What makes you think that it won’t count?

I understand that using the card for rotating categories has a limit per period. Does the cashback received from using the portal have a limit?

No, portal cash back isn’t limited.

[…] Discover extreme savings […]

FM, I just tried to reload a $500 Sears GC using a $500 HIGC. I had forgotten in the past I should load $499 because of Sear’s $1 pending charge, but I loaded all $500 anyway. When I called Sears, they then called up ‘the credit card’s phone number.’ I didn’t give them any phone number to call and so I don’t know if they called Discover or HIGC. He put me on hold for 5 minutes and told me my shipping/billing address didn’t match and so the order couldn’t be processed. But yet, there is a $500 pending charge on the HIGC side. I told the guy to just cancel the order (and I hope the pending charge drops after a couple of days). Do you know what I did wrong here?

I don’t know. It seems like reloading with HI gift cards can be hit or miss. I do expect that the charge will drop off eventually. May take as long as a week though

I made $1500 worth of purchases at Sears in June and only got 1%. I chatted with Discover today and they said Sears was considered a Department Store. I pushed back a little and said I had received cash back at Sears in the past as a Home Improvement store, so she said she’d add the extra 4%. So I don’t know if they’ll keep doing it, but it worked this time.

I called Discover tonight and got the extra 4% credited. Got a nice CS rep and it didn’t require any pushing to get the “one-tme courtesy adjustment” along with the reminder that Sears is considered a Department Store by Discover. Thanks FM for the reminder to call and inquire- I had completely written the money off.

Awesome

I had well over $1500 spent at Sears online last quarter through Discover, but did not get the 5%. A phone call to discover gave me an agent who said Sears counts as a department store and not a home improvement store.

Has anyone actually gotten credited for this?

Try calling again. Hopefully you’ll get a friendlier agent the second time.

Can you explain further about how to roll gift card credits into shop your way points?

The hard part is finding the deals where Sears offers 100% back in points. The best source I know of to find those deals is to watch the SlickDeals hot deals forum. Once you find those deals, simply do this:

1. Click through Shop Discover to Sears

2. Add item to cart

3. Go to checkout. Make sure that it shows that you’ll get 100% back in points.

4. Pay with Sears gift card

Do I have to use a discover card to get the 10% portal cash back? Can I use a Sears gift card and still the 10% portal cash back?

No, in my experience, you can get the portal cash back regardless of how you pay. That said, if the portal doesn’t track correctly, you won’t get any help from Discover when you contact them to complain. Also, a few readers have said that Discover has clawed back cash from them that they earned when using non-Discover cards, but that has never happened to me. My guess is that their cash was clawed back for other reasons.

I have been raking in cash hand over fist using this same technique with a couple additional steps and so I have some insights to share. Firstly: You mentioned that Discover might claw back some of the cashback bonus if you use the shopdiscover portal but not the discover card. This has happened to me only once in 24 months. It happened immediately following a month in which I earned about $3600 in cashback bonus without ever charging a cent on my discover card(I was using all GCs). I received an email saying how I was a big cashback customer and they wanted to review my purchases. They noticed that I was using the cashback portal but wasn’t putting any charges on the card so they reversed all of the pending bonuses accrued so far in the month, which cost me about 1200. So I used other portals for about two months while things cooled down then I went right back to using GCs in the discover portal and they havent clawed anything back since then. I am careful to make at least 1 purchase per month on the discover card now and I usually carry a small balance, which (I suspect) keeps a couple of the red flags from popping up.

Secondly, I noticed in your article here, under “Add up the savings” you have listed “Use points to buy merchandise: 10% (from portal)” which is incorrect. Points are applied basically exactly the same as using a coupon/discount so you only receive portal cashback on whatever amount is leftover after points are applied. If you buy a $100 item and use $100 of sywr points, then you won’t pay any sales tax and you also won’t get any portal cash back. Basically you will get 10% back on the $0.00 that you spent.

Thanks Daniel, that’s great info about the clawbacks. Regarding using the SYWR points to pay, though, it must be a YMMV thing. I’m sure I’ve received portal payouts for items where I’ve paid with points.

Oops, you are correct. You do get portal cashback when paying with SYWR points I am sorry. That was my error! And it only took me 10 months to admit it!

I had to experiment on it using shopathome to figure it out. (They show your pending cashback from sears within a few hours. Compared to Discover, who didnt itemize cashback whatsoever when i used them, or Upromise who takes up to a week to show cashback)

FM,

Do you have any experience with the credit card rental car coverage when a certificate is used? Most credit cards require that the full amount is charged to the credit card. Will using a rental certificate invalidate the coverage? If so, for me even a 50% saving is too much risk to take compared to using Costco travel and my CSP to rent a car.

In my experience, the receipts (from National, anyway) don’t show up as payments (they’re treated more like discounts off the initial price). So, as long as you pay for part of the rental with your credit card it should look like you paid the whole thing with your credit card. I haven’t tested this theory, but I believe it is safe.

I’ve been playing these games for a while with Sears and Discover. There was a significant change today on the Sears website that affects how I use the system though. Before today, I could change the number of existing points redeemed against the purchase price and still earn the full SYWR bonus and full Discover cash back bonus. As of this morning, the SYWR bonus points are scaled proportionally based on how much you pay with GC/CC. I hope it’s temporary!

Based on comments on SlickDeals, I get the idea that the ability rollover points to more points depends on the particular offer. The one I showed here didn’t allow it, but supposedly other offers do. I guess we’ll see as new offers appear

We, too, have had a Discover card for years. With all the advertising Discover is doing lately about the “It Card” and it getting 1% on everything, plus 5% rotating categories, I seemed to remember a tiered system less than 1% in the past. I decided to call Discover about our old card and found out it was a “More Card” still on the tiered system. I asked to be switched to the “It Card” (without any credit checks) and now will be earning a minimum of 1%. I suggest readers do the same and find out what type of Discover card you have, what the earning rate is, and switch, if necessary.

I agree

One thing I hate aboutt shop discover is the lack of itemized accounting for cashback portal earnings. I placed several large orders throughout the discover portal for hard goods and not received an email confirming my earnings. Does prior to this, all of my ourchases tracked. Does anyone have experience getting credit for these purchases? I know they say to wait up to 8 weeks for the credit and it’s only been 2, but I’ve always received an email in a few days.

I agree! I hate that too. I don’t have experience trying to eek out missing rewards from them so I can’t comment on that.

I strongly encourage you to use the “Feedback” link in the lower right corner to pass along your wish for Shop Discover rewards tracking online. Don’t be mean, just ask to have it added and mention how it would add value and increase your usage. Those comments get monitored and taken into consideration for future website enhancements.

Thanks. Just did this. I was then invited to fill out a survey in exchange for $5 Amazon credit. Done.

I recently purchased a gift card with email delivery, via discover shopping portal. I got an email from Discover, indicating that I have earned the 10% cash back bonus.

Thanks, great info. the ability to earn from portals for Sears’ e-gift cards seems to come and go over time whereas physical gift cards and gift card reloads seem to be stable so I prefer those routes.

This actually is the sort of thing I would do. Even though there are straightforward MS ways of making cash or points that are probably much easier, I’m drawn to these “crazy schemes”. I think partly it’s because this is a much more *old school* feeling deal. And there’s also something like the joy of free, that could maybe be called “the allure of cleverness”.

An old school deal goes great with my old school Discover card, which I’ve had since sometime in the mid 90s. If only Diner’s club had set up some card tables outside our college book store, my life could be so different now. Well… my miles and points strategy could be slightly different now.

I like that: the allure of cleverness…